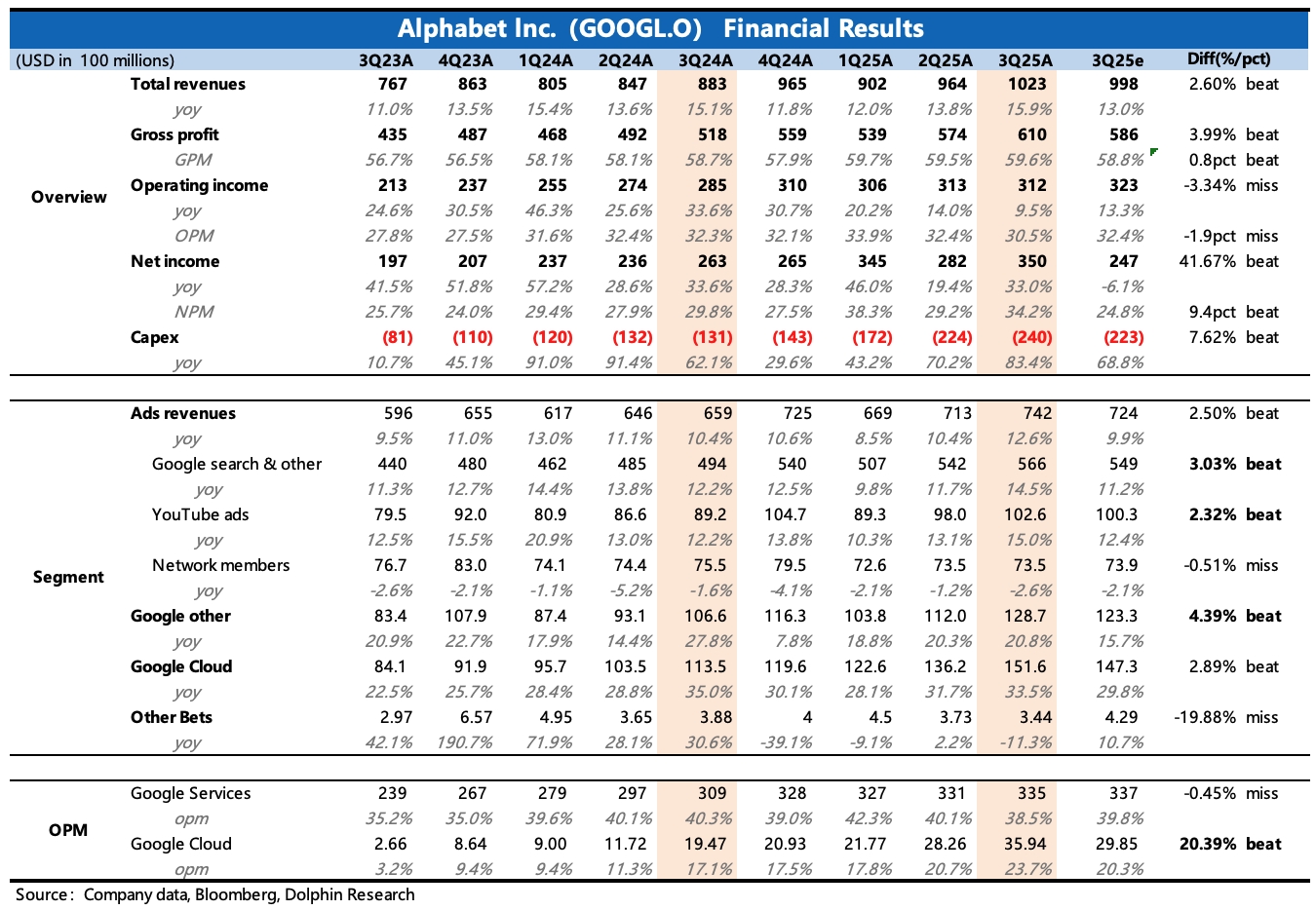

Google 3Q25 Quick Interpretation: Third-quarter performance is impressive! Despite OpenAI's spotlight and the two-month revaluation based on full-stack AI logic, Google delivered an almost perfect report card just when it needed to test its EPS, continuing its revaluation journey.

1. Explosive advertising performance: Both YouTube and search grew by 15%, exceeding market expectations. Dolphin Research can understand why YouTube ads beat expectations. With user activity leading the industry, the market's 12% growth expectation was indeed a bit conservative.

However, what surprised Dolphin Research was the search business. Not only did it not slow down on a high base, but it also accelerated, which means there's no issue of AI erosion. It can only be said that the competitors are not strong enough + Google's own strong ecosystem made Google's transformation path more relaxed than expected.

Although Gemini has an inherent advantage gap as an independent app compared to ChatGPT, looking at the entire ecosystem, Gemini has 650 million monthly active users and processes 7 billion tokens per minute, making the gap with ChatGPT not that significant.

Recently, OpenAI launched an AI browser, which Dolphin Research believes still lacks disruptive power ("Google: My fate is determined by me, not by OpenAI").

2. Expected prosperity in cloud services: The cloud business now mainly looks at the accumulated unfulfilled orders (Revenue Backlog). If the order accumulation maintains high growth, then cloud revenue growth can be sustained for a period of time. As of the end of Q3, the backlog reached $155 billion, a year-on-year increase of 43%. With these order backlogs, short-term future revenue growth can continue to maintain over 30%.

3. Controllable capital expenditure growth: The market's concern about uncontrolled Capex did not materialize. Although actual capital expenditure in the third quarter was slightly higher than market expectations, management guided 2026 capital expenditure to be between $91 billion and $93 billion. If calculated based on this year's $85 billion, the growth rate is 8%, which is less than the market's expected scale of over 10%, or $95 billion. With controllable capital expenditure and revenue exceeding expectations, who wouldn't love this outlook trend?

4. Steady growth in subscriptions and other revenues: Other revenues, mainly from YouTube memberships, Google One, Google Play, and Pixel hardware, grew by 21% in the third quarter, not slowing down as expected. The company disclosed that the number of paid subscribers for YouTube and Google One has exceeded 300 million.

5. Profitability continues to improve after excluding fines: This quarter, a $3.5 billion EU antitrust fine was confirmed, affecting the profit margin by 3 percentage points. Excluding this, the operating profit margin was 34%, with both quarter-on-quarter and year-on-year improvements. The improvement in operating efficiency mainly relied on faster revenue growth, while sales and administrative expenses either declined or grew slowly, and R&D personnel costs and server depreciation continued to accelerate. $Alphabet(GOOGL.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.