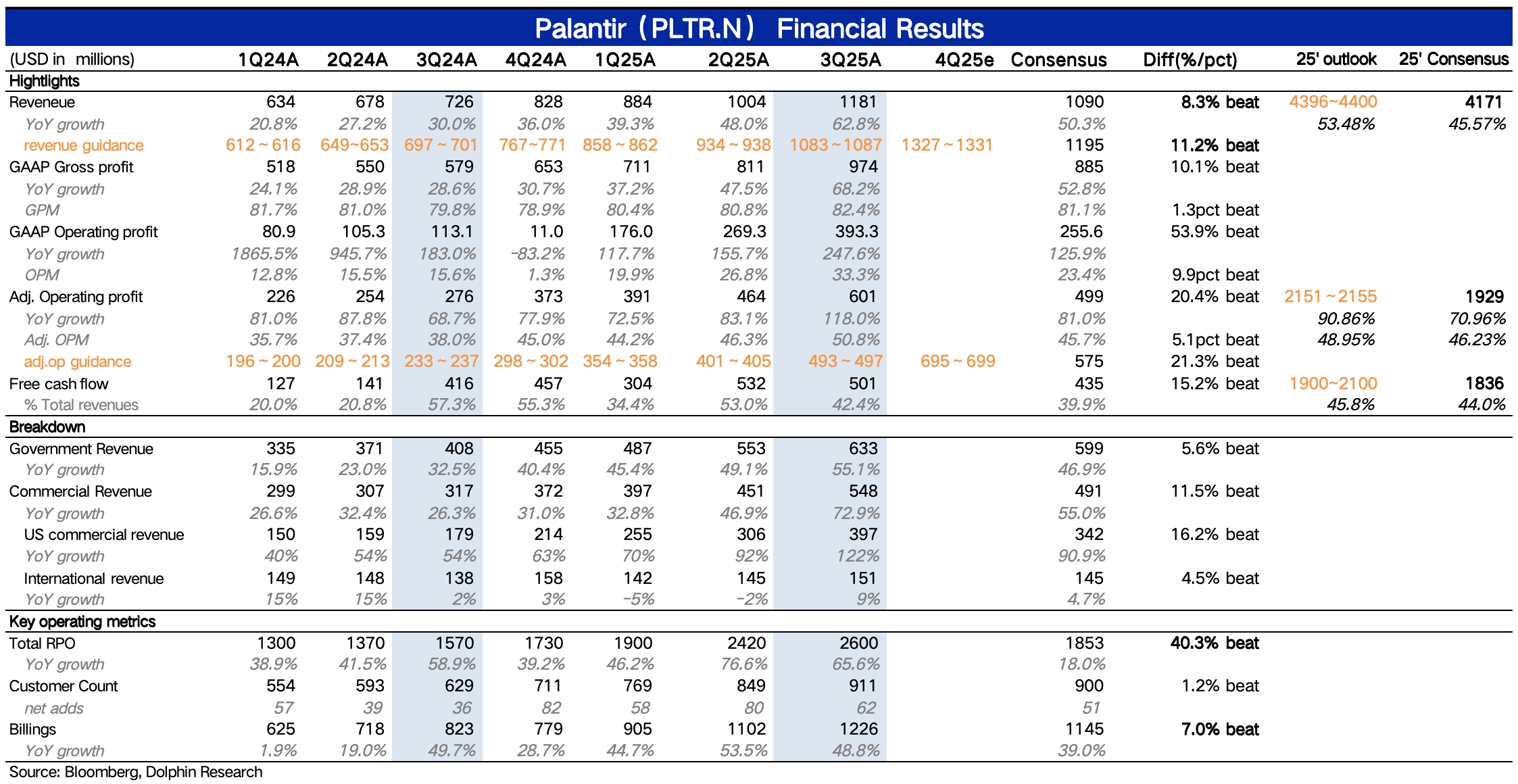

Palantir 3Q25 First Take: In the third quarter, Palantir delivered a set of results that exceeded expectations across the board, yet the market seemed to react negatively once again, as if the positive news had already been priced in. Looking back at past performance versus market reactions, it is not difficult to see that starting from this year, over the three quarters, as valuations have risen, the market has become increasingly 'immune' to Palantir's performance:

In Q1, a minor flaw with a miss in the international commercial market led to a direct 12% drop post-earnings; Q2 saw record-breaking explosive results, but only a 5% increase in after-hours trading; and this time, Q3 still showed impressive results (flaws—net increase in contract balance slowed, guidance for Q4 growth did not accelerate, possibly due to seasonal factors and deliberate conservatism by management), yet the stock price even directly fell.

Aside from the most critical fear of high valuations, Dolphin Research believes that the market still lacks a clear understanding of Palantir's market boundaries (is the TAM $100 billion or $1 trillion?), and relying solely on management's unofficial qualitative description of a tenfold increase in five years cannot be used as a certainty to factor into valuations. Therefore, to reduce unknown risks, some funds may prefer to cash in. Now let's look at the specific performance:

1. Current performance exceeded expectations across the board: The third-quarter performance was significantly better than expected in both revenue and profit. Government revenue accelerated quarter-on-quarter, with international government revenue growth even surpassing that of the U.S. government. Commercial revenue also accelerated, including a slight decline in the base which contributed to the growth.

By market, U.S. commercial growth once again soared to 122%, and international commercial growth began to rebound to positive growth. However, Palantir's deep ties with the U.S. defense and security departments may still affect the willingness of corporate clients outside the U.S., especially in Europe, to cooperate.

The profit side is where Palantir has consistently performed relatively well. Although the product service is more customized (relying on professional engineers FDEs for initial deployment), logically, the growth trend of labor costs should change in sync with revenue growth, but actual expense growth between quarters has remained stable and significantly lower than revenue growth. The third-quarter GAAP operating profit margin increased by 7 points to 33%, and the fourth-quarter guidance implies that the profit margin will continue to increase by 2 percentage points.

2. Guidance growth slightly slowed: The median growth rate for fourth-quarter guidance is 61%, slightly slowing compared to the third quarter's 63%, which may become a point for the market to nitpick. But considering Palantir's past seasonal fluctuations, and due to the U.S. Department of Defense reforming procurement processes, leading to a temporary pause in procurement actions, it may also have some drag on fourth-quarter performance.

However, Dolphin Research believes these are still short-term disturbances and will not change Palantir's long-term trend (the Department of Defense procurement process reform is actually beneficial to Palantir).

3. Operational indicators are healthy: Whether it is the number of customers or the amount of new orders, they are in a state of healthy growth, reflecting strong current demand. But under high valuations, the market may not be satisfied with the net increase in contract balance and the lack of acceleration in order flow quarter-on-quarter. $Palantir Tech(PLTR.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.