Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

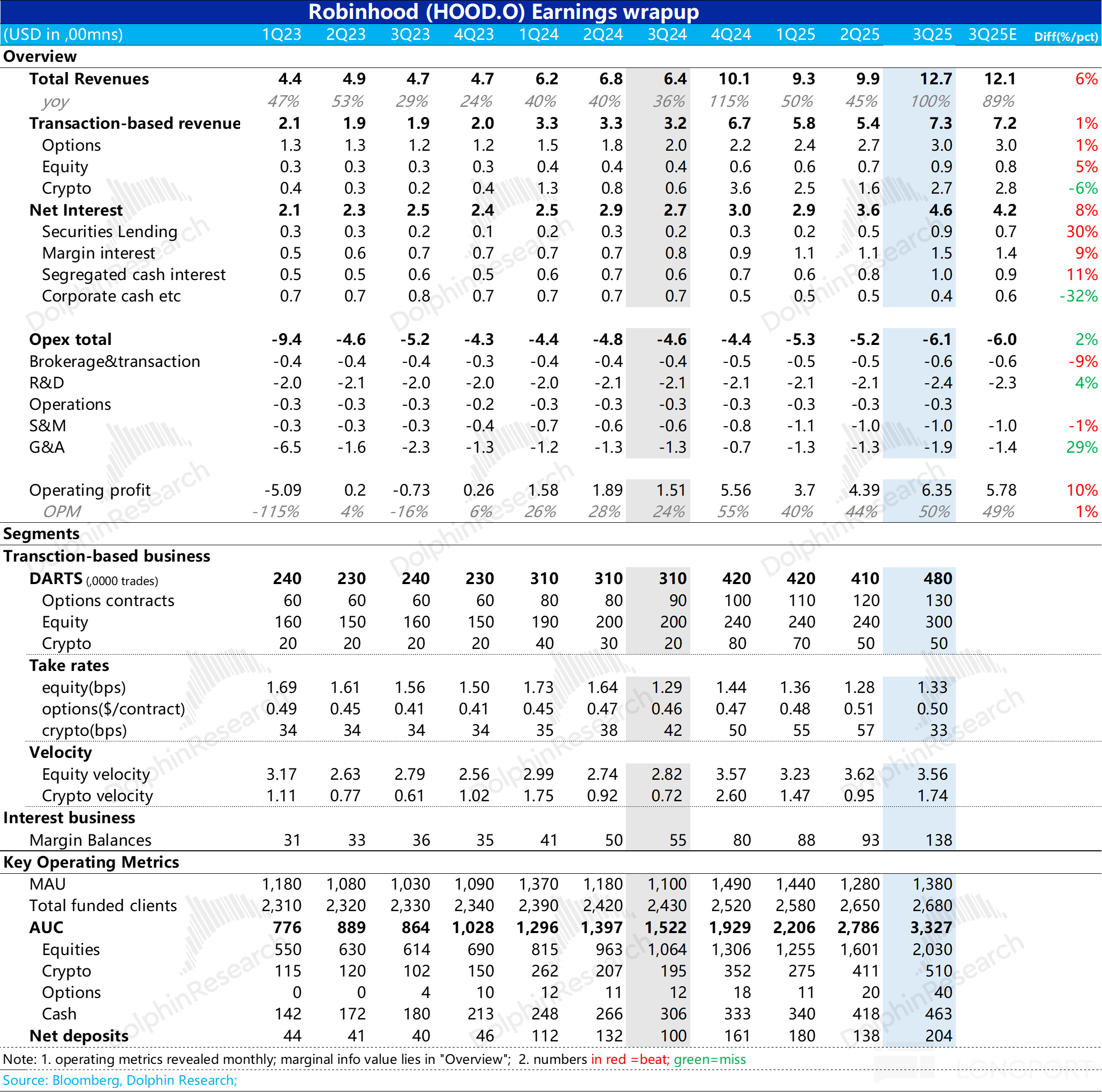

On November 6th, the American influencer retail brokerage stock $Robinhood(HOOD.US) released its earnings report before the U.S. stock market opened. After a nearly 300% surge over three quarters, the...

Micron to Stop Selling Server Chips to Chinese Data Centers; Meta Plans to Raise $30 Billion to Build Data Centers | Today's Important News Recap

1017 | Dolphin Research Focus: 🐬 Macro/Industry 1. Shares of two U.S. regional banks plummeted due to loan fraud and bad debt issues, with the regional bank index posting its worst performance since ......

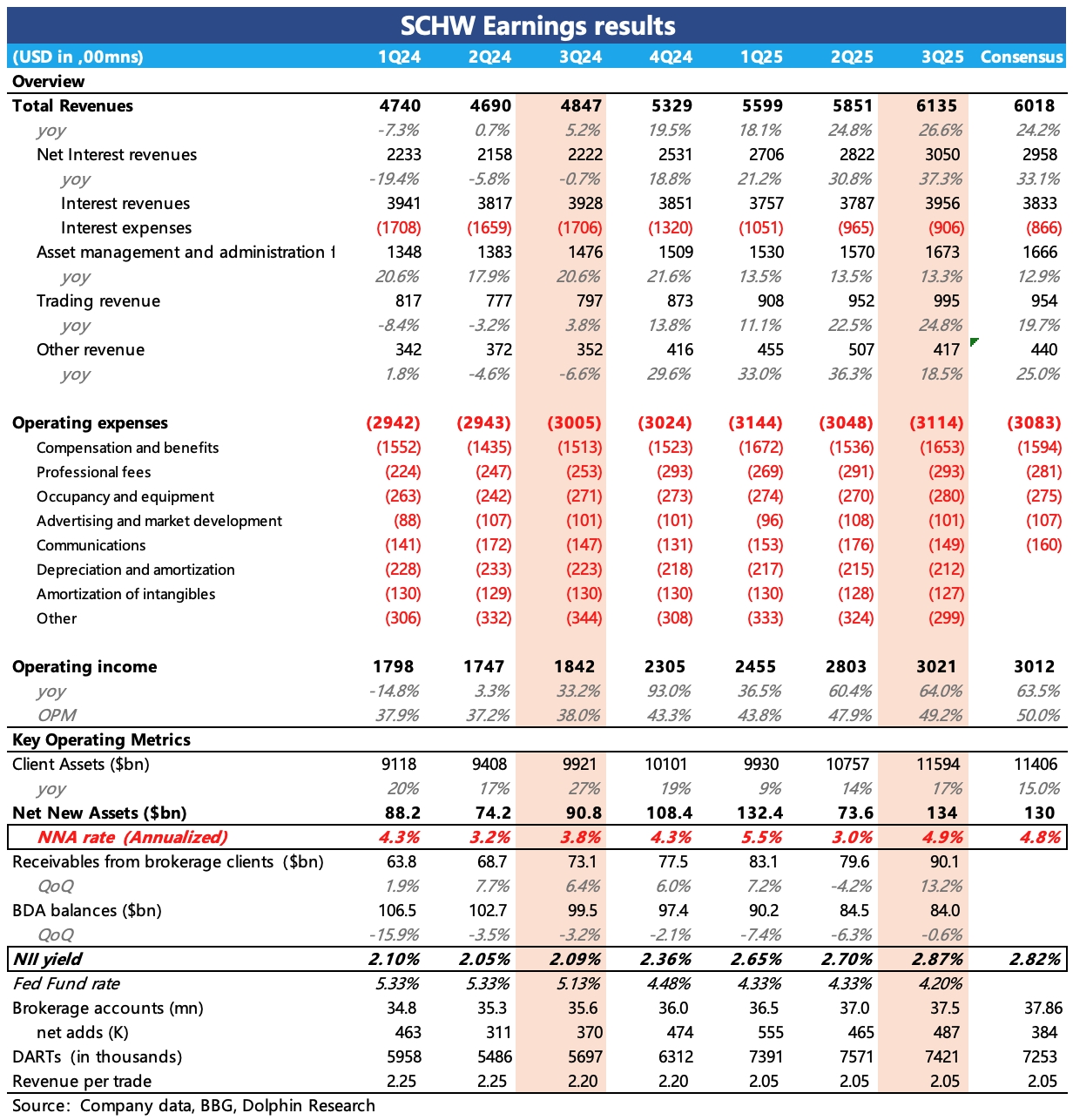

Charles Schwab (Minutes): Will launch cryptocurrency trading next year, but is not optimistic about tokenized stocks.

Fully capable of mitigating the impact of interest rate cuts through cash reinvestment.

The growth rate of NNA is recovering.

Charles Schwab 3Q25 Quick Interpretation: Charles Schwab's third-quarter performance slightly exceeded expectations, with highlights in interest and trading income. The core logic still stems from the...