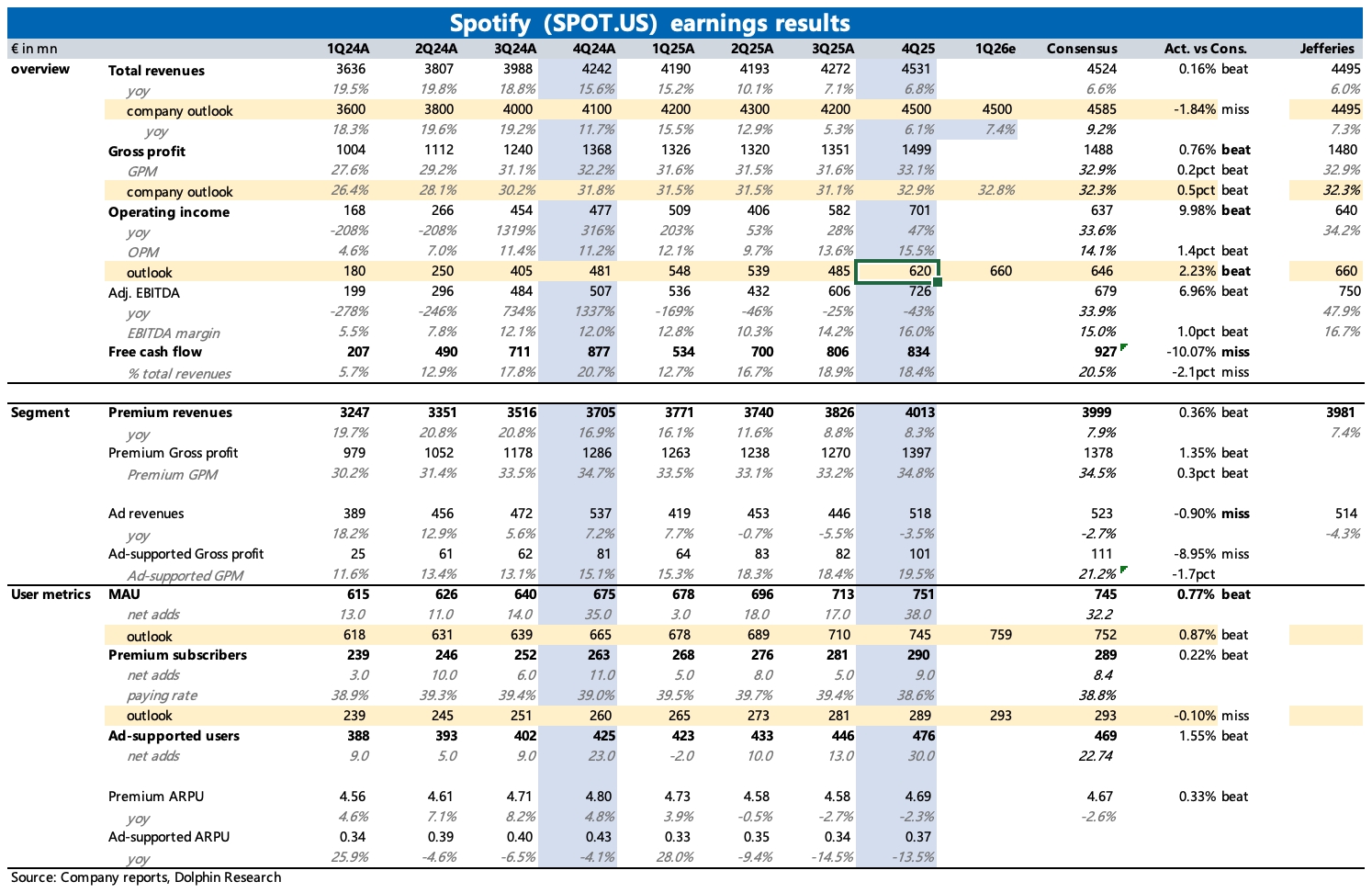

Spotify 4Q25 First Take: Q4 print and guide were solid vs. expectations. Heading into the release, sentiment and forward fundamental expectations were near a trough amid several bearish narratives. (In the comp chart below, Dolphin Research pulled Jefferies' late-Jan estimates; vs. BBG consensus, recent positioning looks cautious.)

In this setup, a 'no‑drama' report already helps release pressure. That said, investors will want clarity from management on the profit trajectory and targets (further price hikes or other cost actions) and on AI's impact to the medium/long-term outlook.

1) GPM steadies nerves: With a high royalty cost ratio, gross margin swings drive earnings sensitivity, making GPM the key metric to watch. It reflects horizontal competitiveness (end-user pricing power) and vertical bargaining power with labels.

Q4 GPM reached 33.1%, beating expectations. QoQ expansion was driven by price hikes, while the YoY lift was more about relatively lower royalties on bundled plans. Q1 GPM guide implies a slight QoQ downtick, likely reflecting new licensing agreements, but still sits above the market's cautious stance.

2) Underlying growth holds up: Spotify reports in EUR, while the USD weakened vs. EUR and North America accounts for ~35% of revenue. FX was a ~5% headwind to the quarter's revenue base. Reported revenue growth was 7% for a second straight single-digit quarter, but ex-FX it was ~13%.

The company guides Q1 revenue of €4.5bn, below consensus. However, the U.S. price increase already began in Q1, and management likely baked in some near-term churn.

3) Subs remain the pillar: Growth is driven by subscription revenue, while ads are still being retooled after a prior leadership change. Q4 paid subs net adds were nearly 9mn, slightly below 11mn a year ago, but solid given widespread price increases that tend to trigger short-term churn. Paid ARPPU rose ~4% ex-FX, evidencing the price hike effect.

4) R&D efficiency improved: OP rose 47% (+53% FX-neutral), with OPM at 15.5%, up both YoY and QoQ. Drivers included price increases and opex discipline, notably R&D, which fell ~20% YoY.

There was also a decline in SBC-related social charges. Prior guidance overstated this by ~€50mn, leading to actual OP of ~€700mn vs. €620mn guided, a wider-than-usual delta. $Spotify(SPOT.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.