With great popularity comes great scrutiny. After the "international" trend toy $POP MART(09992.HK) gained global fame, it also faced numerous challenges. Firstly, shortly after the release of the third-generation Labubu, a stampede occurred during an offline rush to purchase, resulting in fatalities. Subsequently, as the scalper prices for Labubu declined, some began to doubt Labubu's long-term potential.

Today, the stock plummeted again, accompanied by numerous rumors. There are speculations about a potential share placement, but the company is currently almost a cash-generating machine, with no business rationale for a share placement. There are also rumors that experts in reverse roadshows mentioned a slowdown in Pop Mart's sales growth in September, indicating a lack of momentum.

Following the market close, the company confidently released "eye-catching" third-quarter operating data, letting the numbers speak for themselves:

1. Third-quarter revenue increased by 245%-250% year-on-year, compared to 204% in the first half.

2. Growth in China was 185%-190%, accelerating from 135% in the first half;

a. Online: 300%-305% vs. 1H25 212%

b. Offline: 130%-135% vs. 1H25 118%

(PS: Dolphin Research estimates that after the offline purchase incident, consumers began shifting to online purchases)

3. Overseas: Year-on-year growth of 365%-370%, also accelerating from 314% in the first half.

a. Asia-Pacific: Year-on-year growth of 170%-175%

b. Americas: 1,265%-1,270%

c. Europe and others: 735%-740%

(PS: Due to adjustments in regional classifications, year-on-year comparisons are not provided here)

Dolphin Research reviewed the current market consensus for the company's 2025 revenue, which is generally expected to be around 32 billion, implying a second-half revenue of slightly over 18 billion, with a growth rate of less than 120%. However, the company's actual third-quarter revenue growth is 250%. This magnitude of discrepancy is evident at a glance without further explanation from Dolphin Research.

Based on the third-quarter growth trend, Dolphin Research projects that the full-year revenue for 2025 will exceed 40 billion, nearly tripling the 13 billion scale of 2024.

A single-year revenue increase of over 25 billion essentially doubles China's market capacity with Monster, while overseas growth primarily relies on the U.S. market.

Of course, at this juncture, the market is more concerned about whether Monster has become a bubble. Where is the next blockbuster product to succeed Monster? Where will the additional 25 billion in revenue come from next year, and in the years beyond?

The sustainability of Pop Mart's growth seems to be a growing concern for the market as the company's growth accelerates. Frankly, Dolphin Research finds it challenging to provide comprehensive answers to all these questions.

However, based on the current revenue scale, Monster still has room for expansion geographically. Currently, the European market has not yet matured, providing some certainty for growth in 2026.

Regarding the succession of blockbuster products, the Star People currently appear to appeal to all demographics, regardless of gender or age, achieving widespread acceptance. However, whether it can reach the level of Monster remains a significant question for many.

Nevertheless, the third-quarter performance indicates that Pop Mart, despite high growth and ongoing controversies, has not yet reached the end of its growth trajectory. Even if Monster's product cycle may still shine for some time.

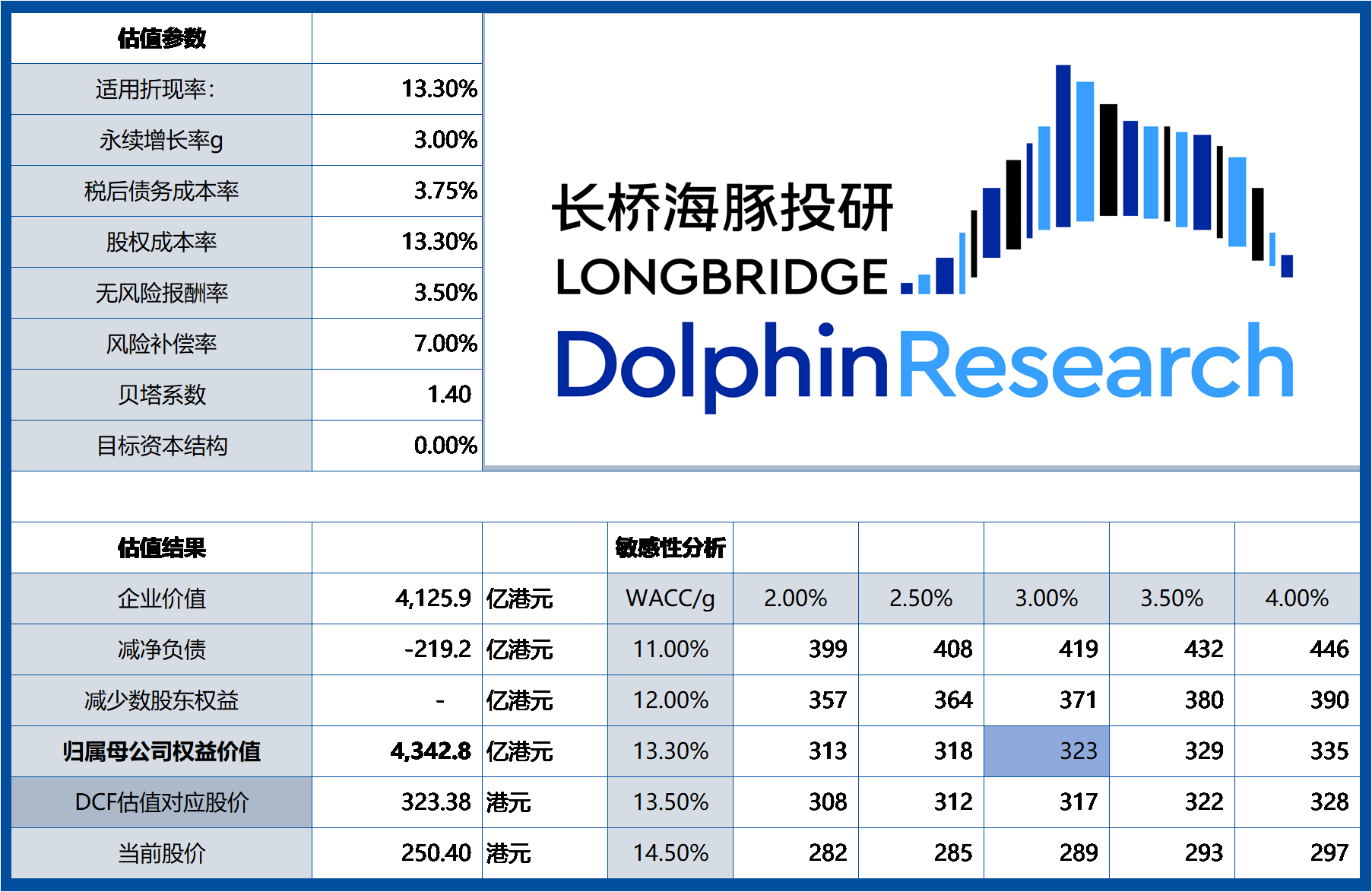

With another explosive third-quarter performance, Dolphin Research can only raise its forecasts again. Based on the latest third-quarter performance data, even if growth for 2026 and 2027 is moderated, Pop Mart's stable position above 300 HKD and a valuation exceeding 400 billion HKD remains a high-probability event.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.