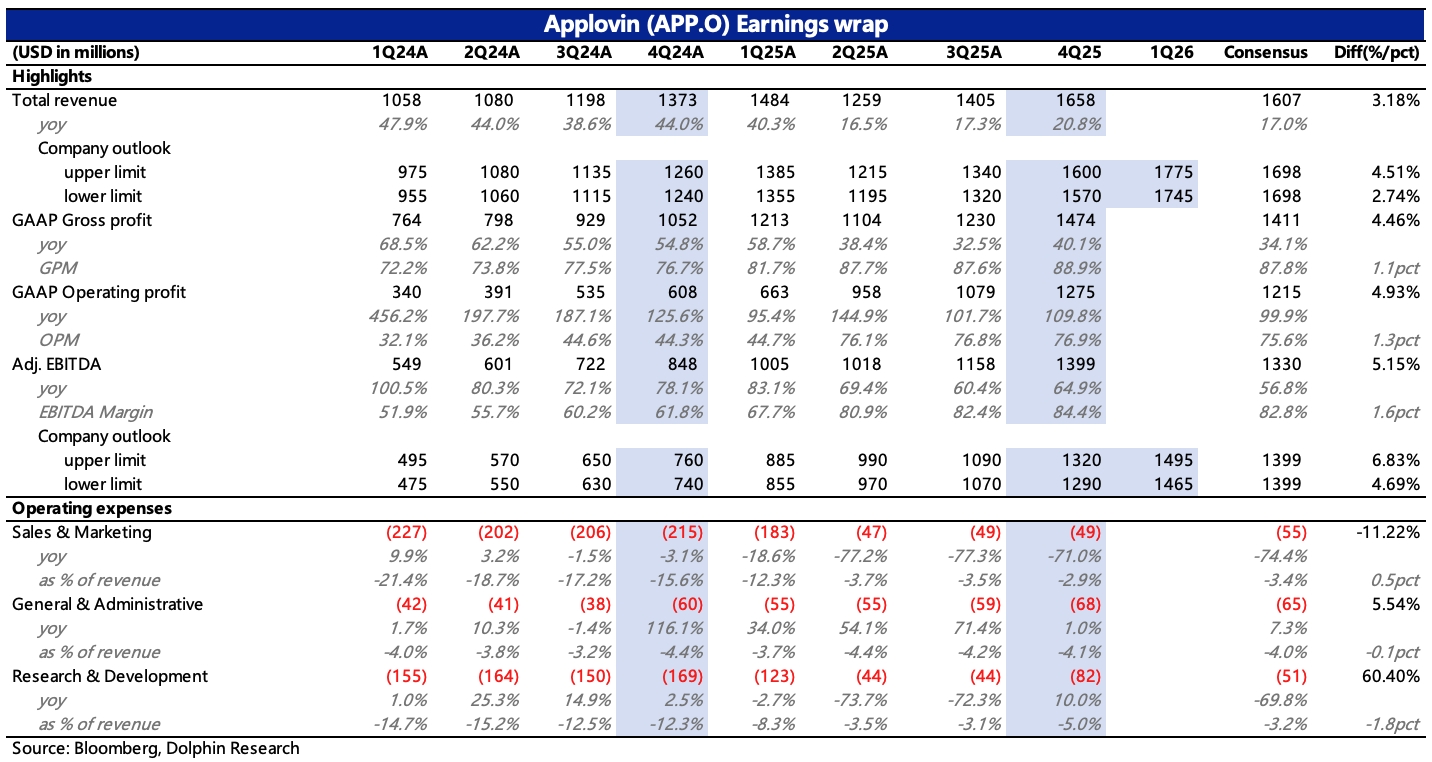

APP 4Q25 First Take: Q4 results were solid, with revenue up 21% YoY (+66% organic on a like-for-like basis; +18% QoQ).

Q1 guidance points to >50% organic growth and 7–10% QoQ. Given management's conservative stance, actual performance could be better.This is stronger than Unity Grow's flat QoQ, showing APP offset e-comm seasonality with its strong share in gaming.

Profitability continued to improve QoQ, with Adj. EBITDA margin at 84.4%, and Q1 margin guidance roughly flat vs. Q4.While slightly below some top houses' more bullish expectations (e.g., BofA), the print broadly matches buy-side views after early-year downward revisions.

Those cuts followed a slowdown in high-frequency holiday e-comm data.Even so, the stock kept selling off on the print, after tracking Unity lower yesterday and with valuation already not rich.

This highlights fragile sentiment, with the market likely worried about Meta's return to iOS in-app ads and potential implications from Cloudx. $AppLovin(APP.US)The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.