Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

XPeng surged 17% in a single day; Intel AI Chief jumps ship to OpenAI | Today's Important News Recap

1111 |Dolphin Research Key Focus: 🐬 Macro/Industry 1. The U.S. Senate has passed a temporary spending bill aimed at ending the longest government shutdown in history, which has lasted for 41 days. Th......

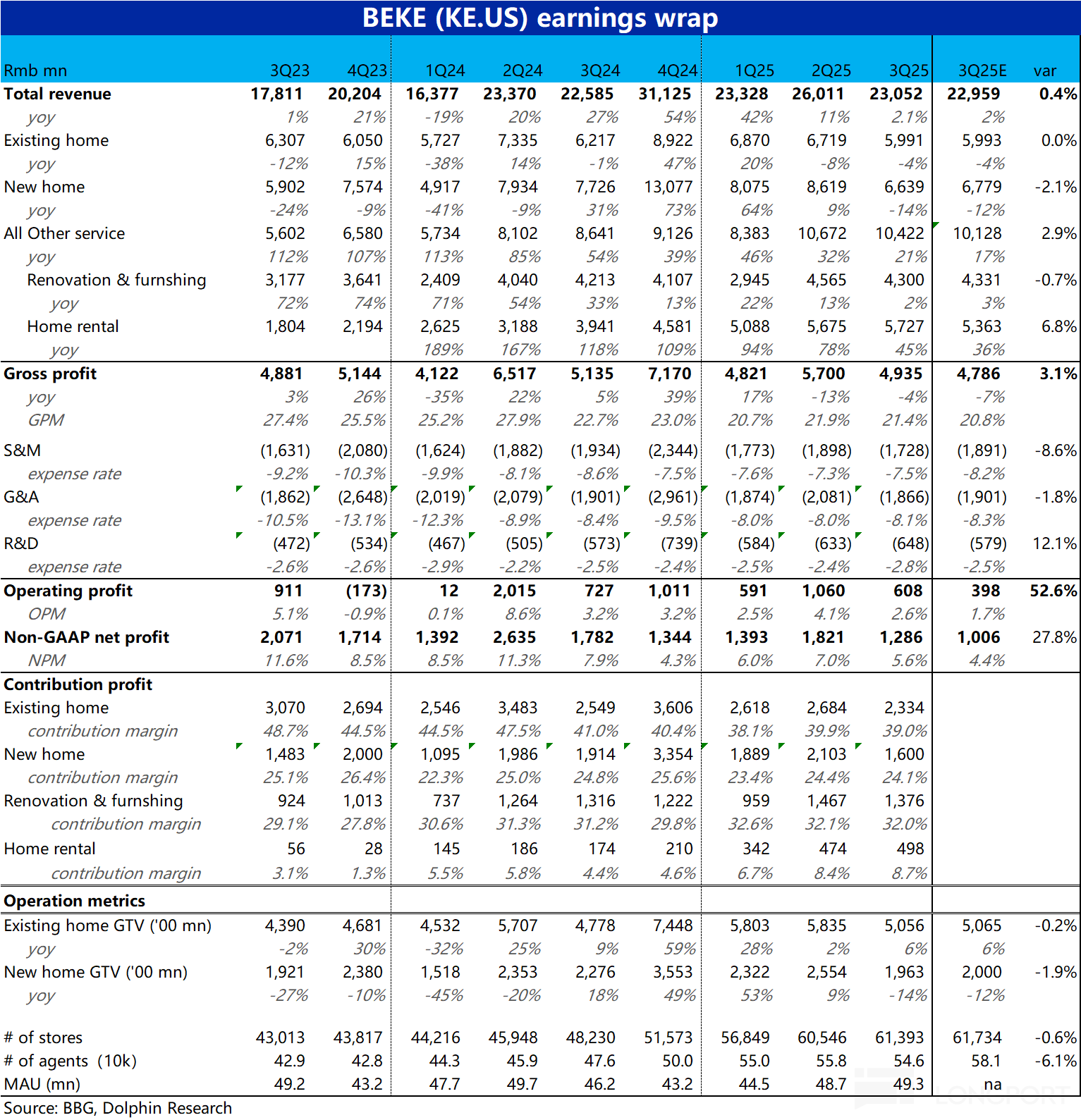

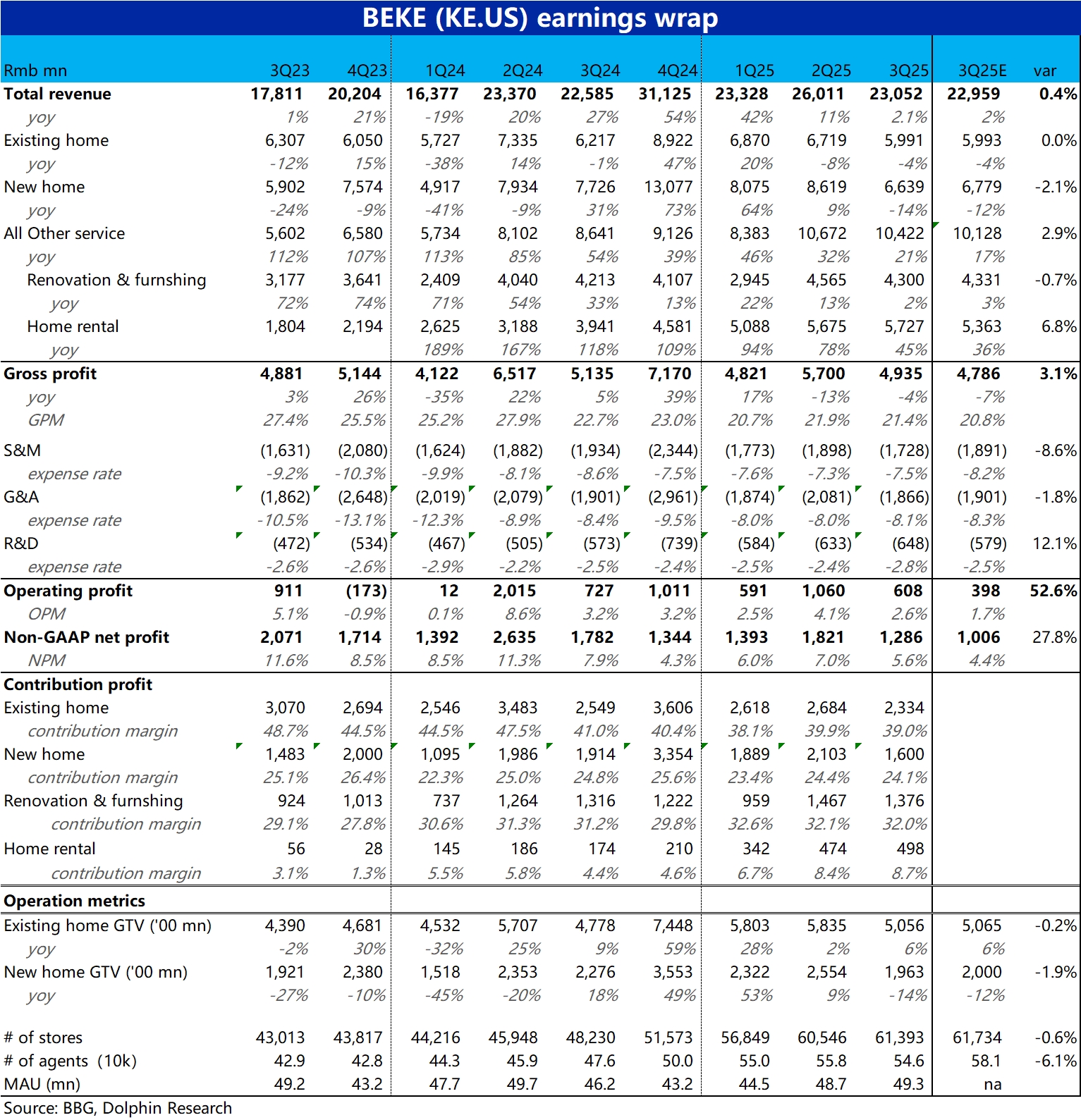

The following are the minutes of the $Barrick Mining(B.US)eike (BEKE.US) FY25Q3 earnings call organized by Dolphin Research. For an interpretation of the financial report, please refer to "Beike: Is T...

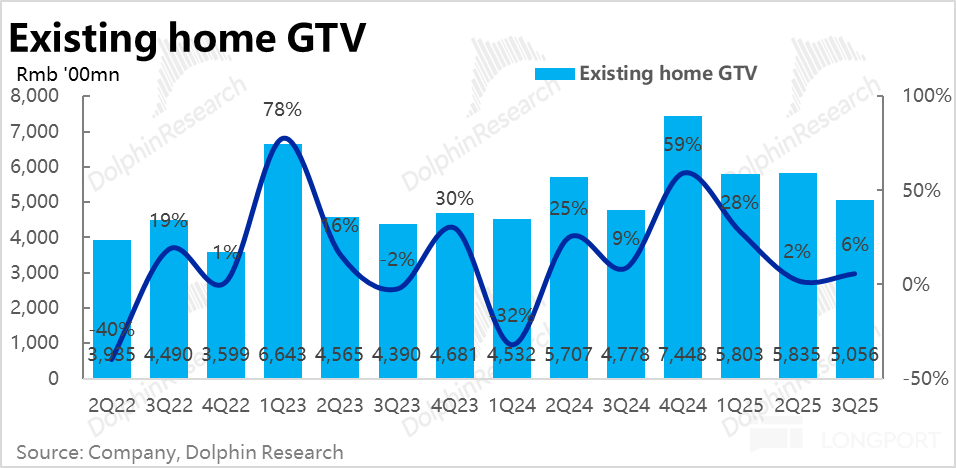

Leading domestic housing intermediary--$KE(BEKE.US) announced its Q3 2025 results on the evening of November 10th before the US stock market opened. Overall, the performance can be summarized as "not ...

Beike 3Q25 Quick Interpretation: Overall, Beike's performance this quarter can be summarized as "not good, but not as bad as feared."

Due to the recent general decline in U.S. stocks, the company's sh...

The following is the $KE(BEKE.US) FY25 Q2 earnings call minutes. For earnings interpretation, please refer to the article "贝壳: The Real Estate Market Cools Again, Can Beijing and Shanghai's 'Relaxatio...