Recently watching $BYD ELECTRONIC(00285.HK) and $LK TECH(00558.HK) this trend, intraday fluctuations, the "death cross" made me want to sell, but then it rose a tiny bit.

On the other hand, $FIT HON TE.........

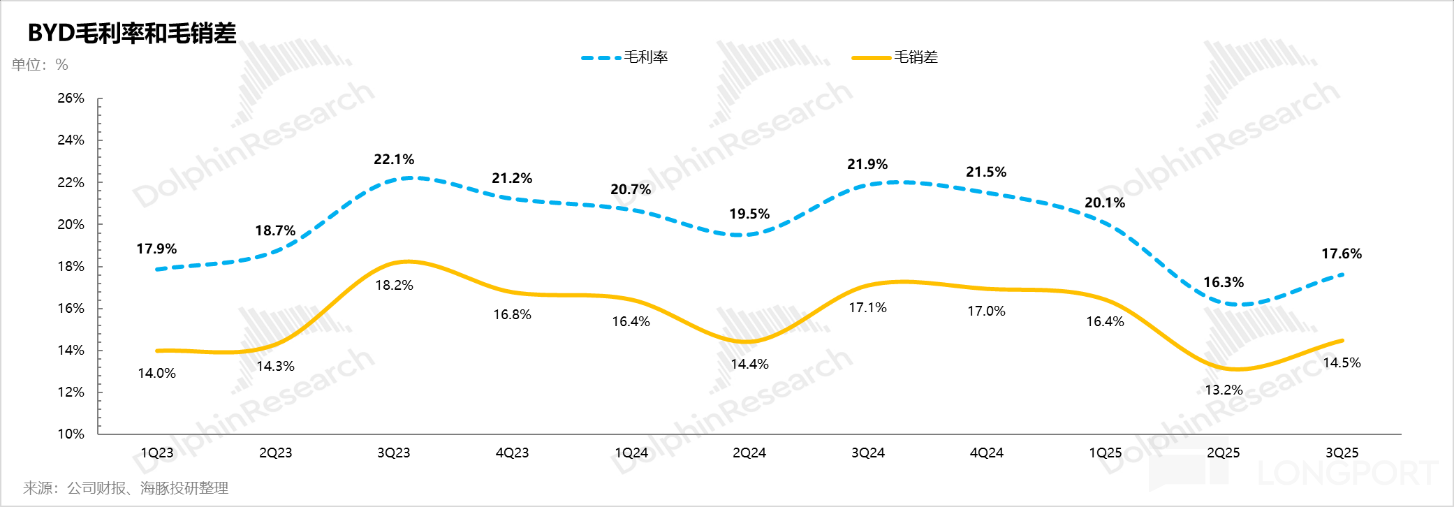

BYD: Once the King of Competition, Now Being Outcompeted, Can the King of BYD Successfully Break the Deadlock?

Can it reclaim the throne?

Hong Kong stock hot trading (8.13)| Hong Kong technology stocks fully exploded, Tencent hit a four-year high, Alibaba surged over 4%

Hong Kong stocks opened high and moved higher, with technology stocks and pharmaceutical stocks rising together. The technology index rose 2.35%, Tencent Music surged more than 15% after earnings, and...

Hot Trades in Hong Kong Stocks (8.12)|SMIC/Hua Hong's Q3 Guidance Exceeds Expectations, Apple Supply Chain Soars, Coal Shortage Boosts Stock Prices!

SMIC/Huahong's impressive performance boosts chip stocks, Apple's $100 billion investment in risk aversion stimulates the supply chain, and the rebound in coal prices fuels energy stocks.

Hot Trades in Hong Kong Stocks (8.6)| AI + Apple Supply Chain Double Boost! BYD Electronics Soars 10%, Tencent Hits New High, Innovative Drugs Secure 47 Billion Mega Order!

On August 6th, AI computing power and Apple's supply chain led the market rally. BYD Electronics surged over 10% in a single day due to iPhone 17 inventory expectations, Tencent Holdings hit a new hig...