Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

Low revenue, low factory utilization rates and high depreciation have been weighing on TI's margins. TI will grow 13% in CY25 to $17.7B but that's still down 12% vs previous peak. Industrial is 26% be...

ASE inked a deal with Analog Devices (ADI) to buy ADI’s Penang, Malyasia packaging plant as part of a long-term supply agreement, they said. ASE, the world’s biggest chip packaging/testing firm, will .........

Analog Devices has a growing presence in AI/DC with its content in HBM testers and vertical power. Its AI revenue will grow from $400M in FY24 to $500-$600M in FY25. Claims to have hundreds of thousan...

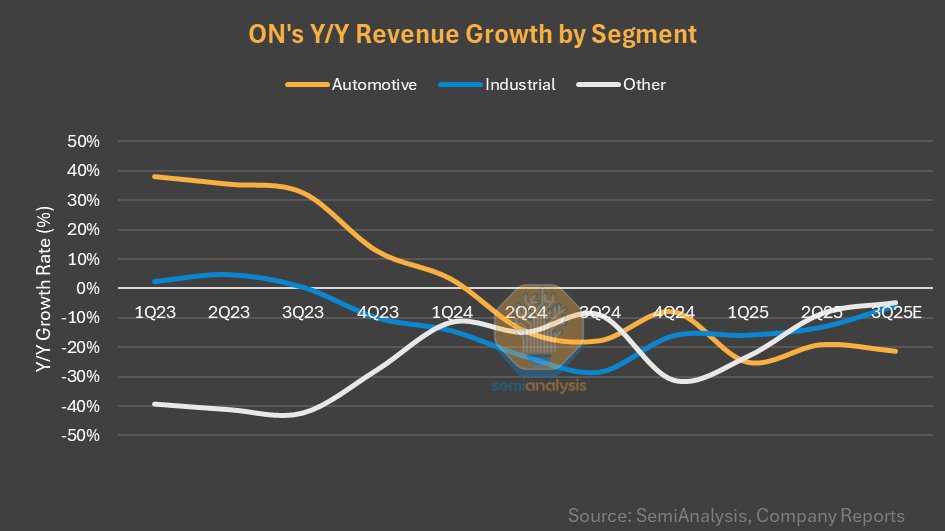

On Semi 2Q25: Revenue down y/y for 8th straight quarter; -2% q/q and -15% y/y to $1.47B; Industrial below expectations while Auto and Other above expectations;

Industrial down y/y for 7 straight quar......Semiconductor companies that crossed COVID quarterly revenue peaks so far include NVIDIA, AMD, Broadcom, Marvell, Hynix, Micron, Monolithic Power & Qualcomm. In the foundry sector, TSMC and SMIC. Most...