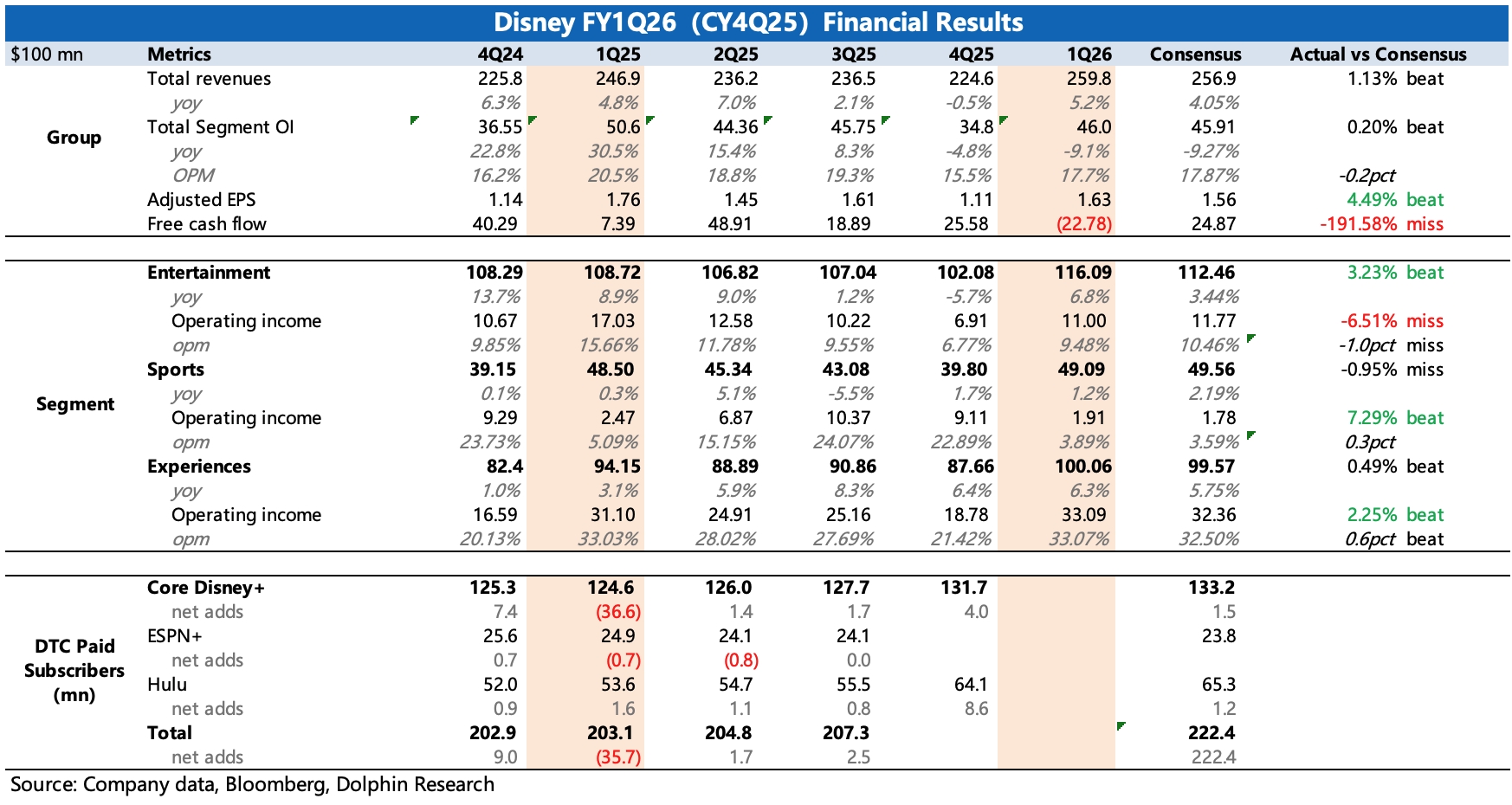

Disney FY1Q26 First Take: On the company’s guided key metric — sum of segment OI — results were in line. While OI delivery matters, investors typically focus more on the revenue trajectory when thinking about upside on valuation. By sub-segment, performance was mixed.

1) Total revenue slightly beat, led by Entertainment. Although sub-segment detail was limited, the revenue mix implies a strong film sales contribution. Zootopia 2 outperformed expectations with $1.77bn global box office, ranking No. 2 in 2025, second only to Ne Zha’s $2.26bn.

In addition, Streaming benefited from price hikes and select tentpole releases, driving +11% revenue. The company stopped disclosing streaming subs; back-solving suggests limited help from volume.

2) Sports benefited from the NBA. Despite a ~half-month YouTube blackout and a tough YoY comp from the Star carve-out, revenue held steady with a slight miss, supported by higher NBA ratings.

3) Parks held up under pressure. Against tougher comps and competitive headwinds, the new Disney Treasure cruise itineraries lifted traffic by 1% and per-capita spend by 4%, taking segment revenue up 6.3%.

4) OI remained stable. Entertainment and Parks OPM improved QoQ, while Sports declined seasonally on the content cycle.

5) Outlook: For Q2, management’s OI targets by business are slightly above consensus. However, despite guiding to another potential beat, there was little change to the full-year FY26 outlook.

6) Negative FCF: Mainly due to tax catch-up payments for FY25 and part of FY24, alongside higher QoQ capex. Of the $7bn FY26 buyback authorization, ~$2bn has been executed.

Note: Disclosure structure changed this quarter and some metrics are no longer reported, making certain YoY analyses difficult. The changes reflect last Oct.’s merger with FuboTV, where Disney folded Hulu Live TV into Fubo and took a 70% controlling stake, so FuboTV’s results are now consolidated. $Disney(DIS.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.