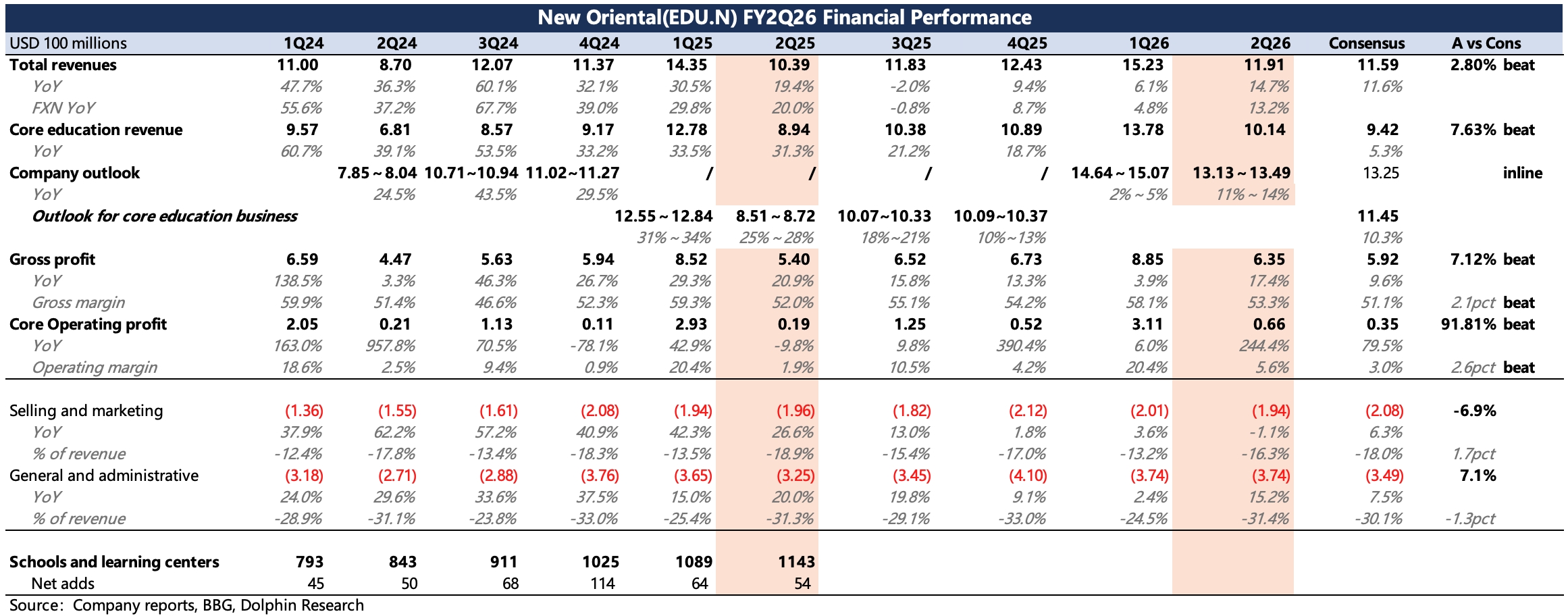

EDU Q2 FY26 First Take: Results beat, led by a better‑than‑feared study‑abroad segment. The company also raised its FY26 revenue guide.

Test‑prep grew 4%. Consulting was undisclosed but likely softer, implying overall roughly flat YoY. Still, this is well above the market’s low‑single‑digit decline expectation.

New initiatives rebounded as expected, validating management’s prior comments on seasonality. Smaller players focus on winter/summer peaks; with Q2 in the fall semester, competitive intensity eased for EDU. However, enrollment growth kept decelerating, implying momentum likely won’t hold next quarter; learning devices also slowed slightly.

Management guided next‑quarter revenue growth in line with the Street. It raised the FY26 revenue guide to $5.3–5.5bn, implying +8–12% (was +5–10%).

A group‑wide cost‑out/efficiency program kicked off in Q4 FY25 (calendar Q2 2025) and was evident last quarter. Execution continued this quarter, with cuts concentrated in selling expenses; OPM expanded by nearly 400bps YoY.

The company paid the planned dividend and repurchased $86mn of shares this quarter. Under the previously announced $490mn shareholder‑return program, the implied yield vs. the current ~$9.0bn market cap is 5.4%, providing support during drawdowns. $New Oriental EDU & Tech(EDU.US) $NEW ORIENTAL-S(09901.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.