Company Encyclopedia

View More

Optical Cable

OCC.US

Optical Cable Corporation, together with its subsidiaries, manufactures and sells fiber optic and copper data communications cabling and connectivity solutions primarily for the enterprise market in the United States and internationally. The company offers fiber optic and hybrid cables for high bandwidth transmission of data, video, and voice communications; and copper datacom cables, including unshielded and shielded twisted pair constructions. Its fiber optic connectivity products include fiber optic wall mounts, cabinet mount and rack mount enclosures, pre-terminated fiber optic enclosures, fiber optic connectors, splice trays, fiber optic jumpers, plug and play cassette modules, pre-terminated fiber optic cable assemblies, adapters, and accessories; and copper connectivity products comprising category compliant patch panels, jacks, plugs, patch cords, faceplates, surface mounted boxes, distribution and multi-media boxes, copper rack mount and wall mount enclosures, cable assemblies, cable organizers, and other wiring products for equipment rooms, telecommunications closets, data centers, and workstation applications. In addition, the company provides network, data storage, and telecommunications management systems, such as data cabinets, wall mount enclosures, horizontal and vertical cable management systems, and open frame relay racks; and datacom wiring products, including various enclosures, and modules and modular outlets for single dwelling and multiple dwelling residential uses.

731.40 B

OCC.USMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

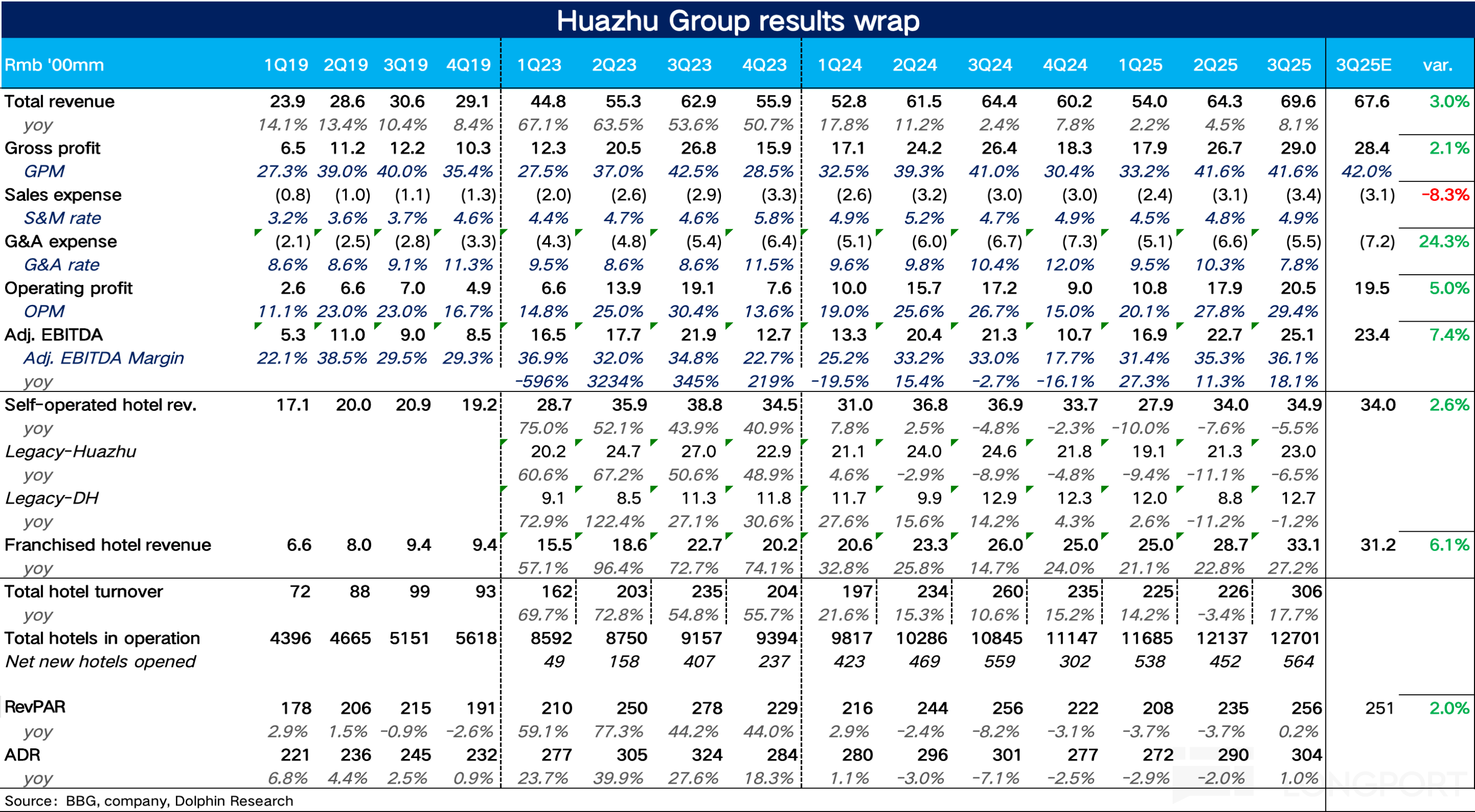

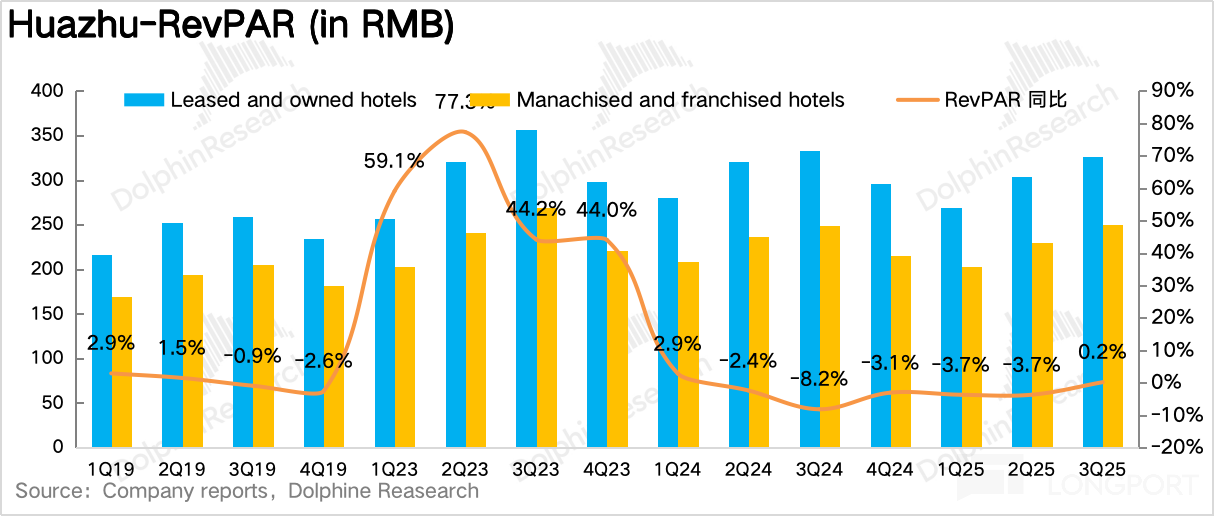

On 17 November 2025 Beijing time, prior to the US market open, Huazhu (1179.HK/HTHT.O) $HWORLD-S(01179.HK) $H World(HTHT.US) released its Q3 2025 financial report. Driven by robust leisure travel dema...