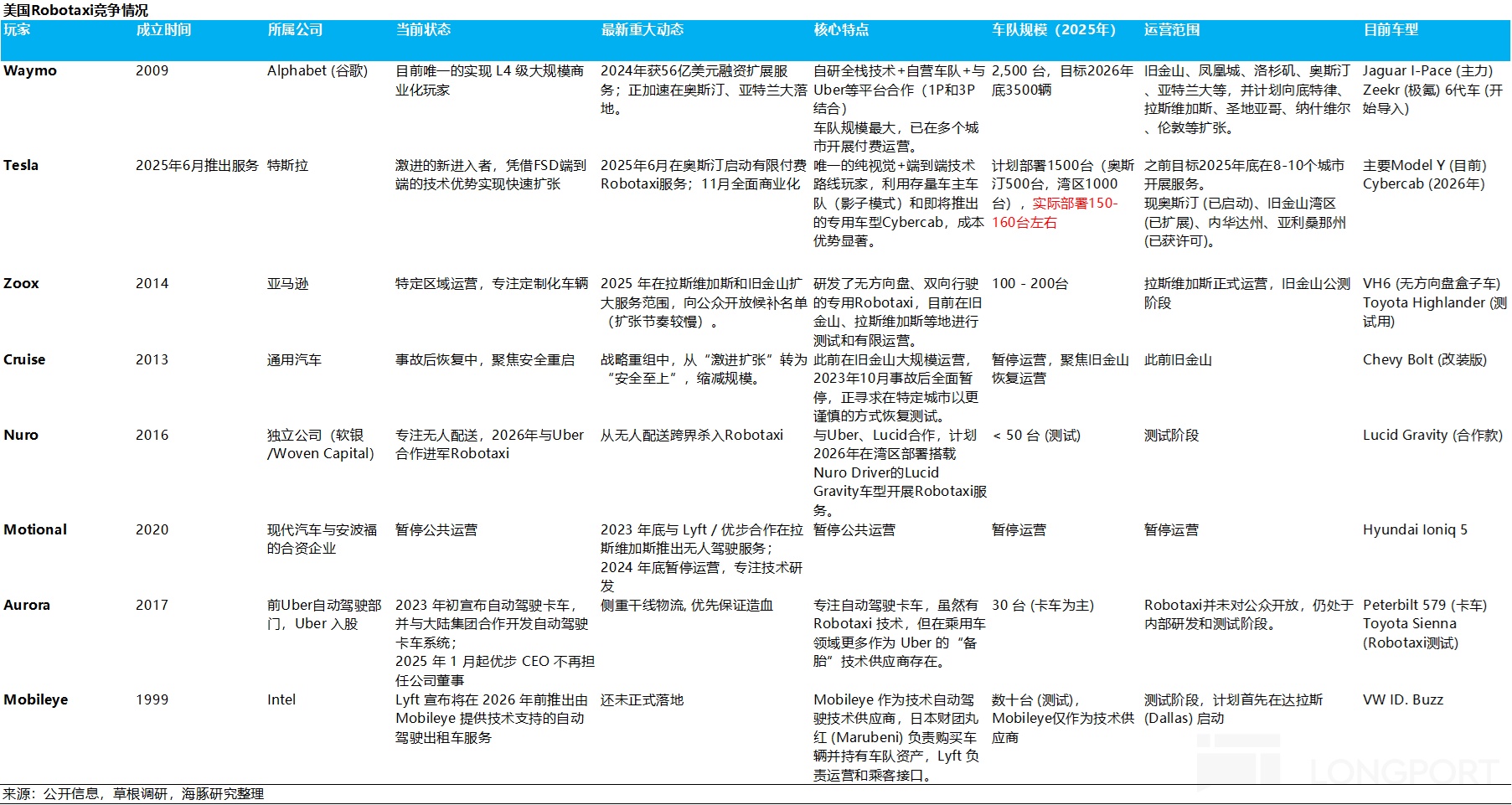

The U.S. Robotaxi race is no longer a free-for-all, with smaller players exiting as the market enters a clear shakeout. Competition has converged into three blocs, and Dolphin Research walks through what each is really holding.

1) As the incumbent, Waymo leads for now on a 2,500-vehicle fleet and fully driverless ops across multiple cities, holding >25% share in San Francisco. But its multi-sensor stack drives unit cost to roughly $80k, pushing fares above $2/mi and creating heavy cost-down pressure.

2) Tesla is the aggressive challenger, with a vision-only and vertically integrated approach aimed squarely at the pain points. The Cybercab slated for 2026 mass production targets a $25k–30k unit cost and dynamic pricing around $1.3/mi, and the plan to onboard owner vehicles drives near-zero marginal cost.

3) The NVIDIA-led alliance takes an open route, teaming up with Uber for demand and OEMs for vehicles while monetizing via tech licensing. However, reliance on synthetic data training leaves model progress behind Tesla (roughly at FSD V12 levels), and supply-chain premiums inflate Robotaxi costs.

Debate centers on three fronts. On tech, Tesla iterates on massive real-world data with the highest ceiling for end-to-end models, while Waymo and NVIDIA may struggle with long-tail scenarios given limited real driving data.

On cost, Tesla's vision-only plus vertical stack creates a gap others can hardly close.On biz model, Tesla's owned ecosystem and asset-light scaling trump Waymo's asset-heavy ops and the alliance's coordination challenges.Near term, Waymo benefits from operating experience. Over the long run, cost and scale will decide.

Tesla's vertical integration and real-data flywheel build durable moats in tech and cost.The NVIDIA alliance, constrained by a licensing plus OEM production model, faces structural supply-chain premiums, while Waymo is hampered by high costs and weak generalization.There are three potential endgames. 1) Red-ocean melee: multiple camps hold ground with limited gaps in tech and cost, Tesla at ~30% share and Uber as the biggest winner; 2) Dual oligopoly: Tesla at 55%–65% alongside the NVIDIA alliance at 30%–40%, echoing Apple vs. Android; 3) Tesla dominance: a tech-and-cost monopoly with 70%–80% share.

Waymo may struggle to break out given asset-heavy, high-cost ops, and the NVIDIA alliance, constrained by coordination and data gaps, will be hard-pressed to match Tesla over time. $Tesla(TSLA.US)The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.