Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

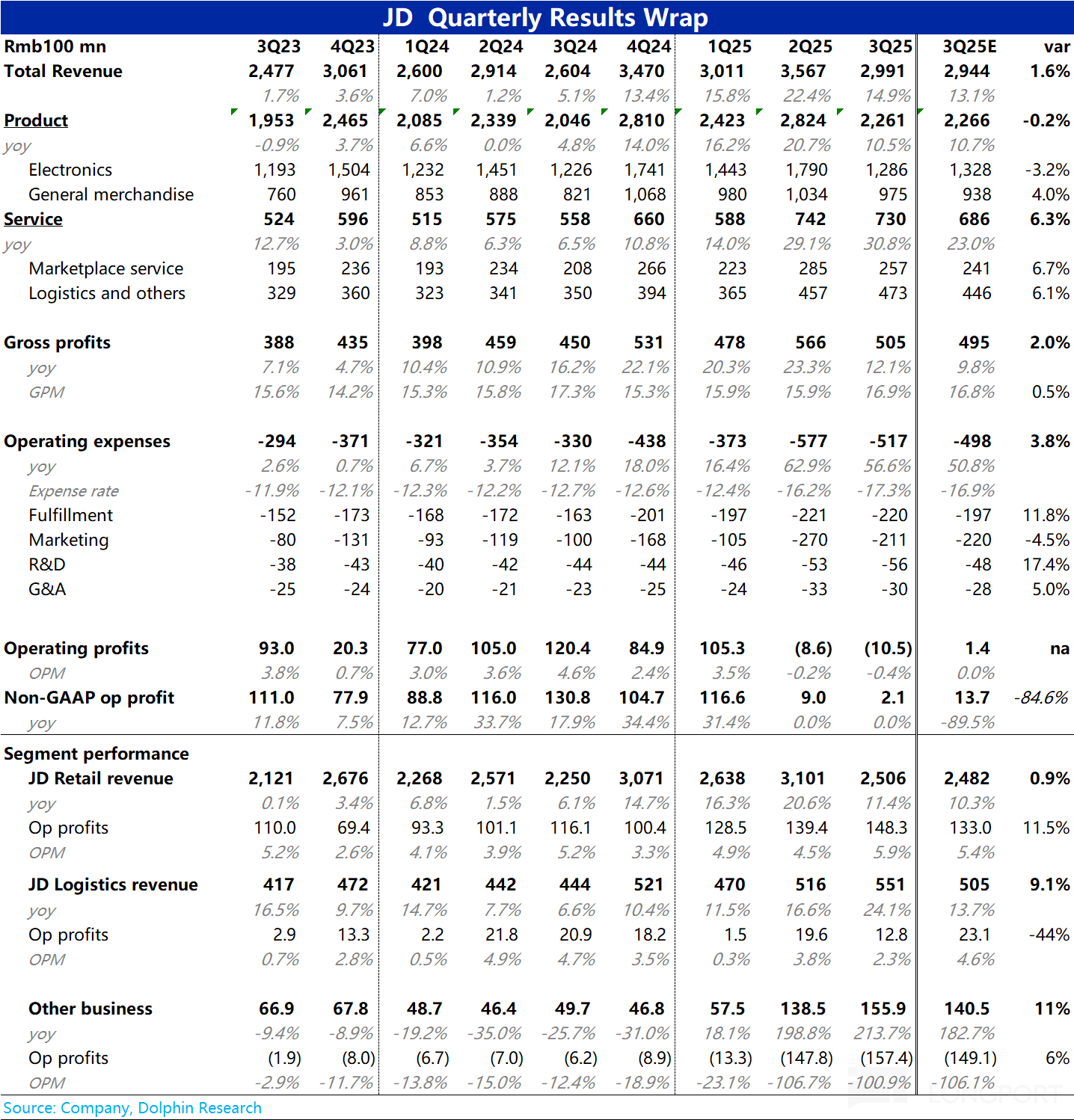

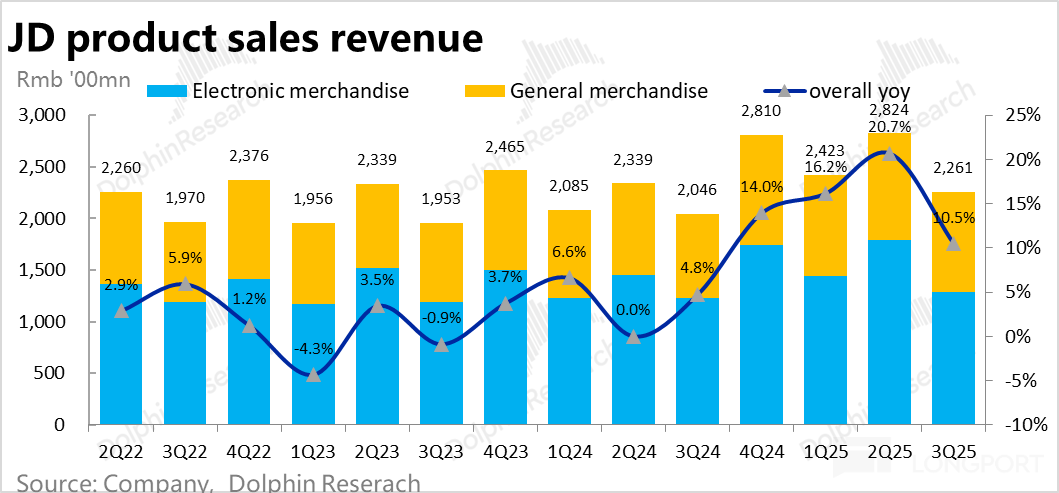

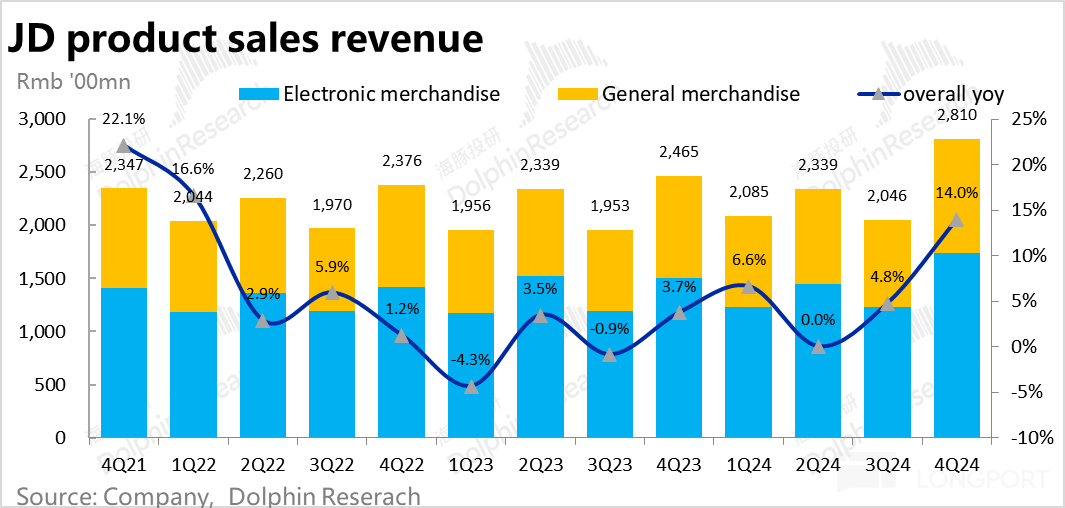

The three major domestic e-commerce giants--$JD.com(JD.US) first delivered their Q3 financial report on November 13th. In summary, this quarter's performance was also "divided," with both good and bad...

Hesai (3Q25 Minutes): Lidar shipments are expected to reach at least 2 million to 3 million units by 2026

The collaboration with BYD currently covers more than ten models, and more new models will gradually achieve mass production from 2025 to 2026.

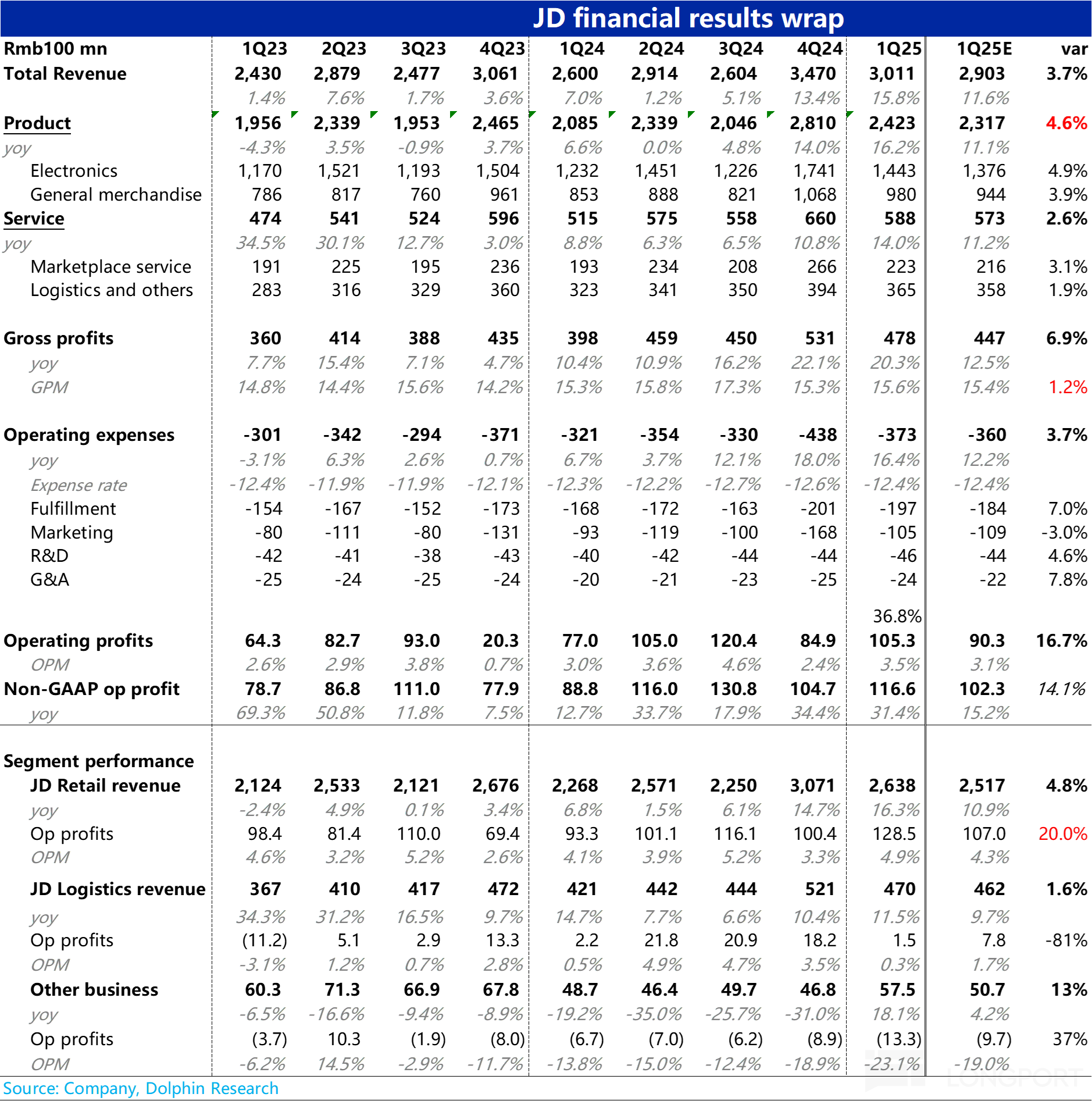

On the evening of May 13th, Beijing time, before the US stock market opened, $JD.com(JD.US) announced its financial report for the first quarter of 2025. At first glance, it looks quite good, but is i......

JD.com (Minutes): Electric growth peaked and then declined, consumer goods remained strong throughout the year

The following is the minutes of JD's Q4 2024 conference call. For the financial report commentary, please see "National Subsidies Support the Market, JD Finally 'Gets Out of the Pit'." 1. Review of Co...