Company Encyclopedia

View More

Outbrain

OB.US

Outbrain Inc., together with its subsidiaries, operates a technology platform that connects media owners and advertisers with engaged audiences to drive business outcomes in the United States, Europe, the Middle East, Africa, and internationally. The company operates a two-sided marketplace, forming an end-to-end advertising platform with direct media owner and advertiser relationships. It also provides advertising solutions for advertisers, including a CPC performance platform and CPM-based managed and self-service platforms, and bespoke creative studio solutions that provide data-driven creative tailored to various environments and channels. In addition, the company offers budgets spanning video, display, native, and performance advertising services and technology solutions that enable media owners to deeply engage their audiences, increasing the total revenue opportunity media owners can realize.

10.730 T

OB.USMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

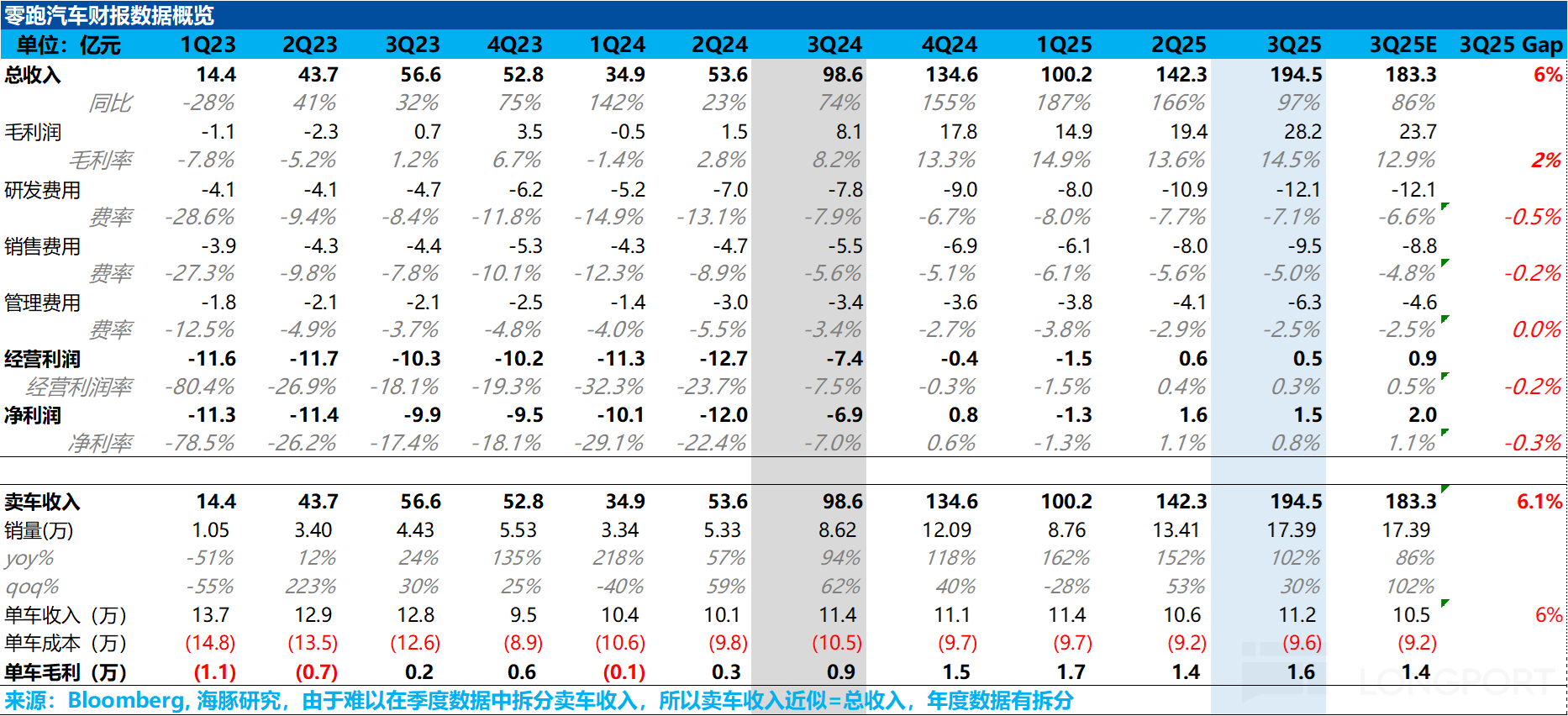

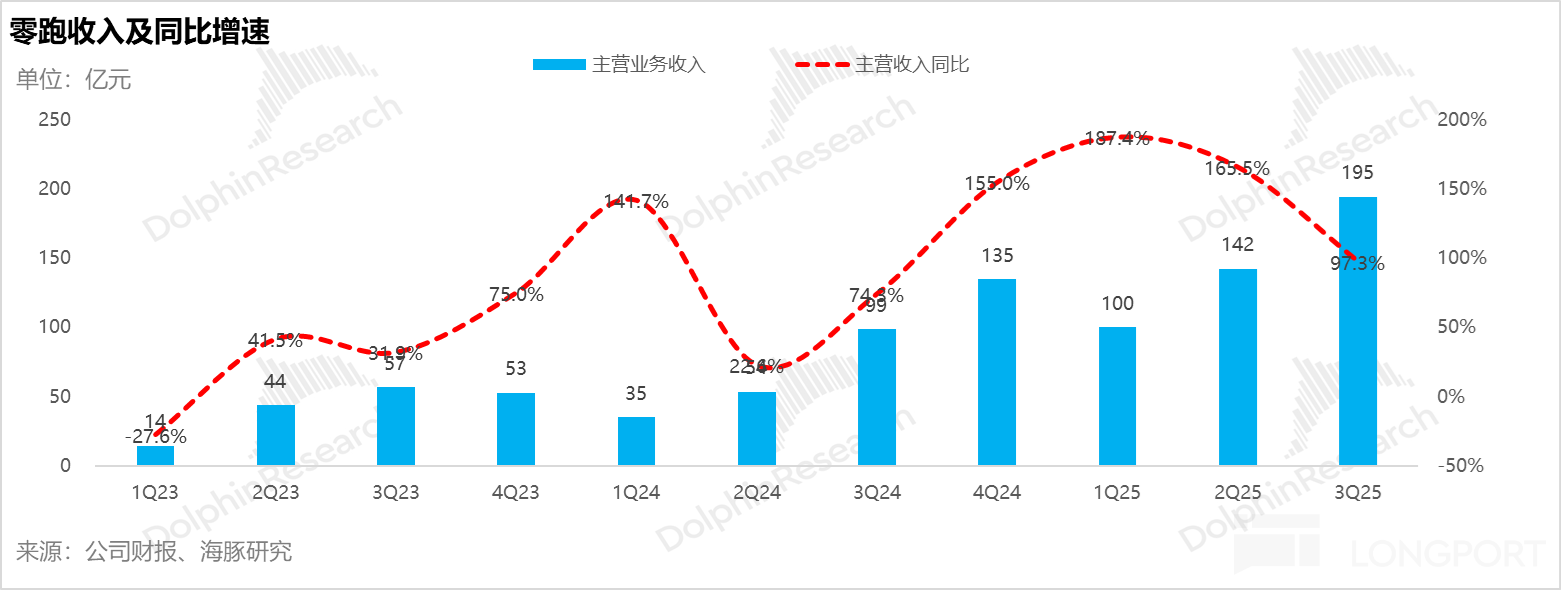

The significant increase in the three expenses has eroded Leapmotor's net profit.