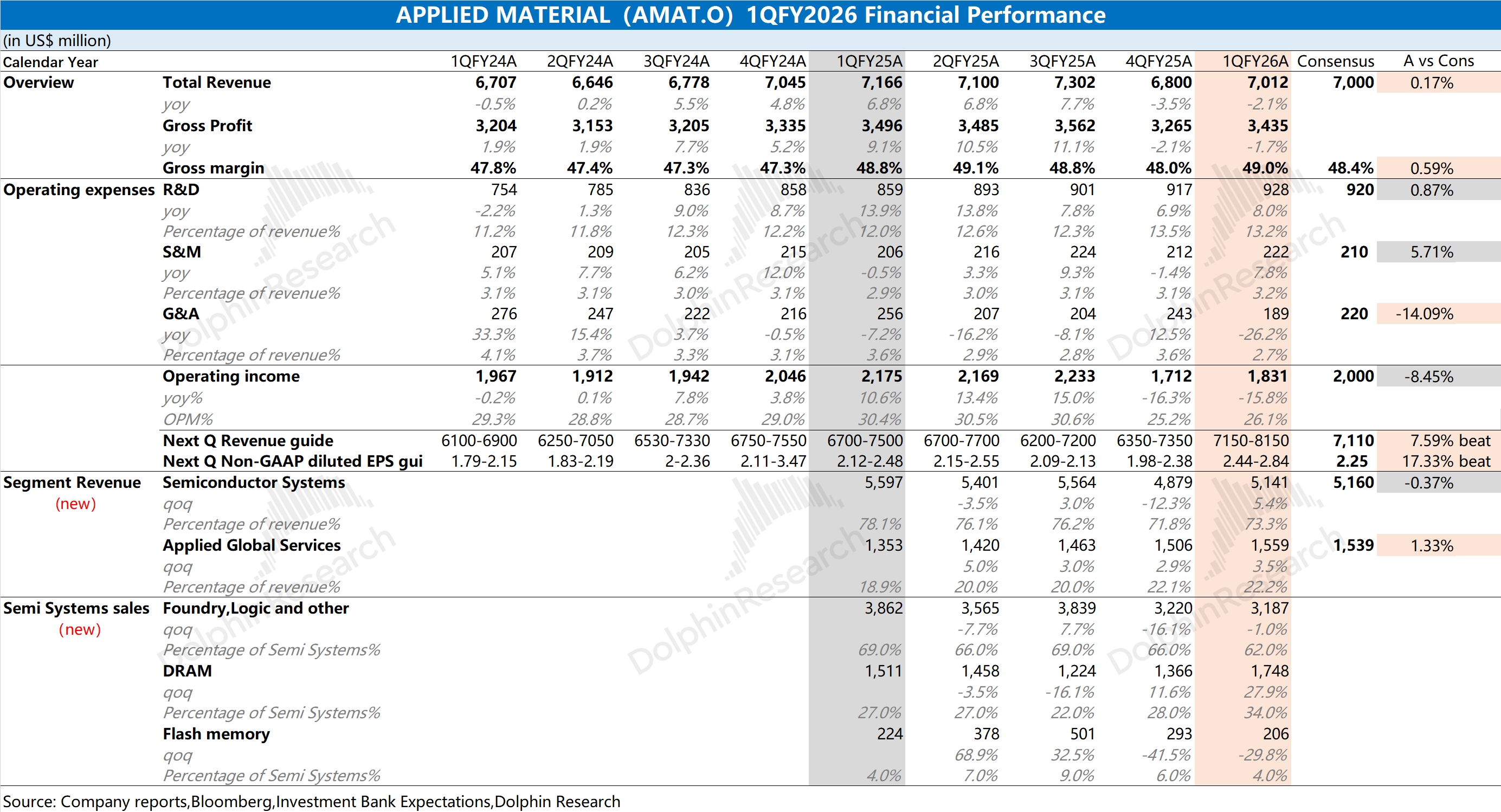

AMAT First Take: Solid quarter; revenue and GPM in line with the Street. The YoY decline on the top line reflects a tough comp from last year's semi cycle. DRAM and Services delivered double-digit growth, a strong showing.

Notably, the company revised its reporting this quarter. The 200mm equipment biz. was moved into the Semiconductor Systems segment from Applied Global Services, and the Display biz. was reclassified into 'Other'. These changes better highlight the core franchise.

Guidance is the clear positive vs. this quarter's print. Mgmt guides next qtr revenue of $7.15–8.15bn, midpoint +9% QoQ, above consensus ($7.1bn). EPS of $2.44–2.84 also tops the Street ($2.25).

Earlier, mgmt indicated 2026 revenue would be 'first half low, back half high', so the market kept 1H expectations muted (only modest growth). The new guide clearly beats that, driven mainly by memory-related semi equipment, which has delivered double-digit QoQ growth for two straight quarters.

Big picture, semi Capex is in an upcycle and AMAT sits in the first tier of WFE vendors. As TSMC and Micron raise Capex, that should directly fuel results, leaving room for further beats. For more, follow Dolphin Research's detailed First Take and Trans. $Applied Materials(AMAT.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.