Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

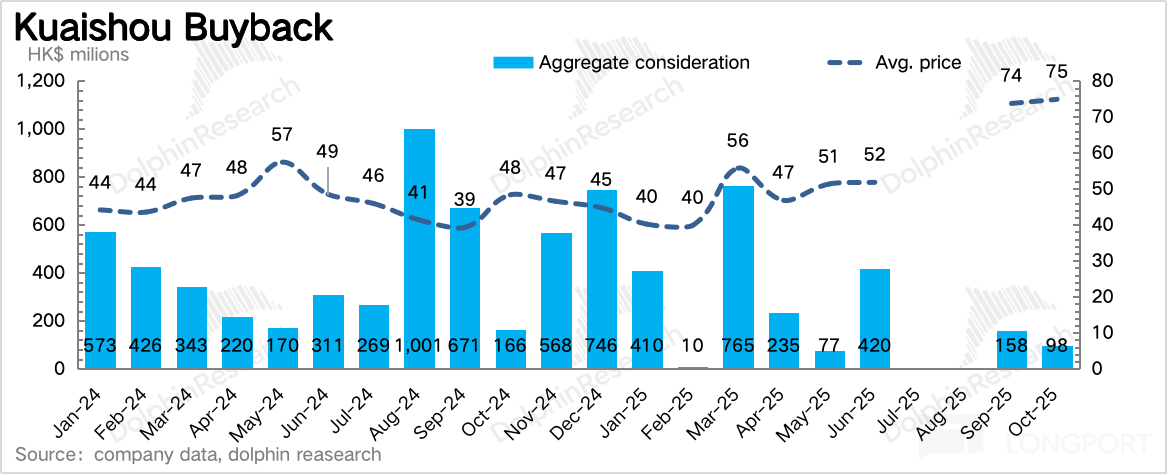

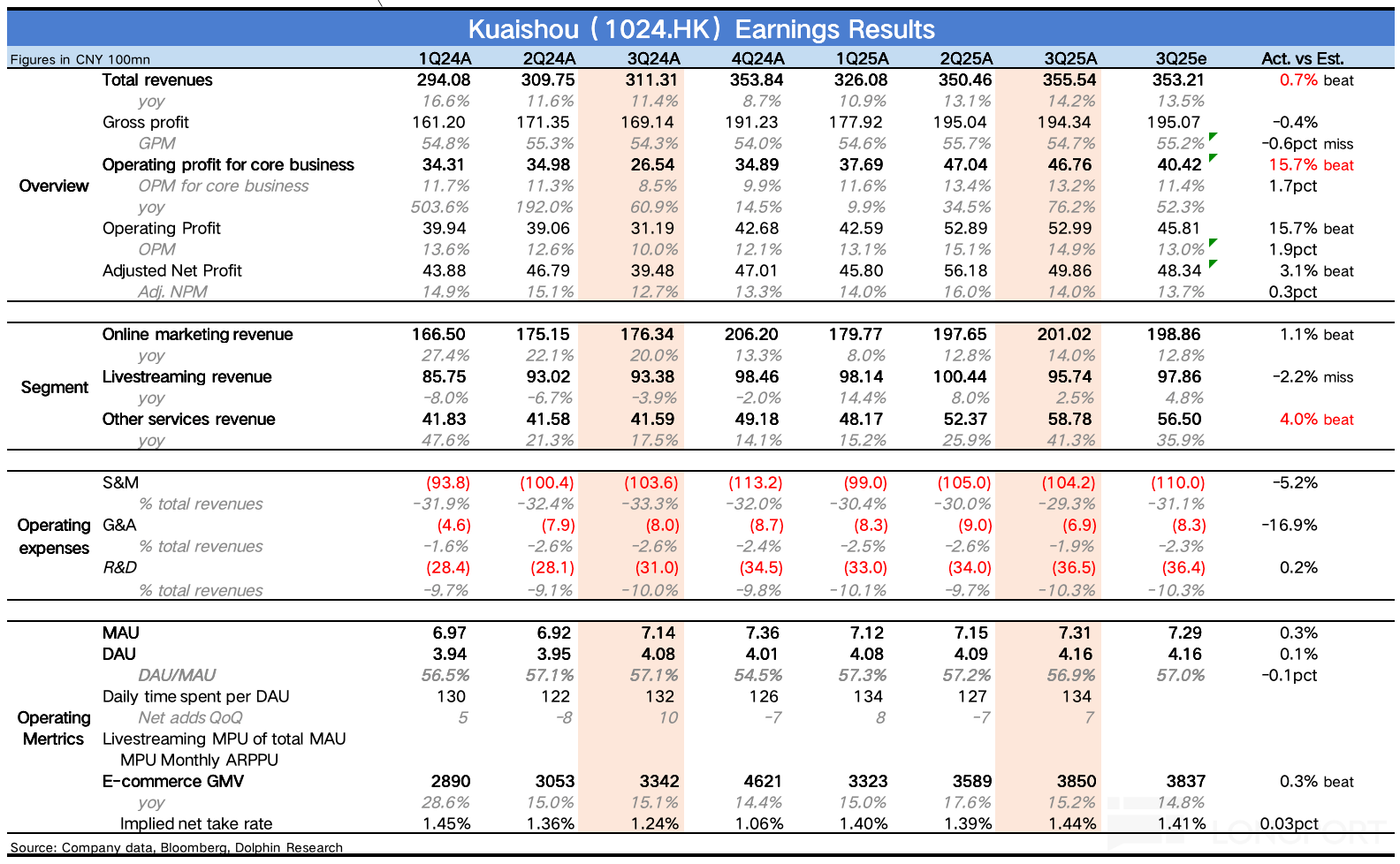

$KUAISHOU-W(01024.HK) released its third-quarter report after the Hong Kong stock market closed on November 19th, Beijing time. The Q3 performance was generally stable, with the highlight being the pr...

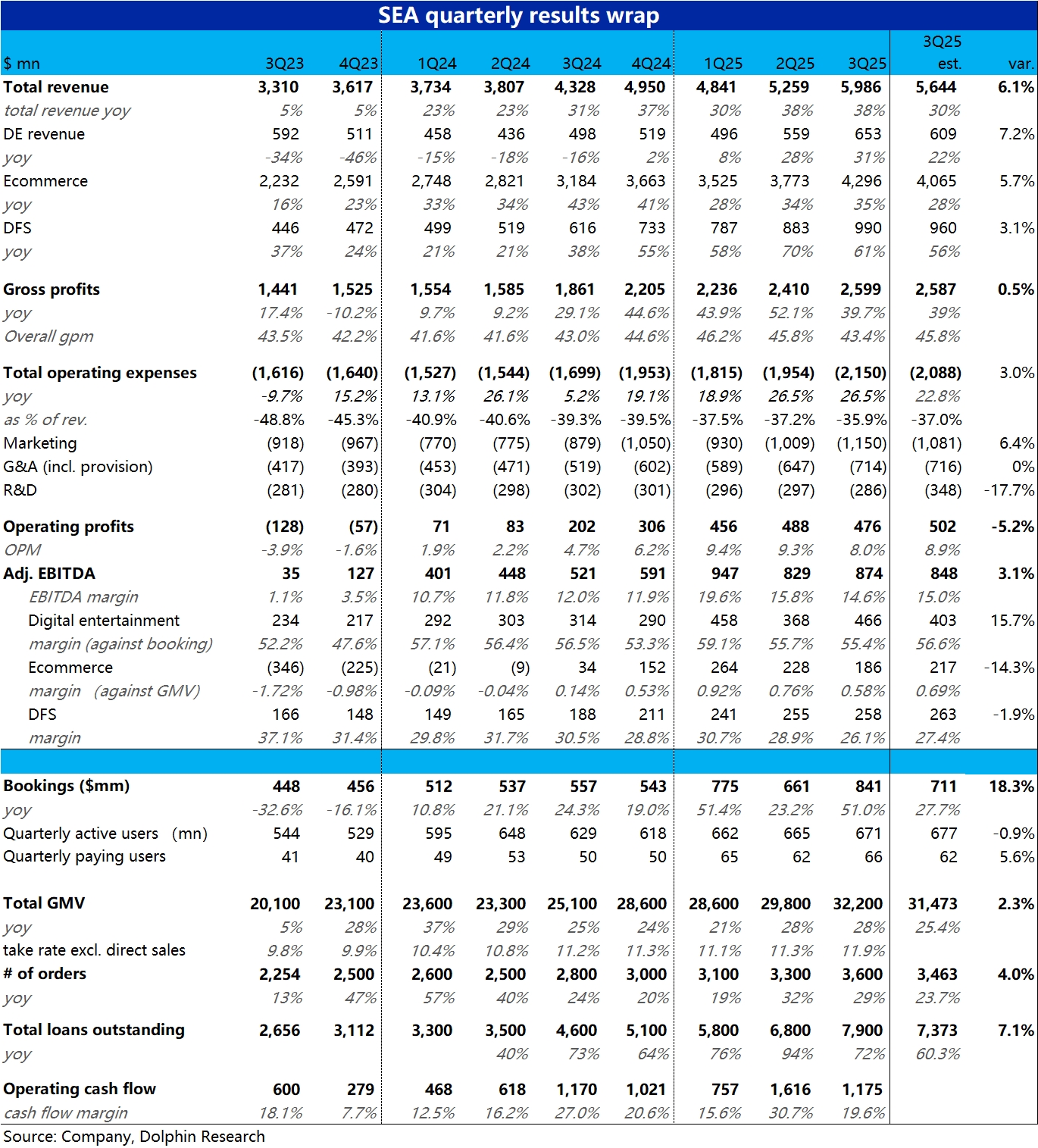

The following are the minutes of the $SentinelOne(S.US)ea(SE.US) FY25Q3 earnings call organized by Dolphin Research. For the earnings interpretation, please refer to "SEA: The Unchanged Answer Sheet C...

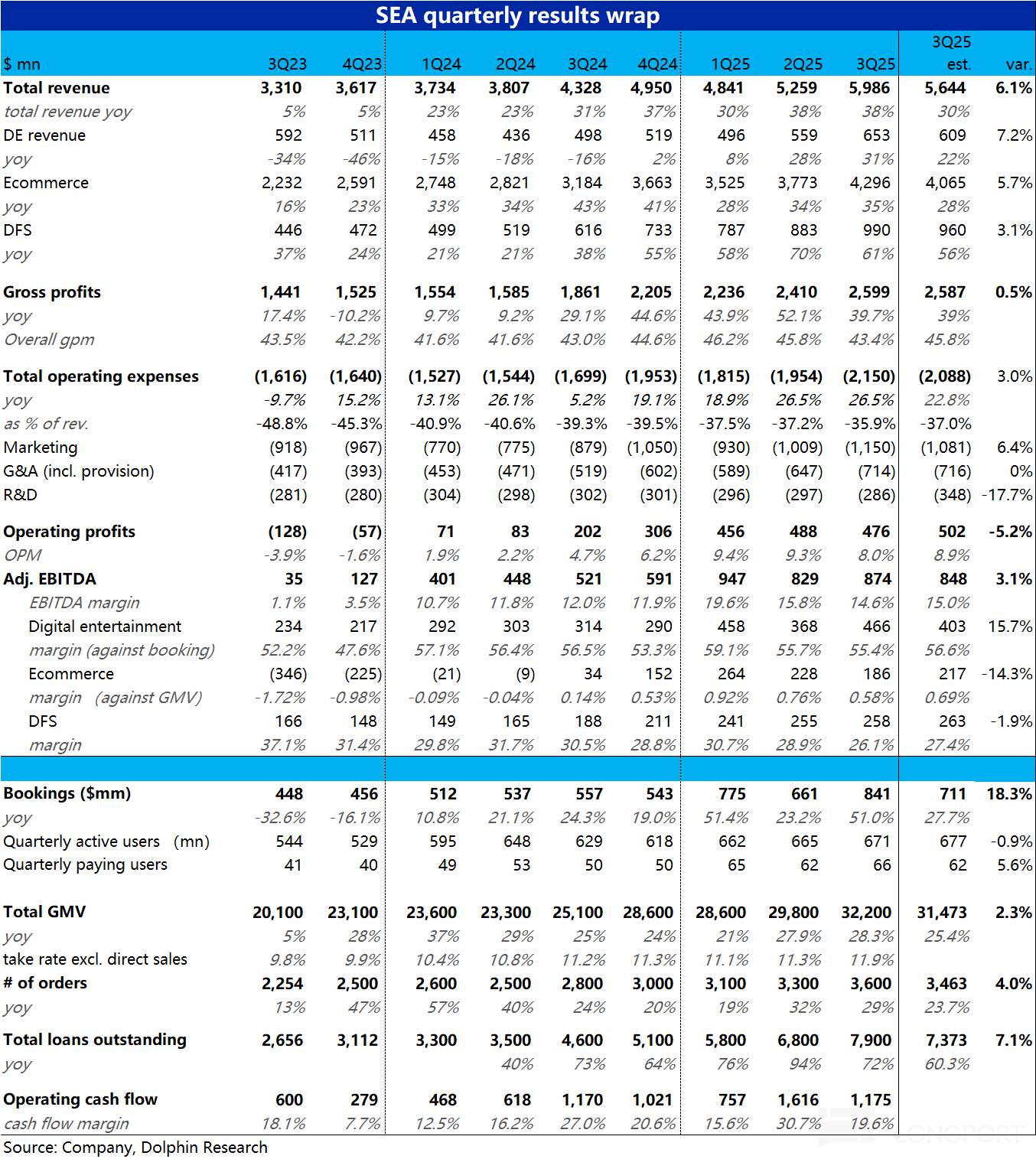

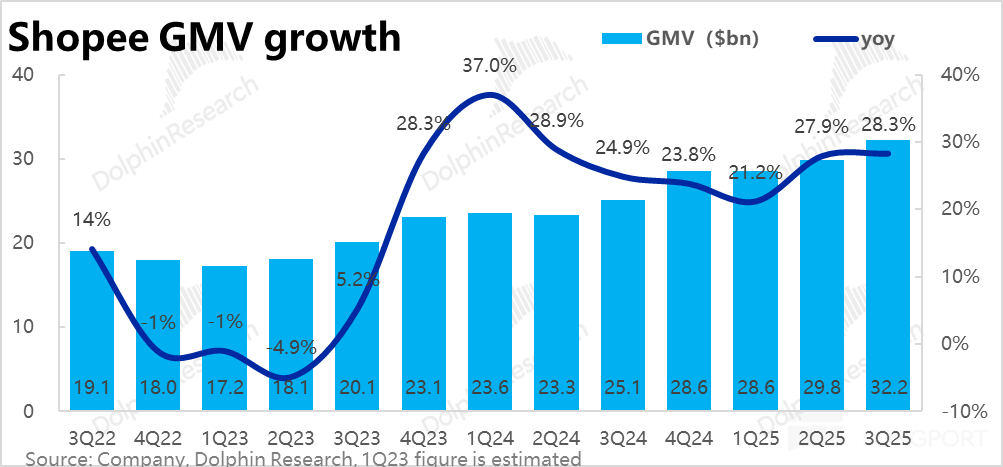

The Southeast Asian Little Tencent, $Sea(SE.US), delivered its Q3 earnings report on the evening of November 11, before the U.S. stock market opened. In summary, this quarter's performance is a mix of...

Sea 3Q25 Quick Interpretation: Overall, Sea's performance this quarter is somewhat fragmented, with both highlights and shortcomings. The highlight is on the growth side, where the revenue and busines...

The following are the minutes of Apple's FY2025 Q4 earnings call organized by Dolphin Research. For earnings interpretation, please refer to "Apple: iPhone Holds the Center Stage, When Will AI Reveal ......