Company Encyclopedia

View More

MoneyLion

ML.US

MoneyLion Inc., a financial technology company, provides personalized products and financial content for consumers in the United States. The company’s platform offers access to banking, borrowing, and investing solutions for customers. Its principal products include RoarMoney, an insured digital demand deposit account; Instacash, a cash advance product that gives customers early access to their recurring income deposits; Credit Builder Plus membership program, which enables customers to access and manage funds, establish or rebuild credit history, and monitor financial health; MoneyLion WOW membership program, that provides financial tools, cashback rewards, exclusive savings, and additional benefits; MoneyLion Active Investing, an online investment account offered to WOW members to control their investment journey; MoneyLion Managed Investing, an online investment account that offers access to separately managed accounts invested based on model exchange-traded fund portfolios; MoneyLion Crypto, an online digital asset account; and Roundups, which provides features designed to encourage customers to establish good saving and investing habits. It also provides marketplace solutions, such as valuable distribution, acquisition, growth, and monetization channels; and creative media and brand content services.

587.29 B

ML.USMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

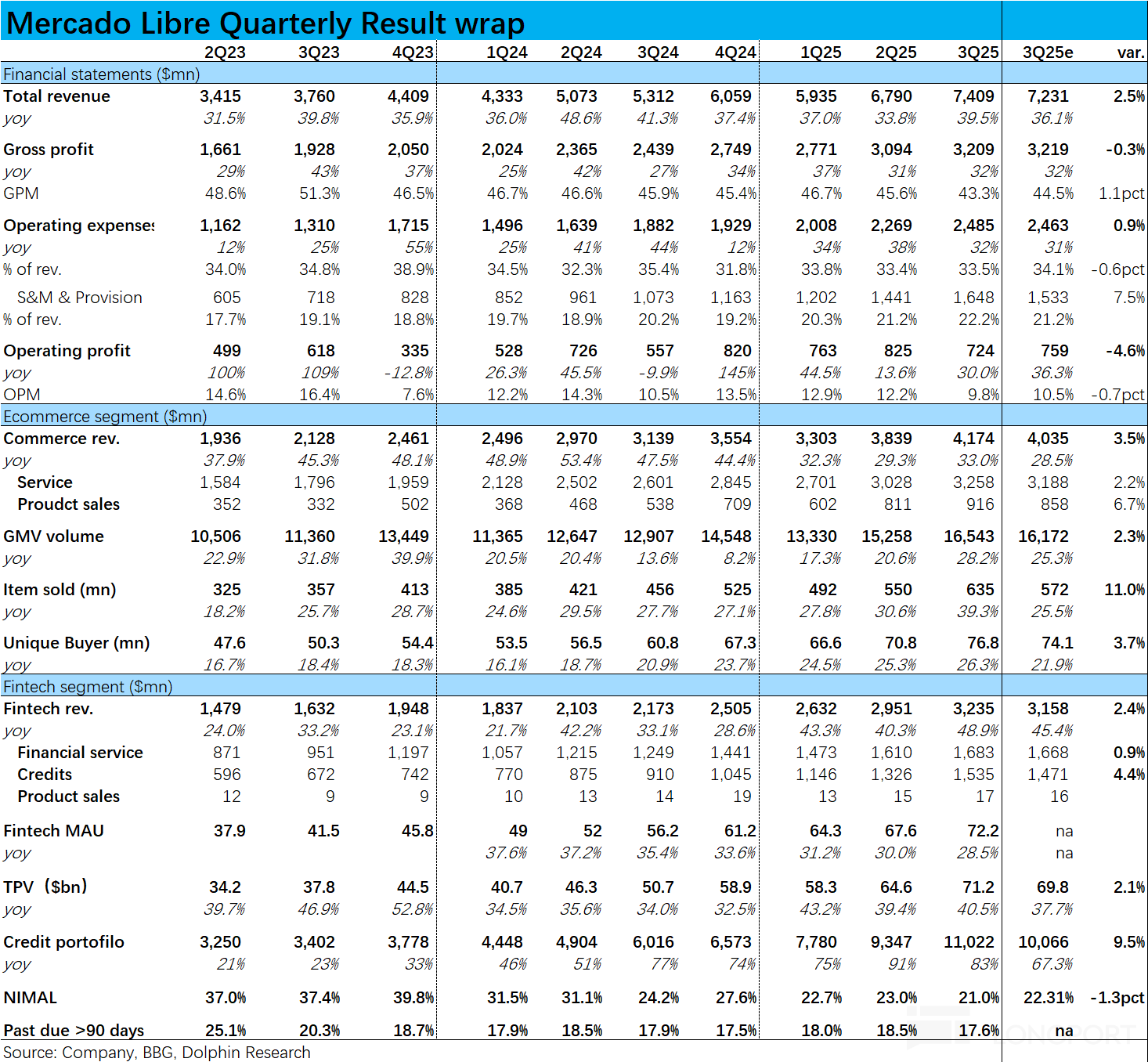

The following are the minutes of the Mercado Q3 2025 earnings call organized by Dolphin Research. For financial report interpretation, please refer to "Meli: Profit Miss? It Might Just Be the 'Growing...

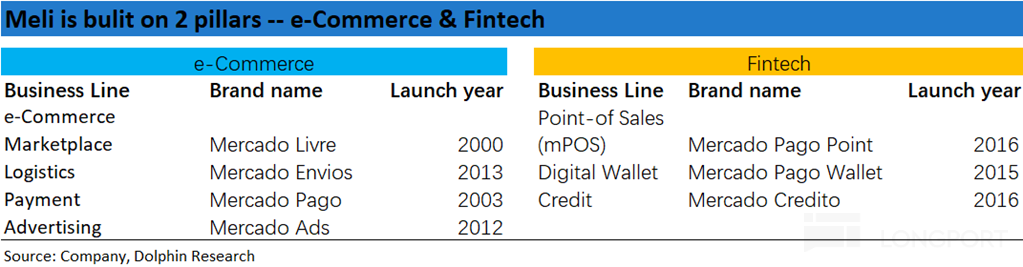

The Latin American version of "Alibaba"—$Mercadolibre(MELI.US) (hereinafter referred to as Meli) released its financial report for the third quarter of 2025 on October 30. Overall, the revenue side pe...

$Lemonade(LMND.US) The following answer systematically breaks down how Lemonade (LMND.US) integrates AI across the entire insurance value chain, its current outputs, and how it is reflected in financi...