Moutai 3Q25 Quick Interpretation: Overall, Moutai's Q3 performance continued to decelerate on the basis of Q2. The weak market demand has been transmitted from consumers to channels and has now finally reflected in the financial statements, which is a "pain period" that must be faced before the industry bottoms out. Nevertheless, Moutai still achieved positive growth in the third quarter.

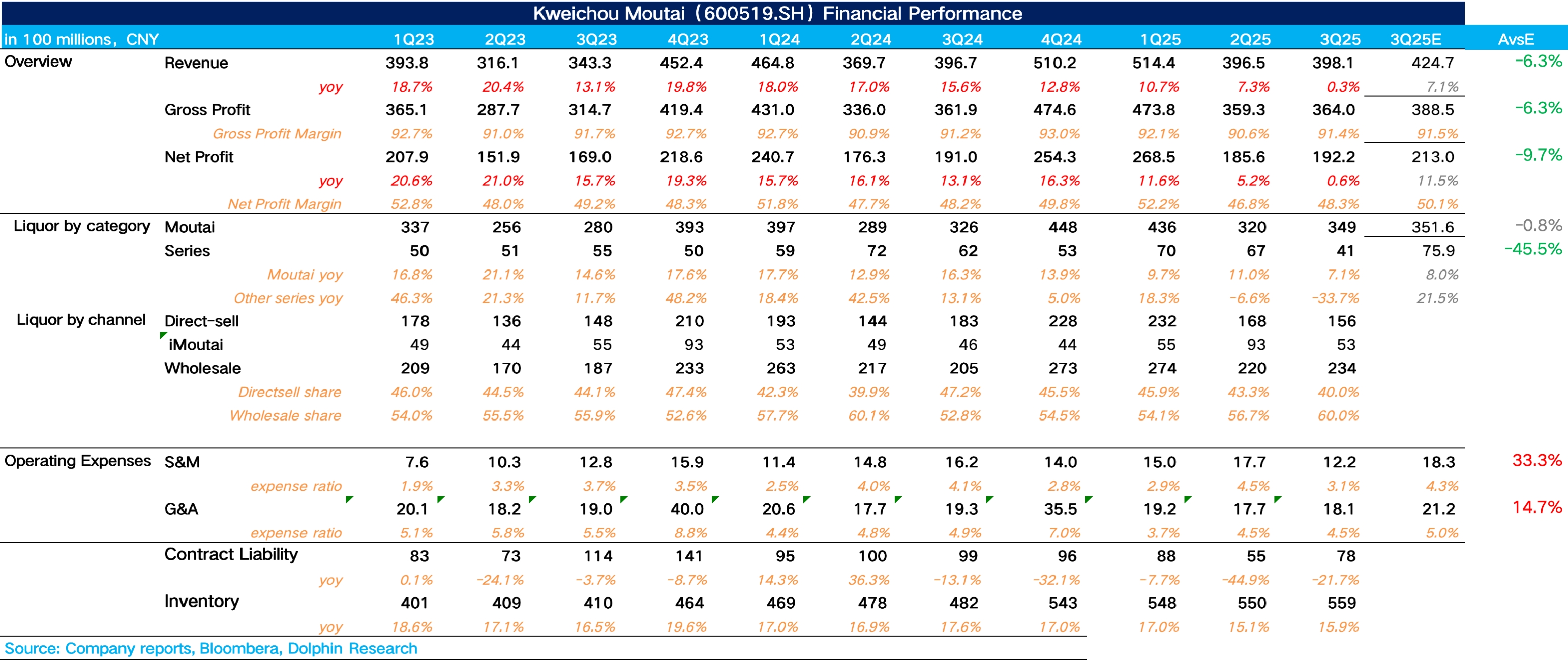

In Q3, Moutai achieved total revenue of 39.8 billion yuan, a year-on-year increase of 0.3%. Among this, Moutai liquor achieved revenue of 34.9 billion yuan, a year-on-year increase of 7.1%, remaining the ballast stone of Moutai's performance. Considering the strict control of supply and price stabilization of Feitian, Dolphin Research speculates that the growth of Moutai liquor is more attributed to the increased contribution from the release of non-standard liquor.

The series liquor achieved revenue of 4.1 billion yuan, a year-on-year decrease of 34%. In the context of comprehensive price inversion, high channel inventory, and sluggish demand, Dolphin Research speculates that to alleviate the burden on channels, the company basically abandoned the strategy of pushing goods to distributors to achieve growth in the third quarter.

By channel, in 3Q25, Moutai's direct sales channel achieved revenue of 15.6 billion yuan, a year-on-year decline of 14.8%, with the proportion of direct sales falling back to 40%. Dolphin Research speculates that since the direct sales channel reflects the actual demand at the terminal, Moutai increased the proportion of distributor channels to alleviate performance pressure amid weak demand.

In terms of gross margin, due to the increased proportion of Moutai liquor compared to the same period last year, the overall gross margin slightly increased by 0.2 percentage points to 91.4%. In terms of expense ratio, during the industry downturn, the company reduced market investment efforts, with the sales expense ratio dropping by 1 percentage point to 3.1%, while the management expense ratio remained stable.

Ultimately, the net profit attributable to the parent company reached 19.2 billion yuan, a year-on-year increase of 0.6%. For more details, please refer to Dolphin Research's subsequent financial report commentary. $Moutai(600519.SH)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.