TSM (Trans): Capex to rise by tens of billions YoY, a decision made after talks with downstream customers.

Below is Dolphin Research's Trans of $Taiwan Semiconductor(TSM.US) Q4 2025 earnings call. For our First Take, see:《台积电: AI 界 “真大佬”,谁会拒绝?》

Key takeaways from TSMC's call:

a) Capex: For 2026, capex is guided to $52–56 bn (+$11–15 bn YoY), vs. market at $48–50 bn. Allocation: 70–80% to advanced nodes, ~10% to specialty tech, and 10–20% to advanced packaging and testing (24: 8% -> 25: 10% -> 26: 10–20%).

Management is typically conservative, yet is lifting capex by over $10 bn. On the call, management said this plan reflects discussions with customers and their customers (CSPs), indicating urgent downstream need for TSMC capacity adds.

Higher capex is an immediate positive for upstream semi equipment names such as ASML and AMAT, which rallied post-call.

b) Outlook: 2026 revenue growth target ~30% (in line with raised Street expectations). 2024–2029 USD revenue CAGR expected at ~25%.

GPM to improve to 63–65% next quarter. Over the cycle, long-term GPM targeted at 56%+ (prior 53%).

c) Technology roadmap: N2 entered volume in Q4 2025 in Hsinchu and Kaohsiung with healthy yields and will ramp fast in 2026. N2P to start volume in H2 2026, enhancing performance and power. A16 with Super Power Rail (SPR) to start volume in H2 2026 for select HPC.

d) Non-AI (smartphones and PCs): With memory prices set to rise, shipment growth for phones and PCs should be very limited. TSMC supplies most premium smartphones, which are less sensitive to memory pricing.

Details from the call:

I. Headline financials recap

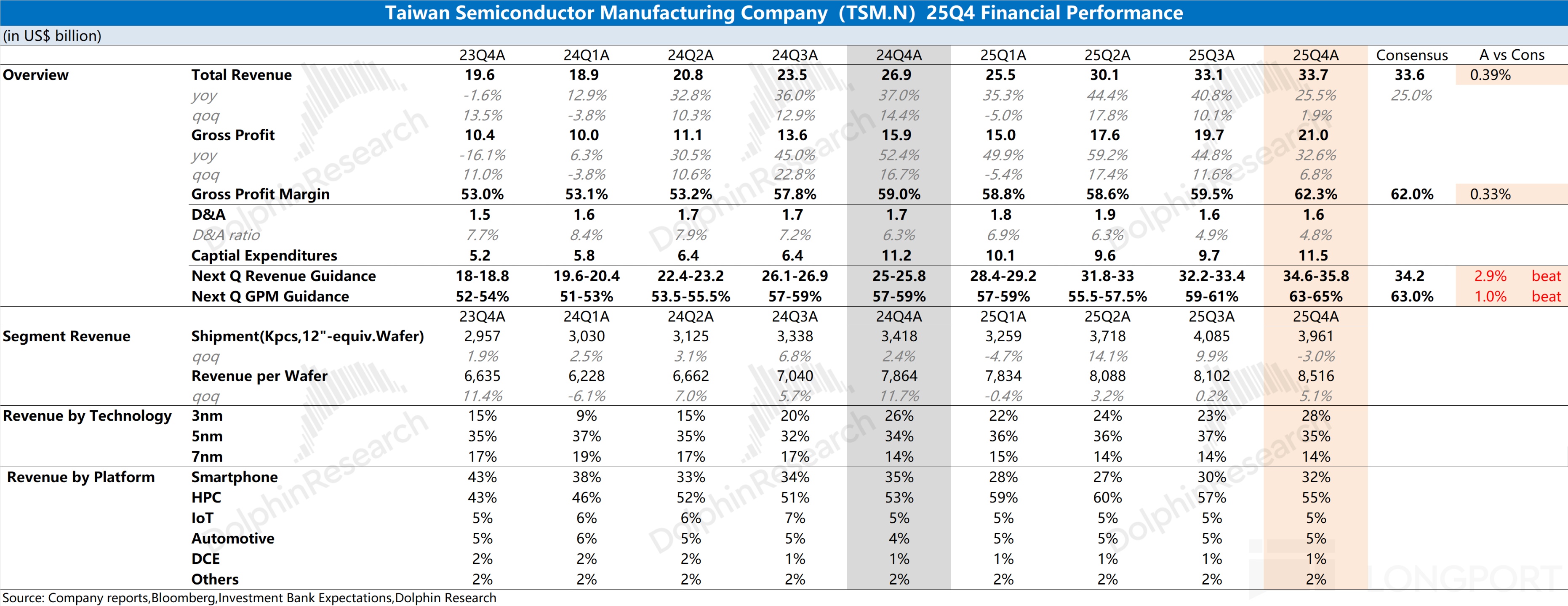

Q4 2025:

- Revenue: $33.7 bn (+1.9% QoQ), +5.7% QoQ in NT$.

- GPM: 62.3% (+280 bps QoQ), above the guided range, driven by cost optimization, favorable FX, and high utilization.

- OPM: 54% (+340 bps QoQ).

- EPS: NT$19.5; ROE: 38.8%.

- Advanced nodes (7nm and below) were 77% of wafer revenue, with 3nm at 28%, 5nm at 35%, and 7nm at 14%.

By platform, HPC was 55% of revenue (+4% QoQ). Smartphones were 32% (+11% QoQ).

FY2025:

- Revenue: $122.0 bn (+35.9% YoY), or NT$3.8 tn (+31.6% YoY).

- GPM: 59.9% (+380 bps YoY).

- OPM: 50.8% (+510 bps YoY).

- EPS: NT$66.25 (+46.4% YoY); ROE: 35.4% (+510 bps YoY).

- Advanced nodes were 74% of wafer revenue (2024: 69%), with 3nm at 24%, 5nm at 36%, and 7nm at 14%.

By platform, HPC was 58% of revenue (+48% YoY). Smartphones were 29%.

OCF: NT$2.3 tn. Capex: $40.9 bn (NT$1.3 tn). FCF: NT$1.0 tn (+15.2% YoY).

Cash dividends: NT$18/sh in 2025 (vs. NT$14 in 2024).

II. Earnings call details

2.1 Prepared remarks

Guidance:

- Q1 2026: revenue $34.6–35.8 bn (midpoint +4% QoQ, +38% YoY). GPM 63–65%. OPM 54–56%.

- 2026 tax rate: effective 17–18% (vs. 16% in 2025).

2026 profitability drivers:

- Overall utilization to improve modestly.

- N3 GPM to exceed corporate average around mid-2026.

- Profitability supported by better manufacturing efficiency and cross-node optimization (flex between N7/N5/N3).

- Overseas fab mix dilutes GPM by 2–3% initially, widening to 3–4% later.

- N2 volume in H2 to dilute 2026 GPM by ~1%.

Capex and long-term targets:

- 2026 capex: $52–56 bn (Street: $48–50 bn), with 70–80% to advanced nodes (mainly N2), ~10% to specialty, and 10–20% to advanced packaging/testing.

- 2026 D&A to grow by high-single-digit % YoY.

- Long-term: target through-cycle GPM 56%+ (from 53%) and ROE 20%+.

2026 outlook and AI-led growth:

In 2025, the company-defined 'Foundry 2.0' scope (all logic foundry, packaging, testing, mask making, and related) grew 16% YoY. For 2026, industry growth is expected at 14% YoY, while TSMC targets nearly 30% USD revenue growth on tech leadership.

AI demand remains strong: AI accelerator revenue was ~16–18% of total in 2025. AI accelerator revenue CAGR is projected near 58% over 2024–2029.

Long-term growth: USD revenue CAGR of ~25% for 2024–2029, led by AI accelerators. Smartphones, HPC, IoT, and Auto also contribute.

Global manufacturing footprint:

- Arizona, U.S.: Fab 1 in volume. Fab 2 main structure completed, tool move-in in 2026 with volume in H2 2027. Fab 3 under construction. A 4th fab and a first advanced packaging plant are in permitting. Recently acquired additional land to build an integrated mega-cluster in Arizona.

- Kumamoto, Japan: First specialty fab in volume with excellent yields. Second fab under construction.

- Dresden, Germany: Specialty fab progressing as planned.

- Taiwan: Multi-phase 2nm fabs in Hsinchu and Kaohsiung under preparation, with ongoing investments in leading-edge nodes and advanced packaging.

Technology progress:

- N2 entered volume in Q4 2025 in Hsinchu and Kaohsiung with solid yields. Demand to ramp rapidly in 2026.

- N2P, an extension of N2, to enter volume in H2 2026, improving performance and power efficiency.

- A16 with SPR to enter volume in H2 2026 for select HPC products.

2.2 Q&A

Q: Can you share more on customer demand signals? Given the large step-up in capacity commitments, some worry about an AI bubble. You must have vetted the capex plan carefully. Please elaborate on feedback and your view of the cycle.

A: AI demand is real, and the $52–56 bn capex was decided prudently. Over the past 3–4 months, we spent significant time with customers and their end customers. We needed to ensure demand is genuine, and we have spoken with all major CSPs.

They showed us evidence that AI is directly driving their businesses. They are growing and generating tangible financial returns. I reviewed their finances and they are highly liquid.

Of course, I asked about use cases. One hyperscaler told us these technologies materially improve their social media operations, and their users continue to grow.

We also developed TSMC-specific plans to raise manufacturing efficiency based on our AI learnings. Even a 1–2% productivity gain is meaningful for us.

Our Arizona ramp is on track. Key metrics — yields and density — are now broadly on par with Taiwan lines. U.S. customers urgently want local wafer capacity. The second land purchase in Arizona reflects real need to boost efficiency, lower cost, and better serve U.S. customers.

Q: Beyond chips, DC infrastructure like power is critical. How does TSMC assess power and grid availability in AI infra buildouts? Is this part of your planning?

A: My first concern is Taiwan power. I need sufficient power to expand without constraint. On global AI data center power, as one customer's customer told me, they started planning 5–6 years ago.

They said TSMC wafers are the bottleneck, and asked me not to worry about other parts because wafer supply must be solved first. That said, we do monitor global power, especially in the U.S.

We also look at supporting assets such as turbines and nuclear, and related components. We watch rack and cooling supply too. Conditions look fine, and we need to keep narrowing the supply-demand gap.

Q: On advanced packaging: what was the revenue contribution last year? Capex used to be ~10% and could rise to 20%. More detail on the expansion focus — 3D IC, SOIC, and potentially panel-level packaging over time? How will you work with OSET partners?

A: Advanced packaging was close to 10% of revenue last year, around 8%. This year it should be slightly above 10%.

We expect it to outgrow the company over the next five years. On capex, it used to be around 10% (sub-10%). Now advanced packaging plus mask making, etc., will be 10–20% of capex.

So the absolute dollars are higher. We invest in the advanced packaging our customers need, including the areas you mentioned.

Q: On non-AI markets: with memory and other component costs rising, how do you view demand? Outlook for PC and smartphone units? And within HPC, what about networking and general-purpose servers?

A: Even if you call them 'non-AI,' they are still related to AI. Networking processors need AI data to scale, and switches remain strong.

For PCs and smartphones, we expect memory prices to rise, so unit growth will be very limited. For TSMC, we do not see changes in customer behavior.

We supply most premium smartphones, which are less sensitive to memory prices, so demand remains robust. In short, we are working hard to close the supply gap and continue shipping significant wafers.

Q: On global capacity: there are reports TSMC is exiting 8-inch and mature 12-inch, converting to advanced packaging. Is that accurate? What are the key drivers — power constraints or online biz priorities?

A: We are reducing 8-inch and 6-inch capacity (not 12-inch). But we support all customers and discuss flexible resource allocation with them.

If their businesses are healthy, we will continue to support even on 8-inch. That commitment stands.

Q: On rising memory prices vs. softer demand: how will your customers or their customers address tight memory? Any impact on 2027?

A: No impact on TSMC. As noted, most of our customers now focus on premium smartphones or PCs.

These segments are less sensitive to component prices. Their forecasts for this year and next remain very healthy.

Q: TSMC has been supply-constrained for AI since 2024, and 2026 still looks tight. Does $52–56 bn capex this year imply supply-demand balances in 2027? Will this ease the current bottleneck?

Also, we hear about challenges hiring engineers in the U.S. and Taiwan. Can you discuss this trend and the scale of engineering shortages?

A: A new fab takes 2–3 years to build. Even with $52–56 bn of spend, the contribution to this year is near zero and only modest in 2027.

We are preparing supply for 2028–2029 and hope the gap narrows by then. For 2026–2027, we focus on near-term output via productivity, which continues to improve.

Our teams are motivated to meet customer needs, not just for financials but to be a trusted partner. In the near term (2026–2027) we are productivity-first, and results are good.

Our goal is to support customers. Near term (2026–2027) we prioritize productivity, and in 2028–2029 we step up capex significantly. If AI demand trends as expected, the investment will continue.

Q: TSMC's wafer ASP rose ~20% for a second year in 2025. With higher advanced-node mix and overseas fabs with higher costs, is +20% ASP the new normal? How do you see 2026 ASP amid annual price talks? Is Q1 guidance factoring price hikes at advanced nodes?

A: Each new node is priced higher, so blended ASP rises. That has been true and will remain so.

On profitability, price is one of six drivers, but gains mainly come from others. The first is high utilization.

The second is manufacturing excellence. We are also optimizing across nodes, including converting some N5 lines to N3, and shifting from mature nodes to more advanced ones where appropriate.

Q: Historically, new nodes peaked in revenue in year 2–3 of volume, but now year 4–5 can be higher. What does this mean financially and competitively?

A: Semis now require both low power and high speed. TSMC's process leadership delivers both, so waves of front-end customers keep coming.

That creates long, steady demand. We have N2 and N2P, and a third generation later would not be surprising, as iteration never stops.

Technology cadence builds our moat and enables customers to keep innovating. They stay with TSMC to keep their products competitive.

Q: How big will 2nm be in 2026 revenue? And on cost-per-transistor, concerns rose a few years back, but since 5nm performance-per-cost improved. Why are smartphone and PC customers accelerating migration to 2nm?

A: 2nm will be a larger node than 3nm from the start. In absolute revenue, 2nm is larger.

As a percentage, it matters less because the overall base is bigger. All products now chase low power and high speed, and our tech delivers that value.

We upgrade every year, so even within a node, customers keep improving products. Even if cost per transistor rises, performance-per-dollar improves, which is why customers keep partnering with us.

Q: AI revenue grows 15%+ per year, but tokens consumed grow ~15% QoQ. What token growth and GW power do you assume behind the 5-year AI outlook?

A: I am also trying to parse token growth, but my customers' product performance is rising very fast. From Hopper to Blackwell to Rubin, performance roughly doubles or triples.

So token and compute growth are massive, and frankly hard to track precisely. On GW power, I care more about how much TSMC earns than how much power we support.

The bottleneck remains TSMC wafers, not power. If you ask how many GW our capacity can support, the answer is: far from enough for now. U.S. power supply is actually ample.

Q: You said 2027 spend is more about productivity, with 2028–2029 much higher. Given stronger demand, could capex reach $200 bn over the next three years?

A: To clarify, we already raised capex meaningfully this year, but capacity takes 2–3 years to come online. When we said 2027 may not jump again, we meant output ramps take time.

We will focus on productivity in 2026–2027, while major volume from new fabs arrives in 2028–2029. Today's spend supports capacity two years out or beyond.

As for totals, we spent $101 bn in the past three years. The next three years will be significantly higher. I will not disclose the exact number, but it will be substantial.

Risk disclosure and disclaimer: Dolphin Research Disclaimer & General Disclosures