Company Encyclopedia

View More

Angel Oak Mortgage REIT

AOMR.US

Angel Oak Mortgage REIT, Inc., a real estate finance company, focuses on acquiring and investing in first lien non- qualified mortgage loans and other mortgage-related assets in the United States mortgage market. It offers investment securities; residential mortgage loans; and commercial mortgage loans. The company qualifies as a real estate investment trust for federal income tax purposes. It generally would not be subject to federal corporate income taxes if it distributes at least 90% of its taxable income to its stockholders.

78.70 B

AOMR.USMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

Mortgage rates are climbing even though the Federal Reserve just cut interest rates. At first glance, that feels strange. If the Fed is lowering borrowing costs, shouldn’t mortgages also get cheaper? ...

............Houston, we have a problem.

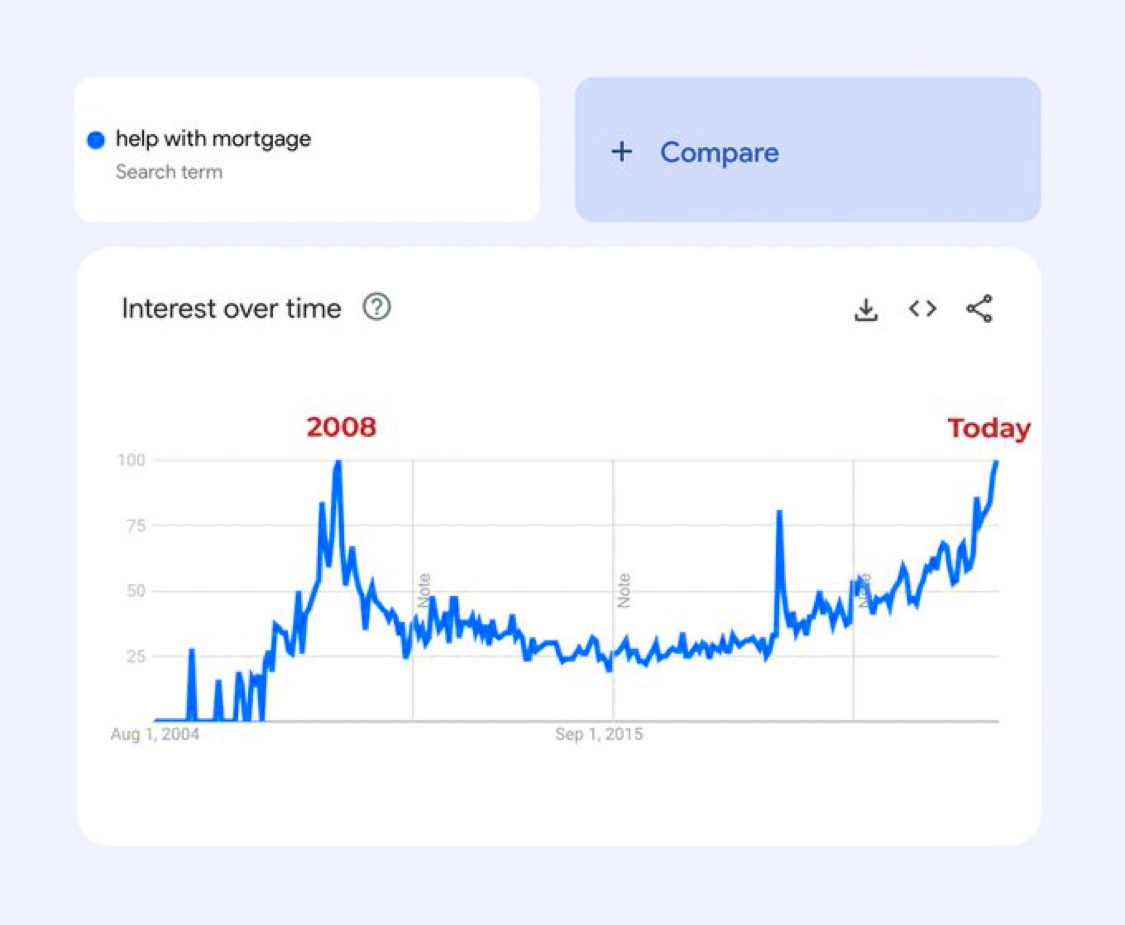

Search interest in “help with mortgage” has climbed beyond the heights reached during the 2008 housing crisis.Source: StockMarket.News

The 30-Year Mortgage Trap: How Low Rates Froze the Housing Market?

Source: StockMarket.News

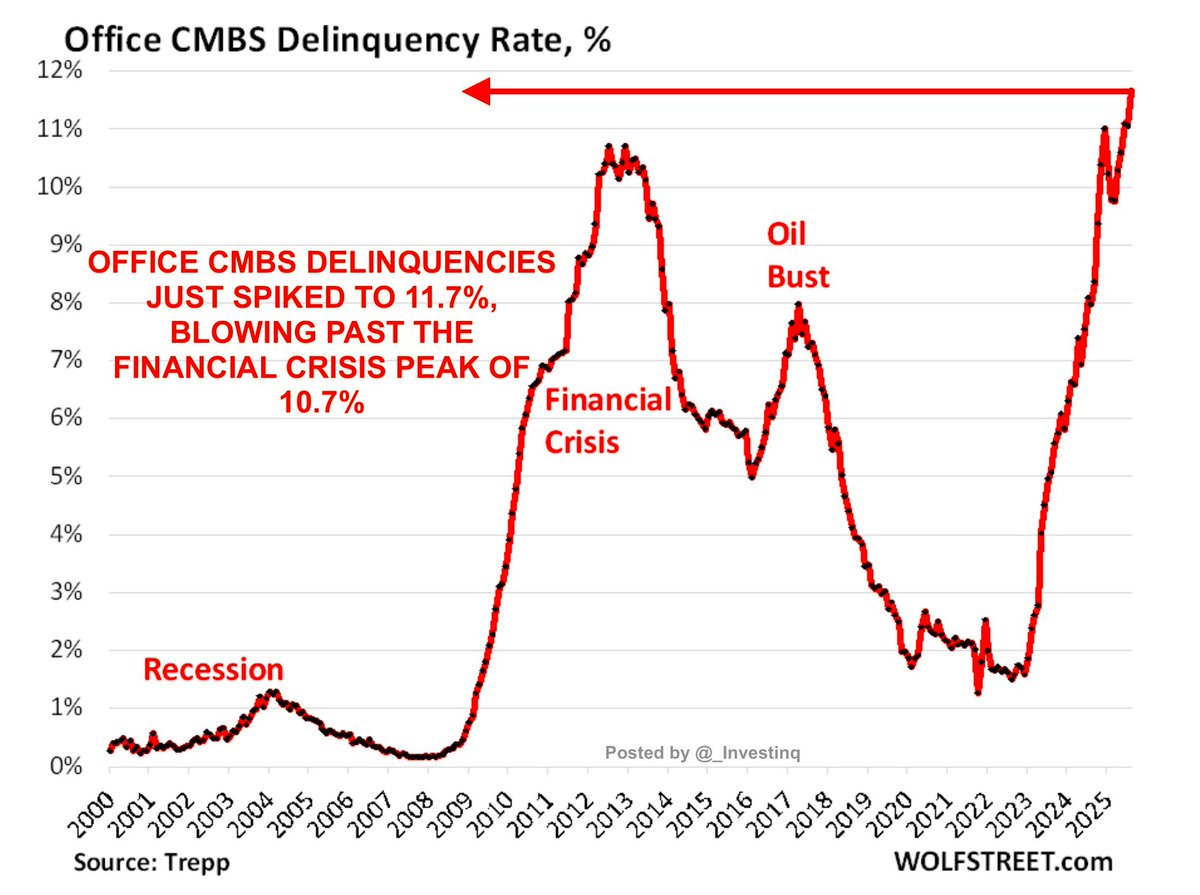

A slow-motion collapse is sweeping through commercial real estate.

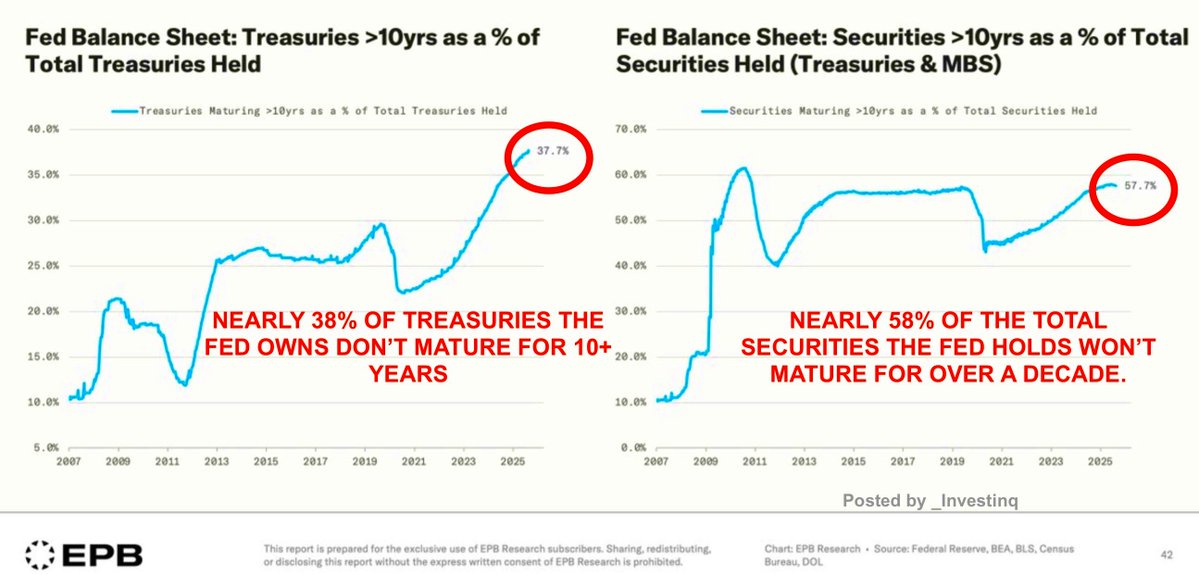

Office buildings are vacant, mortgages are defaulting, cities are broke.Taxpayers are quietly being lined up to take the fall.(a threa...🚨 Nearly 38% of Treasuries the Fed owns don’t mature for 10+ years.

Add in mortgage bonds, and almost 58% of its holdings are long-term.This trap changes how rates, markets, and your money work.(a thr...