Posts

Posts Likes Received

Likes ReceivedBehind Alibaba's violent rise, is the spring of Chinese assets really back?

Hello everyone, I am Dolphin Analyst, and the weekly market portfolio strategy is here again. The key information is as follows:

1) Chinese concept stocks rose sharply this week, mainly due to the appreciation of the yuan, which drove the Chinese assets to rise rapidly. In addition, the price drop of the ten-year US Treasury bond that Dolphin mentioned last week (due to the contraction of the US service industry PMI) led to a fall in the discount rate on the denominator side, which also contributed to the rise of Chinese assets.

2) Looking at the valuation percentile, Hong Kong stocks have gradually approached the historical average valuation level after the sustained rise in the past few weeks. However, with weaker exports expected next year, and after the appreciation of the yuan reaches a plateau, performance realization for individual stocks will be more important because it is unlikely that the US dollar will flood the market as it did in the past. During the current market valuation rebound, the risk of stock price decline is very high for some small-cap stocks that rely solely on changes in macro beta to boost their valuations despite their poor fundamentals.

If you must find stocks to invest in, the recommended ones are stocks with low valuations, improving fundamentals, and still have room for repair, such as Alibaba and Didi that Dolphin had recommended by reviewing e-commerce last week.

3) The ten-year US Treasury bond yield has fallen rapidly this week from 3.9% last week to around 3.5% now. As the job market remains tight, the time to repair it is fleeting. This week, the US stock market has officially started driving the earnings season, and Dolphin has followed TSMC, which is the company that will lead this earnings season. We need to pay special attention to the risk of inventory and the outlook for the company's performance in the first quarter and the whole year of 2023 this earnings season. Because the stock prices of major internet giants collapsed in the last earnings season mainly because of their pessimistic outlook.

4) Alpha Dolphin Portfolio had already been adjusted in advance, and Chinese concept stocks had the highest weight in the portfolio, with a return of more than 6% last week. The portfolio did not make any adjustments after the rise.

Here are the details:

I. After the US stock market breathes, the performance hammer is on its way

1) US Treasury bond falls as expected

First, let's look at the pricing anchor of global equity assets—the yield on the US ten-year Treasury bond: As Dolphin mentioned in last week's portfolio weekly report "US stocks were not red during the Chinese New Year but will experience a performance hammer", the further upward risk of the yield on the ten-year Treasury bond, when it was almost at 4%, is not significant, and there will be some corrective measures in the US stock market last week.

As it turns out, the yield on the ten-year US Treasury bond fell more than 30 basis points this week, down to 3.55%. The major contributor to the decline is the downward revision of long-term real economic growth expectations, while the decline in long-term inflation expectations also plays a role but a smaller one.

2) Is the recessionary trade coming back? The chain reaction of the collapse of non-manufacturing PMI

2) Is the recessionary trade coming back? The chain reaction of the collapse of non-manufacturing PMI

Dolphin Analyst has previously stated that service PMI, service consumption + employment are the three key observation indicators for the US economy in the future, among which service PMI is the most forward-looking economic indicator, and employment and service consumption belong to lagging indicators.

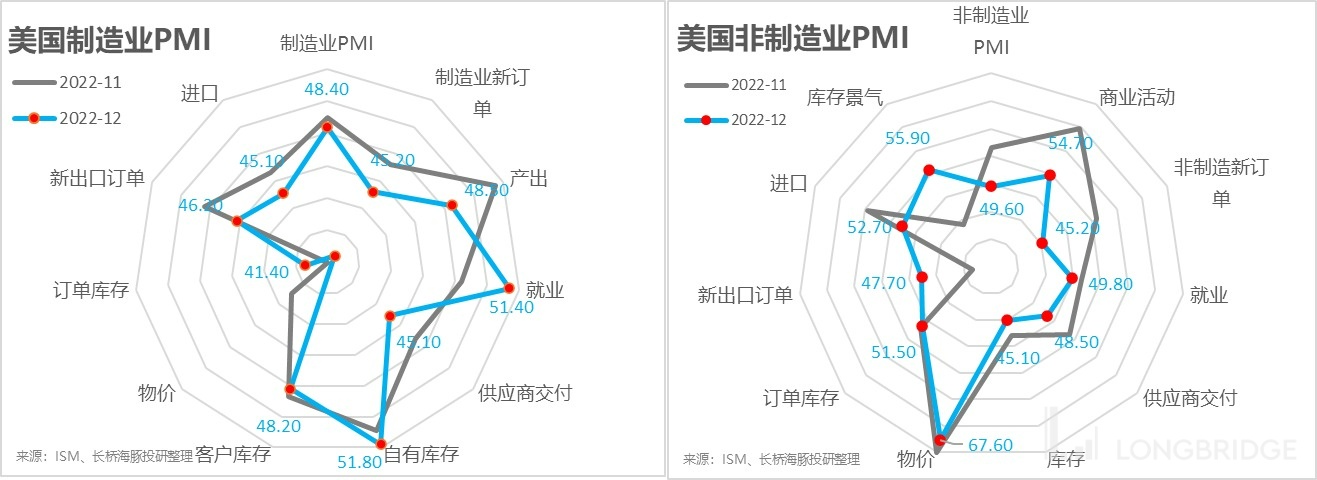

Last week, a key inflection point occurred in PMI related to the service industry: the non-manufacturing PMI in the US in February fell below 50 for the first time, while it was 56.5 last month, directly contracting by 7 percentage points, and the degree of decline was very large. Among them, the two subdivided key indicators - new orders and business activity index fell the most.

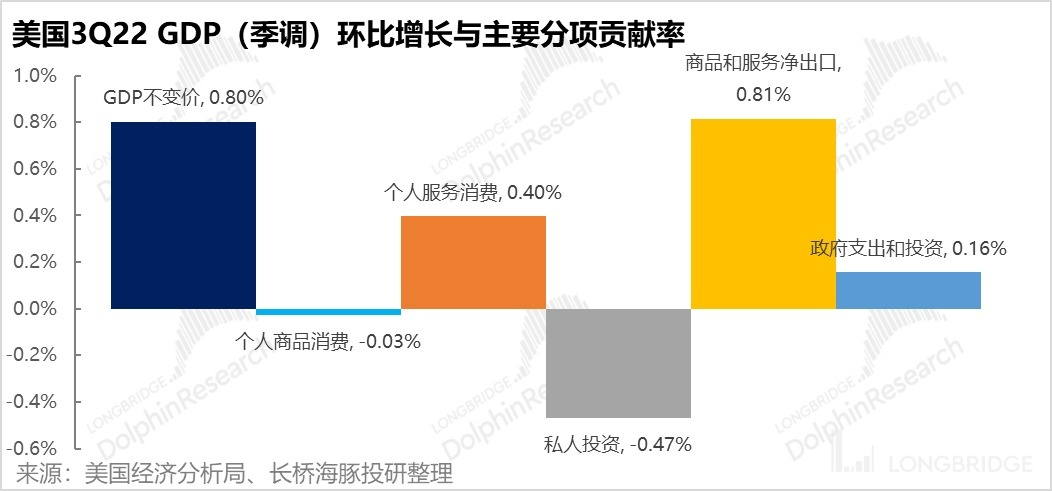

The reason why this change is important is that the current growth of the US economy GDP mainly comes from personal service consumption.

Companies expand when they have profit. During the period when the non-manufacturing PMI price index is still at a historical high, the rapid decline in new orders and business activities, as well as the revenue of non-manufacturing PMI entering the contraction zone below 50, is likely to mean that the profitability of service industry enterprises is deteriorating under the pressure of high service consumption prices.

Considering the key variable that will affect stock prices during the fourth quarter earnings season is the profit outlook for the new year and the first quarter, the rapid decline in service PMI may cast a shadow over the profit outlook for enterprises.

3) Another confirmation, the United States is still short of workers

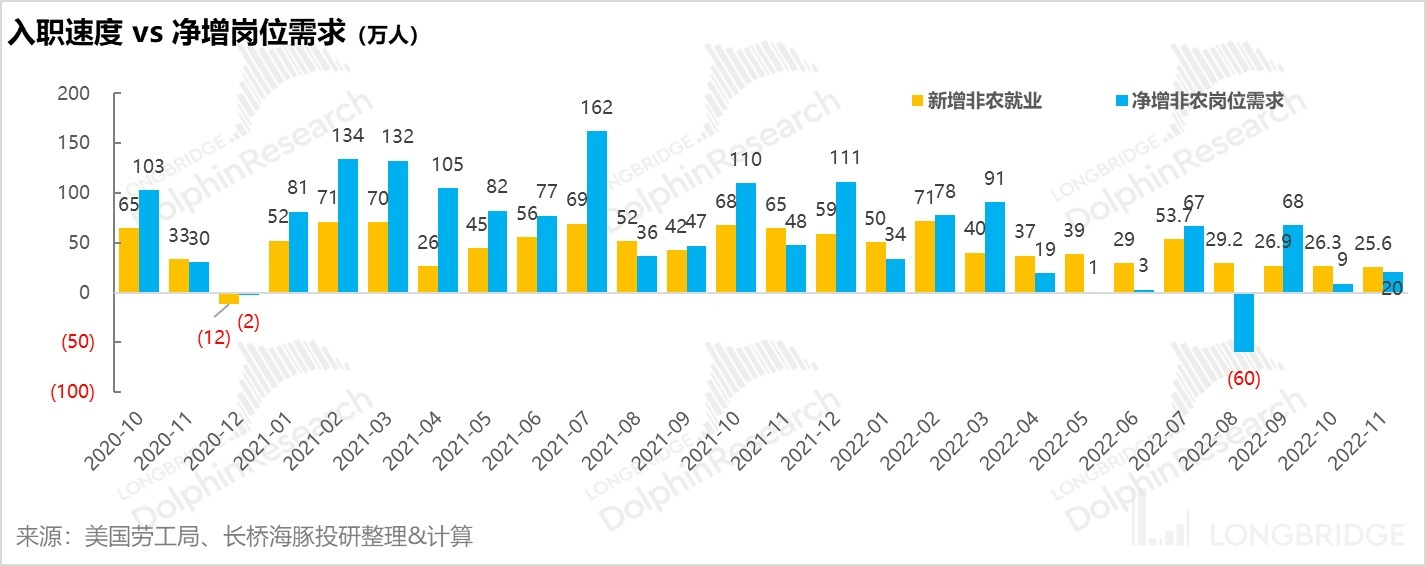

Last week, job vacancy and employment data were released, and the trend is essentially the same, which is a job market that is "short of workers."

- The non-agricultural job vacancies in November are indeed still on the decline, but the reduction of job vacancies is mainly due to the filling of a large number of new jobs, rather than a decrease in net demand for jobs. In the absence of a synchronized increase in the labor pool, the narrowness of the shortage of workers is mainly achieved by reducing the unemployment rate, and the tension of the job market (the ratio of the number of job vacancies relative to the number of unemployed people looking for jobs) is still increasing. In other words, the subsequent vacancies will either be filled through salary increases, or they will remain open for a long time, or they will be withdrawn if the company's situation deteriorates.

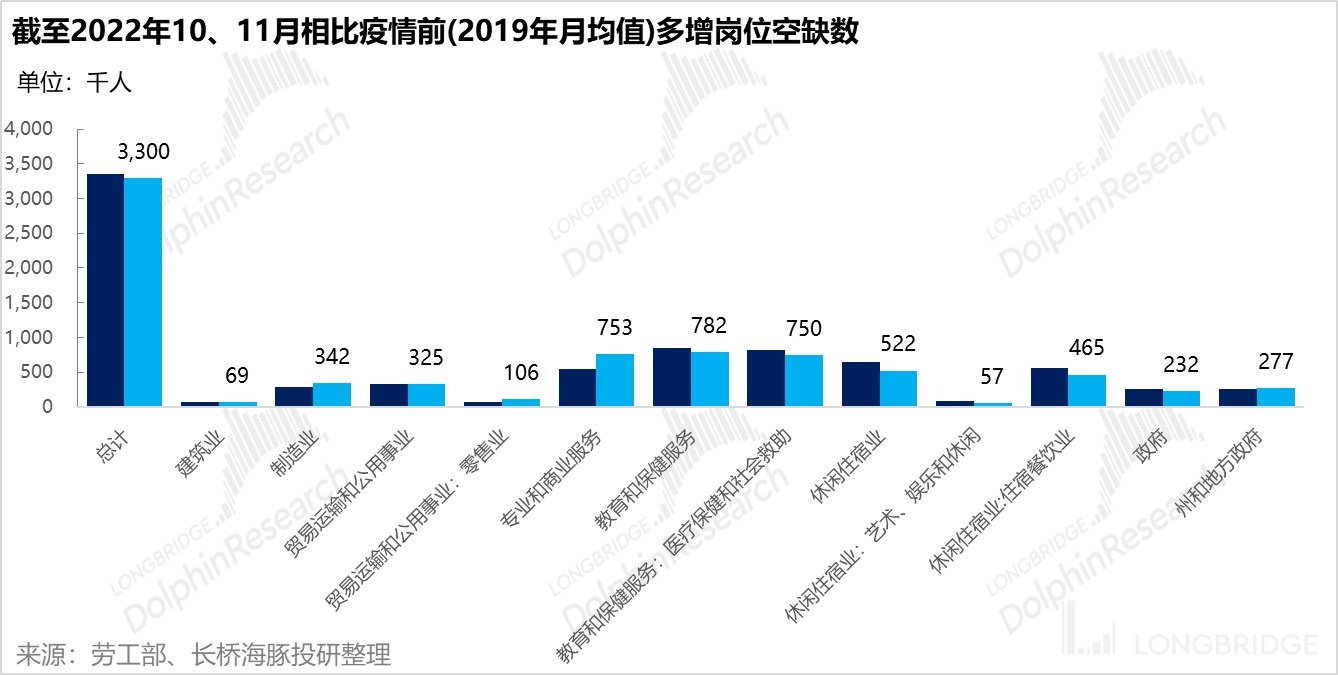

As of the end of November, there were still many job vacancies in the professional business services, medical social assistance, and accommodation and food service industries, and there is still a severe shortage of blue-collar workers.

While December's new jobs are still significant, with more than 220,000, the increase in jobs is still dominated by labor-intensive industries such as education, healthcare and leisure hotels.

Although labor demand is strong, there are signs of a weakening growth in hourly wages in December in the United States, with a month-on-month growth rate of 0.3%, equivalent to a year-on-year growth rate of 3.4%. This slowdown will also alleviate market anxiety over the wage-inflation cycle.

Overall, however, the shortage of personnel revealed this time is not marginal incremental information, and employment is a lagging indicator, not a completely linear upward or downward trend, so the more important information is the turning point information such as the significant decline of the service industry PMI index below the boom-bust line after American savings are exhausted. If it continues to decline, it basically means that the major economic growth engine of the United States, service consumption, will also cool down.

In addition, this week's U.S. stock market is gradually entering the earnings season, and after last week's correction in the U.S. stock market, the risks of declining results and expectations also need to be taken seriously.

2) Opportunities in China, with one up and one down

China's latest PMI for December has also been released, and unsurprisingly, both manufacturing and service PMIs hit new lows during the peak month of the outbreak.

But for China, it is also most likely to be a turning point. After December, the opportunity for PMI rebound is set in stone. The leading indicator of production and business expectation has already entered the expansionary zone except for the import price of raw materials.

Behind this is the expectation of an economic super-speed recovery after the peak of running, brought about by the pandemic release in China: Most people in the market originally expected the country to face a peak of infections before and after the Spring Festival, but based on the current recovery of subway passenger flow, the peak of infections in most large and medium-sized cities should have passed before the Spring Festival. The speed of economic recovery will exceed the market's original estimate.

2) RMB strong and overall valuation improvement of Chinese concept stocks

2) RMB strong and overall valuation improvement of Chinese concept stocks

Although both are relatively poor PMIs, the different inflection points result in completely different performances of various large assets: the return of the expectation of the US recession has caused the just-repaired US dollar to start to decline again, while the offshore RMB quickly began to rise after the New Year's Day and had risen from the pre-holiday level of 6.97 to 6.79 as of January 9.

The offshore RMB price almost entirely synchronizes with the Heng Seng technology: RMB appreciation + 10-year US bond decline, leading Chinese concept stocks to quickly rise as offshore RMB assets. Therefore, Chinese concept stocks have once again become a carnival of undervalued and small-cap Chinese stocks in recent times.

After comparing China with the US, it can be discovered that the ultimate result of the economic expectations of the two markets, up and down, are as follows: Hong Kong stocks as offshore RMB assets, which foreign investors are fully involved in pricing, are at risk of discounting the denominator end, while RMB appreciation itself will also bring upward income and profit expectations to the numerator end.

Previously, Hong Kong stocks plummeted tragically. Now, they are returning for the same reason. The value recovery may be late, but it will eventually return.

Also because of this, during the decline of the 10-year Treasury bonds last week, Chinese assets had the most violent increase. The KWEB index directly recovered the lost ground of the past year and returned to positive growth from an annual perspective.

3) Beta recovery is approaching, and the hard truth is whether it can withstand performance inspection

Currently, based on the extent of the repairs of Hong Kong stocks, corresponding to the profits that collapsed in the past year, PE (TTM) repairs are mostly around the 50th percentile of the past 5-10 years.

Considering that China had a large trade surplus last year and the RMB was relatively weak, and with the lifting of the outbreak and the return of the RMB, the end-of-year demand for exchange settlement was already high, coupled with the recent weakness of the US dollar index, the fast rise of the RMB has temporary factors.

However, the export next year is destined to be weaker. After the RMB appreciation is close to the smooth period (around RMB 6.6-6.7 against the US dollar), based on the assumption that it is difficult for the US dollar to repeat the benchmark assumption of a large-scale flood in 2023, the realization of individual stock performance will become more important. In this wave of valuation rebound, there is a very high risk that some small-cap stocks with poor fundamentals and simply relying on macro-beta changes to push up their valuations will see their stock prices fall due to the underperformance of the latter. III. Alpha Dolphin Portfolio Returns

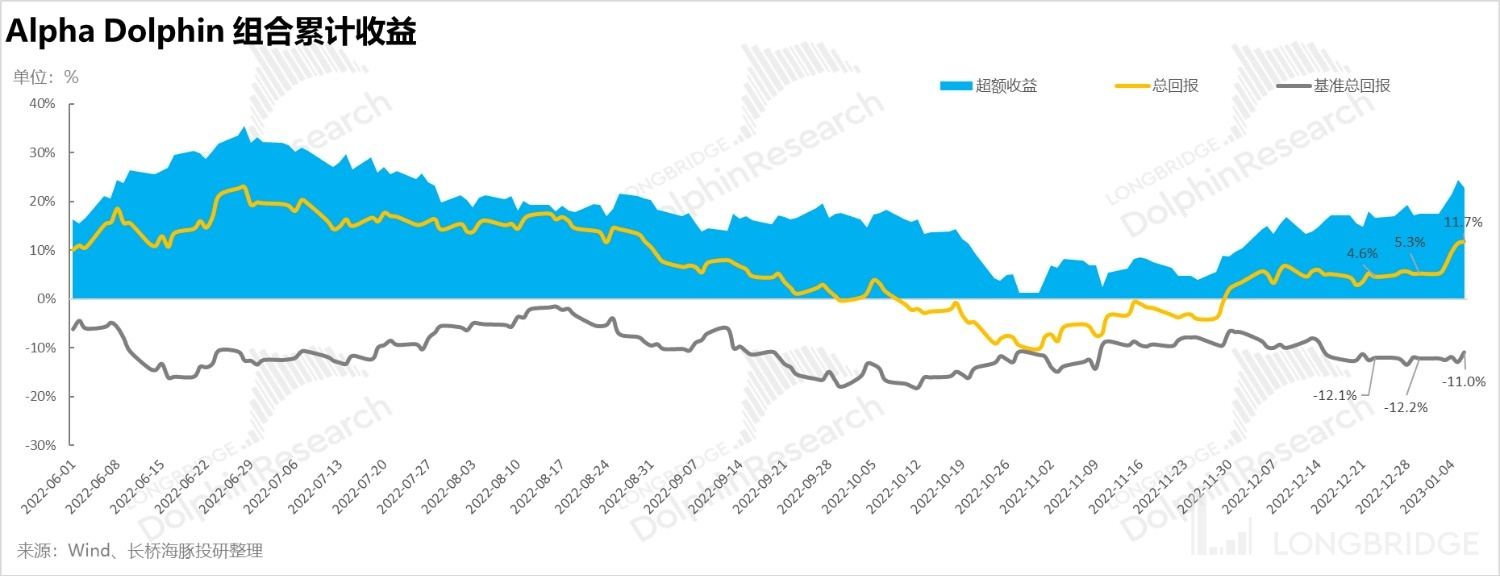

Since the end of November, Dolphin Analyst has been concentrating on Alpha Dolphin portfolio holdings, and there has been no opportunity to buy on dips in Hong Kong stocks. Therefore, positions have remained unchanged in the past two weeks.

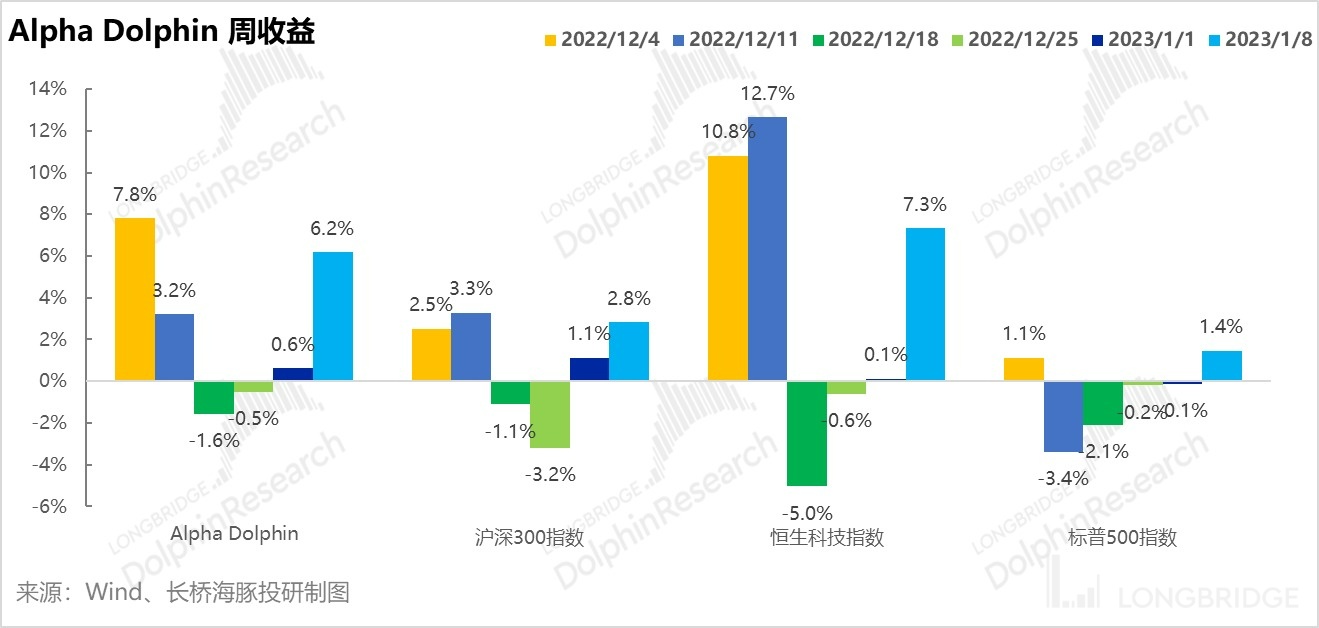

In the week ending January 8th, the Alpha Dolphin portfolio increased by 6.2% (with equity rising by +7%), significantly outperforming the Shanghai and Shenzhen 300 (+2.8%) and the S&P 500 (1.4%), but weakly underperformed the Hang Seng Tech Index (+7.3%).

Since the start of testing the portfolio until the end of last week, the absolute return of the portfolio was 12%, outperforming the S&P 500 by 23% in excess returns.

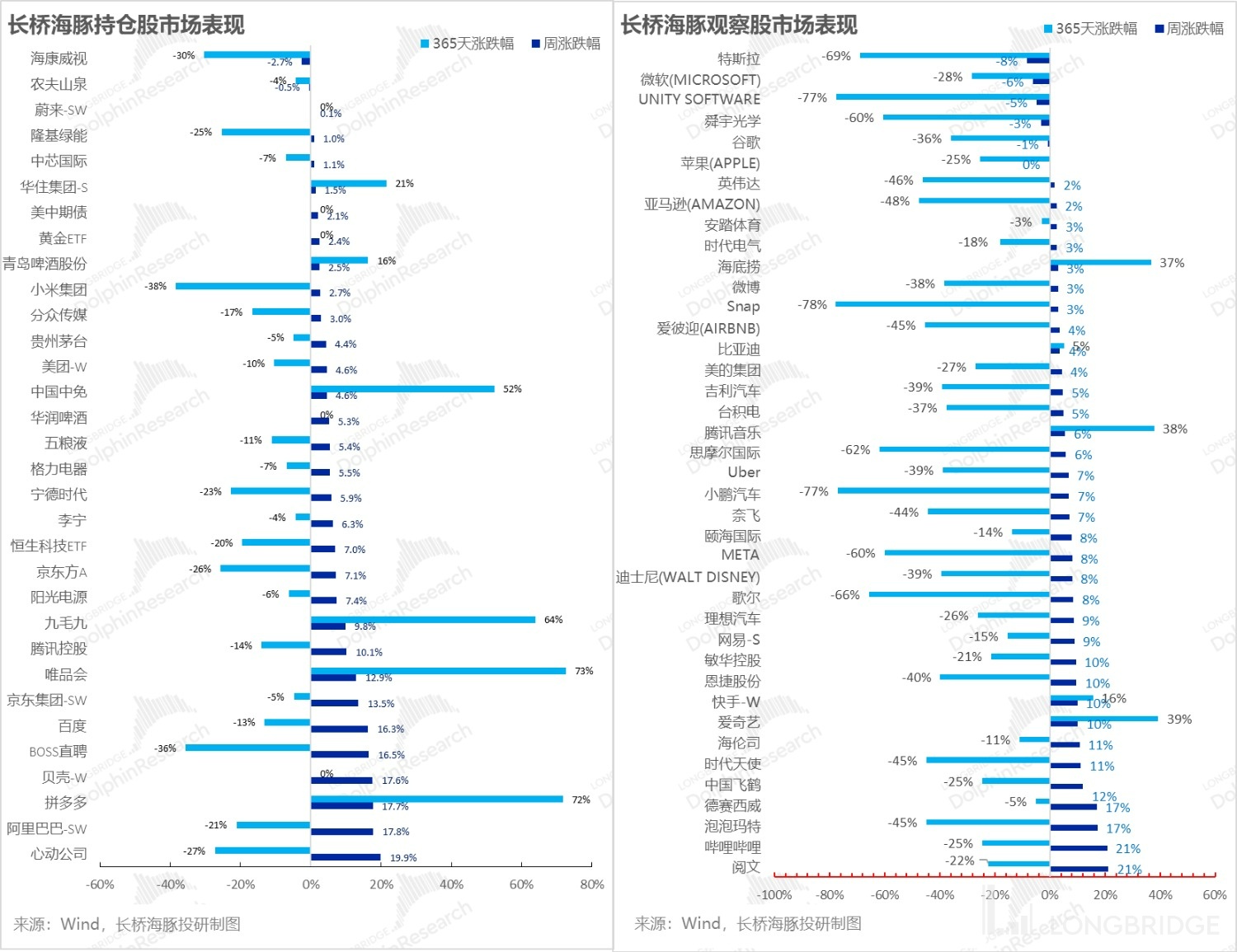

V. Performance of individual stocks: Another week of frenzy for Chinese assets

During the first week after the new year, e-commerce and gaming skyrocketed again, and the gaming sector mainly benefited from the issuance of imported version numbers, which exceeded expectations from the market. The e-commerce sector mainly benefited from the rapid recovery of the epidemic and the opening up of the gold industry business, which most e-commerce companies have.

Currently, six of Dolphin's portfolio holdings have achieved positive returns from the perspective of the 365-day annual increase and decrease, and Pinduoduo and Vipshop have almost doubled. Stocks that have significantly overperformed can basically be attributed to two categories: either they are naturally strong, such as Pinduoduo and Tsingtao Brewery, or they are expected to reverse their situation due to undervaluation, such as China Duty Free and 9F Inc.

Regarding companies with significant fluctuations in their growth and decline, Dolphin has summarized the driving factors as follows for everyone's reference:

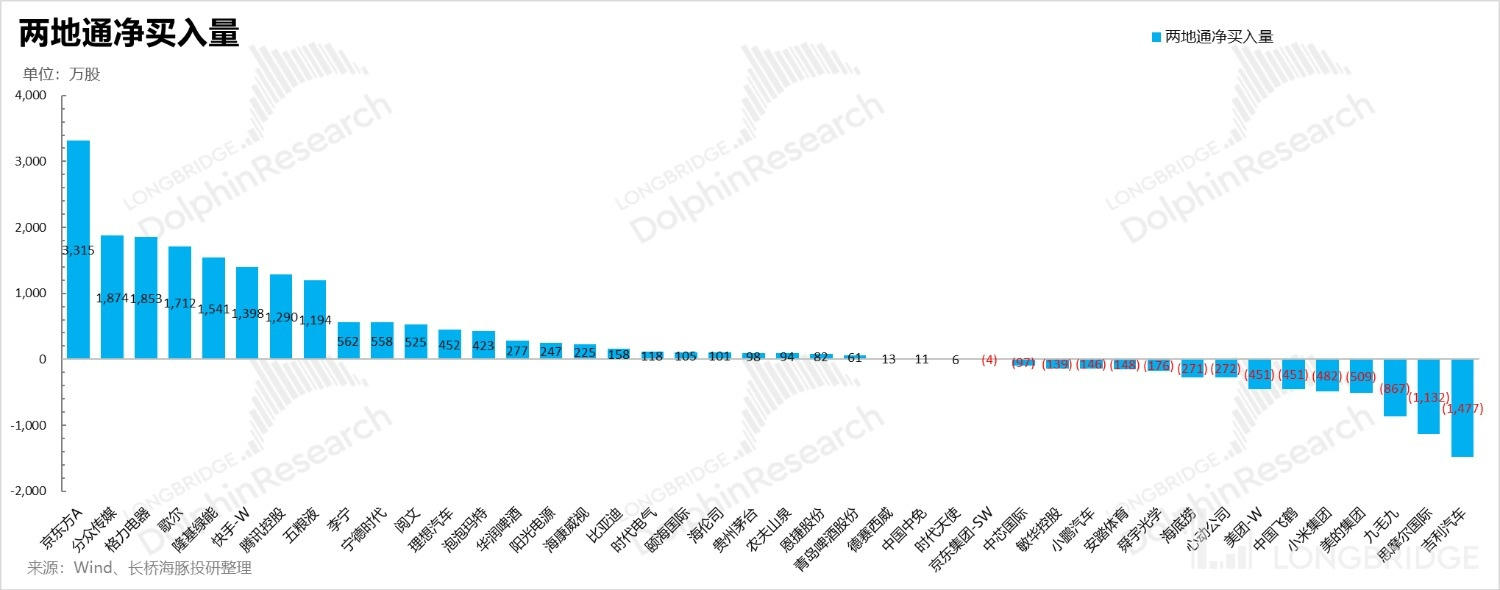

Looking at the northward and southward capital flows of individual stocks in Dolphin's portfolio, BOE climbed from the top of the sell list directly to the top of the buy list in the first four trading days of the previous week, and Focus Media continued to recover under the epidemic situation. Geely had the largest quantity on the sell list.

VI. Portfolio asset allocation

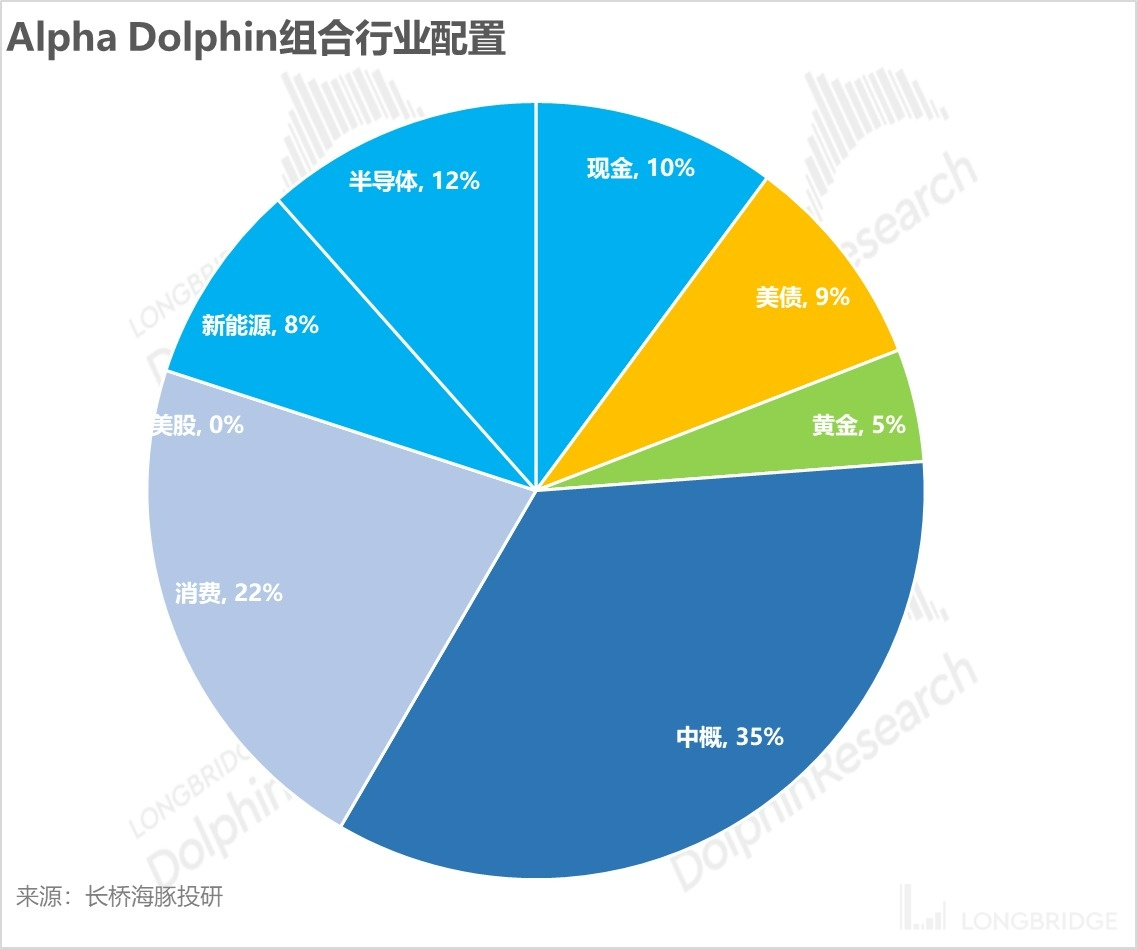

After the portfolio was adjusted, it currently holds 30 stocks/futures, of which one is over-allocated, four are standard-allocated, and 25 are under-allocated. As of the end of last week, the asset allocation distribution and equity asset holding weights of Alpha Dolphin portfolio were as follows:

As of last weekend, the Alpha Dolphin portfolio's distribution of major assets is as follows:

Please refer to the recent weekly reports of Dolphin Analyst:

"Did US stocks fail to rally during Chinese New Year, yet performance is imminent?"

"What is the root of the sluggish US stock market?"

"CPI has fallen, yet why is the Fed still inclined to tighten?"

"Is it that easy to eliminate service inflation? Beware of market over-correction"

"Is Hong Kong stocks finally stabilized? Independent outlook still has room for growth"

"Before dawn comes the darkest time: Is mentality what matters during dark times or daybreak?"

"US stocks 'returning' to reality, how much longer can emerging markets bounce around?"

"Valuation recovery celebrated globally? Another bump to verify performance"

"China's asset violence spikes, why are China and the US light years apart?"

《Are Amazon, Google, and Microsoft Falling Stars? More Meteor Showers in the US stock market?》

《Unreliable "Strong US Dollar" GDP Growth Behind Expected Policy Shift?》

《Time to Test "Steadiness" again: Southern Acquirers vs Northern Runaways》

《Slower Rate Hike? Dream Defeated Again》

《 Sad Q2: Loud "Eagle Voice", Difficult Collective Crossing》

《Falling, Doubtful, Is There Still Hope for Reversal?》

《 Fed Violently Hammers Inflation, Domestic Consumption Opportunities Arise?》

《 The Global Market Falls Again, and the US Shortage of Workers Is the Root Cause》

《Fed Becomes the Top Bear, the Global Market Collapse》

《A Bloodbath Caused by a Rumor: Risks Never Disappear, Searching for Sugar in Glass Shards》 [ "《美国向左、中国向右,美国资产的性价比又回来了》", "《裁员太慢不够接盘,美国还得继续 “衰”》", "《美股式 “丧事喜办”:衰退是好事、最猛加息叫利空出尽》", "《加息进入下半场,“业绩雷” 开幕》", "《疫情要反扑、美国要衰退、资金要变卦》", "《眼下的中国资产:美股 “没消息就是好消息”》", "《成长已然狂欢,但美国就一定是衰退吗?》", "《2023 年的美国,是衰退还是滞涨?》", "《美国石油通胀,中国新能源车做大做强?》", "《美联储加息提速,中国资产机会反而来了》", "《美股通胀又双叒爆表,说好得反弹能走多远?》" ] 《This is the most down-to-earth way, the Dolphin Investment Portfolio is launched》

Risk Disclosures and Statements in this Article: Dolphin Investments Research Disclaimer and General Disclosures

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.