iPhone Rocks, with Gemini Teamup — Is Apple’s AI Era Finally Coming?

Apple (AAPL.O) released its Q1 FY2026 results (quarter ended Dec 2025) post-market on Jan 31 Beijing time. Key takeaways:

1) Headline results: revenue of $143.8bn (+15.7% YoY), beating the Street ($138.3bn).Growth was driven mainly by iPhone and Services.

GPM was 48.2%, up 130bps YoY, ahead of consensus (47.5%). Services GPM rose to 76.5% YoY, while Hardware GPM improved to 40.7%. The margin uplift reflected lower China-related tariffs and USD weakness.

[Per U.S.-China negotiations: the U.S. has halved 'fentanyl tariff' on China-made goods from 20% to 10% since Nov.10, 2025]

2) iPhone:$Apple(AAPL.US) iPhone revenue was $85.3bn (+23.3% YoY), well above consensus ($78.2bn).Growth was aided by the iPhone 17 lineup and a weaker USD. Dolphin Research estimates unit shipments up ~5.7% YoY and ASP up ~16.7% YoY.

3) Hardware ex-iPhone: iPad revenue rose 6.3% YoY, supported by M5 Pro and A16 models. Mac and other hardware declined, with Mac facing a tough comp from last year's M4 cycle and demand for other hardware still soft.

4) Services: revenue reached $30.0bn, in line with consensus ($30.0bn). With a 76.5% GPM, Services generated 33% of total GP on a 21% revenue mix.

5) Revenue by region: the Americas remained the core base, still above 40% of mix and up 11.2% YoY, while Greater China was the best-performing region this quarter.

Under the 'spec bump at same price' strategy, the iPhone 17 256GB qualifies for state subsidies in Mainland China, lifting iPhone units in the region by ~20% YoY.

Dolphin Research view: re-acceleration, AI remains the focus.

Results topped on revenue and margin, driven by the iPhone 17 cycle and a weaker USD.

1) Top-line growth: primarily from the iPhone 17 series.iPhone grew 23% this quarter; despite limited innovation, the 'spec bump at same price' strategy worked well. In particular, the iPhone 17 256GB qualifying for state subsidies boosted Mainland China units sharply.

2) Margin expansion: despite memory price headwinds, Hardware GPM rose again on lower China-related tariffs and USD depreciation, with China tariffs cut from 20% to 10% this quarter. (Following U.S.-China talks, exports of China-produced goods benefited from the lower rate)

Beyond the quarter, management guided next quarter revenue growth of 13–16% YoY ($107.8–110.6bn), with GPM at 48–49% and iPhone as the key driver. While memory inflation will weigh more on margins next quarter, the guide still implies steady-to-better levels.

Beyond this print, the market is also focused on:

a) Apple–Google Gemini partnership: on Jan 12, Apple and Google announced a multi‑year deep collaboration. The next-gen Apple foundation model will be built on Google's Gemini models and cloud, powering future AI features, including a more personalized Siri slated for this year.

Specifically, Gemini will provide trillion-parameter models and technical support, with compute handled on-device and via Apple's private cloud.

As to why Gemini: Apple and Google already have a >$20bn annual search deal, and Gemini's share has been rising, now above 20%.

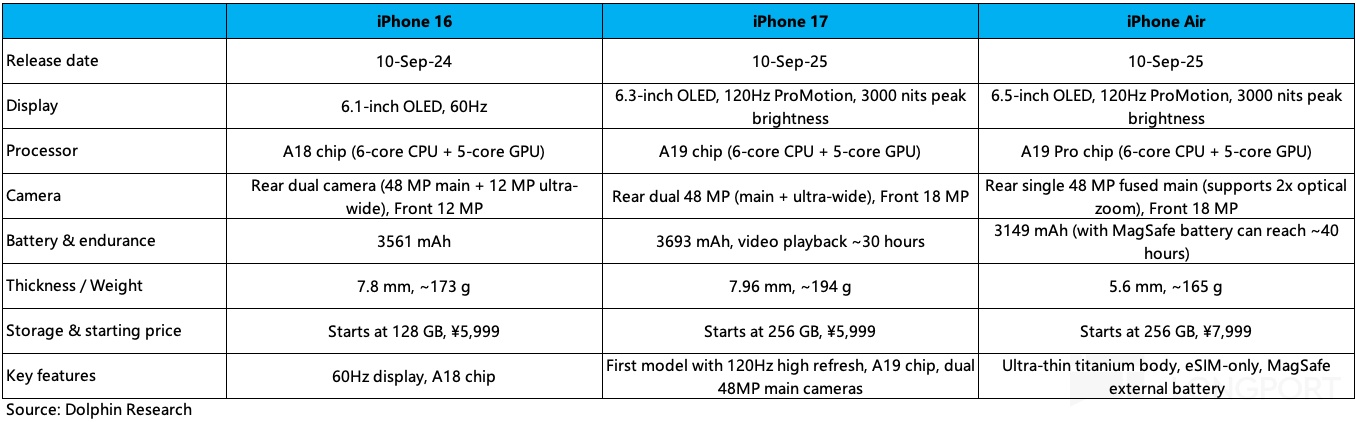

b) New product performance: iPhone remains the hardware core, and this quarter's growth was driven by last fall's launches. While innovation was modest, the 'spec bump at same price' strategy delivered a clear payoff.

The iPhone 17 series standardized 256GB as the base, while keeping the RMB 5,999 price point that meets state subsidy criteria. This helped Mainland China iPhone shipments rise nearly 20% YoY, far outpacing the broader smartphone market (-0.8% YoY).

c) Siri upgrades: expectations have risen post the Gemini tie-up.

The Gemini-powered Siri could appear as early as mid-to-late Feb in iOS 26.4 beta, with a general release planned for Mar–Apr, running on Apple's private cloud with ~1.2tn parameters. Powered by Gemini, new core capabilities may include multimodal text/image/voice interaction, a 128K-token context window, real-time screen parsing, and cross‑app complex task execution.

All in, near-term results are still driven by the legacy franchise (notably iPhone). But the market is watching Apple's AI progress more closely, with the coming Siri upgrade especially important.

Apple's current mkt cap is $3.79tn, implying ~30x PE on FY2026 net income (assumes +12% revenue growth, 48.3% GPM, and a 17.5% tax rate). Historically, the PE range is 25x–40x, placing the stock slightly below the midpoint.

Two lenses for Apple: 1) Near term, the recovery is led by the strong iPhone 17 cycle. The next-gen devices are expected to debut 2nm chips, which could support demand and keep trends resilient. 2) Medium to long term, Apple already has a massive hardware base, and breakthroughs in AI/Siri can unlock further growth optionality.

Overall, this print underscored Apple's market clout. The iPhone 17 'spec bump at same price' effectively acts as a margin-sharing upgrade. Put simply, when Apple 'shares economics,' growth snaps back to double digits.

The core franchise remains solid, supporting a premium PE even at lower growth. With a vast global installed base, AI/Siri is the key upside option. Leveraging Gemini's 'brain' raises expectations for Siri iterations, potentially opening more growth runway.

Weak after-hour trading reflected market concerns over memory price hikes, which could drag down on Apple's gross margins.

But one important reminder: Gemini-powered Siri could appear as early as mid-to-late Feb in iOS 26.4 beta, with a general release planned for Mar–Apr,

While memory drag on apple's margin is more likely to become visible after mid-year. Right now a stronger AI Apple weigh much more than a margin erosion by memory chip inflation.

Dolphin Research's detailed read of Apple's results follows:

I. Apple's core franchise remains resilient

1.1 Revenue: Q1 FY2026 (4Q25) revenue was $143.8bn, +15.7% YoY, beating the Street ($138.3bn). Growth was led by iPhone, iPad, and Services, while Mac and wearables/other hardware declined.

By hardware vs. software:

1) Hardware grew 16.1% YoY, driven by iPhone and iPad, with iPhone up 23% and Mac/wearables down. 2) Software grew 13.9% YoY, holding double‑digit momentum; the Google lawsuit resolution reduced risk, and the Gemini collaboration lifted expectations.

By region, all major regions grew YoY. The Americas, Europe, and Greater China are the three largest contributors. The Americas stayed above a 40% mix and grew 11.2% YoY, Europe rose 12.7%, and Greater China led at +38%. With the 'spec bump at same price' policy, the iPhone 17 256GB qualifies for state subsidies, driving a ~20% YoY unit increase in Mainland China.

1.2 Margins: Q1 FY2026 (4Q25) GPM was 48.2%, up 130bps YoY, ahead of consensus (47.5%). The uplift came from both higher Hardware and Services margins.

Dolphin Research's split of margins:

Services GPM stayed high at 76.5%, while Hardware GPM improved to 40.7%, mainly on tariff changes and USD depreciation.

Per U.S.-China talks: the U.S. plans to halve the 'fentanyl tariff' on China-produced goods to 10% from 20%.

1.3 OP: Q1 FY2026 (4Q25) operating profit was $50.9bn, +18.7% YoY. Growth reflected both revenue expansion and margin gains.

Opex ratio was 12.8%, up 40bps YoY. SG&A stayed stable, while R&D has increased over the past two quarters.

Capex was $2.4bn, down 19% YoY. Despite Big Tech stepping up AI spend, Apple's capex remains relatively low, with portions of AI and innovation spend booked in R&D, which has grown at double digits recently.

II. iPhone: 'spec bump at same price' is working

Q1 FY2026 (4Q25) iPhone revenue was $85.3bn, +23% YoY, ahead of consensus ($78.2bn). The iPhone 17 cycle and a weaker USD supported growth.

Dolphin Research breaks down volume and price drivers:

1) Units: per IDC, global smartphones grew 1.4% YoY in 4Q25. Apple's global units rose ~5.7% YoY, outperforming the market.

Growth came from the iPhone 17 cycle and Mainland China, where state subsidies on the iPhone 17 256GB helped drive ~20% YoY unit growth (vs. China market at -0.8% YoY). This was the standout regional performance.

2) ASP: based on revenue and units, iPhone ASP was roughly $1,049, +16.7% YoY. With the iPhone 17 refresh and USD weakness, ex‑U.S. revenue and pricing benefited from FX translation.

III. Hardware ex-iPhone: iPad rebounded; others down

3.1 Mac

Q1 FY2026 (4Q25) Mac revenue was $8.4bn, -6.7% YoY, missing consensus ($9.1bn), mainly on a tough comp from last year's M4 strength.

Per IDC, the global PC market grew 11% YoY, while Apple's PC units rose 4.4% YoY, underperforming the market. Dolphin Research estimates Mac ASP at ~$1,181, down 10% YoY.

3.2 iPad

Q1 FY2026 (4Q25) iPad revenue was $8.6bn, +6.3% YoY, slightly above consensus ($8.2bn), supported by M5 Pro and A16 models.

3.3 Wearables and other hardware

Q1 FY2026 (4Q25) revenue was $11.5bn, -2.2% YoY, missing consensus ($12.1bn) and remaining soft this quarter.

Management cited AirPods Pro 3 supply chain issues, but AirPods are only part of the segment. The continued decline still points to weak downstream demand.

IV. Services: steady gains, new AI catalysts

Q1 FY2026 (4Q25) Services revenue was $30.0bn, +13% YoY, in line with consensus ($30.0bn). Even with U.S. App Store allowing external links, Services maintained double‑digit growth, underscoring ecosystem moats.

Services GPM rose to 76.5%, marking five straight quarters above 75%. At a 21% revenue mix, Services contributed 33% of total GP.

Apple's AI strategy remains 'privacy-first and ecosystem-integrated': 1) launch Apple Intelligence with dozens of features such as visual intelligence and real‑time translation, supporting 15 languages with high active adoption; 2) leverage Apple Silicon (e.g., M5) to build a leading AI hardware platform; 3) partner with Google to co‑develop the next-gen Apple Foundation model enabling more personalized AI features in 2026.

The Google lawsuit resolution reduced Services risk, and Apple's purchase of Gemini services deepens collaboration. Gemini will supply trillion‑parameter models and tech support, while compute remains on‑device and in Apple's private cloud, increasing expectations for Siri iterations. If the next-gen Siri delivers, Services could see additional growth optionality.

Dolphin Research read-throughs on Apple:

Oct 31, 2025 call recap 'Apple (Trans): stepping up AI investment, new Siri next year'

Oct 31, 2025 earnings take 'Apple: iPhone holds the center stage, when will AI show up?'

Sep 10, 2025 event take 'Apple: minor iPhone tweaks to hold the line, major AI still incubating?'

Aug 1, 2025 call recap 'Apple (Trans): capex growth mainly AI-related'

Aug 1, 2025 earnings take 'Apple: AI slow to ship, iPhone to the rescue'

Risk disclosure and statement: Dolphin Research disclaimer and general disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.