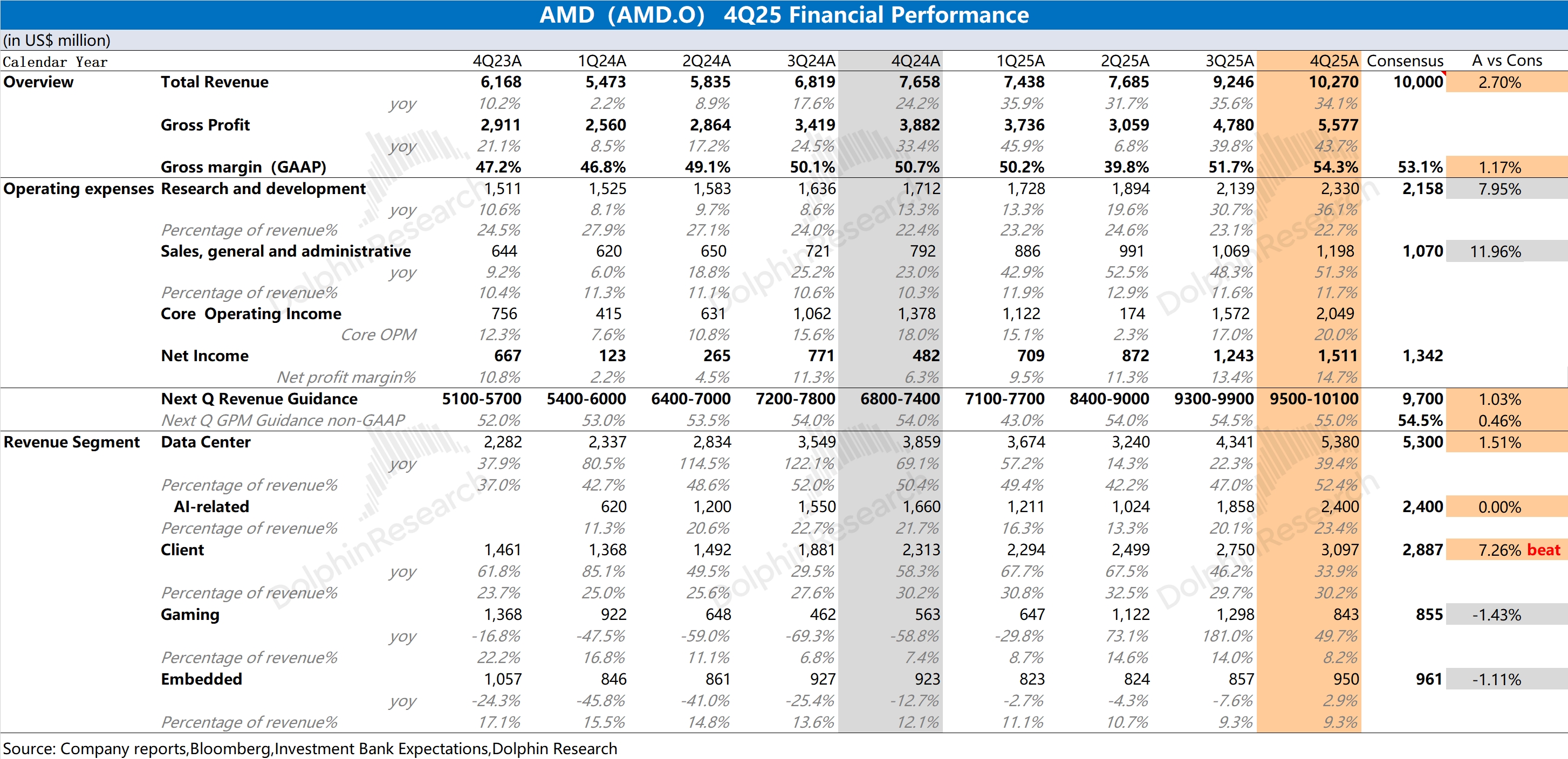

AMD 4Q25 First Take: Results were decent, with revenue and GPM in line with consensus. Growth was primarily driven by a rebound in CPU demand.

However, drilling into the numbers, QoQ growth for the MI355 family underwhelmed. With data center upside mainly from server CPUs, Dolphin Research estimates AI GPU revenue at approx. $2.4bn this quarter.

Excluding ~$390mn from MI308 shipments to China, AI GPU revenue for the rest (incl. MI355) was only about $2.0bn, up just $150mn QoQ. MI355 only began volume production in 2H25, yet QoQ growth already slowed in Q4.

Based on next-quarter guidance, Dolphin Research expects total revenue to decline ~5% QoQ. With seasonal softness in Client & Gaming and Embedded, we infer AI GPU revenue could slip to around $2.2bn. Excluding roughly $100mn from MI308, the rest would be up about $100mn QoQ.

The company cited customer readiness issues, noting roughly $1.5bn of Q1 orders will ship in Q2. Still, so soon after MI355's ramp, two consecutive quarters of slowing QoQ growth will prompt questions about the product's competitiveness.

Against a strong CPU rebound, AMD's overall trajectory remains solid, and the MI450 line slated for 2H is widely anticipated. That said, MI355's QoQ prints have poured some cold water on sentiment. For more details, follow Dolphin Research's upcoming commentary and call Trans. $AMD(AMD.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.