ASML: Memory orders surge; litho supercycle arrives

ASML released its Q4 2025 results (through Dec 2025) pre-market U.S. time on Jan 28, 2026 Beijing time. Key takeaways follow.

1) Revenue & GPM: a) Q4 revenue was EUR 9.72bn (+5% YoY), beating consensus (EUR 9.56bn), driven mainly by stronger demand from Mainland China. b) GPM reached 52.2%, within guidance (51–53%), helped by a higher mix of higher-priced EUV shipments.

2) Opex & profit: Net income came in at EUR 2.84bn (+5% YoY), with NPM at 29.2%. Profit growth broadly tracked revenue as GPM expansion was offset by higher opex.

3) Segment detail: Systems revenue was EUR 7.58bn (+6.6% YoY); Services revenue was EUR 2.13bn (-0.6% YoY). The mix was roughly 80:20, with growth driven by systems while services stayed stable.

1) Systems revenue: EUV and ArFi remained the core revenue drivers, contributing nearly 88% combined. EUV revenue was ~EUR 3.64bn, and DUV immersion ArFi was ~EUR 3.03bn.

2) Systems shipments: ArFi shipments were 37 units, the highest among tool types. EUV shipments were 14 units, rebounding QoQ on stronger memory orders downstream.

3) Systems ASPs: EUV ASPs are well above ArFi. Per Dolphin Research estimates$ASML(ASML.US) EUV ASP rose to ~EUR 260mn this quarter, while ArFi was ~EUR 82mn, keeping the price ratio around 3:1.

4) ASML core focus points: Key areas to watch are below.

a. Regional revenue: Mainland China was the largest contributor at 36% (~EUR 3.5bn), above the company’s prior share expectation (25%). Taiwan contributed ~EUR 1.26bn (13%).

b. Orders: Net bookings surged to EUR 13.1bn, up EUR 7.7bn QoQ and far above consensus (EUR 6.8bn). Beyond normal Q4 seasonality, the beat was driven by stronger memory orders.

5) Guidance: Q1 2026 revenue guided to EUR 8.2–8.9bn (street, post-raise: EUR 8.5bn) with GAAP GPM at 51–53% (street: 52.4%).

Management also provided FY26 guidance: revenue of EUR 34–39bn (+4–19% YoY), with full-year GPM at 51–53%.

Dolphin Research view: Triple-digit bookings point to a high-growth upcycle

ASML delivered a solid print, with revenue and margin in line with guidance. The market is more focused on orders and forward outlook than on the quarter’s reported figures.

1) Orders: ASML’s net bookings were EUR 13.16bn, well above consensus (EUR 6.8bn). The upside was led by outsized, above-seasonal orders from memory makers. This should also support memory equipment names such as Lam Research and Applied Materials.

2) Next-quarter guide: The company guides Q1 2026 revenue to EUR 8.2–8.9bn, vs earlier street consensus of EUR 8.13bn. After TSMC raised its 2026 capex, major brokers lifted their Q1 estimates to ~EUR 8.5bn, and the company’s guide is broadly in line.

Management also issued FY26 guidance: revenue of EUR 34–39bn (+4–19% YoY), with GPM at 51–53%. With capex raised by both memory majors and TSMC, the sell-side has already pushed FY26 growth expectations above 20%, making management’s guidance conservative vs market.

3) Buybacks: Of the prior EUR 12bn program, EUR 7.6bn had been executed by end-2025, and management announced a new EUR 12bn buyback for 2026–2028.

Beyond the print, the market is focused on the following:

a) Downstream capex: a leading indicator

Since TSMC, Intel and Samsung are key customers, foundry capex outlook is a leading indicator for ASML.

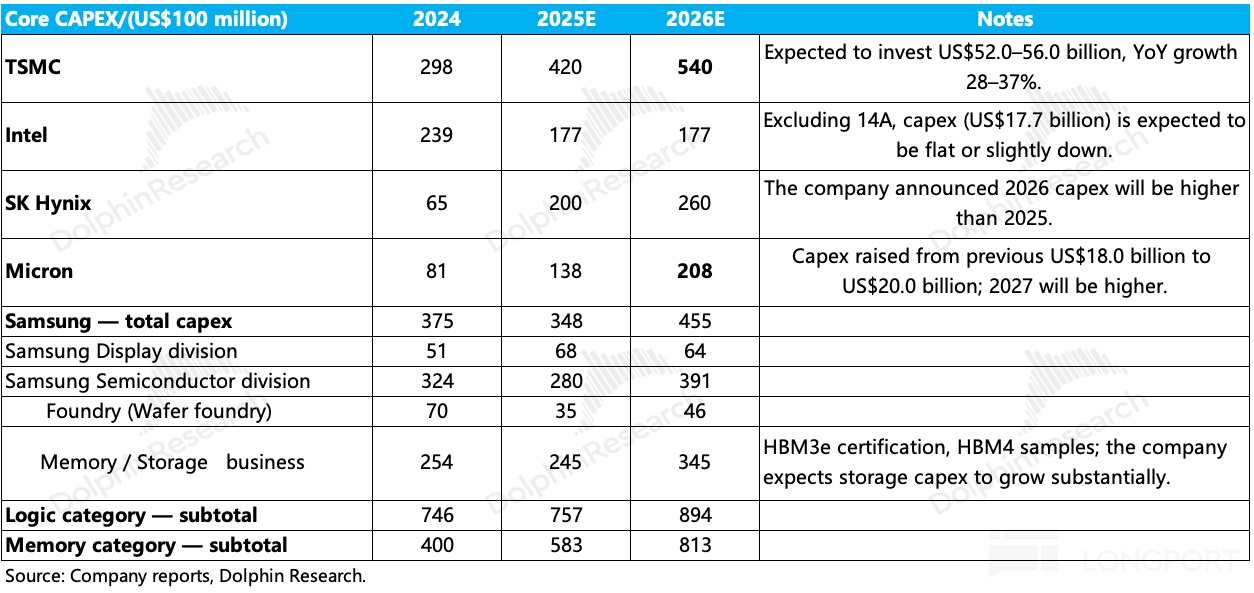

Following results from Micron, TSMC and Intel, all three provided 2026 capex outlooks. TSMC plans to lift 2026 capex by over USD 10bn, and Micron’s capex will exceed USD 20bn, which has supported ASML’s share price.

Aggregating major customers’ capex, Dolphin Research estimates 2026 logic capex growth at ~18%, while memory capex growth may approach ~40%. While revenue and bookings have yet to show high growth this quarter, the upswing should show through over 2026.

b) High-NA EUV progress: the core tool for next-gen nodes

As nodes move below 2nm, High-NA EUV will become the next core tool. TSMC and Intel have already ordered ASML’s top-end High-NA EUV to support next-gen R&D and future production.

By customer, Dolphin Research believes TSMC’s initial 2nm and Intel’s 18A will still use Low-NA EUV to secure yields. High-NA EUV purchases are primarily for TSMC’s next-gen 2nm and Intel’s 14A R&D and pilot runs, so the shipment peak should come after 2026; watch ramp timing at leading customers.

Putting a) and b) together, ASML is set for high growth in 2026, driven by capex from TSMC and memory makers. As next-gen nodes move to volume, increased High-NA EUV shipments should add further upside.

ASML’s current market cap is USD 572.9bn, implying ~39x 2026 PE on post-tax core profit (assumptions: revenue +22% YoY, GPM 53.1%, tax rate 16.8%, EUR/USD = 1.2). Versus the historical 30x–45x PE range, the current multiple sits near the mid-range.

Overall, supported by AI and memory demand, ASML is in a positive cycle of rising downstream capex. Even after high growth in 2026, greater utilization of High-NA EUV (€200mn/unit -> €400mn/unit) should help sustain earnings growth.

ASML trades at a higher PE than TSMC. The premium reflects its stronger monopoly position as the only global supplier of EUV lithography systems, giving high visibility when downstream capex ramps.

Dolphin Research sees the biggest positive in bookings, driven by memory customers’ incremental orders. With TSMC and Intel’s 2026 capex plans set, Samsung and SK hynix are also likely to step up.

The AI-driven capex cycle creates an upswing into 2026, and the subsequent High-NA product upgrade adds a second leg. The two cycles together could extend ASML’s super-cycle, leaving room for further re-rating from a mid-range PE.

Below is Dolphin Research’s detailed analysis of ASML. Details follow.

I. AI memory tailwinds: capex plays’ spring

1.1 Net bookings: For capital equipment names with long lead times, orders are placed well in advance and cancellations are rare.

Thus, ASML’s orders usually drive the stock more than revenue. With memory and logic players raising capex, shipments won’t spike immediately, so the key is how much bookings beat.

The real highlight this quarter is the surge in new bookings. This is the key positive.

By detail: i) Logic bookings were EUR 5.8bn, up EUR 3.0bn QoQ (seasonal). ii) Memory bookings were EUR 7.4bn, up EUR 4.9bn QoQ (well above seasonal).

1.2 Revenue: ASML delivered Q4 2025 revenue of EUR 9.72bn (+5% YoY), beating consensus (EUR 9.55bn). Growth was mainly driven by Mainland China customers.

For 2026, management guided revenue to EUR 34–39bn (+4–19% YoY). With TSMC and memory players lifting capex, the street has already raised FY26 revenue growth expectations to 20%+, pointing to a high-growth year.

1.3 GP & GPM: Q4 2025 GP was EUR 5.07bn (+5.8% YoY). GPM was 52.2% (+50bps YoY), within the 51–53% guide, driven by a higher share of EUV.

1.4 Net income: Q4 2025 net income was EUR 2.84bn (+5.4% YoY), with NPM at 29.2%. Opex increased, and the opex ratio held near 17%.

Based on bookings and guidance, operating trends have improved, particularly on stronger memory orders. With TSMC and memory adding capex, ASML should enter a positive cycle in 2026, and rising High-NA EUV shipments should further support growth.

II. Segment details: AI + memory, EUV as the main driver

ASML’s revenue is split between systems and services. Services were stable, while systems (nearly 80% of revenue) drove growth this quarter.

2.1 Segment performance

1) Systems revenue

Systems revenue in Q4 2025 was EUR 7.58bn (+6.6% YoY), with EUV, ArFi and ArF Dry all growing to varying degrees.

Given the order mix, TSMC’s capex increase has not yet shown up clearly in orders. This quarter’s order surge came mainly from memory customers.

Systems revenue corresponds to lithography tools, with EUV and ArFi being the largest contributors, together near 90%.

Specifically, the breakdown is as follows. Details below.

a) EUV: Q4 revenue was EUR 3.64bn (+22% YoY). Shipments were 14 units, with ASP around EUR 260mn. Higher-priced High-NA EUV over time should lift blended EUV ASPs.

By product: i) Low-NA EUV (NXE:3800E) is mature, hitting the 220 wph target and up to 230 wph at some customers. ii) High-NA EUV (EXE series) is currently for next-gen R&D, with volume shipments expected after 2026.

b) ArFi: Q4 revenue was EUR 3.03bn (+4% YoY), mainly from Mainland China. Shipments were 37 units, with ASP around EUR 82mn, up YoY.

EUV contributed most to growth, with EUV units flat YoY and growth driven by ASP. By units, ArFi remained the largest, with demand mainly from Mainland China.

By end-market, systems revenue is still skewed to logic, at roughly 70% vs ~30% for memory. Logic remains the dominant driver.

2) Services revenue

Q4 2025 services revenue was EUR 2.13bn (-0.6% YoY). Services include maintenance and related items and are less cyclical.

Over the long run, services remain relatively stable, holding near EUR 2.1bn this quarter. As systems shipments rise, services will decline as a share of total revenue.

2.2 Regional revenue

Q4 revenue was concentrated in Taiwan, Mainland China, Korea and the U.S., which together accounted for ~90%. These four markets dominate shipments.

Mainland China remained the largest contributor at 36%, above management’s earlier 25% comment for orders, thanks to strong ArFi pull-ins. Demand remained strong.

Based on regional revenue and bookings, Dolphin Research sees clear strength in memory (SK hynix, Samsung and Micron). Korea’s share rebounded to 22%, and as orders convert to shipments, Korea’s share should rise further.

ASML reports revenue by ship-to location. Thus, TSMC’s raised 2026 capex of USD 52–56bn will not all show up in Taiwan; some will be shipped to its U.S. fabs, likely lifting both Taiwan and U.S. shares.

Overall, ASML is entering a positive cycle, with high growth expected in 2026 on AI and memory demand. Being at the top of the semi supply chain, tight supply creates urgency for tool purchases and capacity adds.

Capex hikes by TSMC and Micron represent two demand legs: AI chips at TSMC, and memory capacity at Micron, SK hynix and Samsung. All these expansions require lithography.

ASML enjoys a dominant monopoly in lithography, so a portion of customers’ higher capex converts directly into its revenue, underpinning high growth. After TSMC’s capex lift, the street raised this quarter’s growth expectation to 20%+, and the standout metric this print was bookings, which reinforced the high-growth view.

<End here>

Related ASML research by Dolphin Research. See links below.

ASML

Oct 15, 2025 call Trans.: ASML (Trans.): 2030 targets intact; next-quarter update on next year's outlook

Oct 15, 2025 Earnings Review: ASML: AI capex adds a buff; the worst is behind!

Jul 16, 2025 call Trans.: ASML (Trans.): Focus on tool efficiency, not tool count

Jul 16, 2025 Earnings Review: ASML: Nvidia is hot; lithography is still lukewarm?

Apr 16, 2025 call Trans.: ASML (Trans.): Even if tariffs land, we should not be the main bearer

Apr 16, 2025 Earnings Review: ASML: Order declines flash warnings; will tariffs take another bite?

Jan 29, 2025 call Trans.: ASML: Mainland China revenue to normalize near 20% (4Q24 call)

Jan 29, 2025 Earnings Review: ASML: The bellwether returns

Oct 15, 2024 call Trans.: ASML: Mainland China mix to normalize near 20% (FY24 Q3 call)

Oct 15, 2024 Earnings Review: ASML: A bruising misstep, again the AI cycle’s first casualty?

Jul 17, 2024 call Trans.: ASML: EUV shipments to be similar to last year (FY24 Q2 call)

Jul 17, 2024 Earnings Review: ASML: Expectations high, deliveries slower; can’t catch the AI dream

Apr 17, 2024 call Trans.: ASML: 2024 is a transition; 2025 turns up (FY24 Q1 call)

Apr 17, 2024 Earnings Review: ASML: Results slumped; can AI winds reach lithography?

Jan 24, 2024 Earnings Review: ASML: Explosive orders—semi heading up?

Oct 18, 2023 Earnings Review: ASML: The crown jewel still cycles with the industry

Jul 21, 2023 Earnings Review: ASML: Great capabilities still bow to the cycle

Sep 21, 2023 Deep Dive: ASML: Is the lithography king cheap at <30x?

Jul 14, 2023 Deep Dive: ‘Ultimate conviction’ ASML

Risk disclosure and disclaimer: Dolphin Research disclaimer and general disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.