Sanhua Intelligent Controls: Unflashy biz — how does it keep riding every boom?

Sanhua Intelligent Controls: Low-profile biz, yet always on the right wave?

Anyone tracking the humanoid robot supply chain can’t skip $SANHUA(02050.HK) $Sanhua(002050.SZ). The closer Tesla’s Optimus gets to mass production, the tighter Sanhua’s linkage becomes with Tesla’s humanoid program as a core Tier One supplier.

From a share-price perspective, Sanhua has seen multiple upward re-ratings as cooperation deepened with Tesla and other leading OEMs in NEVs and humanoids. Momentum accelerated after the H-share listing in mid-2024 as expectations around humanoid progress rose, lifting both A/H shares sharply. However, since Sep-2025, A/H prices appear to have diverged.

Turning to fundamentals, since the 1970s Sanhua has grown from a near-handcrafted village shop into a global leader in precision components for refrigeration and autos, while pushing into new frontiers. It is a representative case of Mainland China’s manufacturing ascent. What capabilities powered Sanhua’s rise, and can they sustain an edge as it expands into new markets?

To answer this, we first review Sanhua’s development path to understand its competitive strengths, while clarifying what it actually makes and sells. Based on that, the next piece will examine its humanoid robotics strategy.

Body:

I. The company started in refrigeration. How did it scale from a tiny workshop into a category leader?

Pivoting from farm machinery repair to refrigeration parts on clear market signals. Sanhua’s predecessor, the Xicheng Commune Farm Machinery Repair Plant in Xinchang, mainly repaired simple farm tools but was loss-making and near bankruptcy. In 1979, founder Zhang Daocai joined as head of supply and sales, becoming deputy director in 1982 and director in 1984. He spotted surging demand for refrigerator components as fridges rapidly entered Chinese households and decided to enter refrigeration parts, renaming the plant to Xinchang Refrigeration Parts Factory and making components the core strategy.

University collaboration enabled the first domestic two-position three-way solenoid valve, breaking foreign monopoly. In 1987, to address R&D and process gaps, Zhang partnered with Shanghai Jiao Tong Univ. and developed China’s first two-position three-way solenoid valve, ending Japanese dominance. Why this product? The logic was threefold.

First, clear demand. The valve is a must-have fluid-control part in refrigerators, switching refrigerant on/off and flow direction. No domestic firm could make it then, imports were pricey, and it was a choke-point component for China’s fridge industry. Meanwhile, local fridge makers had scaled up, making the valve a hard requirement.

Second, the product carried R&D and manufacturing barriers, reducing commoditization risk and fitting Sanhua’s positioning. Third, a structural cost edge vs. overseas brands supported share gains.

Subsequently, Sanhua developed thermal expansion valves, electronic expansion valves, and drain pumps, and set a course of in-house R&D and brand building. In 1992, it was renamed Zhejiang Sanhua Group. Figure: Solenoid valve

Figure: Electronic expansion valve

Source: Sanhua IC website, Dolphin Research

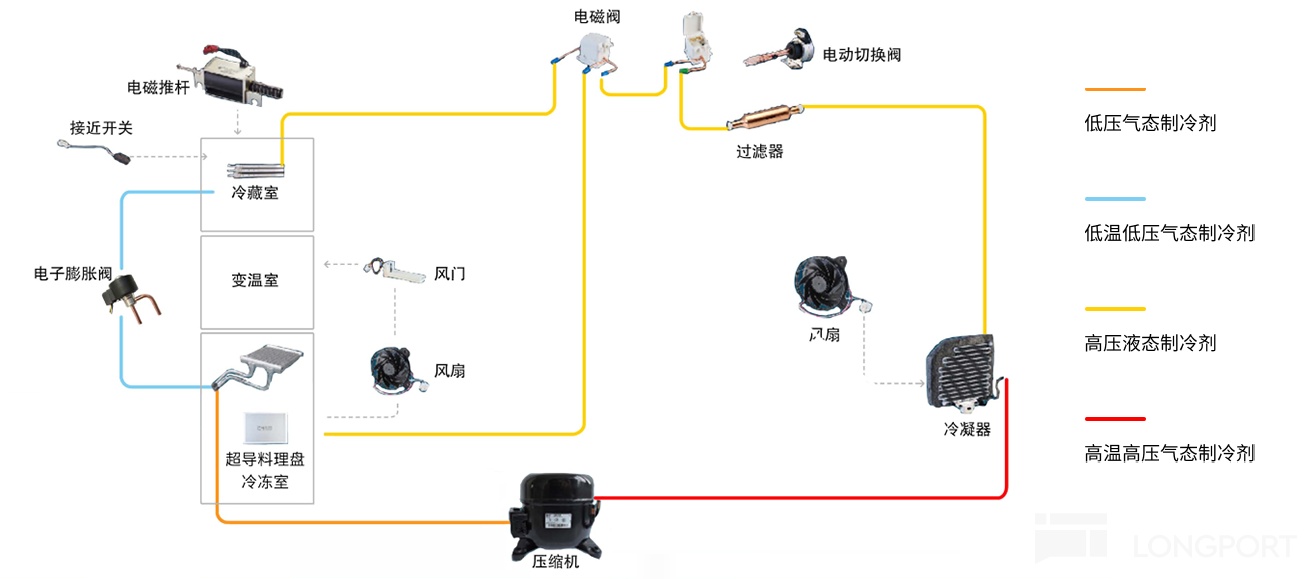

Figure: Refrigerator refrigeration system schematic

Source: Sanhua IC website, Dolphin Research

Seizing the air-conditioner wave alongside fridge components. China’s AC industry scaled later than fridges but grew fast. Sanhua moved into AC shut-off valves, enabling import substitution again. Developing the four-way reversing valve and winning on cost. In 1995, Sanhua built a core HVAC component, breaking the U.S. monopoly and supplying multiple China AC OEMs.

Sanhua’s four-way valve matched import performance at a meaningfully lower price, driving rapid share gains. Sales hit 1 mn units in 1999, global share reached ~25% by 2000, and ~50% by 2006, with customers across Haier, Gree, Midea, Hisense, and overseas names like Samsung, LG, Panasonic, Mitsubishi, and Daikin. Figure: Residential AC system schematic

Source: Sanhua IC website, Dolphin Research

Acquiring the former would-be acquirer. In 2007, Sanhua acquired U.S.-based Ranco, the onetime leader and inventor of the four-way valve. Back in 1996, as Sanhua first gained share, Ranco noticed this low-profile rival and tried to buy Sanhua’s four-way business, but Sanhua declined. The tables turned a decade later.

II. What is a valve?

Sanhua’s story centers on ‘valves’. In refrigeration, a valve is a critical fluid-control component that regulates the flow, pressure, and direction of refrigerants by modulating its opening. Refrigeration relies on heat exchange via refrigerant flow and phase change, absorbing or releasing heat. For example, an AC moves indoor heat outdoors to cool the room.

Put simply, a valve is a switch controlling whether and where the refrigerant flows. But it demands precision, sealing, and longevity under complex conditions, and is actuated by coils or stepper motors for automation. It is inherently interdisciplinary, spanning mechanical, fluid, materials, and electrical engineering. Valves are pivotal to precise temperature control in refrigeration systems.

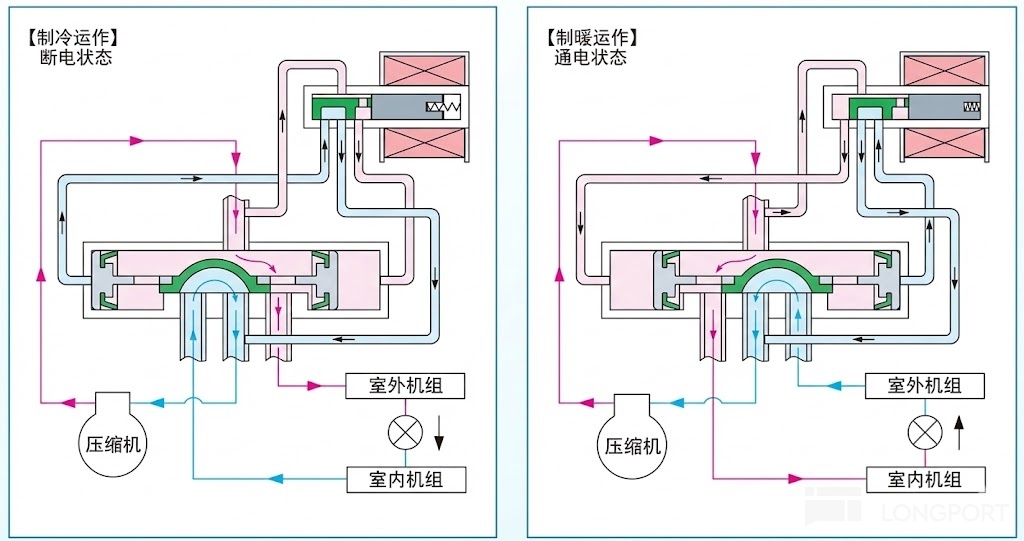

Take the four-way valve as an example: it has four ports and, via spool movement, reroutes refrigerant paths as shown. Figure: Four-way valve working principle

Source: Foshan Hualu, Dolphin Research

In heat/cool AC systems, the four-way valve reverses modes between cooling and heating. Its internals are highly precise to ensure reliable switching of refrigerant circuits, imposing stringent demands on design, materials, and manufacturing. This is why it is a core part.

III. Globalization and expanding beyond legacy product boundaries

After its refrigeration breakthrough, Sanhua shifted from cost leadership to tech leadership as its advantage evolved. It then opened new growth curves overseas and in NEVs. In refrigeration:

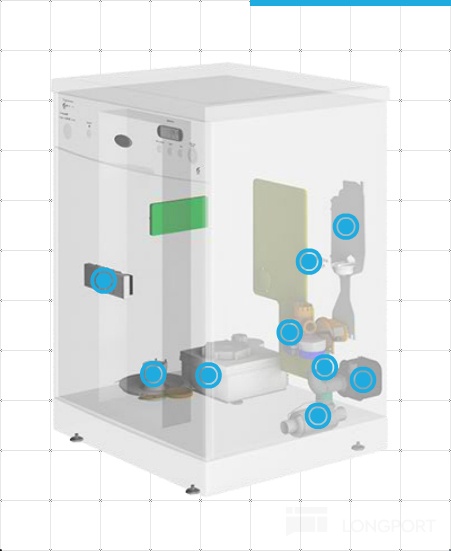

(1) Acquired parts makers such as Aweco and expanded into the global high-end white-goods market. Aweco supplies dishwashers, washing machines, coffee machines, etc., to leading European and Chinese brands including Siemens, Bosch, Whirlpool, Liebherr, Midea, Haier, and Gree. Figure: Aweco’s key products

Source: Aweco website, Dolphin Research

(2) Launched electronic inverter controllers, beating global giants like Danfoss and Emerson to supply solutions to Carrier and others. Controllers differ from valves; they are electronics that send control signals, with core value in circuit design and control algorithms. This lifted Sanhua from single components to system solutions.

(3) Built microchannel products such as microchannel condensers and evaporators for residential AC, commercial AC, and heat pumps. In short, microchannel is an advanced heat exchanger with micron-scale passages that materially boosts heat-transfer performance. Figure: Microchannel condenser

Figure: Microchannel evaporator

Source: Sanhua IC website, Dolphin Research

(4) In parallel, it built factories in Mexico, Poland, and other locations to complete the global footprint. This supported local-for-local supply.

IV. Emerging as a leader in NEV thermal management

Sanhua entered auto early: in 2006 it founded Sanhua Automotive to target vehicle thermal management, and in 2014 it developed an automotive electronic expansion valve, breaking Denso’s monopoly and winning GM orders. Figure: Automotive electronic expansion valve

Source: Sanhua IC website, Dolphin Research

Before 2018, progress was respectable but limited by entrenched Tier One incumbents in legacy autos and a low-growth market. Entry barriers were high and openings scarce for newcomers. A leadership transition also occurred: in 2012, Zhang Yaobo, son of founder Zhang Daocai, became chairman and CEO of Sanhua Holding at age 38, ensuring operational continuity.

Sanhua then captured the NEV inflection. In 2017 it set up the NEV Thermal Management BU to develop integrated systems. In 2018, Sanhua entered Tesla’s supply chain. Execution with Tesla validated its capability, leading to wins from other top OEMs. Its portfolio expanded from valves to integrated modules combining valves, pumps, heat exchangers, and lines, upgrading from parts to systems.

In 2019, Tesla proposed the Octovalve architecture, and in 2022 Sanhua was first to mass-produce it. The Octovalve reduces weight while improving reliability and efficiency, and has since been adopted by Tesla, BYD, and others. By 2023, auto contributed over 40% of listed revenue. Why could Sanhua achieve in NEVs what it could not in the ICE era?

Legacy OEMs relied on Tier Ones like Denso and Valeo for turnkey thermal systems. In the NEV era, the OEM–supplier model changed materially. Tesla designed its own thermal architecture and bypassed Tier Ones to work directly with Tier Twos like Sanhua; Tesla owned the R&D, while Sanhua and peers industrialized at scale.

Leveraging its strengths, Sanhua caught the opportunity, using components as the entry point and then moving up to integrated subsystems. In effect, it evolved from Tier Two to Tier One through system integration. This strategic climb reshaped its position in the value chain.

V. What capabilities define Sanhua, based on its growth journey?

First, sound industry calls. It anticipated demand in fridges, ACs, premium appliances, and NEVs, and seized the opening to join Tesla’s supply chain. Second, clear view of its competitive frontier. It chose products that match and reinforce its edge: compete on cost when appropriate, invest in technology when required.

Third, true R&D and manufacturing depth. This underpinned import substitution, market share gains, and access to top-tier customers. These are the company’s foundations.

VI. Sanhua’s auto business centers on thermal management. What is it?

(i) Framing NEV thermal management

Automotive thermal management regulates both component operating temperatures and cabin comfort. It must dissipate heat or deliver heating to keep key parts (for NEVs: battery, e-motor, power electronics, and chips) in optimal ranges while keeping the cabin comfortable. One might ask: isn’t this similar to AC or fridge systems?

Despite surface similarities, automotive use cases differ materially from traditional HVAC. ACs manage only ambient air in a defined space, while cars must regulate both air and components such as engines (ICE) or the three-electric system (NEV). Operating conditions are also far more dynamic and complex in vehicles.

(ii) Why NEV thermal management has higher value content

Given different powertrains, NEV thermal systems carry 2–3x the value of ICE systems. Looking ahead, value could rise further for several reasons. 1) More components require thermal control, increasing system complexity.

ICE systems mainly cool the engine and manage cabin AC, often using engine heat for cabin heating. NEVs must manage both the three-electric system and the cabin, with batteries adding the most stringent new requirement given tight temperature windows and safety needs. This necessitates precise heating and cooling.

2) Energy anxiety drives integration and efficiency, favoring architectures like heat pumps.

Integration comes from re-architecting the system. Subsystems and loops are coupled to exchange information and energy, balancing thermal loads across the vehicle to raise overall efficiency. This addresses inefficiencies from historically siloed subsystems. 3) Example: Tesla’s thermal system

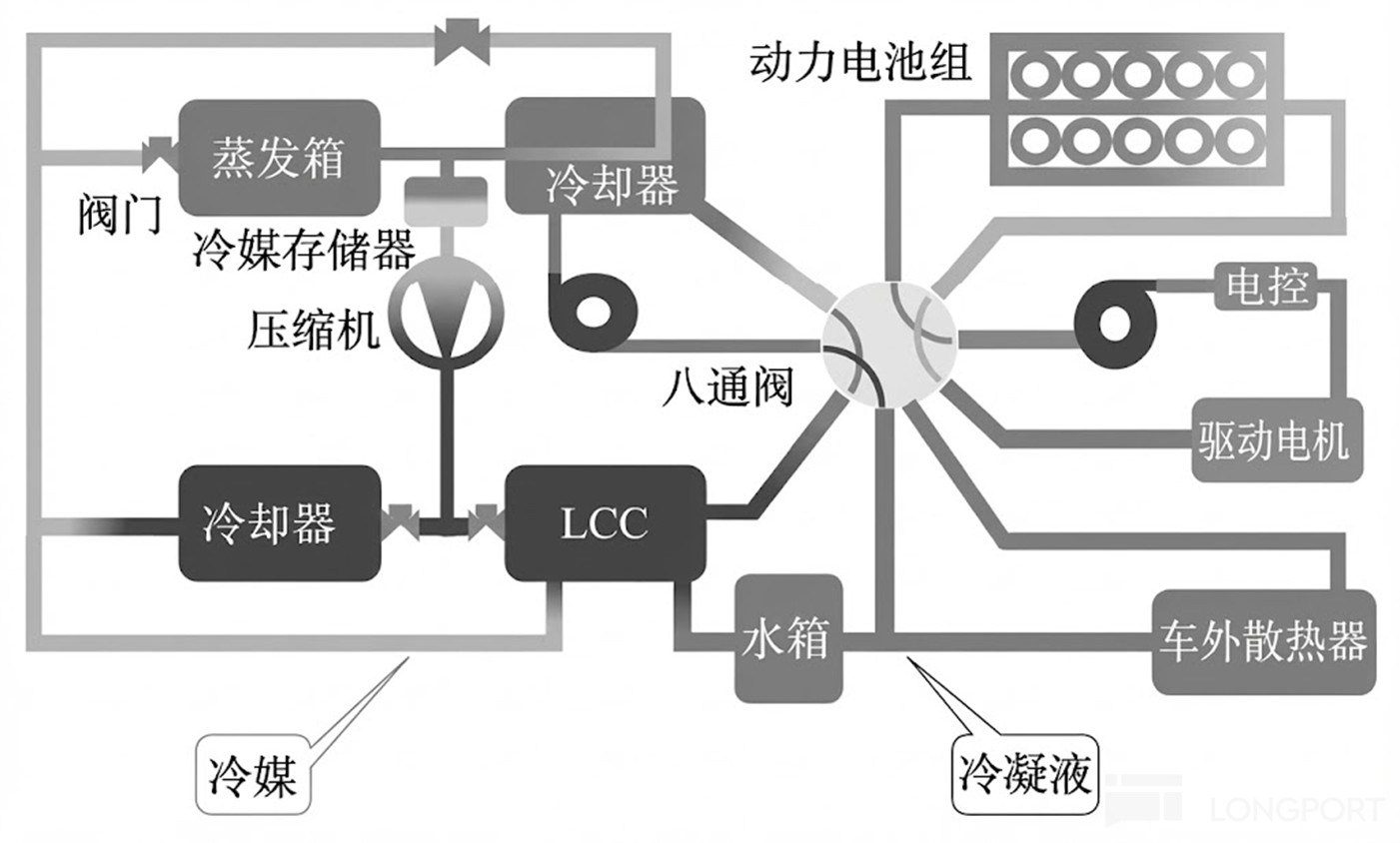

Tesla has iterated through four generations (Gen 5 under development), with rising integration. In Gen 4, the main upgrades are as follows. Figure: Tesla Gen 4 thermal system modes

Source: NEV Thermal Management Review, Dolphin Research

(1) Adopting a heat pump and fully removing PTC heaters

What is a heat pump? Like ACs, it moves heat via a compressor, but its scope in cars extends beyond the cabin and aligns with an integrated thermal architecture. Cabin thermal control uses a heat pump for both cooling and heating. Waste heat from the three-electric system is recovered via the Octovalve to heat the cabin, eliminating PTC cabin heaters that are effectively resistive and power-hungry.

For batteries, the system can route heat from the heat pump, e-motor/inverter waste heat, and low-efficiency heating from the motor/compressor/blower through the Octovalve to the pack. This allows removal of PTC heaters in battery thermal management as well. (2) High integration via the Octovalve

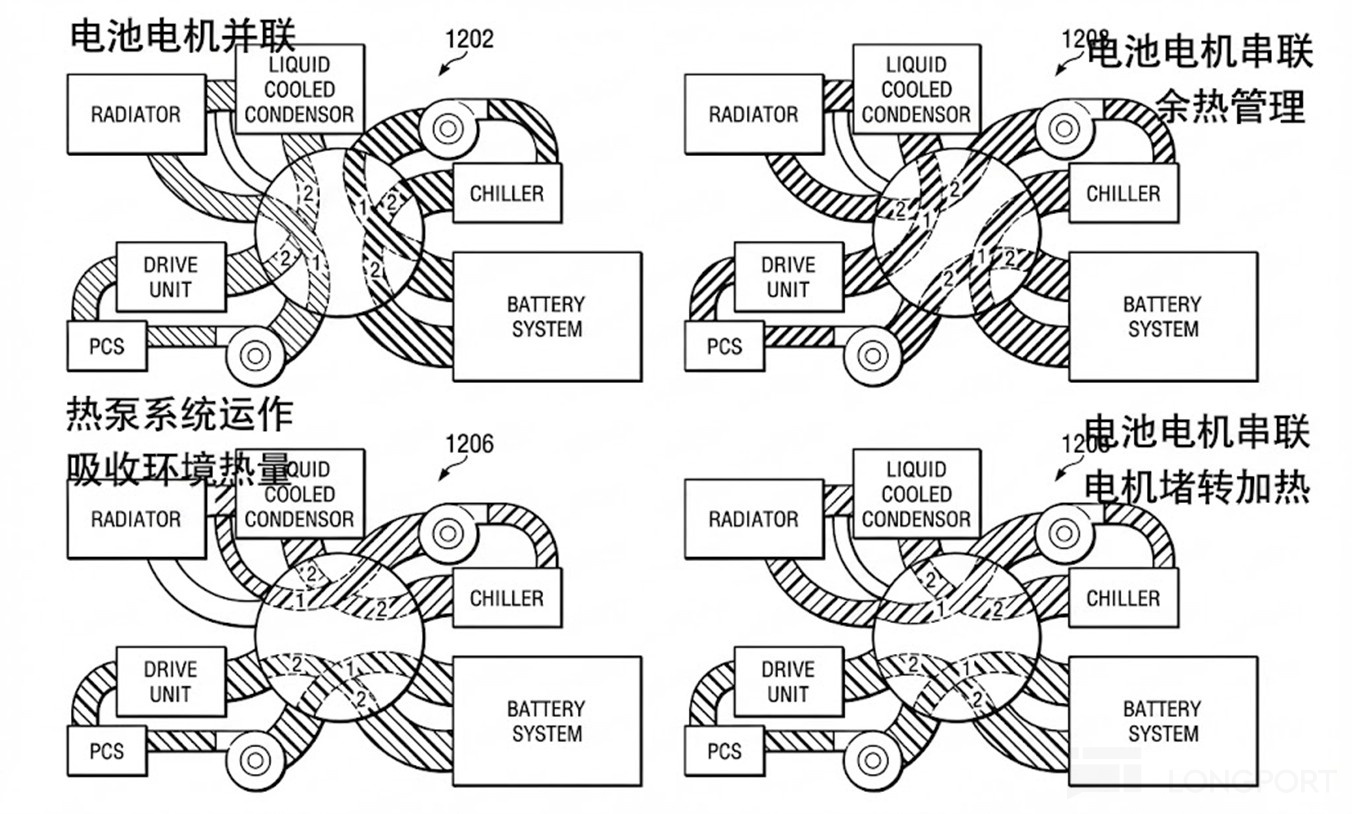

The Octovalve uses a stepper motor to switch multiple key loops, routing coolant (note: not refrigerant) to manage temperatures efficiently. This raises overall system efficiency. Figure: Octovalve operating states

Source: Tesla patents, Dolphin Research

Simply put, heat is directed first to where it is needed and away when it is not, maximizing efficiency through a flexible architecture. In this flow control, the Octovalve is central. It is the system’s traffic hub.

(iii) Why value could rise further

1) With ongoing integration and efficiency pushes, system architectures and technologies will keep advancing. Expect cross-domain fusion, higher heat-pump utilization, and better insulation materials like mica and aerogels. 2) Batteries with higher capacity and energy density release more heat in smaller volumes, demanding stronger cooling such as CATL’s double-sided liquid cooling, while high-voltage fast-charging raises both heating and cooling requirements.

3) Rising vehicle intelligence brings high-power chips and new heat loads. Thermal envelopes must expand accordingly.

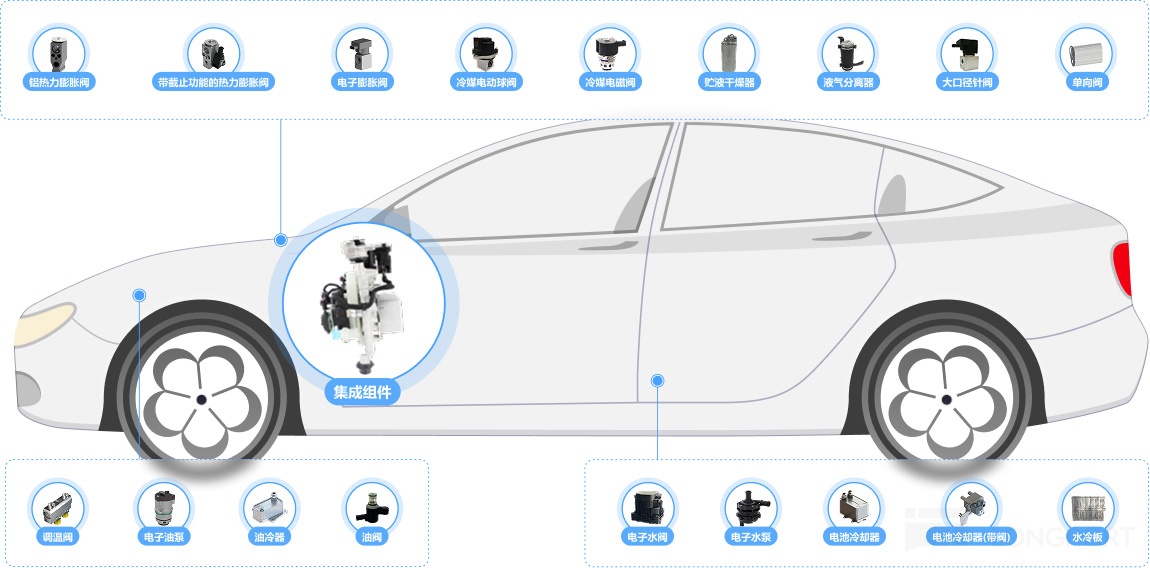

(iv) What’s in an NEV thermal system, and where does Sanhua play?

Figure: NEV thermal system components

Source: Sanhua IC website, Dolphin Research

Key components include: 1) Pumps: mechanical water pumps, e-water pumps, e-oil pumps; 2) Valves: TXV, EXV, solenoid valves, multi-port valves; 3) Heat exchangers: front-end modules, HVAC boxes, condensers, evaporators, cold plates; 4) Compressors (mechanical/electric); 5) Piping.

Apart from compressors and refrigerant, Sanhua supplies almost all major products above. This underlies its systems capability.

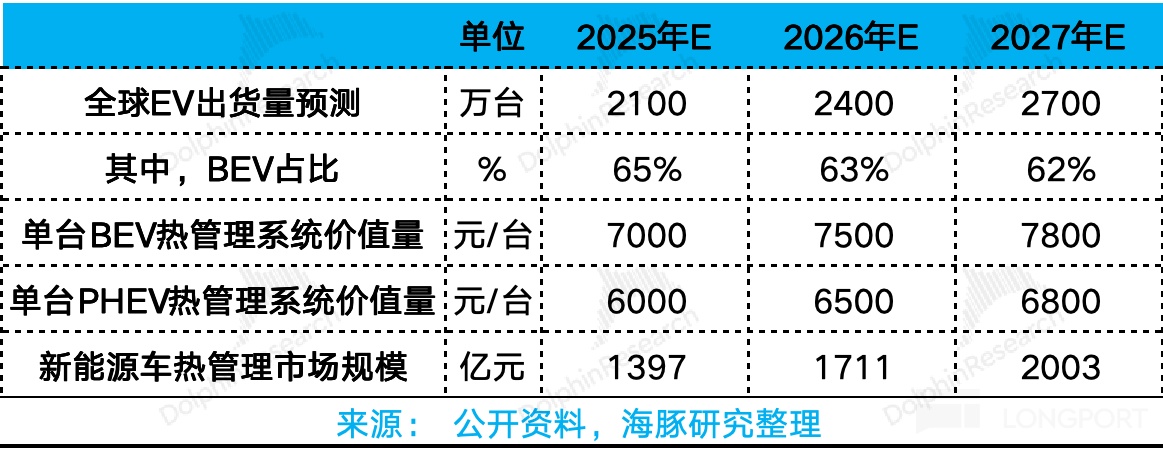

(v) A simple view of market size

The NEV thermal market has substantial runway ahead. Beyond autos, demand extends to compute centers and energy storage, which also need thermal management and offer sizable TAMs. We will discuss these adjacencies in the next article.

We will also cover Sanhua’s humanoid-robot layout and valuation in the follow-up. < Full text ends >

Risk disclosure and statement:Dolphin Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.