Company Encyclopedia

View More

NOVARTIS AG

NVS.US

Novartis AG researches, develops, manufactures, distributes, markets, and sells pharmaceutical medicines in Switzerland and internationally. The company offers Entresto, an angiotensin receptorneprilysin inhibitor to treat symptomatic chronic heart failure with reduced ejection fraction (HFrEF); Cosentyx to treat plaque psoriasis, pso riatic arthritis, ankylosing spondylitis, and nonradiographic axial spondy loarthritis; Kisqali, a selective oral cyclin dependent inhibitor of kinases 4 and 6 (CDK4/6); Promacta/Revolade to treat immune thrombocytopenia (ITP), thrombocytopenia, and patients with severe aplastic anemia (SAA); Tafinlar+Mekinist, an oral combination therapy to treat patients with certain types of cancers; and Jakavi for the treatment of myelofibrosis, polycythemia vera, and acute or chronic graftversushost disease (GvHD). It also provides Tasigna to treat philadelphia chromosomepositive chronic myeloid leukemia in the chronic and/or accelerated phase; Xolair for the treatment of allergic asthma and nasal polyps or severe chronic rhinosi nusitis with nasal polyps; Ilaris to treat fever syndromes, Still’s disease, and acute gouty arthritis; Pluvicto to treat prostatespecific membrane anti genpositive metastatic castrationresistant prostate cancer; Sandostatin SC and Sandostatin LAR to treat acromegaly carcinoid tumors and other types of functional gastro intestinal and pancreatic neuroendocrine tumors; Zolgensma for the treatment of genetic root cause of spinal muscular atrophy; Lucentis; Leqvio to reduce LDL cholesterol; Lutathera; Scemblix; and Fabhalta. The company focuses on therapeutic areas, such as cardiovascular, renal and metabolic, immunology, neuroscience, oncology, and hematology.

4.513 T

NVS.USMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

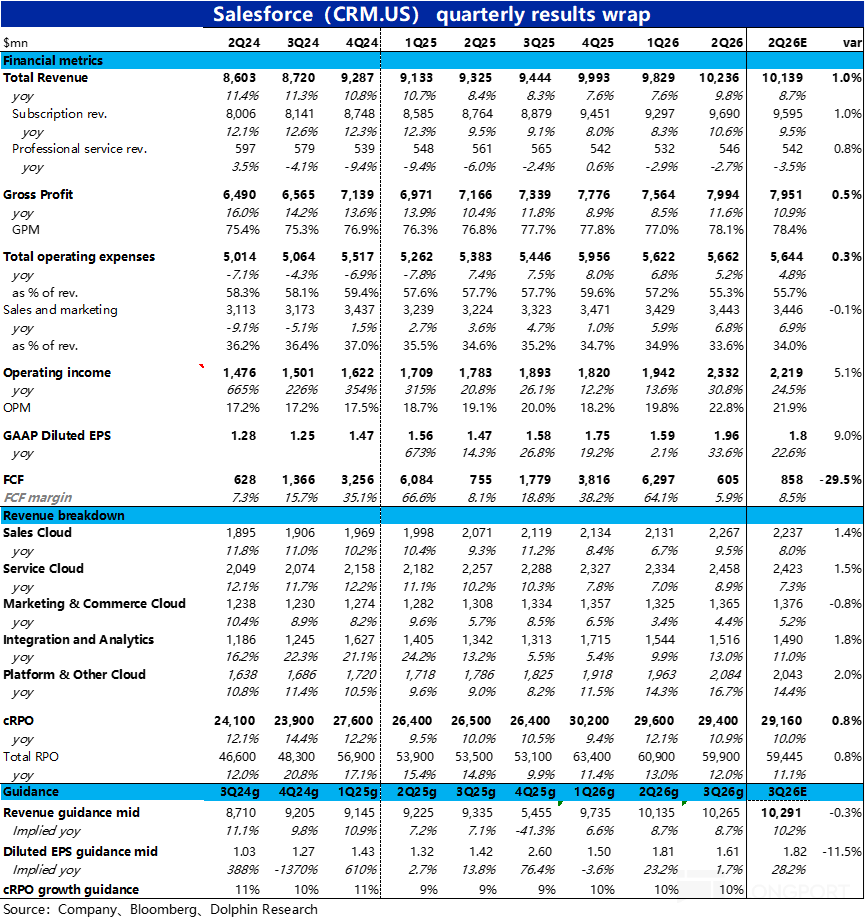

Salesforce (Minutes): The foundation of technology and sales has been laid, looking forward to the harvest period

The following are the minutes of the FY26Q3 earnings call for $Salesforce(CRM.US) compiled by Dolphin Research. For an interpretation of the earnings report, please refer to the article "Salesforce: I...