Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

Wear new shoes, walk the old path

It seems to have developed, turned around, and modernized, but once encountering pressure or real constraints, it reverts to the old ways—the practices from the beginn...

Li Auto releases AI glasses Livis; Micron exits retail storage business to focus on AI | Today's Important News Recap

1204 | Dolphin Research Focus: 🐬 Macro/Industry 1. The Beijing Consumer Association, in collaboration with eight major e-commerce platforms including JD.com, Meituan, Pinduoduo, Vipshop, Douyin, Kuai...

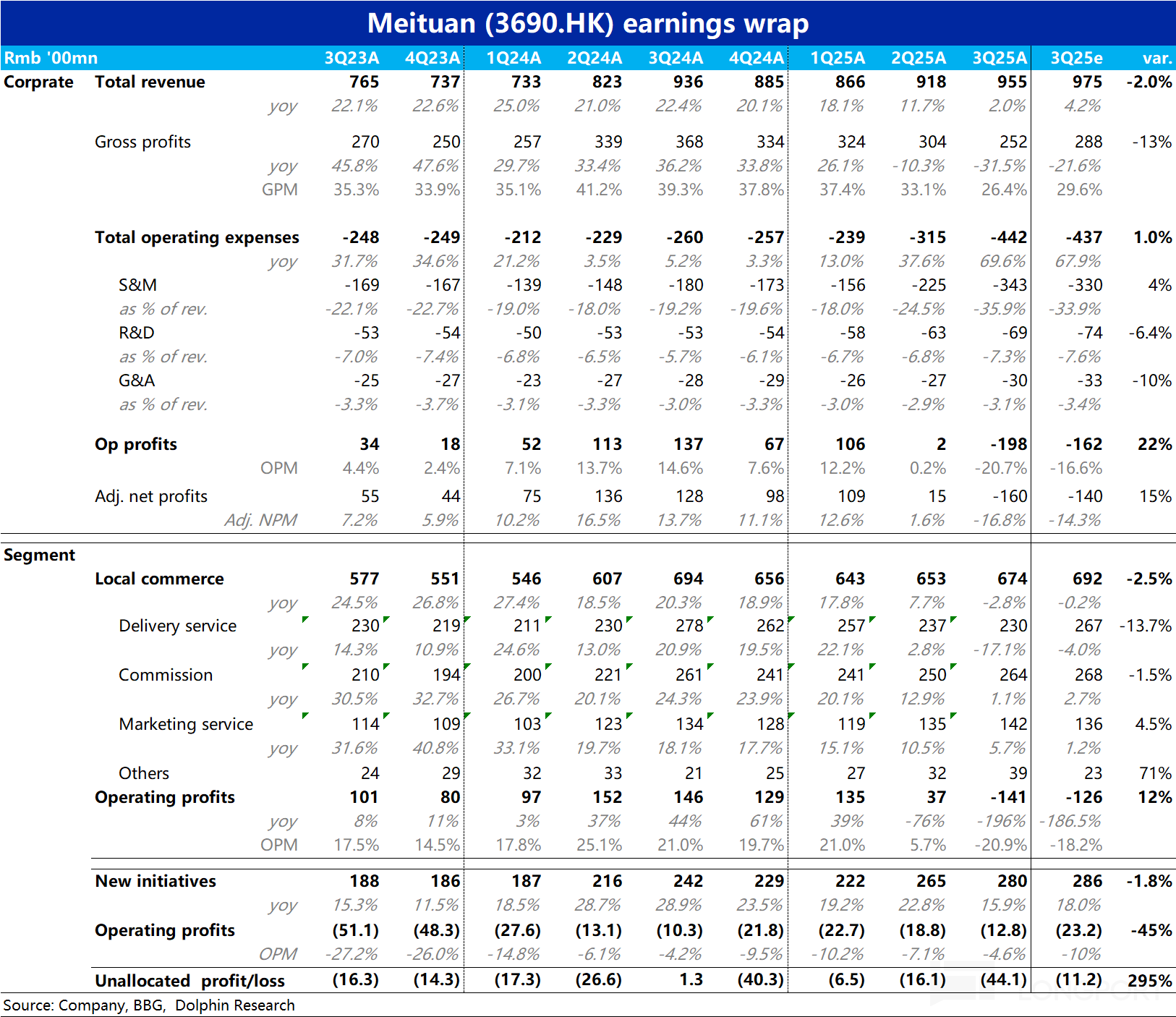

The following are the Minutes of the FY25 Q3 earnings call for $MEITUAN(03690.HK) organized by Dolphin Research. For an interpretation of the financial report, please refer to "Meituan: A Loss of Near...

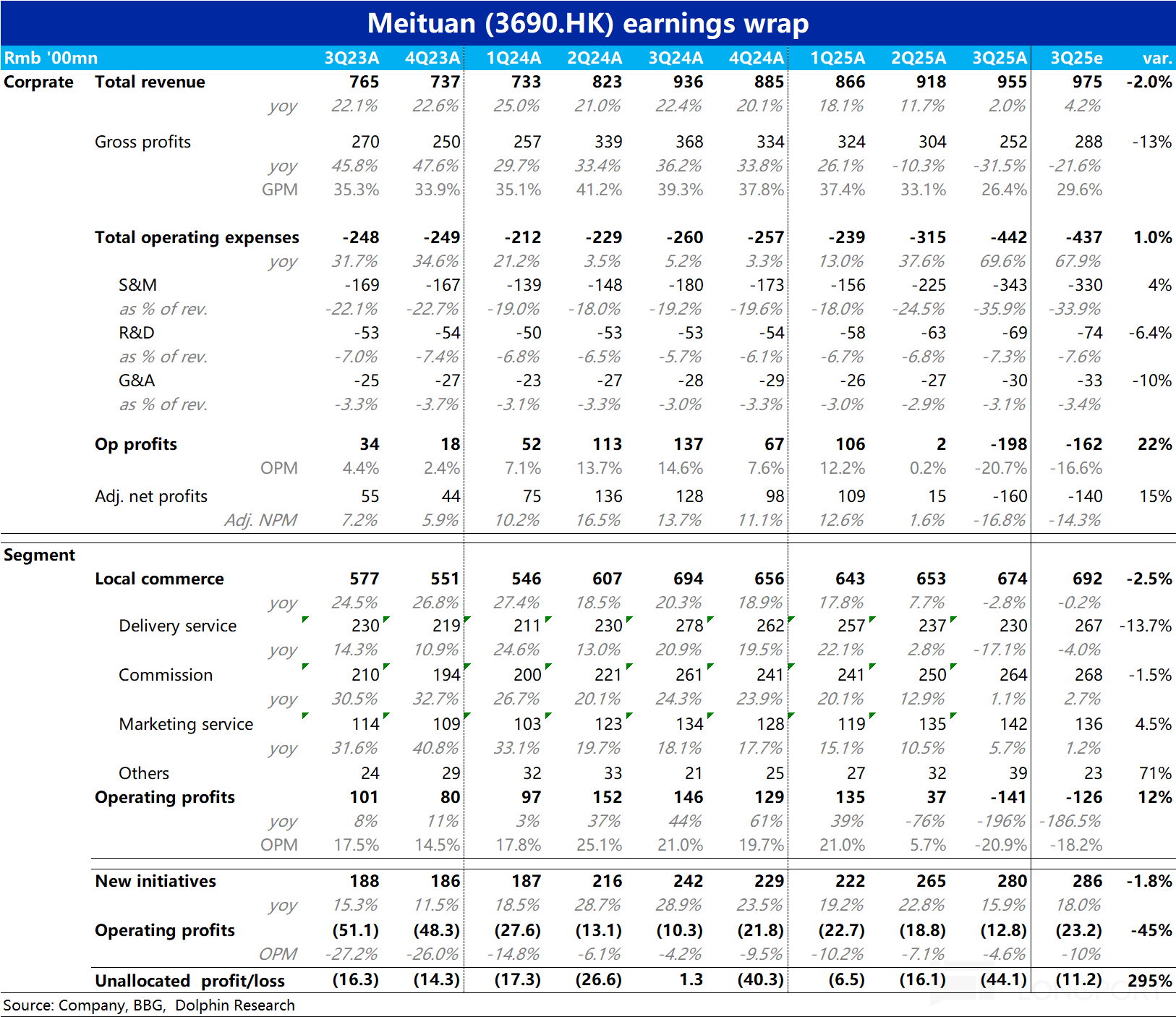

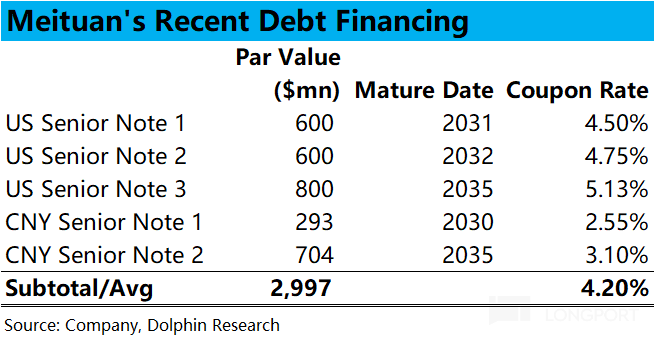

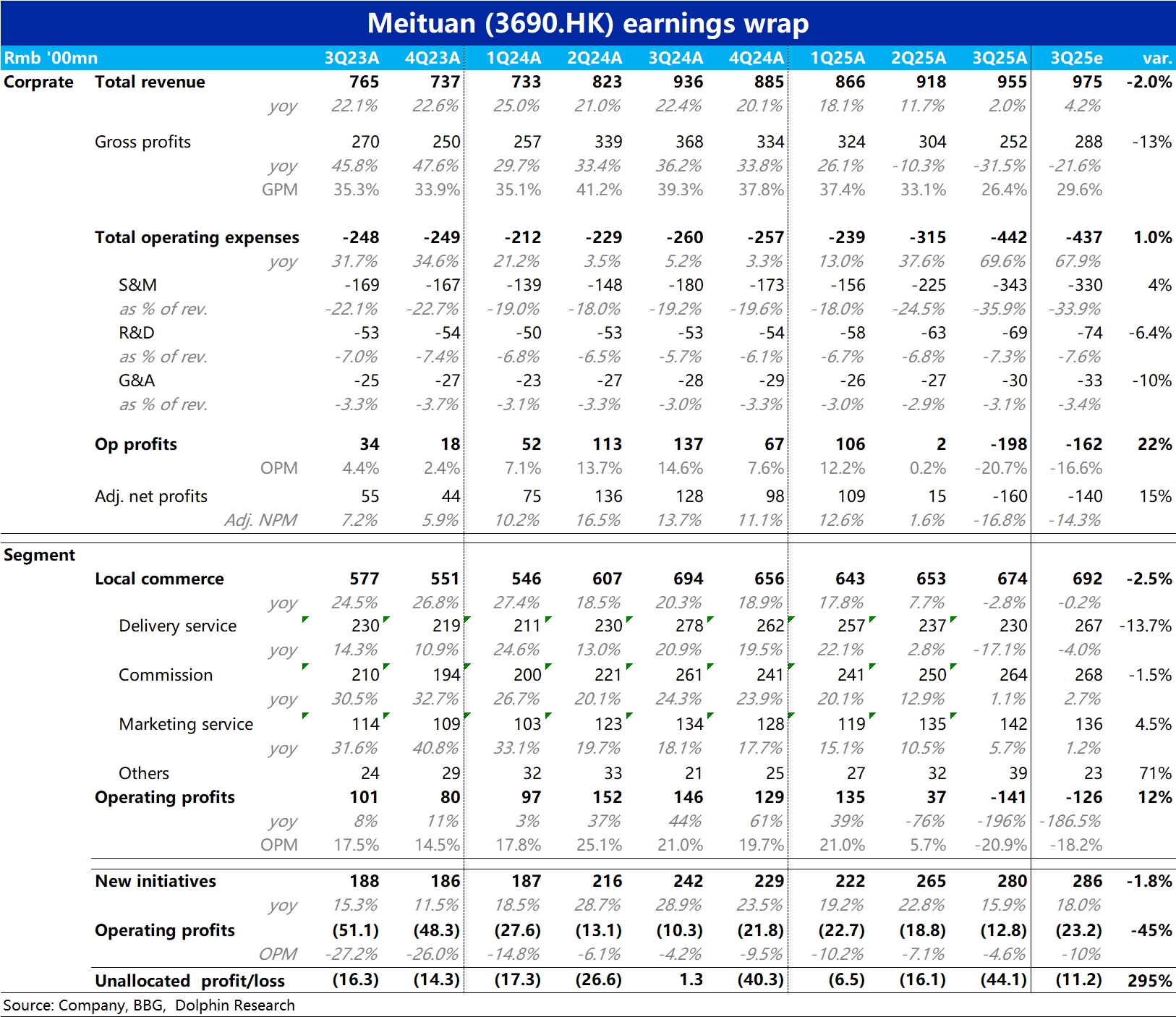

$MEITUAN(03690.HK) released its Q3 earnings after the Hong Kong stock market closed on November 28th, being the last among the 'Three Fools' in the food delivery battle. During the summer quarter, whi...

Meituan 3Q25 Quick Interpretation: Meituan, the most affected in the food delivery battle, had a predictably poor 3Q performance. The group's operating loss for the quarter was RMB 19.8 billion (vs. l...