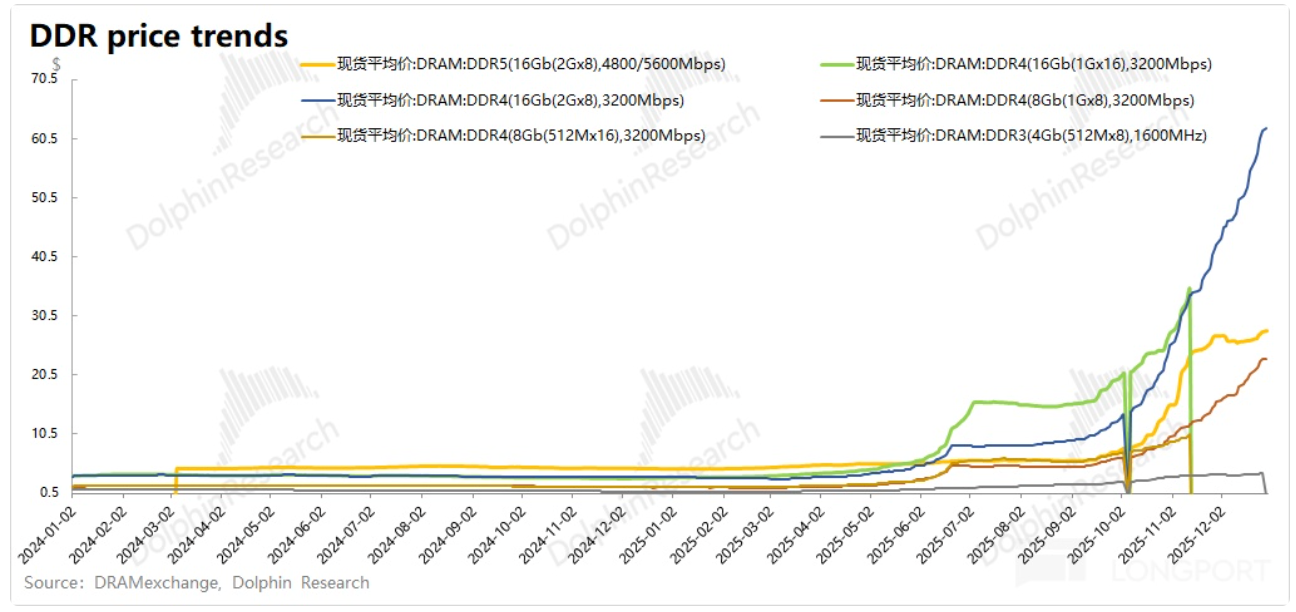

DDR5 prices have surged more than 5x as AI servers grab capacity. They are squeezing supply while turbocharging demand, leaving DDR for legacy PCs and smartphones in short supply.

On the supply side, the three major memory makers have shifted DRAM capacity toward HBM given its higher margins and more urgent demand, crowding out legacy DDR output. Capacity once allocated to PC and smartphone DDR has been retooled for high-end DDR used in AI servers, sharply reducing supply to traditional end-markets.

On the demand side, in the AI inference era, DDR per CPU has jumped from 500GB to 1.5TB. DDR demand from AI servers is set to soar, with YoY growth reaching 222% in 2026. Because DDR for AI servers carries higher ASPs, suppliers will prioritize this profit pool and tilt scarce capacity toward it.

As a result, PC and handset OEMs receive less DDR capacity, and the supply-demand imbalance is pushing prices higher. While traditional end-market demand is also rising, it is growing far slower than AI servers, forcing them to absorb price hikes and ongoing shortages.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.