Kweichow Moutai: Channel Burden Relief, Awaiting Cycle Reversal Drama

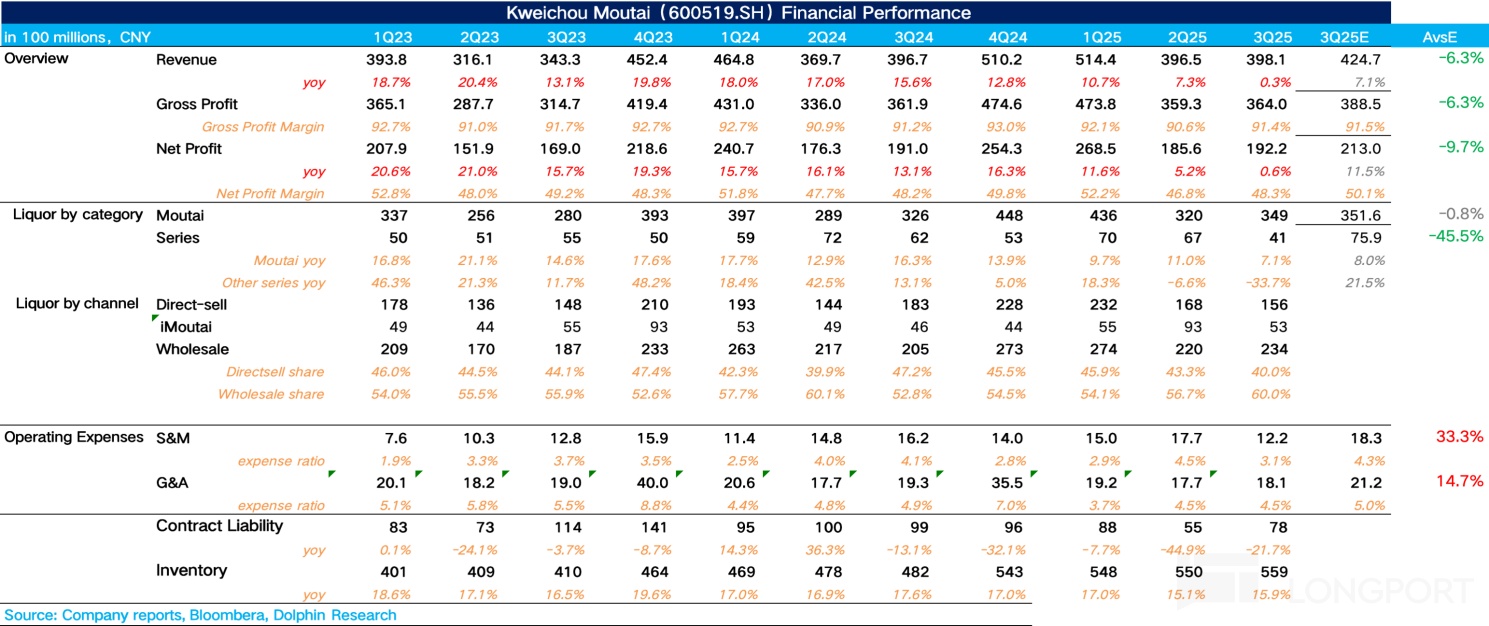

On the evening of October 29th Beijing time, $Moutai(600519.SH) released its Q3 2025 results. Despite the "prohibition order" and continued weak demand, it still achieved positive growth. The key points are as follows:

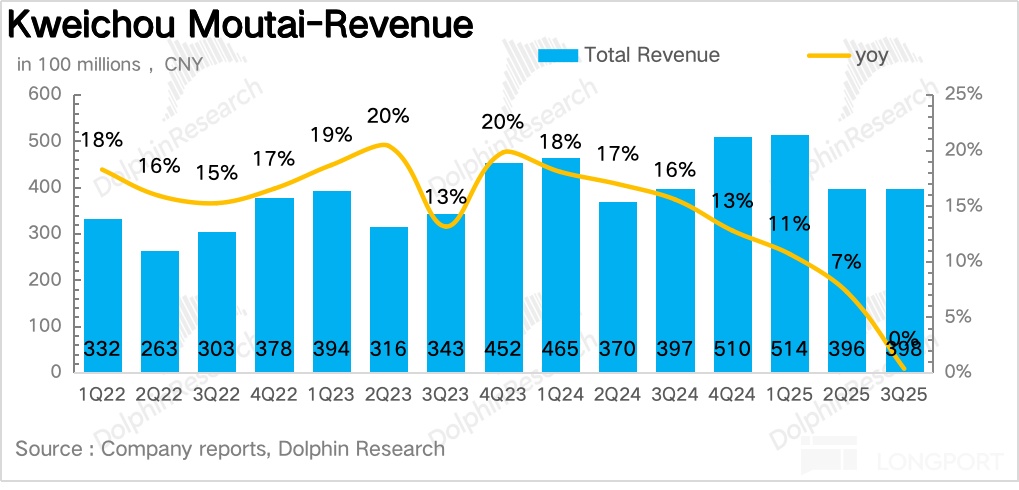

1. Overall performance achieved positive growth: In 3Q25, Moutai achieved revenue of 39.81 billion yuan, a year-on-year increase of 0.3%, which was below market expectations (market expectations were 42.5 billion yuan). The core issue is that market expectations were mainly based on linear extrapolation of the previous quarter's growth rate, underestimating the determination of liquor companies to relieve channel pressure.

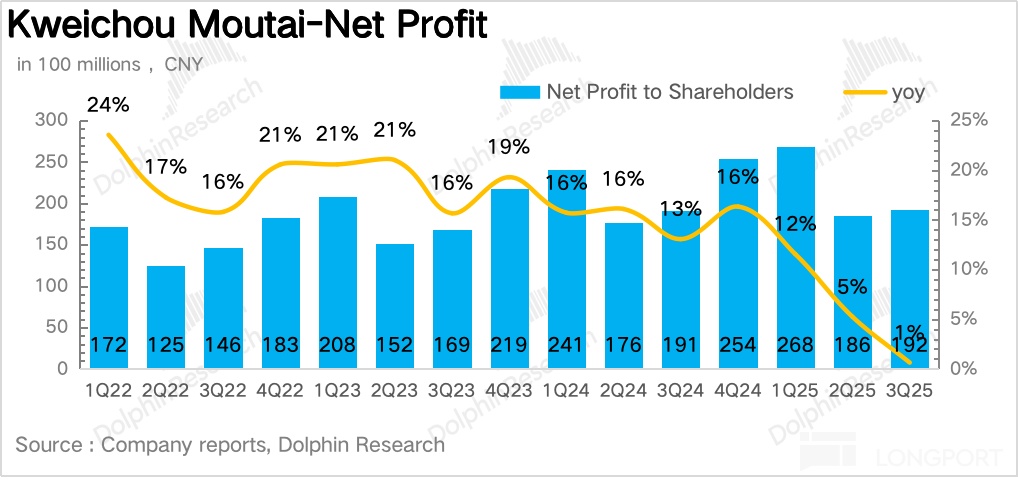

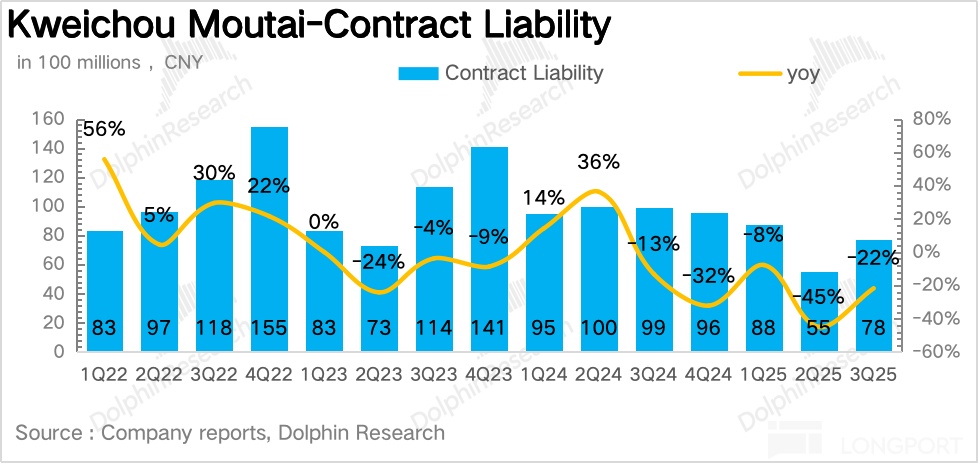

In fact, the continued slowdown in third-quarter performance could already be predicted from the sharp decline in contract liabilities in the second quarter (down 45% year-on-year), so Dolphin Research was not overly surprised. Therefore, market expectations are not very meaningful overall. In 3Q25, Moutai achieved a net profit attributable to the parent company of 19.22 billion yuan, a year-on-year increase of 0.6%, slightly faster than revenue growth.

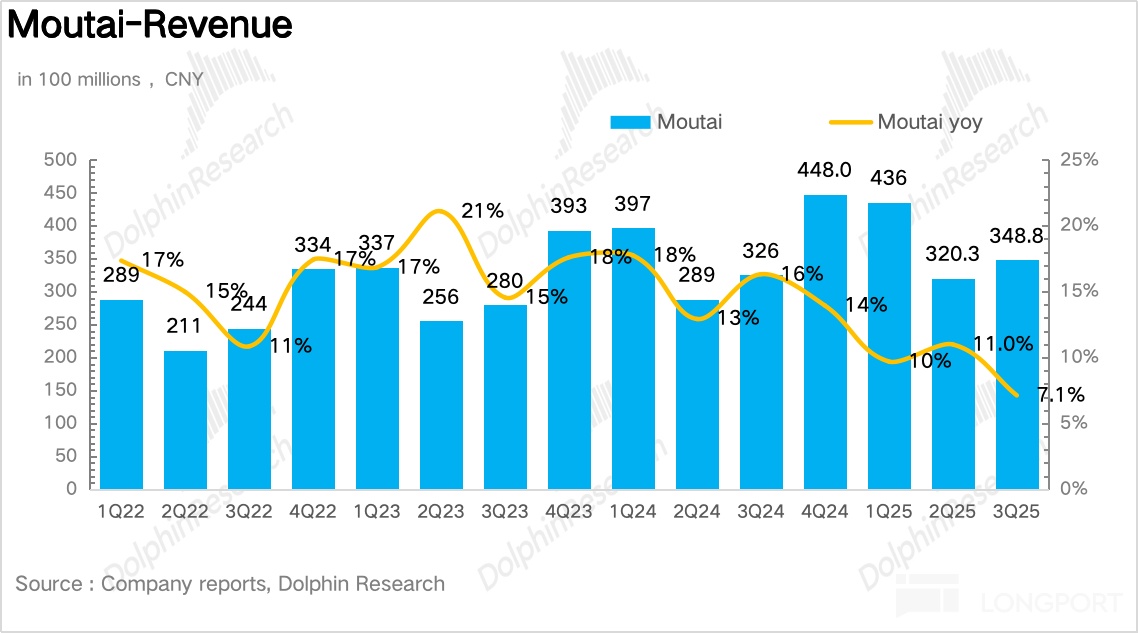

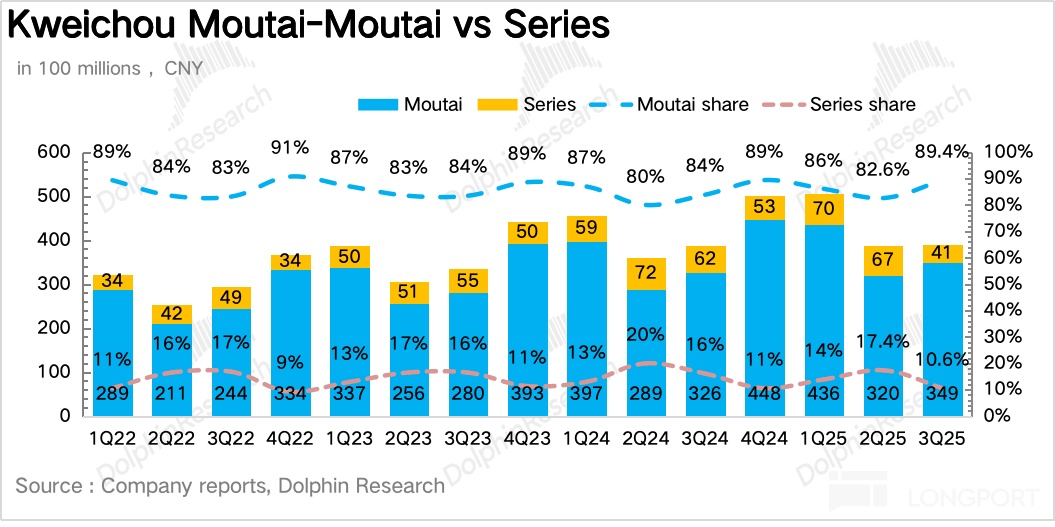

2. Moutai liquor: The ballast of performance. In 3Q25, Moutai liquor achieved revenue of 34.9 billion yuan, a year-on-year increase of 7.1%, with a downward trend compared to the previous two quarters. Based on research information, from the perspective of consumption scenarios, although the decline in banquet scenarios is not significant, the decline in gift scenarios is relatively large, which actually reflects the still weak business demand of enterprises.

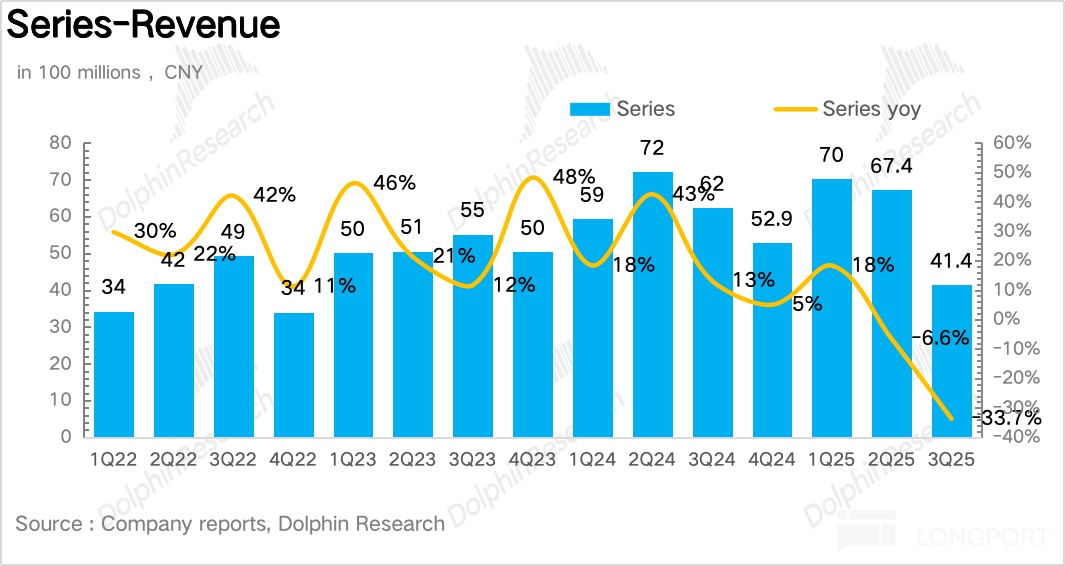

3. Series liquor declined severely. In 3Q25, series liquor achieved revenue of 4.1 billion yuan, a year-on-year decrease of 33.7%. In the context of comprehensive price inversion, high channel inventory, and sluggish demand, Dolphin Research speculates that the company basically abandoned the strategy of pushing goods to distributors to achieve growth in the third quarter to alleviate channel burdens.

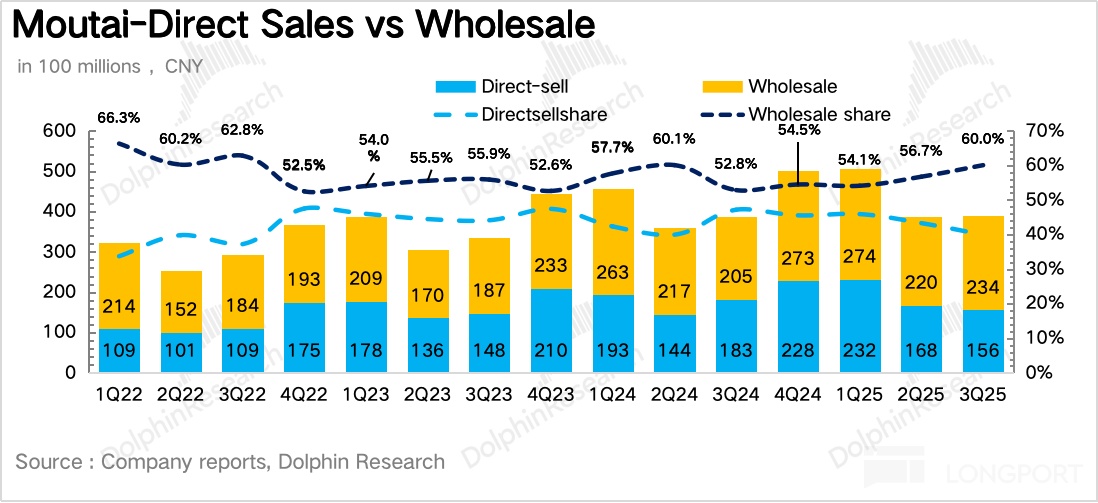

4. Direct sales proportion dropped significantly. In 3Q25, Moutai's direct sales channels achieved revenue of 15.6 billion yuan, a year-on-year decrease of 14.8%, with the proportion of direct sales channels falling to 40%. Dolphin Research speculates that, on one hand, direct sales channels better reflect the actual weak demand at the terminal, and on the other hand, the continued decline in non-standard liquor prices also affected consumers' willingness to subscribe (most non-standard liquor is distributed through direct sales channels).

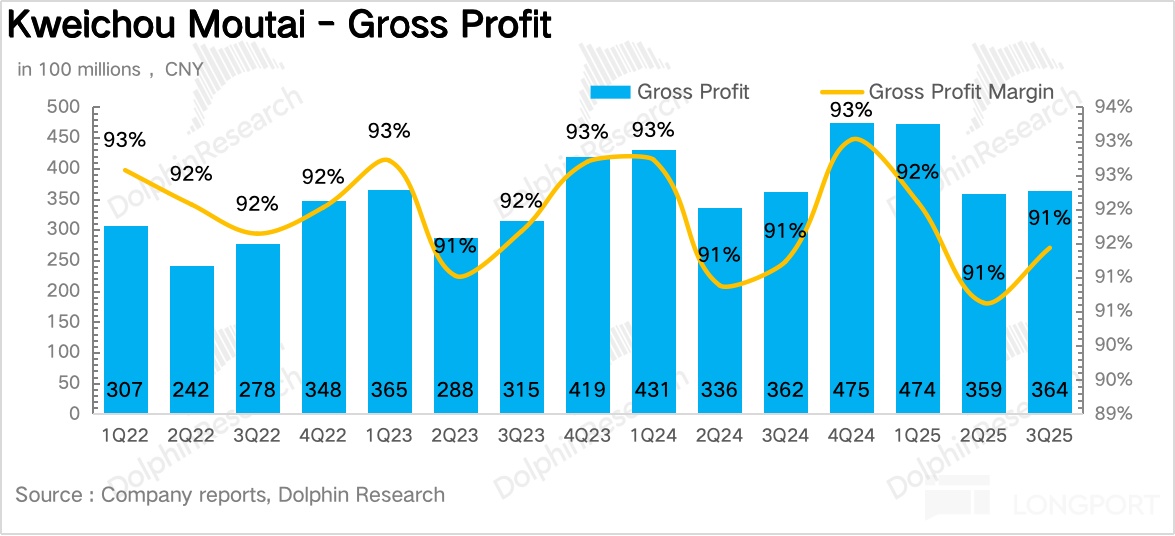

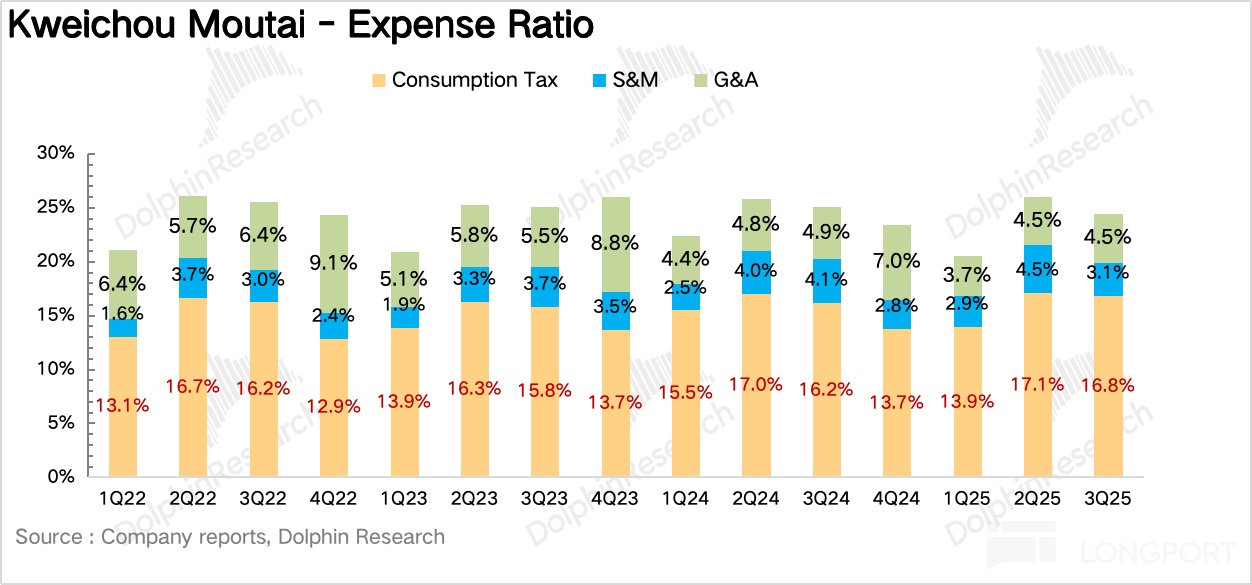

5. Slight increase in gross margin, restrained expense investment. In terms of gross margin, due to the increased proportion of Moutai liquor compared to the same period last year, the overall gross margin slightly increased by 0.2 percentage points to 91.4%. In terms of expense ratio, during the industry downturn, the company reduced market investment efforts, with the sales expense ratio falling by 1 percentage point to 3.1%, and the management expense ratio remaining stable. Ultimately, it achieved a net profit attributable to the parent company of 19.2 billion yuan, a year-on-year increase of 0.6%.

6. Overview of core financial information

Dolphin Research's overall view:

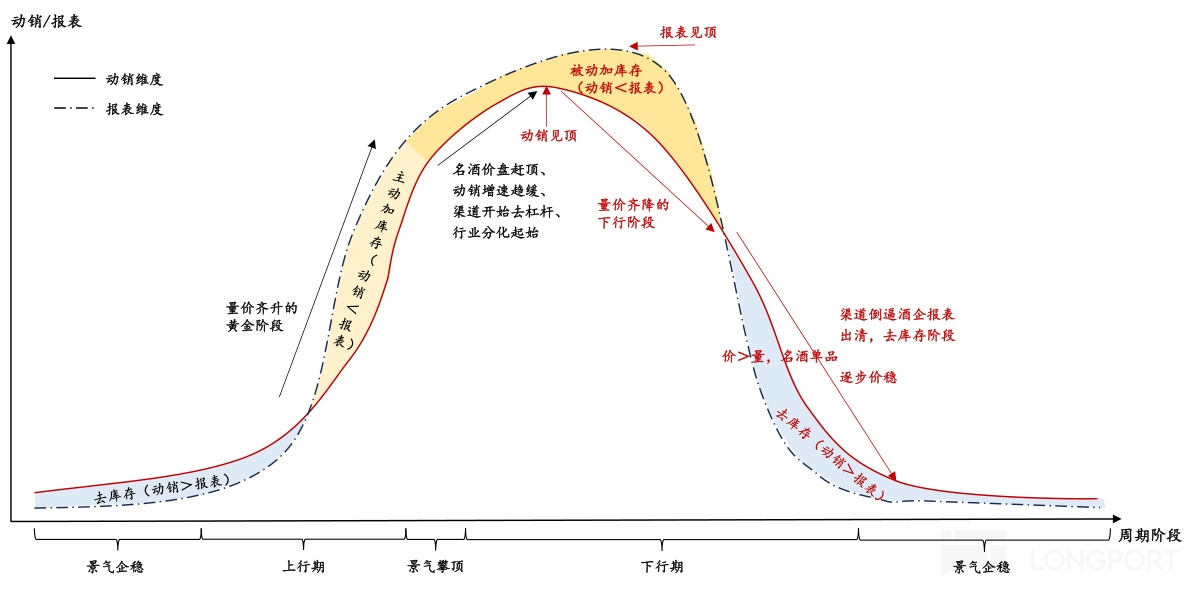

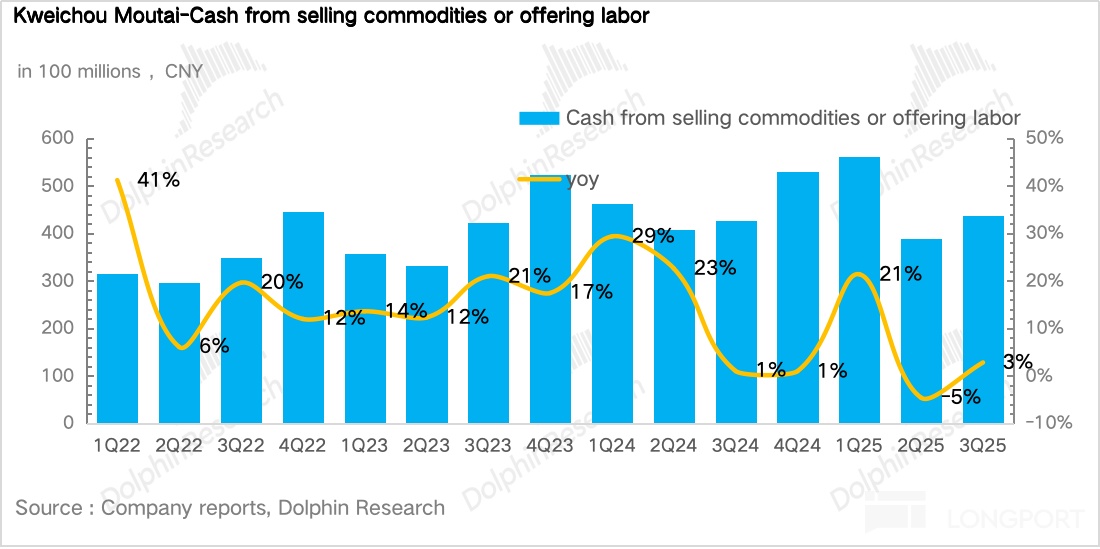

Under normal circumstances, liquor companies can lock in sales by pushing goods to channels in advance, resulting in a mismatch between the data on the report side and actual sales data. However, in the third quarter, the industry reached a consensus to actively reduce shipments to alleviate channel burdens, so the data on the report side in the third quarter is almost equivalent to actual sales data.

Although the single-quarter growth rate has basically hit a new low since 2015, compared to the entire liquor industry in a downturn, Moutai is likely the only liquor company to achieve positive growth in the third quarter, again verifying Moutai's resilience.

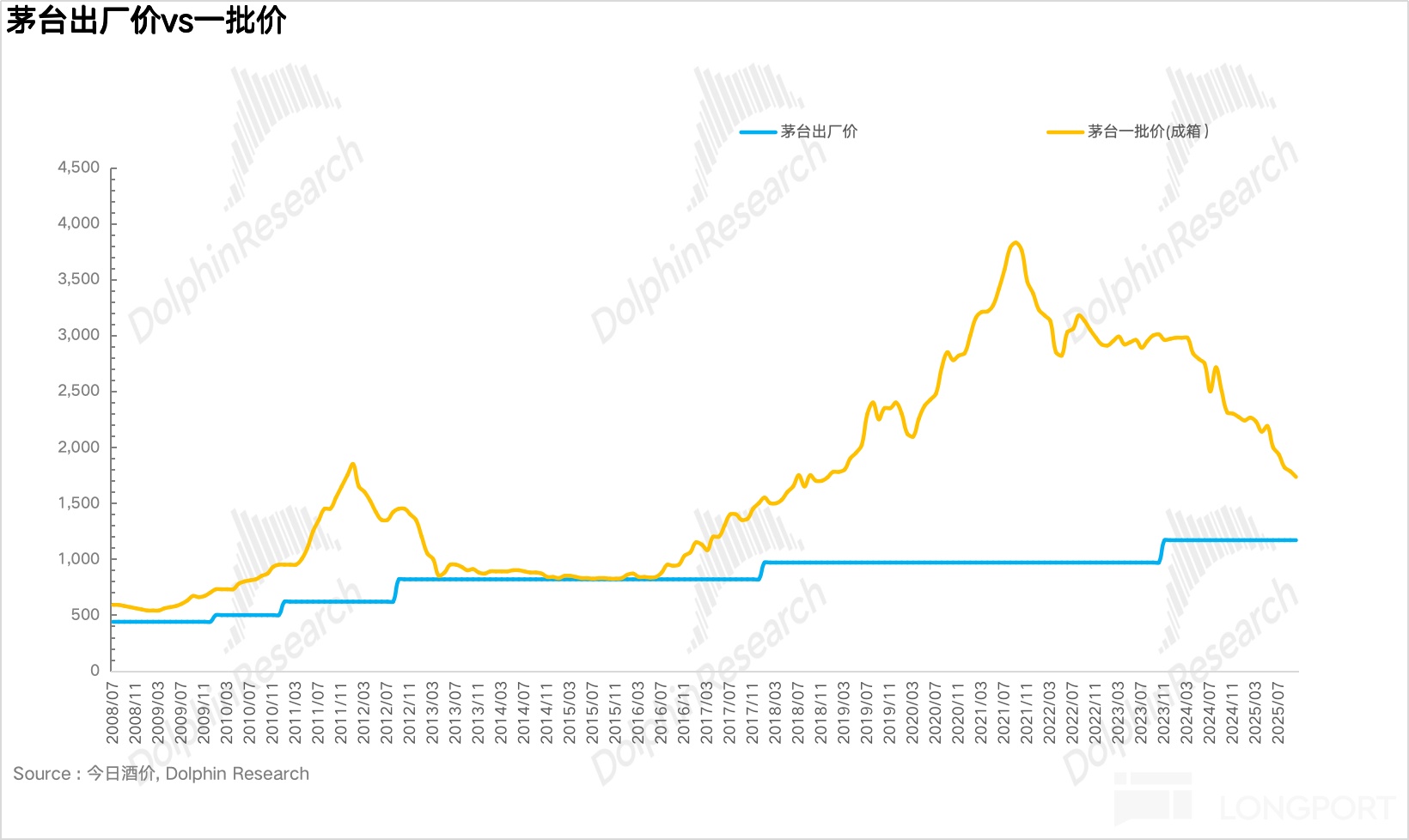

Compared to the deep adjustment period of the liquor industry from 2013 to 2015, although public consumption plummeted at that time, the demand structure gradually shifted to business and private consumption. In this round, besides the restrictions on public consumption, the continued weakness in business demand is the core reason for the continuous decline in wholesale prices and the longer adjustment period.

Additionally, from the supply side, since 2015, leading liquor companies like Moutai and Wuliangye have continuously expanded production, significantly increasing supply. Therefore, Dolphin Research judges that the current situation has not yet reached supply-demand balance and is still in the latter half of active inventory reduction.

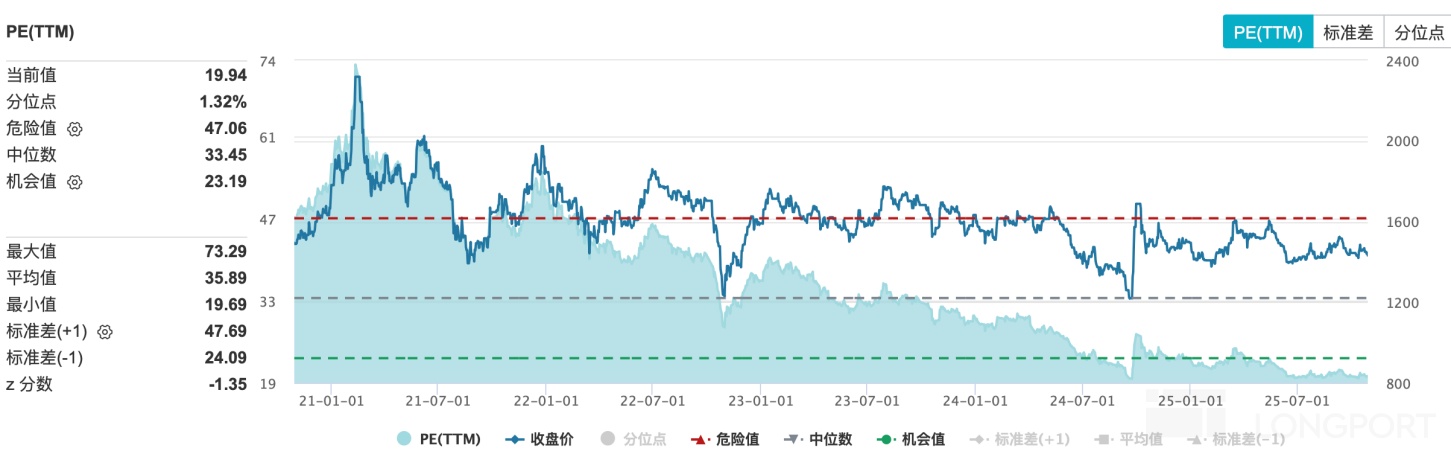

In terms of wholesale prices, although the consumption during the National Day and Mid-Autumn Festival was weak, further pushing wholesale prices below 1,800 yuan, recent valuations of Moutai have not followed the further decline in wholesale prices. Dolphin Research believes this reflects the market's full anticipation of Moutai's wholesale price decline, making the short-term impact of wholesale price fluctuations on valuations somewhat muted.

From the perspective of the industry cycle, since the current stage is in the latter half of active inventory reduction by liquor companies, the most typical feature of this stage is the beginning of improvement in terminal sales, gradual bottoming of wholesale prices, and continuous clearing of reports. Therefore, the decline in wholesale prices actually conforms to industry rules and is not a real marginal negative.

On the contrary, through this Moutai's third-quarter report, it truly verifies that in the industry downturn cycle, the weak market demand has been transmitted from consumers to channels and finally to the report side, which is the "pain period" that the industry must face to build a bottom.

Therefore, based on the above analysis, from the investment rhythm perspective, combined with the information revealed at the Moutai distributor conference in September, terminal sales from July to September have already improved month-on-month. If demand continues to recover, optimistically, it will gradually transition to the passive inventory reduction stage in the first half of 2026, coupled with the low base of the 2025 report side, which may usher in a wave of valuation recovery. However, currently, although the risk of further valuation decline is minimal, Dolphin Research still recommends maintaining a wait-and-see attitude until further demand recovery is observed.

Source: Guojin Securities Research Institute

Below is a detailed interpretation of the financial report:

I. Performance maintained positive growth

In 3Q25, Moutai achieved revenue of 39.81 billion yuan, a year-on-year increase of 0.3%, which was below market expectations (market expectations were 42.5 billion yuan). The core issue is that market expectations were mainly based on linear extrapolation of the previous quarter's growth rate, underestimating the determination of liquor companies to relieve channel pressure. In fact, the continued slowdown in third-quarter performance could already be predicted from the sharp decline in contract liabilities in the second quarter (down 45% year-on-year), so Dolphin Research was not overly surprised. After all, only by alleviating channel burdens can the company "squat and jump" better when the next round of demand arises.

In terms of profitability, in 3Q25, Moutai achieved a net profit attributable to the parent company of 19.22 billion yuan, a year-on-year increase of 0.6%, slightly faster than revenue growth.

II. Moutai liquor: The ballast of performance

In 3Q25, Moutai liquor achieved revenue of 34.9 billion yuan, a year-on-year increase of 7.1%. Based on feedback from the autumn sugar conference, the actual demand in the liquor industry during the double festival peak season declined by 15%-20%, weaker than expected. From the perspective of consumption scenarios, although the decline in banquet scenarios is not significant, the decline in gift scenarios is relatively large, which actually reflects the still weak business demand of small and medium-sized enterprises.

In terms of rhythm, after the "518 prohibition order" policy was introduced, it began to be reinforced in various places from late May, so although the impact of the policy weakened month-on-month from July to September, from a year-on-year perspective, the third quarter actually exerted the greatest pressure on liquor companies in terms of sales and prices.

III. Series liquor declined severely

In 3Q25, series liquor achieved revenue of 4.1 billion yuan, a year-on-year decrease of 33.7%. According to the information conveyed by Moutai at the distributor gathering at the end of last year, the target for series liquor in 2025 is not lower than Moutai's average growth rate over the past five years (corresponding to a 15% annual compound growth rate), combined with the company's expense investment plan for series liquor, Moutai's investment in sauce-flavored liquor in 2025 will increase by 1.5 billion yuan compared to 2024, a year-on-year increase of 50%. Moutai's intention is naturally to actively participate in the competition of sub-high-end and below sauce-flavored liquor through series liquor, filling the gap left by the decline in Moutai liquor.

However, in reality, under the "prohibition order" and continued weak demand, the pressure on series liquor is obviously much greater. In the context of comprehensive price inversion and high channel inventory (currently over 2 months for 1935, with even higher inventory levels for other series liquor), Moutai can basically only rely on continuous high expense investment and high subsidies to drive sales and returns. Looking ahead, if the goal of 15% growth is to be achieved, the implied fourth-quarter series liquor needs to achieve revenue of 10.4 billion yuan, nearly doubling year-on-year growth. Therefore, unless there is explosive growth in demand in the fourth quarter, it will be very difficult for series liquor to achieve the target.

IV. Direct sales proportion dropped significantly

In 3Q25, Moutai's direct sales channels achieved revenue of 15.6 billion yuan, a year-on-year decrease of 14.8%, with the proportion of direct sales channels falling to 40%. Dolphin Research speculates that, on one hand, direct sales channels better reflect the actual weak demand at the terminal, and on the other hand, the continued decline in non-standard liquor prices also affected consumers' willingness to subscribe (most non-standard liquor is distributed through direct sales channels).

V. "Reservoir" decline narrowed marginally

From the "reservoir" contract liabilities item, as of the end of the third quarter, Moutai's contract liabilities were 7.8 billion yuan, down 22% compared to the same period last year, showing some recovery compared to the "cliff-like decline" of 45% in the second quarter. This also indirectly indicates that Moutai's continuous efforts to alleviate channel burdens have somewhat eased the financial pressure on distributors.

VI. Slight increase in gross margin, restrained expense investment

In terms of gross margin, due to the increased proportion of Moutai liquor compared to the same period last year, the overall gross margin slightly increased by 0.2 percentage points to 91.4%. In terms of expense ratio, during the industry downturn, the company reduced market investment efforts, with the sales expense ratio falling by 1 percentage point to 3.1%, and the management expense ratio remaining stable. Ultimately, it achieved a net profit attributable to the parent company of 19.2 billion yuan, a year-on-year increase of 0.6%.

<End here>

Longbridge Dolphin Research "Kweichow Moutai" historical articles:

Earnings season

April 29, 2025 earnings commentary "Kweichow Moutai: Left hand non-standard liquor, right hand series liquor, not afraid of Feitian slowdown? "

April 3, 2025 earnings commentary "Moutai: Barely passing, but how to restore the shattered myth? "

October 26, 2024 earnings commentary "Moutai: Can the pillar still support the backbone of A-shares? "

April 3, 2024 earnings commentary "Anyone can fall, only Moutai "Weeble" "

March 31, 2023 earnings commentary "iMoutai escorts, Moutai "Sea Calming Needle" is a sure thing "

October 17, 2022 earnings commentary "Moutai's performance is flawless, market sentiment is key "

August 3, 2022 earnings commentary "Pillar releases results: Flowing A-shares, iron-clad Moutai "

April 26, 2022 earnings commentary "Direct sales continue to exert force, Moutai continues to dance "

Risk disclosure and statement of this article: Dolphin Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.