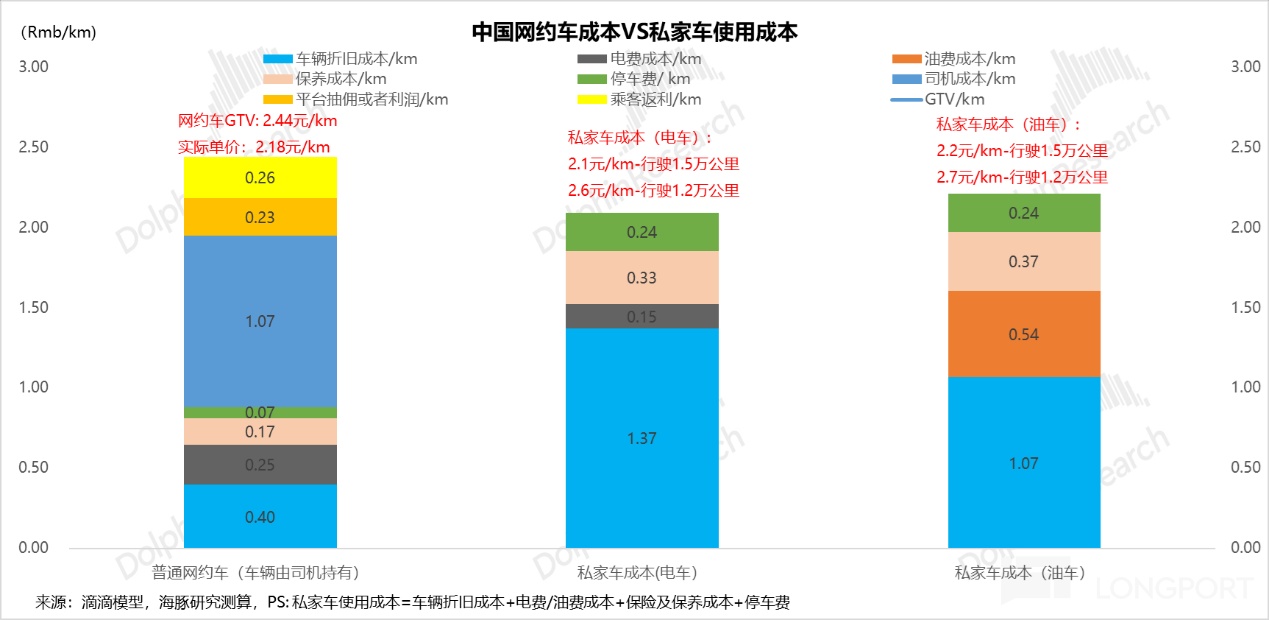

Private cars used to command 85%–90% of trips for one simple reason: they were cheap. TSLA’s Robotaxi cost offensive could flip ownership, an asset-heavy purchase, into a service-based model.The legacy pain point is clear: U.S. ride-hail costs about $2.5/mile vs. $0.7–$1.1/mile for private cars, capping ride-hail’s TAM. Robotaxi attacks the cost stack head-on.

First, it eliminates the driver, the single largest cost, which is ~50%–60% of ride-hail expenses. This takes base operating cost down to $0.7–$0.8/mile, already at parity with U.S. private-car costs.

Second, vehicle costs fall sharply. Tesla’s Cybercab, purpose-built for autonomy, targets a BOM of $25k–$30k vs. Waymo’s ~$80k, with unboxed manufacturing further compressing costs.

Third, operating efficiency jumps: daily utilization rises from 7–8 hours to ~12, the empty-mile rate drops from ~40% to ~20%, and annual passengers miles per car climb from ~40k to ~90k. Fixed costs get materially diluted.

By the numbers: Dolphin Research estimates that by 2035, an optimistic case puts Robotaxi costs at ~$0.4/mile, while Elon Musk’s ultimate target is $0.2–$0.3/mile, both well below private-car cost floors. A base case of ~$0.6/mile is still below most private cars. Even a bear case of ~$0.8/mile would match some private-car costs.

Given Tesla’s vertical integration — in-house AD software and hardware plus Cybercab production — unit economics likely land in the $0.4–$0.6/mile range, positioning Robotaxi to undercut private cars. Mass production of Cybercab in 2026 would be a key milestone to accelerate the shift.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.