Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

A buddy asked about investment strategies

I recommend everyone check out this book [Buffett's Investment Portfolio], it's worth studying carefully 🧐

🏆 Prize Quiz | Will Google Hit $4T Market Cap by the end of 2025?

$Alphabet - C(GOOG.US)jumped 6.28% on Nov 24, hitting a new high at $319.80.

The rally was boosted by strong reception to its new AI mo...

Will Google hit $4T market cap

Single Choice

- Yes 🙌 80%

- No ❌19%

Update: Google $Alphabet(GOOGL.US) is now up 15% since Buffett's Berkshire disclosed a $4B stake

The following are the Minutes of the 3Q25 earnings call for $Futu(FUTU.US) compiled by Dolphin Research. Detailed business data for the quarter can be viewed in the Longbridge APP under Stocks - Panor......

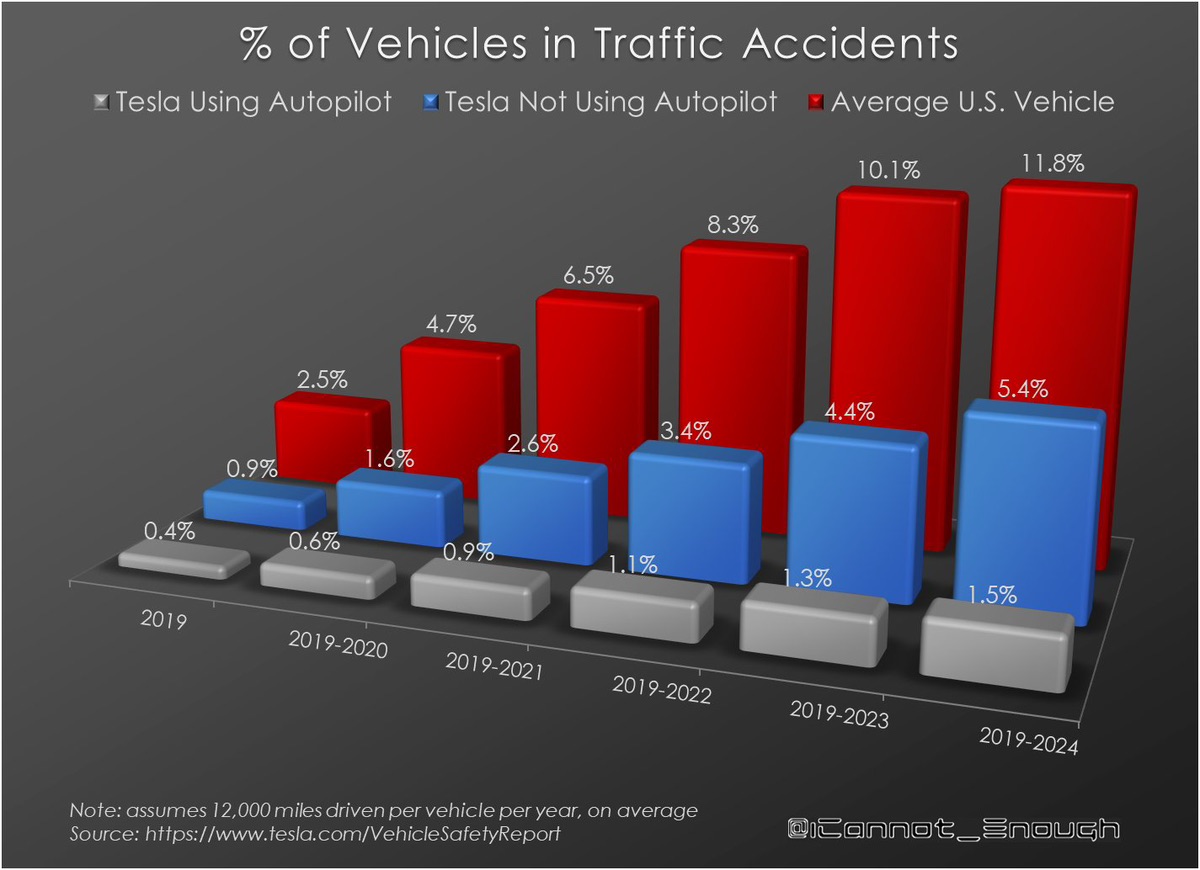

The five-year car accident rate, 11.8%➡️5.4%➡️1.5%, corresponding to regular cars➡️Tesla cars➡️Tesla cars with FSD

Long-term investors also need to consider this situation. I guess Charlie Munger and W...