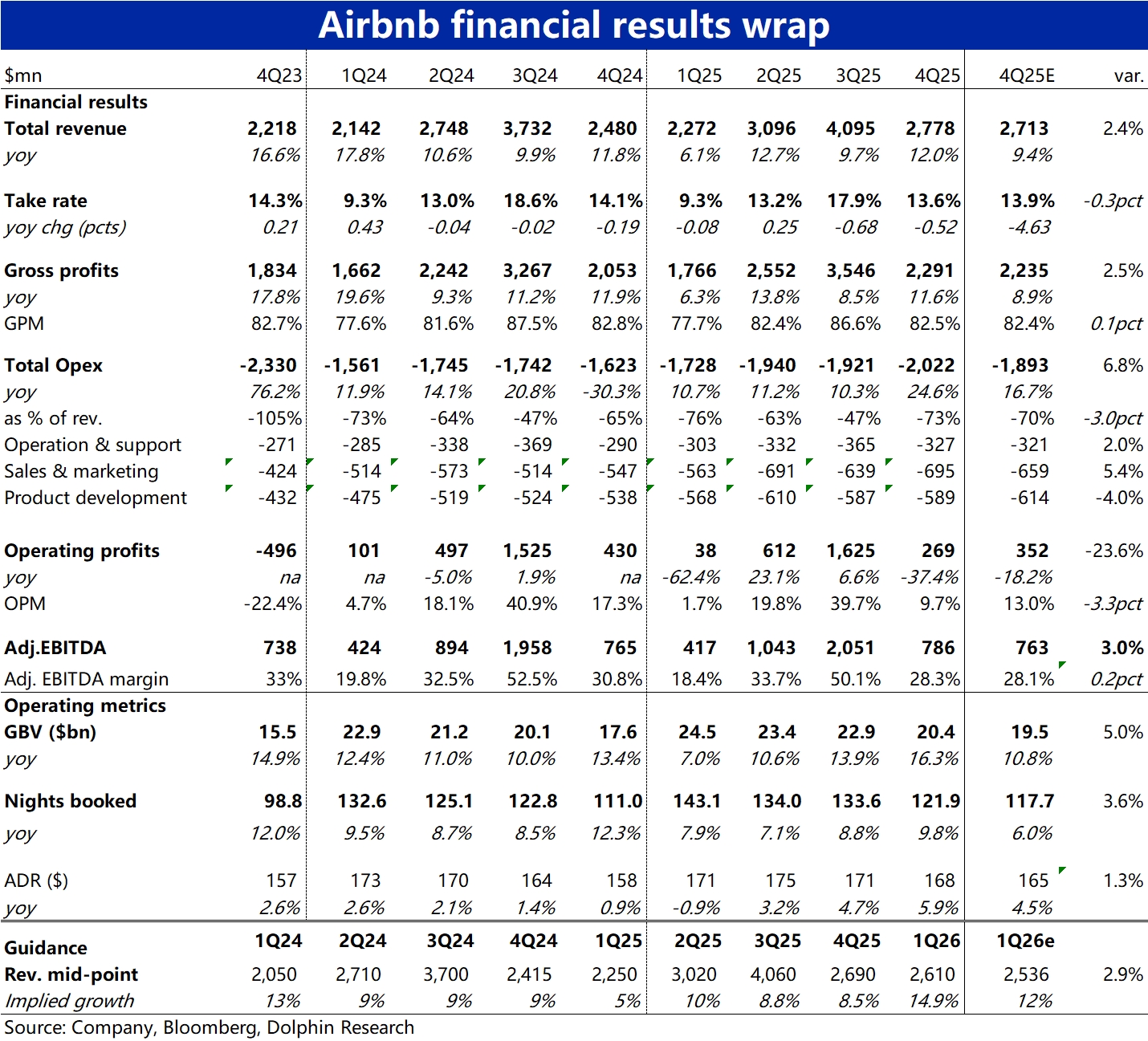

ABNB 4Q25 First Take: Results came in ahead of expectations. Core operating metrics accelerated across the board, defying prior guidance for a slowdown and marking the year's strongest growth. The rub: opex expanded sharply, pressuring margins, though absolute profit still beat.

Details:

1) Core operating metrics were strong, with nights booked up 9.8%, the highest rate of the year vs. prior mid-single-digit guidance. The key driver was firmer-than-feared travel demand in the U.S. and Europe, with signs of acceleration.

FX tailwinds and broad-based price increases lifted ADR by nearly 6%, also a YTD high. With both price and volume up, GBV rose 16% YoY, well above ~11% expected.2) On strong GBV, revenue grew 12%, topping the 9.4% estimate. However, the net take rate fell 50bps YoY, a larger decline than expected, so revenue growth trailed GBV. Management cited booking-to-stay timing shifts.

3) A notable negative was opex expansion, with total operating expenses up nearly 25% YoY, far above the prior slightly-above-10% pace.

By line, spend accelerated across the board, led by sales & marketing +27% and G&A up 60%+ off a low base. As a result, adj. EBITDA margin fell 260bps YoY, below expectations. Strong growth still drove profit above estimates.

4) Guidance: revenue is expected to grow 14–16% next quarter, with a ~3ppt FX tailwind; on a const.-FX basis, the midpoint is 12%, ~1ppt faster than this quarter. Operationally, nights are guided to grow high single digits YoY, and ADR to continue rising on FX support.

Overall, next quarter's growth outlook is solid. For FY2026, management guides revenue growth of at least 10%, while margin is expected to be flat YoY given reinvestment. $Airbnb(ABNB.US)The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.