NFLX 4Q25 First Take: A mixed print, and the pending WBD deal sets up a clash between near-term pressure and long-term conviction.

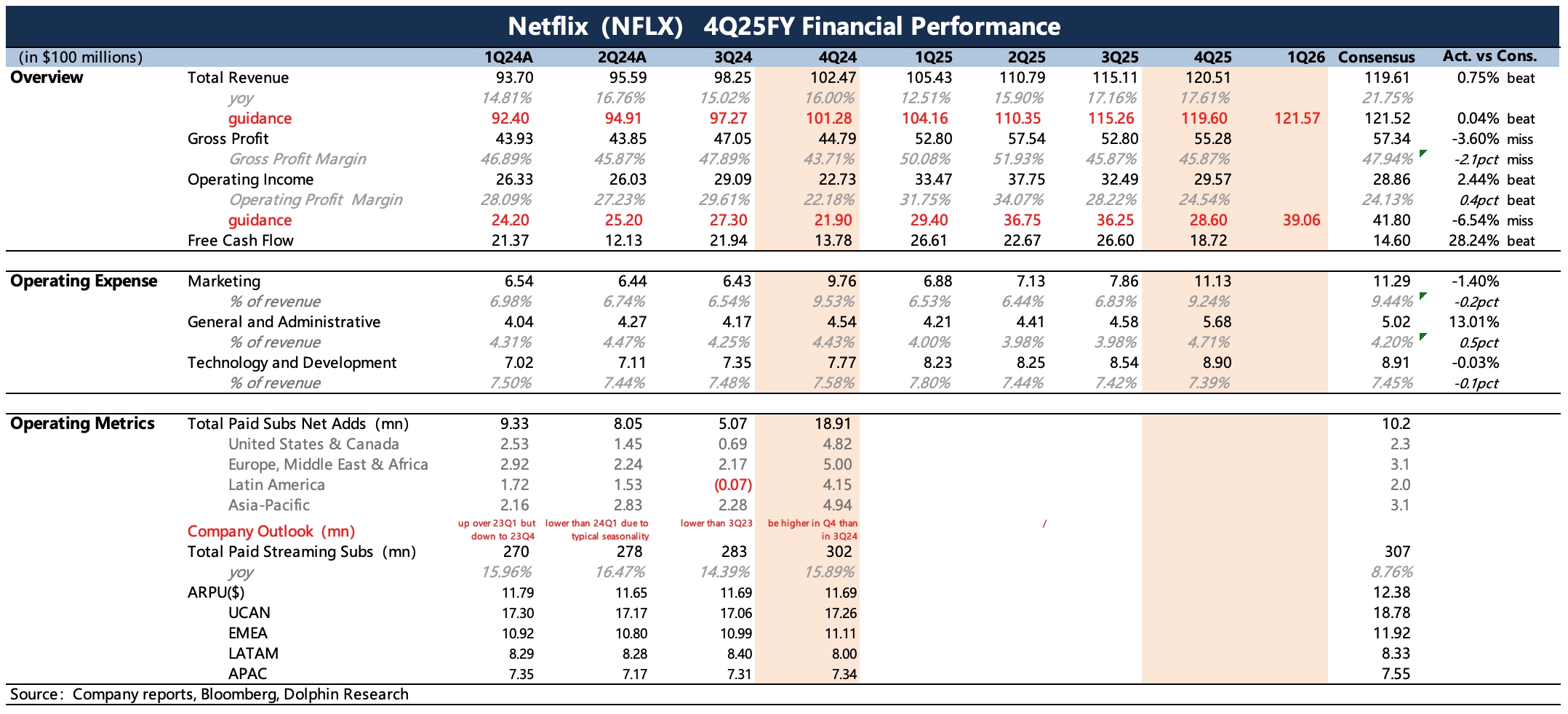

(1) The 'good' — Q4 beat: Core Q4 was solid, with revenue and profit accelerating QoQ, topping prior guidance and consensus. However, pricing contributed more to Q4 revenue vs. the first three quarters.

Subs ended the year above 325 mn, up approx. 8% YoY. The slowdown in user growth likely underpins NFLX’s determination to acquire WBD at almost any cost, which in turn sparks worries about weakening long-term organic growth.

(2) The 'bad' — muted guide: Doubts around organic momentum push investors to focus on guidance. Both 1Q26 and full-year 2026 guides are only in line with unaggressive consensus: Q1 revenue growth at 15.3%, full-year at 12–14%.

OPM is guided a touch below expectations at 31.5% vs. the Street’s 32.5%, reflecting deal-related costs and remaining Brazil tax payments.

(3) Ads still slow near term; potential acceleration in 2H: Management sees 2025 ad revenue above 1.5 bn. That trails the 2–3 bn range many sell-side models assume and likely weighs on topline expectations.

NFLX is piloting programmatic ads in the U.S. and Canada and plans a global roll-out in 2Q26, replacing the current insertion-based model. This should broaden advertiser reach and unlock ad growth.

(4) Near-term FCF pressure; potential pullback in content/buybacks: The latest on WBD is a revised agreement to an all-cash acquisition, reducing target shareholder concerns about value dilution and speeding execution, though the deal remains subject to regulatory approval. For more on deal details, cf. prior notes by Dolphin Research.

NFLX expects roughly 10 bn of FCF in 2025, with only about 9 bn of net cash on hand. It also has 1 bn of short-term debt maturing within a year.

Switching to all-cash requires more external funding: on top of the existing 59 bn bridge loan, NFLX added 8.2 bn, and secured total 25 bn of senior unsecured revolving credit to repay part of the bridge. The bridge now stands at 42.2 bn, and back-of-the-envelope interest cost for a year likely exceeds the potential 2–3 bn content licensing savings post-WBD.

If the deal timeline extends due to disruptions, near-term FCF pressure will be meaningful. During this period, NFLX may curb near-term content spend or slow buybacks (4Q25 repurchases were 2.1 bn, with 8 bn remaining under authorization) as a hedge. $Netflix(NFLX.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.