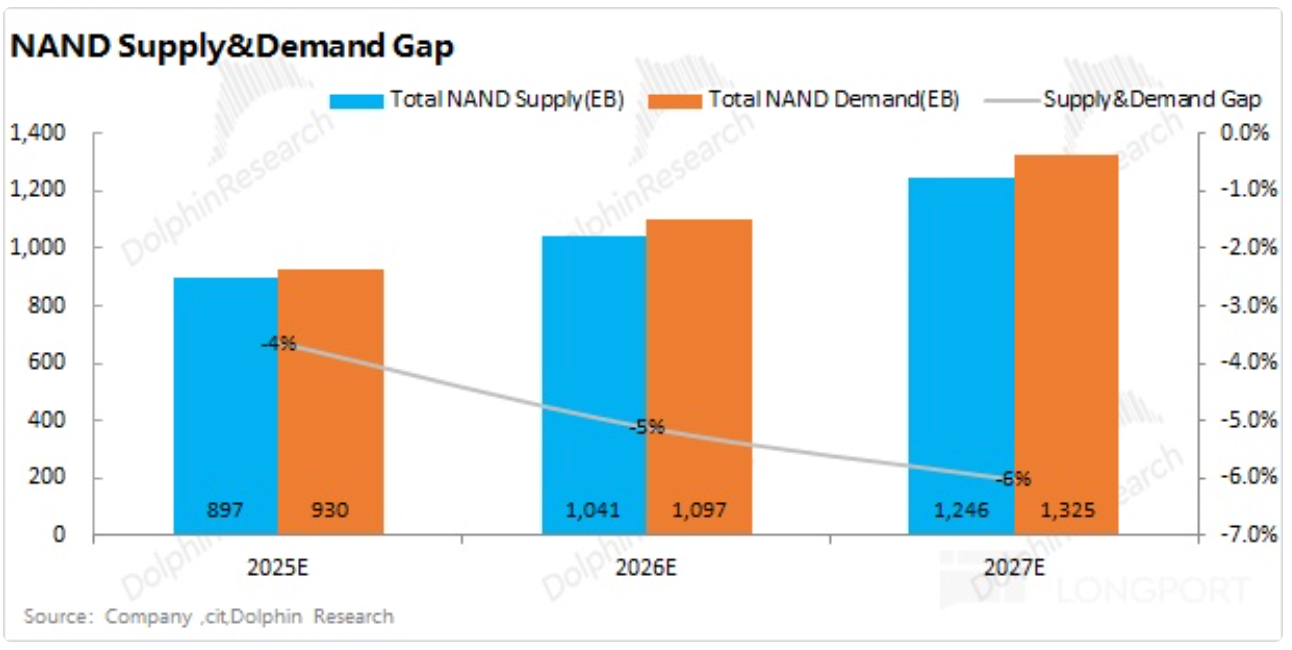

NAND clearly has a 5–6% supply-demand gap and prices are rising. So why aren’t suppliers ramping aggressively?

First, adding NAND capacity has a relatively low barrier: unlike DRAM, you don’t need new fabs, as upgrading tools on existing lines and increasing layer counts can lift output. Precisely because it is easy to expand, suppliers are cautious. In past upcycles, disorderly capex led to glut, price crashes, and heavy losses. They now prefer to keep a ‘tight balance’ and release capacity gradually to sustain higher prices and maximize profits.

Second, NAND competition is more fragmented than DRAM. Beyond the big three, players like Kioxia and SanDisk matter; if one supplier ramps and others don’t follow, it risks putting itself at a disadvantage. Meanwhile, the big three are prioritizing capex for DRAM and HBM, leaving limited budgets for NAND, which naturally curbs large-scale expansion.

So even with a supply-demand gap, suppliers are only expanding moderately. They would rather tolerate some undersupply than risk another round of disorderly growth.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.