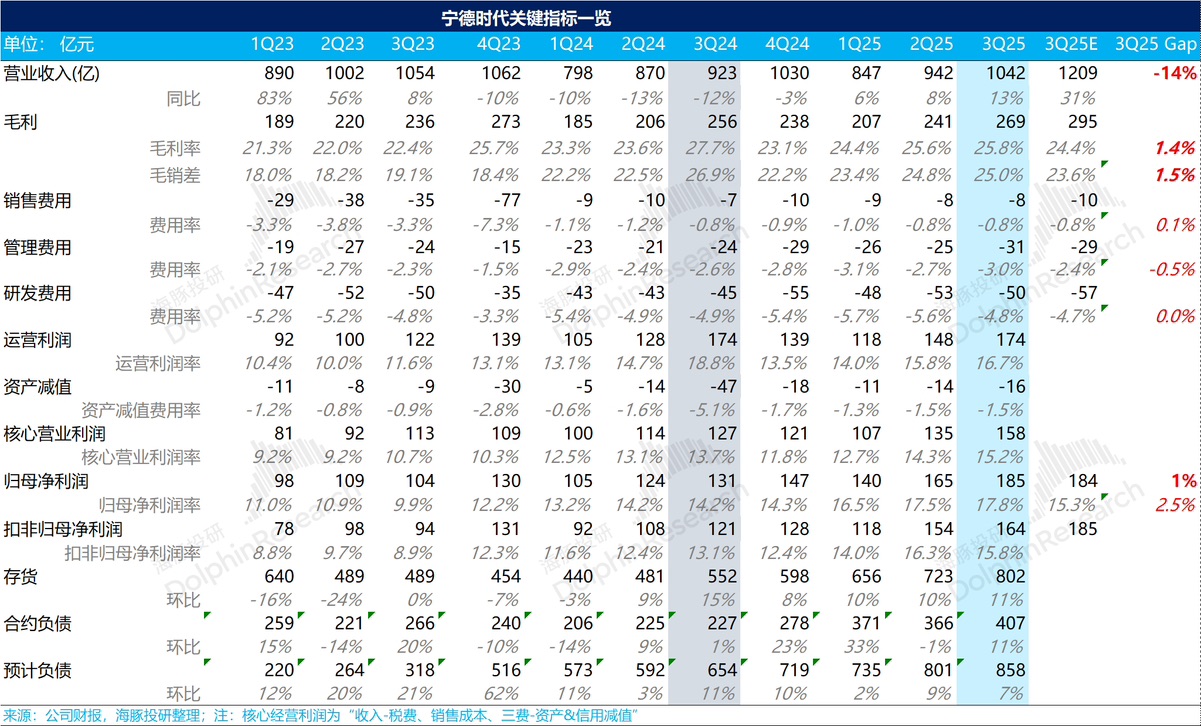

CATL Quick Interpretation: The third quarter appears very contradictory, evidently because the company does not provide revenue guidance but does guide profit ranges. As a result, third-quarter revenue fell far short of market expectations, while profits were basically in line with expectations.

From a revenue perspective, this is not the first time the company has fallen short of market expectations. The market's expectations were based on the increase in prices of battery raw materials such as lithium carbonate since July, which should have driven up the unit price of CATL's shipments. Additionally, the domestic power battery shipment volume saw a year-on-year increase of 36% in the third quarter, and the market expected CATL to keep up with this growth.

However, in reality, after CATL reduced prices to boost shipments in the second quarter, in the third quarter, amidst an industry inflation trend, it maintained prices. As a result, although total revenue was insufficient, the profit per watt was maintained, and total profits were preserved.

Given the current market, it is actually more favorable for CATL to maintain its market share. From this perspective, these results are not a negative surprise but rather an expected outcome.

However, there are several positive signals for the industry and CATL itself:

a. The price of lithium carbonate has returned to normal, and the company's asset impairment remains low relative to revenue;

b. The company's contract impairments are also decreasing, subtly indicating that the industry's supply-side clearing process is nearing completion;

c. Inventory is reaching new highs. Considering that the company's inventory structure is mainly composed of in-transit and finished products, and the current capacity utilization rate is relatively high, the revenue certainty implied by the inventory is high.

In other words, although third-quarter revenue was not as high as expected, the positive operational signals, coupled with the company's increased production guidance for 2026 to 1TWh, are encouraging.

The overall industry trend is improving, and as the industry leader, CATL naturally benefits from the dividends. $CATL(300750.SZ)$CATL(03750.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.