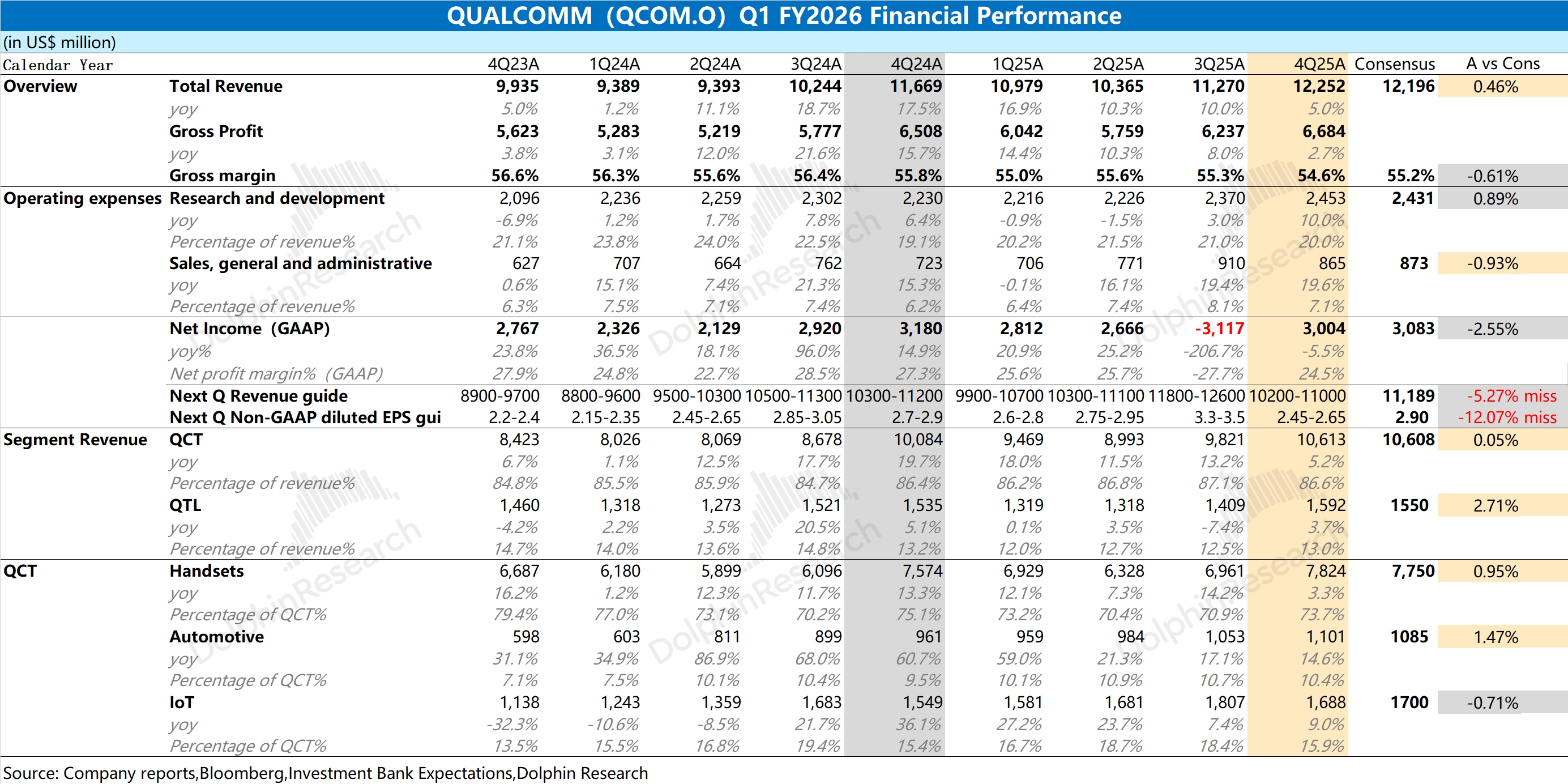

QCOM 4Q25 First Take: Revenue was in line with consensus, while GPM declined as memory shortages and price hikes pressured QCT margins.

The impact from memory shortages and tighter state subsidies was largely priced in, so segment performance broadly matched expectations. However, the Street was most disappointed by next-quarter guidance.

For next quarter, the company guides revenue to $10.2–11.0bn, below consensus ($11.2bn). Non-GAAP EPS is guided to $2.45–2.65, also below consensus ($2.90). This implies both revenue and margin could decline QoQ.

The largest drag is handsets, where the company expects only about $6bn of revenue next quarter, a double-digit YoY decline. Management attributes this to insufficient DRAM supply. While expectations had already been trimmed, the magnitude of the memory impact surprised the market.

Overall, continued memory shortages will weigh on results. Beyond margin pressure from price hikes, constrained supply will cap shipments, limiting any near-term recovery in fundamentals. For now, watch for potential breakthroughs in AI PCs or data centers to rebuild confidence; see Dolphin Research’s upcoming commentary and call Trans for details. $Qualcomm(QCOM.US) $GraniteShares 2x Long QCOM Daily ETF(QCML.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.