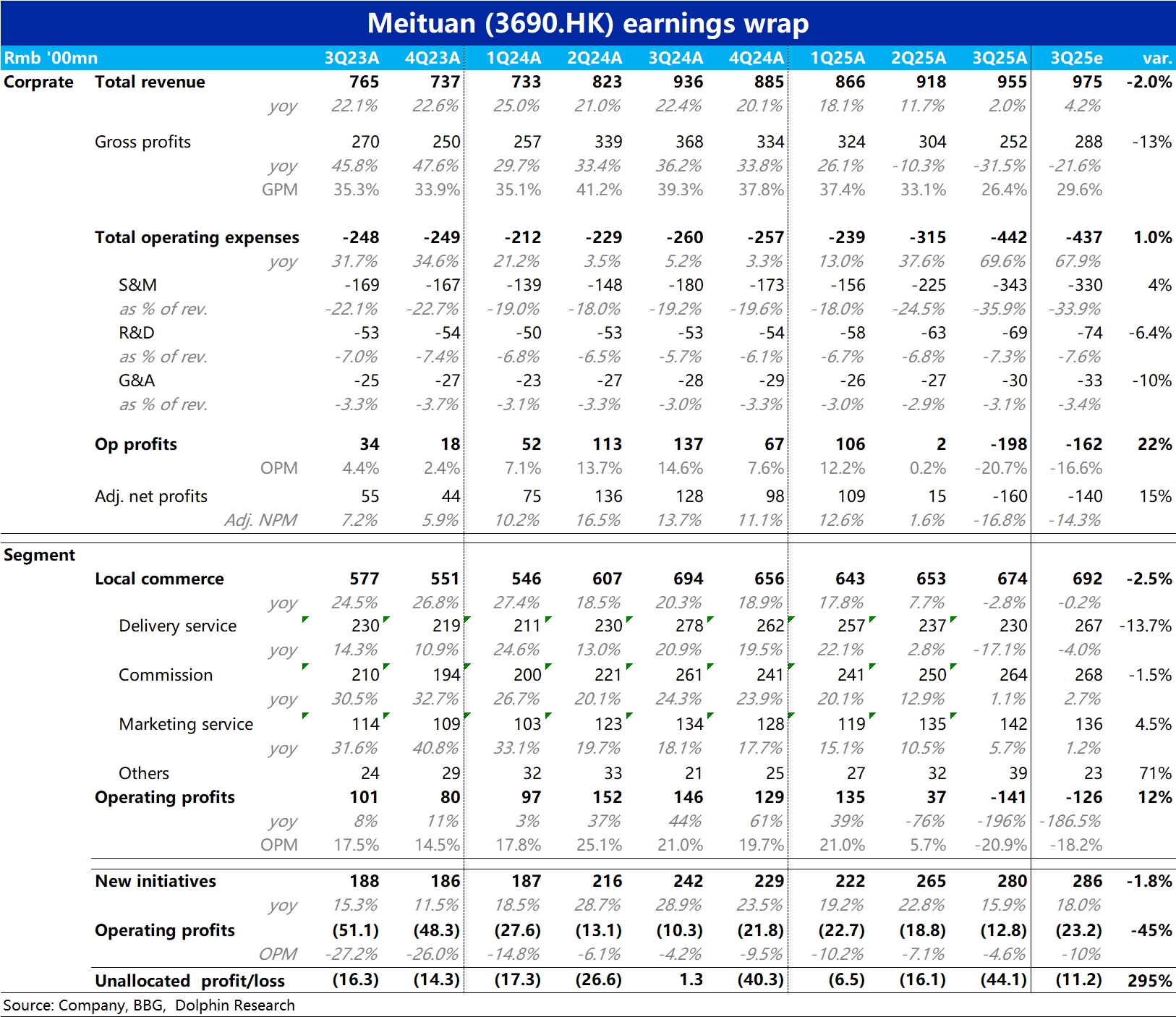

Meituan 3Q25 Quick Interpretation: Meituan, the most affected in the food delivery battle, had a predictably poor 3Q performance. The group's operating loss for the quarter was RMB 19.8 billion (vs. last year's profit of RMB 13.7 billion), exceeding Bloomberg's consensus forecast of a RMB 16.2 billion loss (not updated timely), but roughly in line with the latest sell-side report expectations. Specifically:

1) The core local commerce segment saw revenue decline by nearly 3% this quarter, mainly due to substantial shipping subsidies (recorded as revenue deductions) leading to a 17% year-on-year decline in delivery revenue. Assuming per-order delivery revenue remained flat, the implied cost of shipping fee waivers exceeded RMB 9 billion.

2) Additionally, the growth rate of advertising revenue in the core local segment also significantly slowed to just 5.7%. Logically, the food delivery battle should have limited impact on advertising revenue, which may suggest that Meituan's in-store business also faced some competitive pressure this quarter, prompting the company to voluntarily reduce related fees.

3) In the core local segment, the operating loss for the quarter was RMB 14.1 billion, a net decrease of nearly RMB 29 billion compared to last year, largely reflecting Meituan's losses in instant retail this quarter (it appears the in-store business may not have seen much profit growth), compared to Alibaba's claim of RMB 36 billion loss in flash sales this quarter.

4) As for the new business segment, revenue grew by 16% year-on-year this quarter, slowing by nearly 7 percentage points compared to the previous quarter, while the loss decreased significantly quarter-on-quarter to RMB -1.28 billion. With increased investment in Meituan's overseas business, it should mainly be the substantial contraction of domestic preferred business that helped reduce the loss in new business.

5) However, unusually, the unallocated loss expanded by approximately RMB 2.8 billion compared to the previous quarter. About RMB 1.1 billion can be explained by changes in investment gains or impairments and other operational factors. For the remaining part, the company explained it was due to investments in AI and other projects. There is some suspicion whether the better-than-expected loss in new business was manipulated. $MEITUAN(03690.HK) $Meituan(MPNGY.US) $MEITUAN-WR(83690.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.