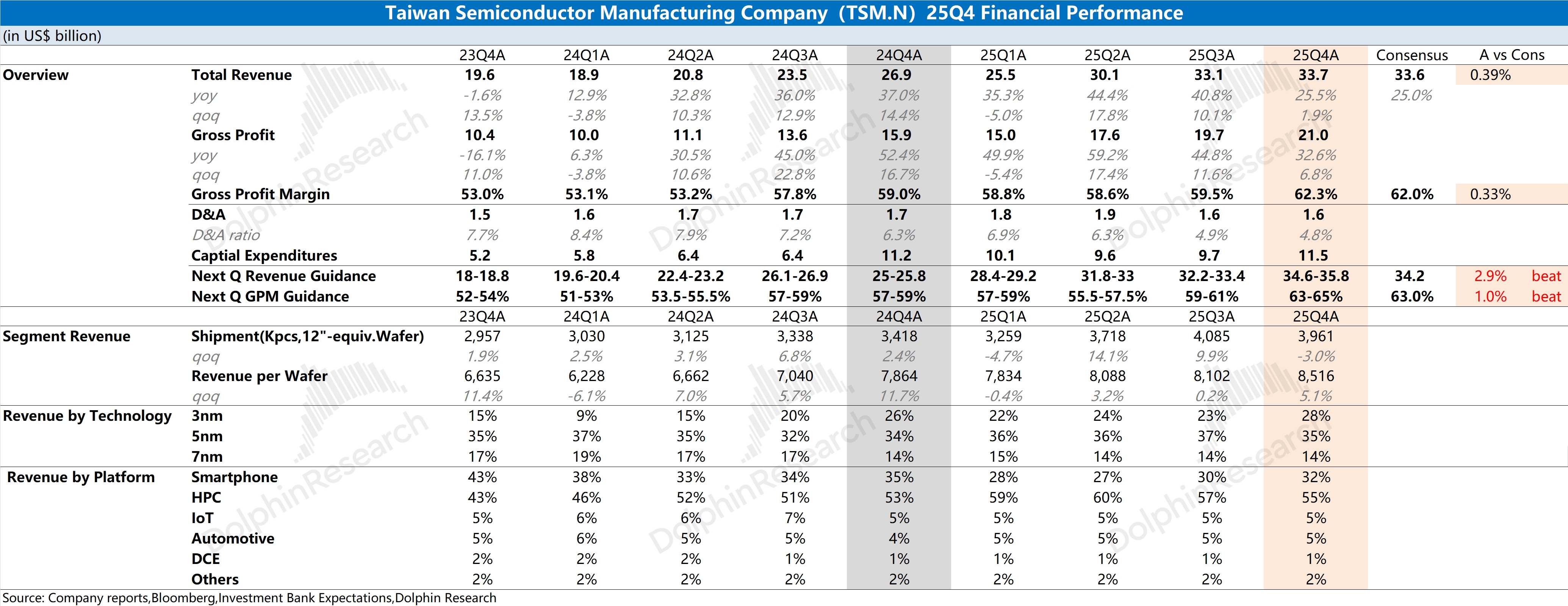

TSMC 4Q25 First Take: Revenue and GPM met the buyside's raised expectations. Revenue rose 1.9% QoQ, partly helped by a stronger USD. On a TWD basis, revenue grew 5.7% QoQ, still a solid sequential print.

The more material items in this print are guidance on GPM, capex and operations. These are the key focus areas this quarter.

1) GPM: GPM came in at 62.3%, above the buyside's 62% after recent upward revisions. The beat was driven mainly by a higher 3nm mix lifting blended ASPs.The company raised next-quarter GPM guidance to 63-65%, ahead of the buyside's 63%. As the mix shifts further to advanced nodes, higher ASPs should continue to support margin expansion.

2) Capex: Capex was $11.5bn this quarter, putting 2025 full-year capex at $40.9bn, up $11.0bn YoY and within the prior raised guide ($40-42bn). The company also guided 2026 capex up to $52-56bn, clearly above market ($48-50bn).

This implies a further $11-15bn increase in 2026 capex. It signals confidence in downstream demand and the 2nm capacity ramp.

3) Operations guidance: The company expects ~30% revenue growth in 2026, in line with the buyside's raised view (up from 25% to 30%). This suggests TSMC is on track for >30% growth for a third straight year in 2024-2026, underpinning its willingness to lift capex.

Overall, this was a strong print with guidance above market. Beyond affirming high growth into 2026, it also boosts sentiment across AI and semis. For more detail, follow Dolphin Research's forthcoming detailed commentary and Trans$Taiwan Semiconductor(TSM.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.