Company Encyclopedia

View More

CTS

CTS.US

CTS Corporation designs, manufactures, and sells sensors, connectivity components, and actuators in North America, Europe, and Asia. The company offers controls, pedals, sensors, switches, transducers, and piezo sensing products; EMI/RFI filters, capacitors, resistors, RF filters, and frequency control products; and piezo microactuators and rotary actuators. It serves transportation, industrial, medical, aerospace, and defense industries. The company sells and markets its products through its sales engineers, independent manufacturer representatives, and distributors.

686.01 B

CTS.USMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

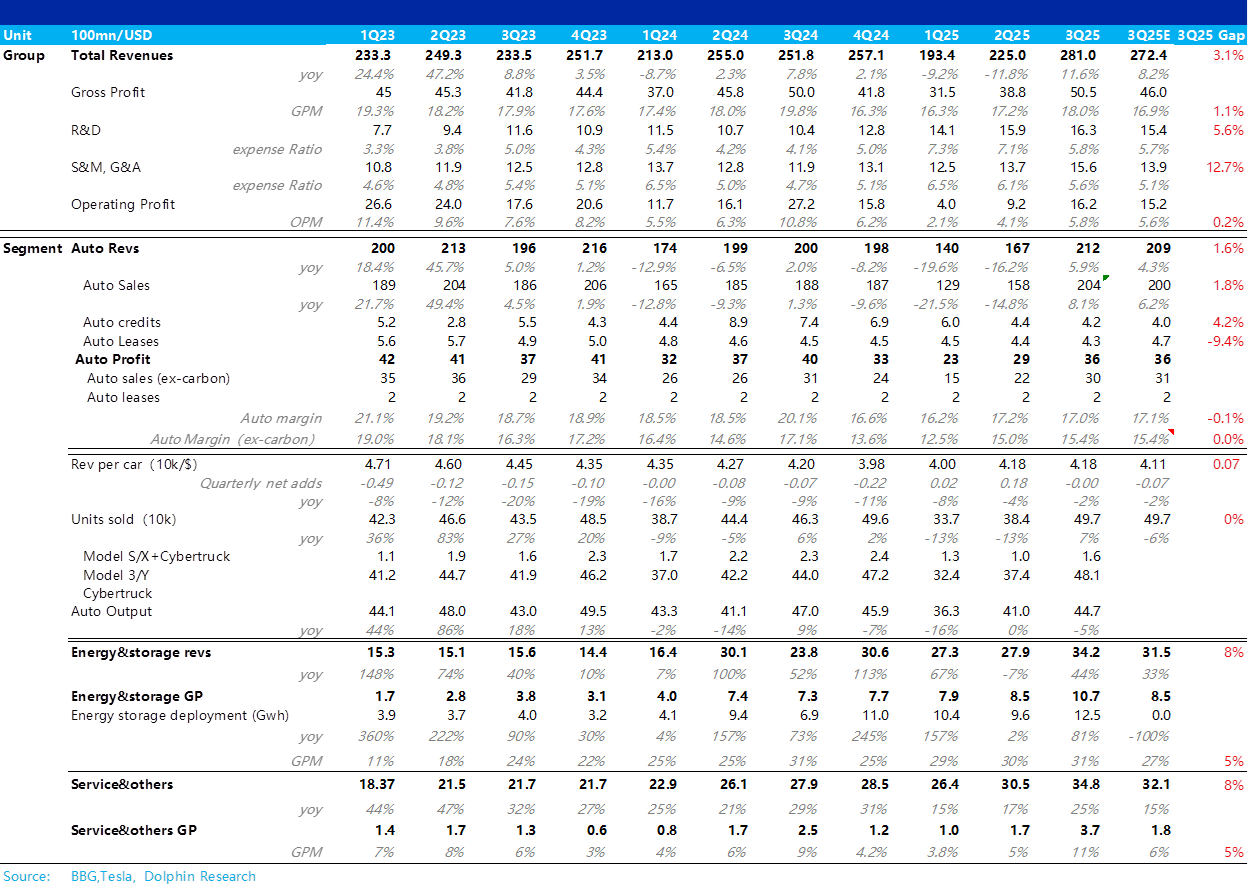

Tesla Quick Interpretation: Overall, regarding Tesla's third-quarter performance, the results are fairly decent. Both total revenue and total gross profit exceeded market expectations. However, net pr...

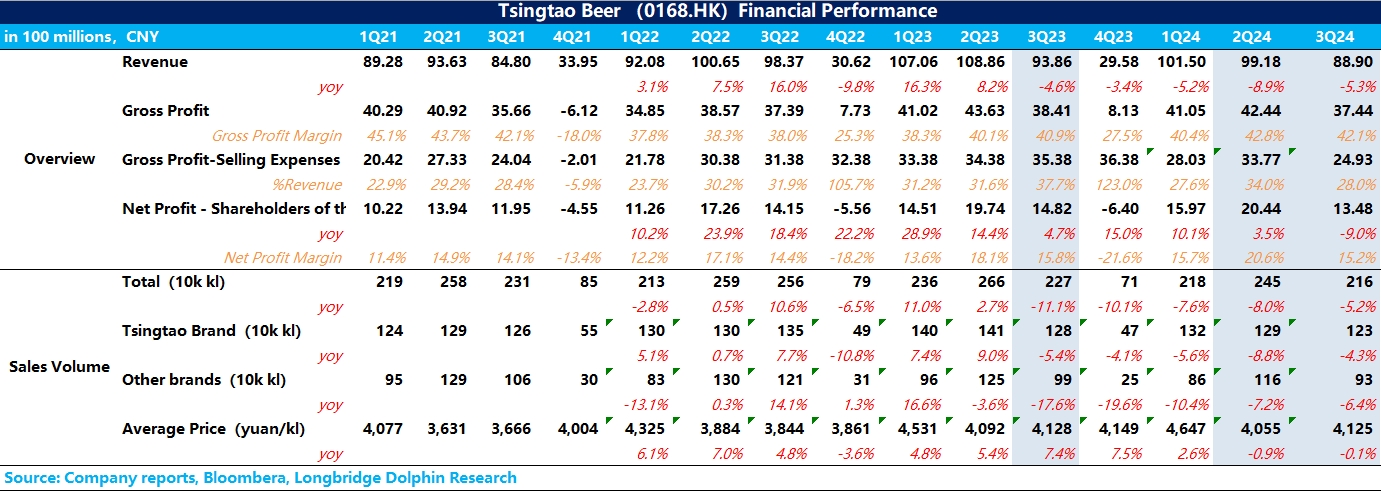

$TSINGTAO BREW(00168.HK) First take: Due to the continued weak macro environment, Tsingtao Brewery's Q3 report still showed declines in both volume and price, but there was some improvement compared t...