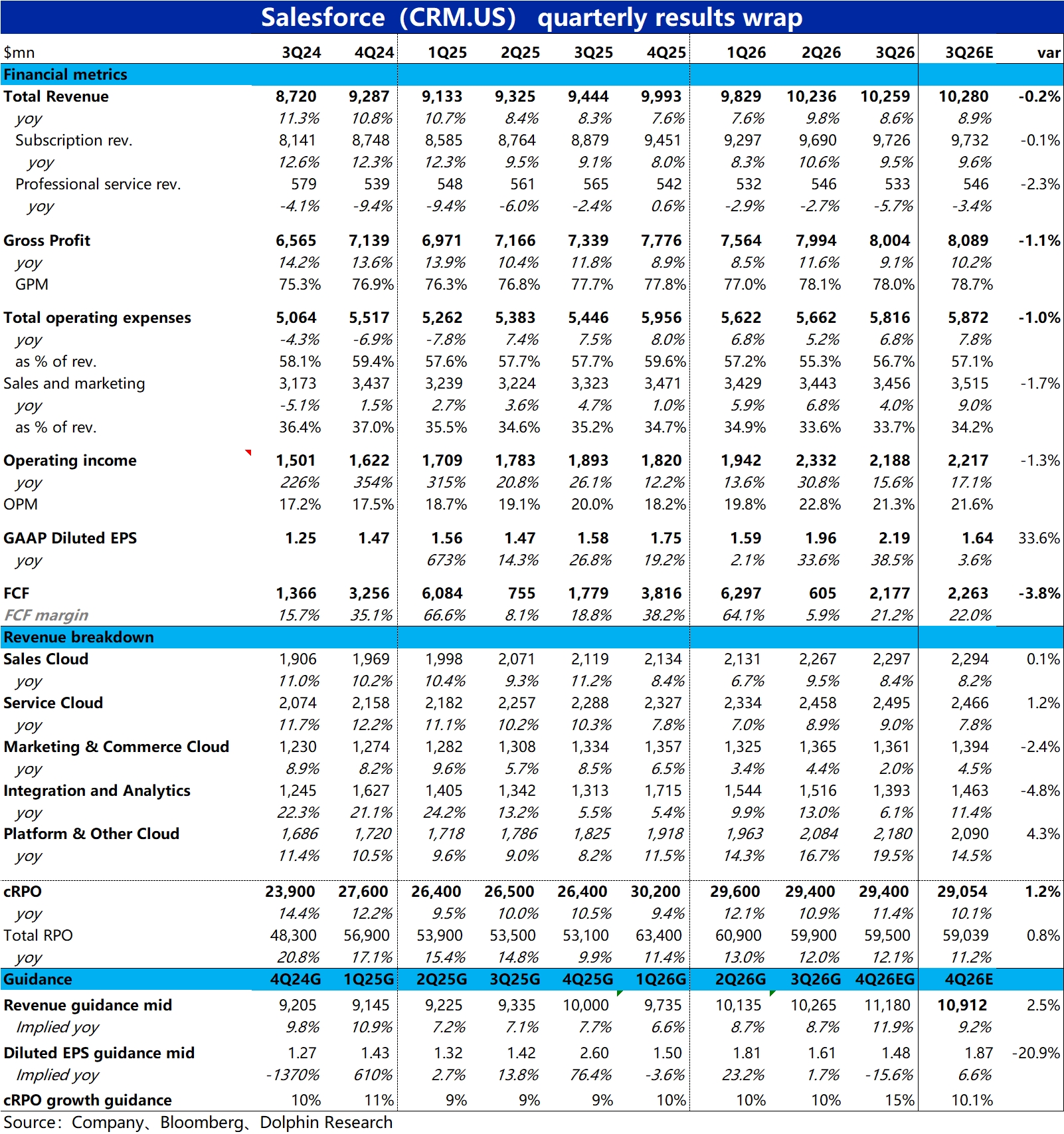

Salesforce F3Q26 Quick Interpretation: Overall, Salesforce's financial performance for the quarter was average, with most indicators slightly below market expectations. However, more critical operational metrics such as cRPO and new orders were satisfactory. The more notable aspect was the acceleration in revenue and cRPO growth in the next quarter guidance, boosted by the acquisition of Informatica. Specifically:

1) Total revenue for this quarter increased by 8.6% year-on-year, slowing down by about 1 percentage point compared to the previous quarter, slightly below expectations. Meanwhile, due to the impact of AI investments, the year-on-year increase in gross margin was only 0.3 percentage points, resulting in a gross profit growth rate of only 9%, also slightly below expectations.

As total operating expenses grew by 6.8% year-on-year, without significant acceleration, actual spending was slightly below market expectations, partially offsetting the slowdown in growth for the third quarter. Ultimately, operating profit and free cash flow fell short of expectations. The quarterly financial report performance was evidently not good.

2) Partly due to the low base in the same period last year, this quarter's cRPO (+11% yoy) and new order growth rates accelerated quarter-on-quarter, showing a better trend compared to past performance.

3) The bigger highlight is that the company has guided next quarter's revenue growth to increase to 11%~12%, and cRPO growth to 15%. However, it should be noted that the acceleration is almost entirely due to the benefits of consolidating Informatica and favorable exchange rates.

4) The most watched Agentforce-related business also made steady progress this quarter. Agentforce and Data 360 annualized revenue reached 1.4 billion, up from 1.2 billion last quarter, continuing to rise. Among them, Agentforce contributed annualized revenue of over 500 million, a year-on-year increase of 330%, with user numbers also increasing by 70%. $Salesforce(CRM.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.