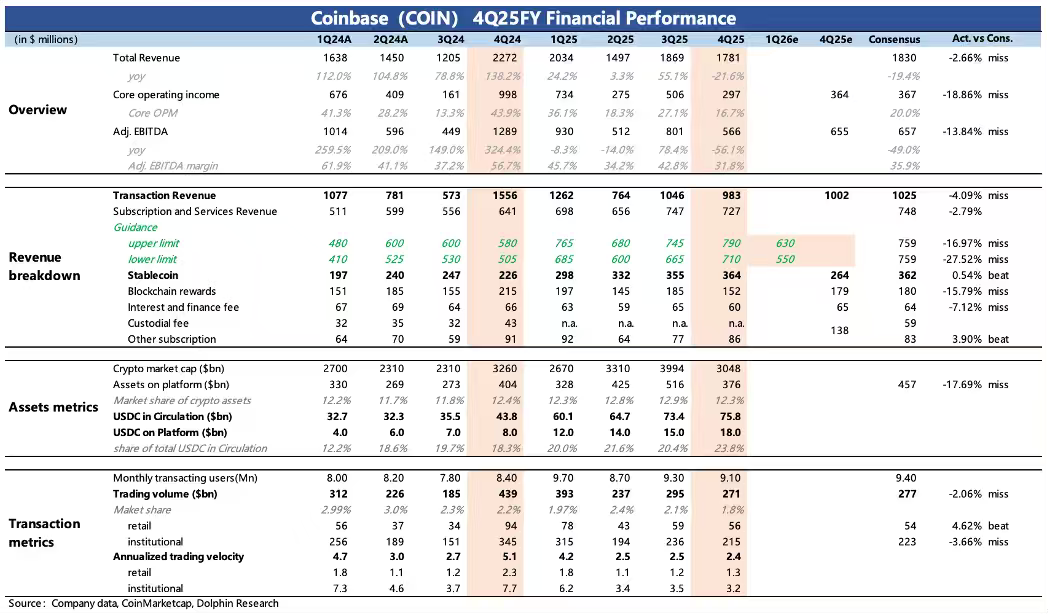

COIN 4Q25 First Take: Q4 results were weak, missing estimates. The stock has largely decoupled from the print, as shares have sold off further with crypto since Feb, while most analyst forecasts were set in Jan. Most of Coinbase's revenue is market-linked.

(1) Trading revenue (55% mix) speaks for itself. Platform trading volume fell 8% QoQ, slightly worse than the industry's ~7%, implying a minor share loss. Customer assets on the platform (AUM) shrank 27% QoQ by quarter-end.

(2) Subscriptions and services are not directly tied to trading, but they also swing sharply when sentiment turns. Within that, blockchain rewards (10% of total revenue) are closely tied to ETH and SOL, both of which plunged in Q4.

(3) Aside from the stablecoin interest share (~20% of revenue), which is largely modelable and came in as expected, most other line items missed.

Beyond the near-term print, the company is investing for future expansion, entering equities trading, equity perpetuals, and prediction markets via M&A and in-house builds, driving a clear step-up in expenses. In a weak market, that further pressured profits: Q4 EBITDA fell 30% QoQ and 56% YoY from last year's peak. Management's Q1 OpEx guide suggests spending will not ease despite the downturn. $Coinbase(COIN.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.