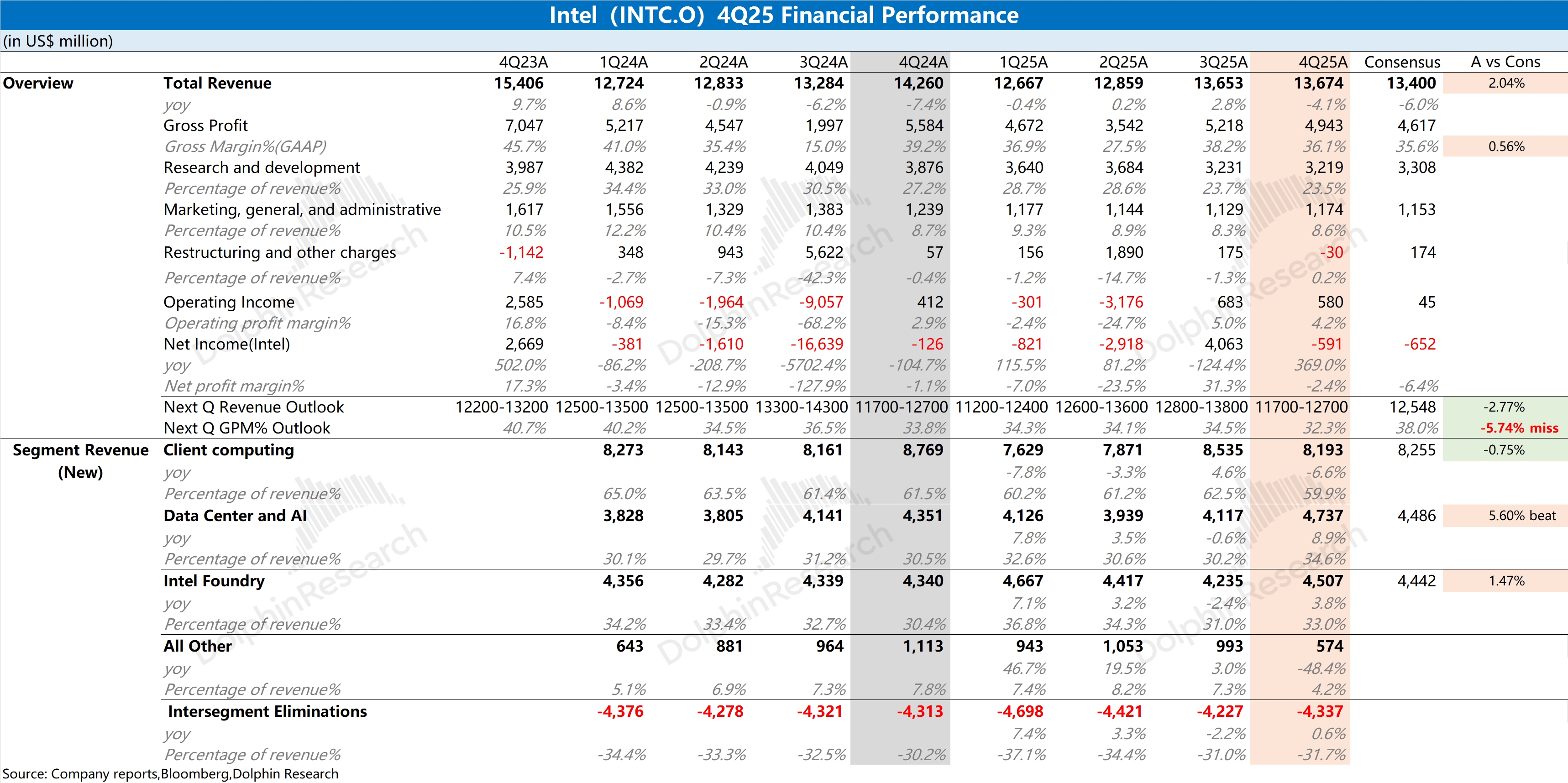

Intel 4Q25 First Take: revenue and GPM were broadly in line with consensus. The YoY revenue decline was driven by the Client business. QoQ GPM contraction reflects early 18A ramp effects.

To meet strong demand in data center (DC), Intel prioritized internal wafer capacity to DC and AI. The Client business partly relied on external foundry supply. This weighed on PC performance.

Guidance for next quarter was disappointing vs. the print. Management guided GAAP GPM to 32.3%, well below the ~38% street. This implies 18A remains a margin headwind, with yield ramp tracking slower than hoped.

The recent share rally has been driven by the Panther Lake unveil (18A ramp) and solid server CPU demand. Intel plans a 10–15% price hike on server CPUs. These factors embed expectations for margin recovery and external foundry traction.

While higher server CPU pricing can boost results, the foundry biz remains the market’s key focus. The latest guide poured cold water on sentiment. A sustained recovery will take more time; for more details, follow Dolphin Research’s upcoming deep dive and call Trans. $Intel(INTC.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.