Nov. Retail Sales: YoY growth below 2%, a post-Covid low — what's behind the slowdown?

Nov macro data, which include Singles' Day, are out. Note the National Bureau of Statistics' published growth rates run about 1–2ppts higher than rates back-calculated from historical series, and we follow the official methodology.

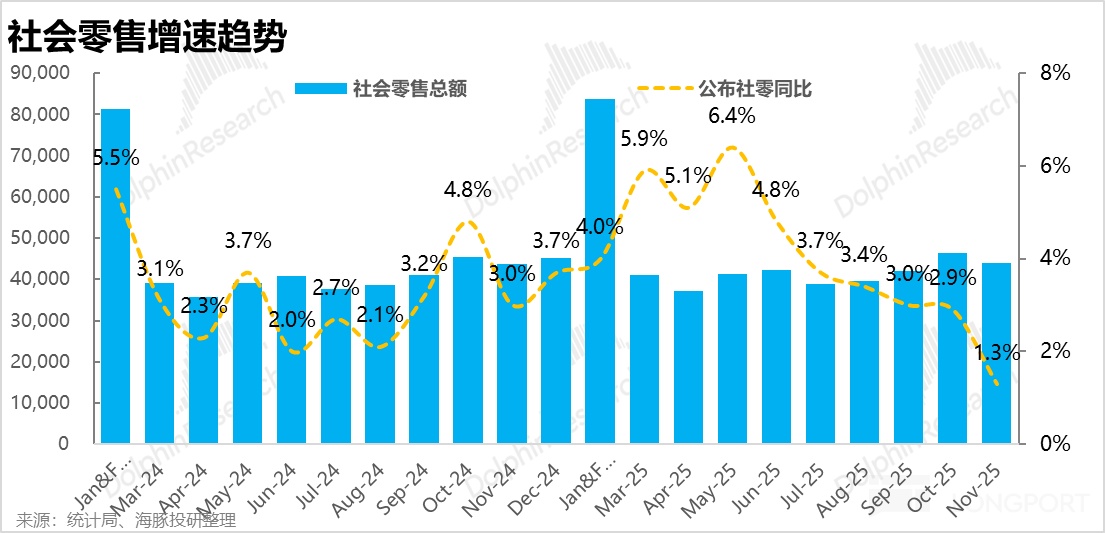

Overall, retail sales rose just 1.3% YoY this month, the weakest single-month pace since the post-Covid period starting in 2023. To understand the drivers, Dolphin Research reviews data by channel and category to pinpoint where the drag came from.

1) Retail sales hit a post-Covid low

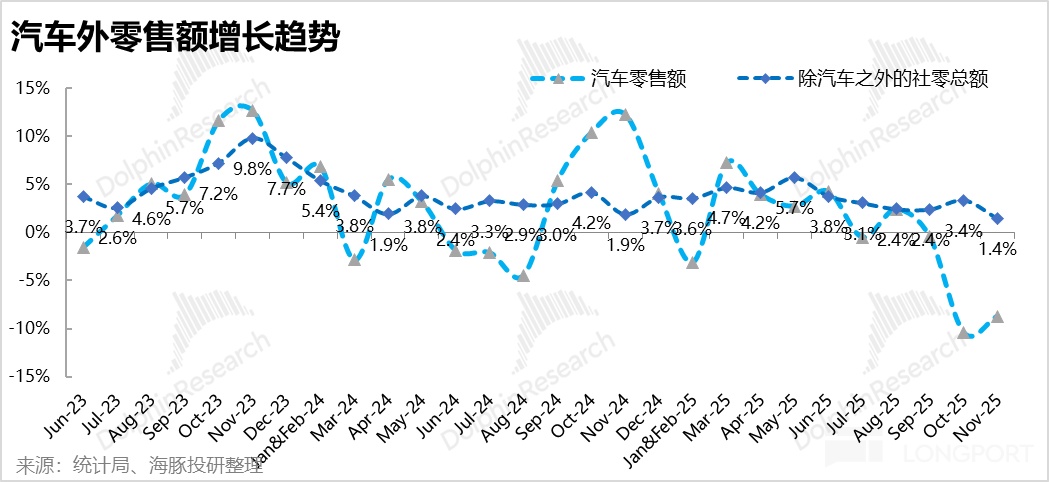

Per NBS, Nov total retail sales of consumer goods rose 1.3% YoY, down sharply from ~3% in prior months. This confirms Dolphin Research's earlier concern and marks a new low for growth since 2023.Even the simple average for Oct–Nov is 2.1%, roughly back to the previous trough before the sharp rebound in Sept 2024. Two factors likely contributed: last year's state subsidies created a tough base, and Singles' Day promotions have effectively shifted into Oct.

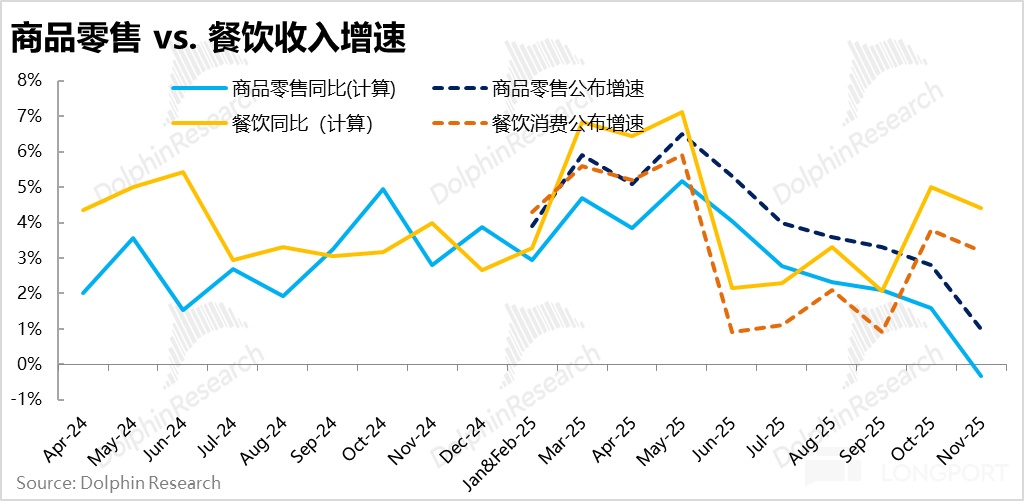

By type of consumption, both goods retail and F&B spending slowed vs. last quarter on NBS growth rates. In absolute growth terms, restaurant revenue has held above 3% since the peak of Sept's food-delivery wars, which is not particularly weak.Goods retail growth, however, plunged to just 1% in Nov, becoming the main drag on overall retail sales. We next look at online vs. offline and category splits to explain the slump in goods retail.

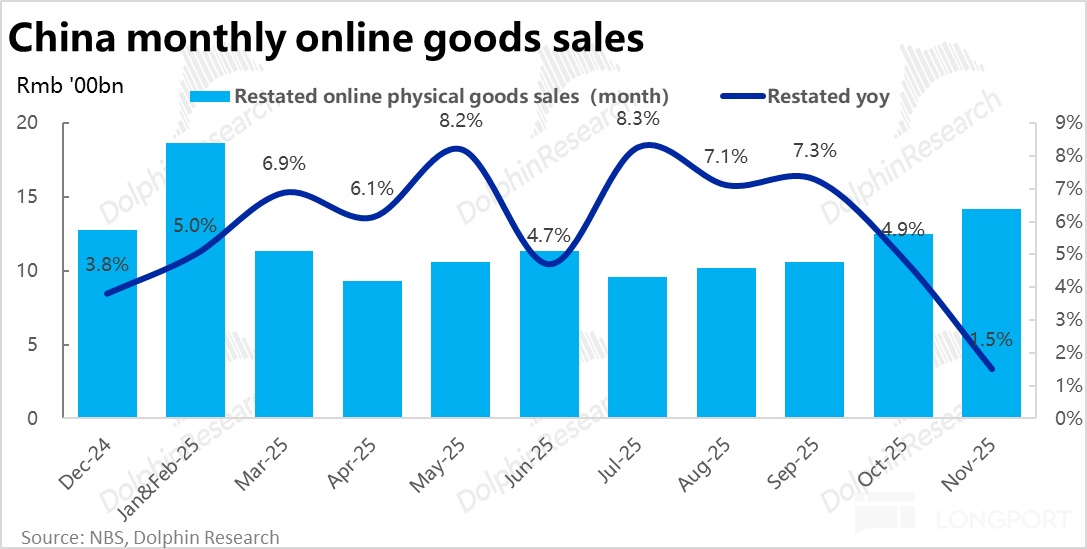

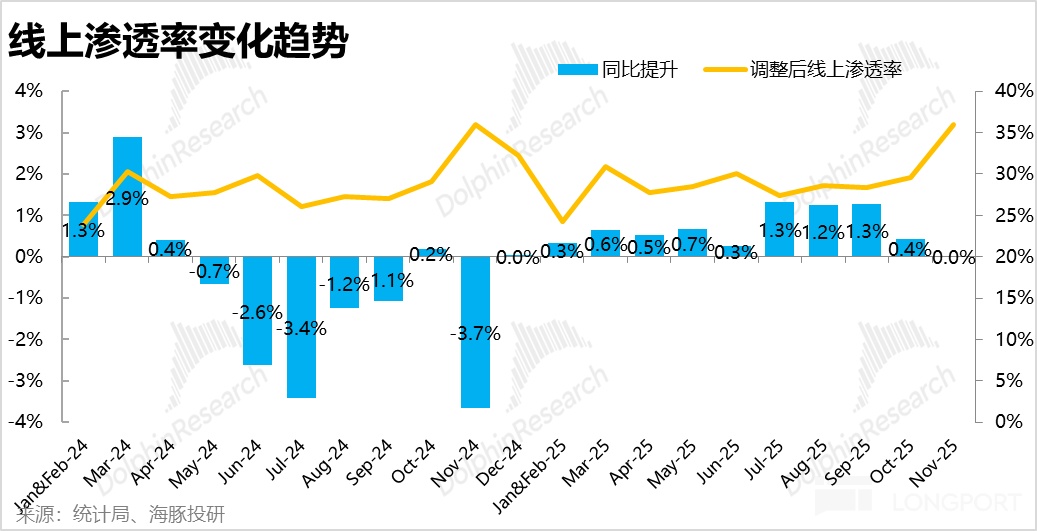

2) Promo timing still matters, but online is not the culprit

As major e-commerce platforms moved Singles' Day earlier, by 2025 most pre-sales started in mid-to-early Oct, and the first sales peak was largely digested within Oct. So front-loading from the e-commerce mega-sale still affected Nov online sales, though seemingly less than last year.Unlike last year, when online retail growth accelerated from Sept to Oct then slumped in Nov in a clear inverted-S pattern, this Oct was already down meaningfully vs. Sept even if still stronger than Nov. In other words, online physical goods growth was weak across both Oct and Nov.

From online physical retail divided by retail ex-auto, online penetration expanded 0.4ppts YoY in Oct but was flat YoY in Nov. Oct was slightly better than Nov, but Nov's weakness looks driven by broad softness in goods retail, not by shrinking online penetration.

3) Subsidy fade and autos dragged, but other categories were soft too

By category, autos were a clear drag: auto retail sales fell 6.6% YoY in Oct and 8.3% in Nov. Retail ex-auto rose 2.5% this month, underscoring autos as a key headwind across Oct–Nov.

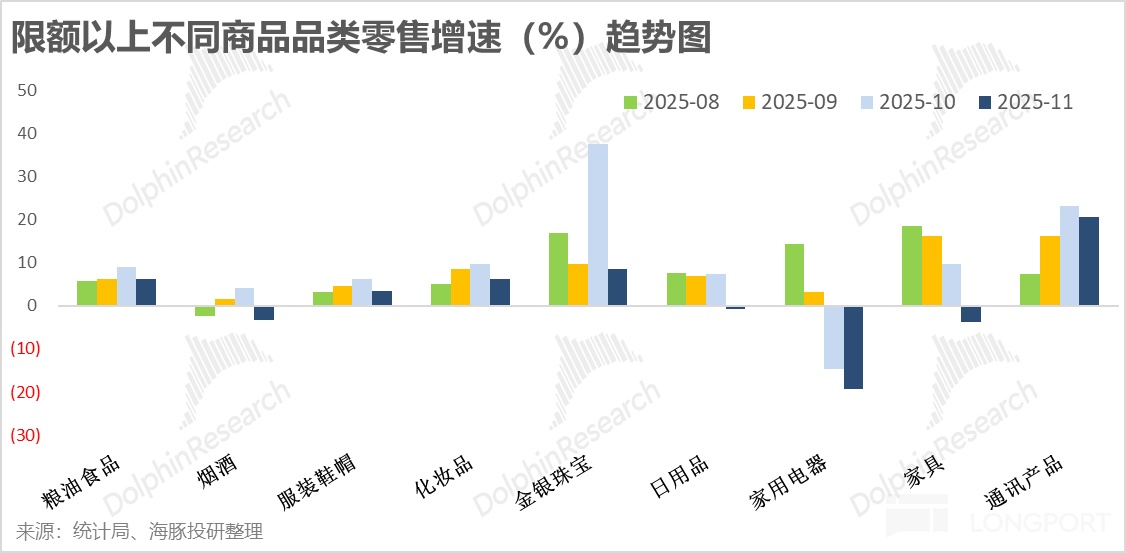

With state subsidies fading and the sector entering a high base, former engines such as home appliances and furniture turned notably negative YoY. They shifted from drivers to meaningful drags.

Although not as weak as autos or appliances, almost all categories decelerated in Nov vs. Oct. Tobacco & alcohol and daily necessities also turned negative, pointing to broad-based weakness in goods retail rather than a few isolated categories.

<End of text>

Risk disclosure and disclaimer: Dolphin Research disclaimer and general disclosures

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.