Company Encyclopedia

View More

CloudFlare

NET.US

Cloudflare, Inc. operates as a cloud services provider that delivers a range of services to businesses worldwide. The company provides an integrated cloud-based security solution to secure a range of combination of platforms, including public cloud, private cloud, on-premises, software-as-a-service applications, and Internet of things (IoT) devices; and website and application security products comprising web application firewall, bot management, distributed denial of service protection, API security, SSL/TLS encryption, script management, security center, and rate limiting products. It also offers website and application performance solutions, such as content delivery, load balancing, DNS, agro smart routing, video stream delivery, web optimization, cache reserve, cloudfare waiting room, and cloudfare data localization suite; SASE platform combines network services and Zero Trust security products that provides a cloud-based network-as-a-service; network services, including magic WAN, magic transit, magic firewall, cloudflare network interconnect, and spectrum.

560.89 B

NET.USMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

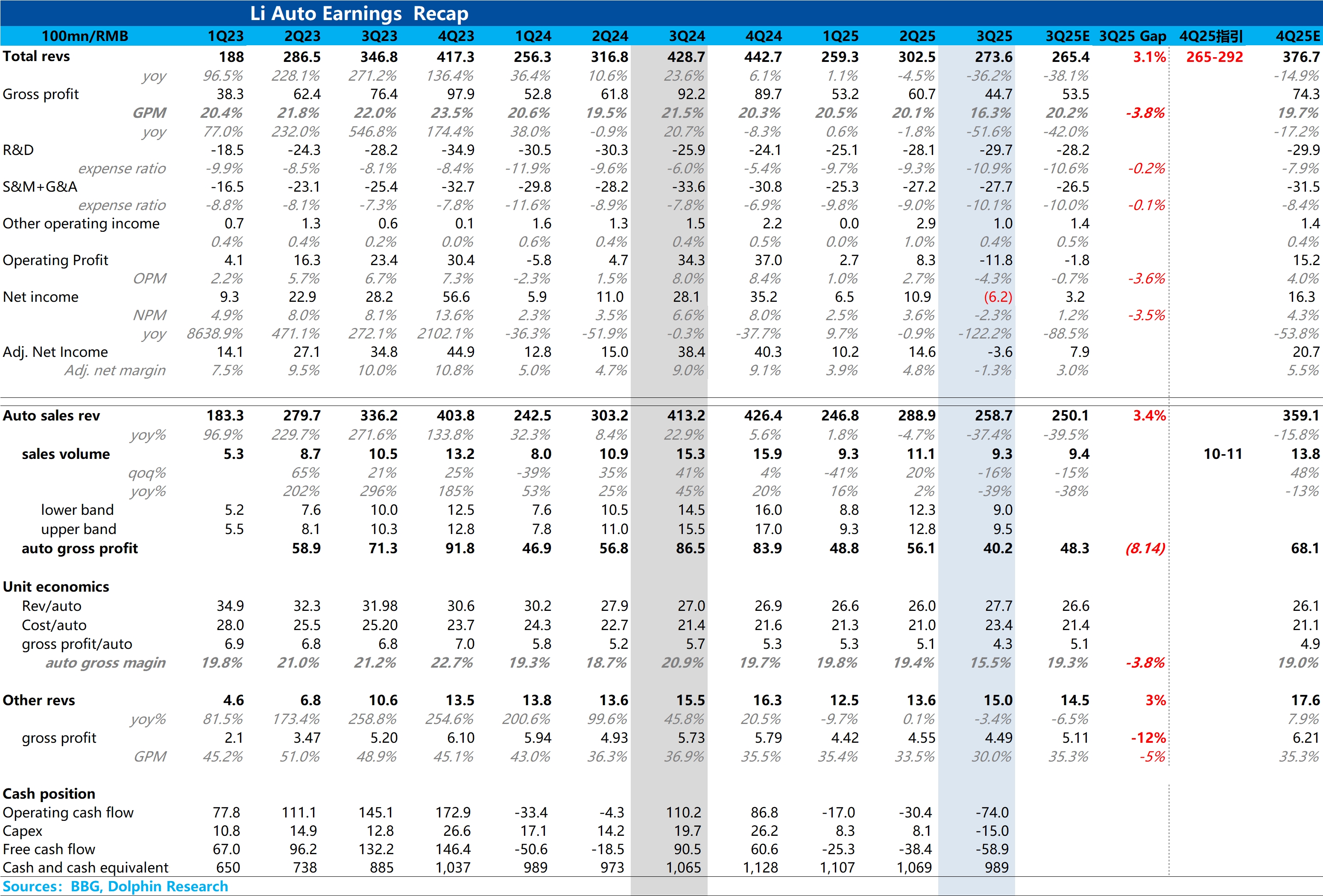

Li Auto 3Q25 Quick Interpretation: Dolphin Research's first glance at Li Auto's financial report can only be described as 'unbearable to look at,' with a significant drop in gross margin and net profi...

Tencent 3Q25 Quick Interpretation: Tencent's third-quarter performance remains stable, slightly exceeding expectations overall. The revenue highlight is overseas games, while the net profit beat is du...

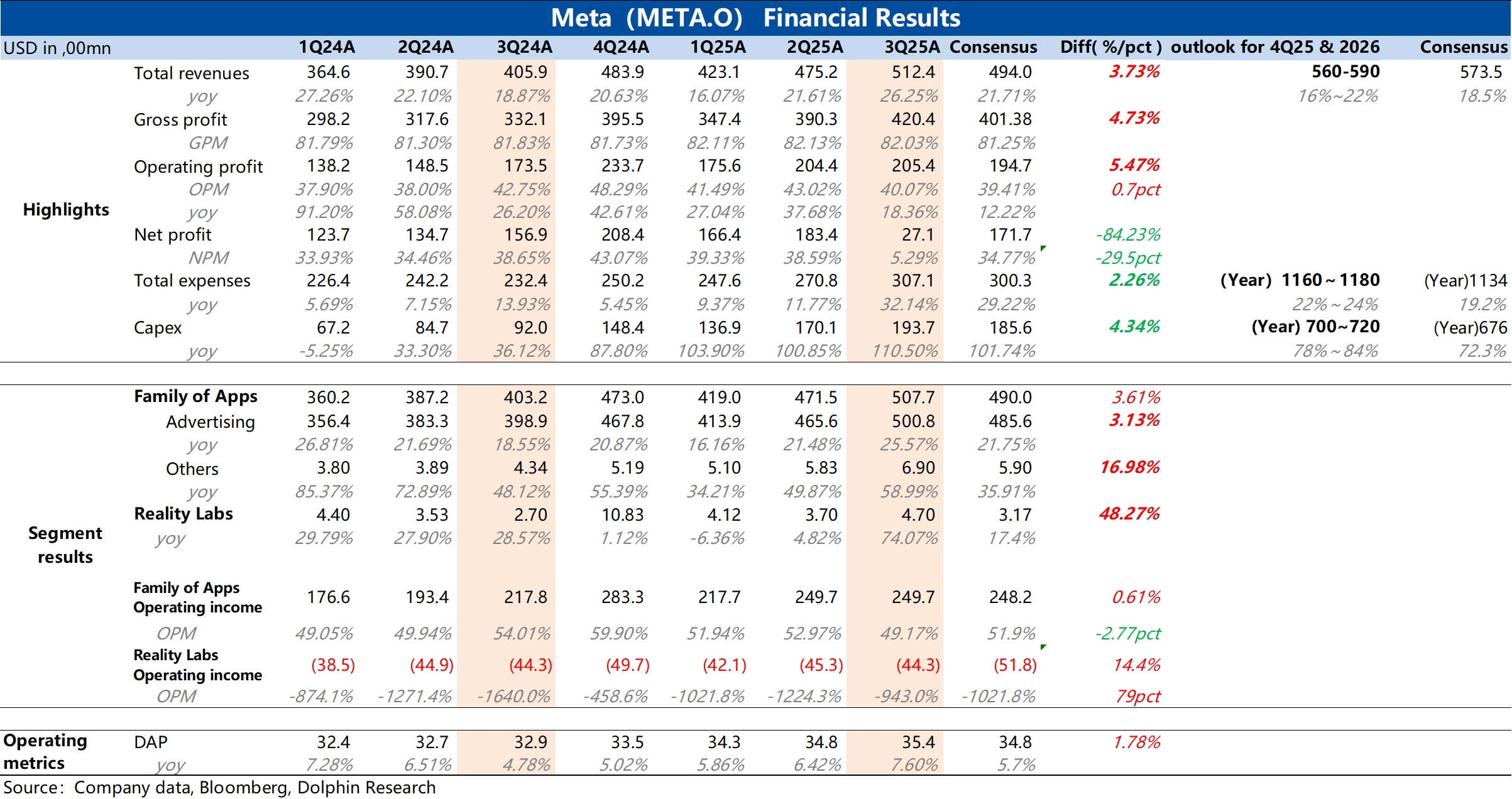

Meta3Q25 Quick Interpretation: At first glance, a company with a market value of $2 trillion having a quarterly profit of only $2.7 billion seems like a major flop! However, the net profit was mainly ...