Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

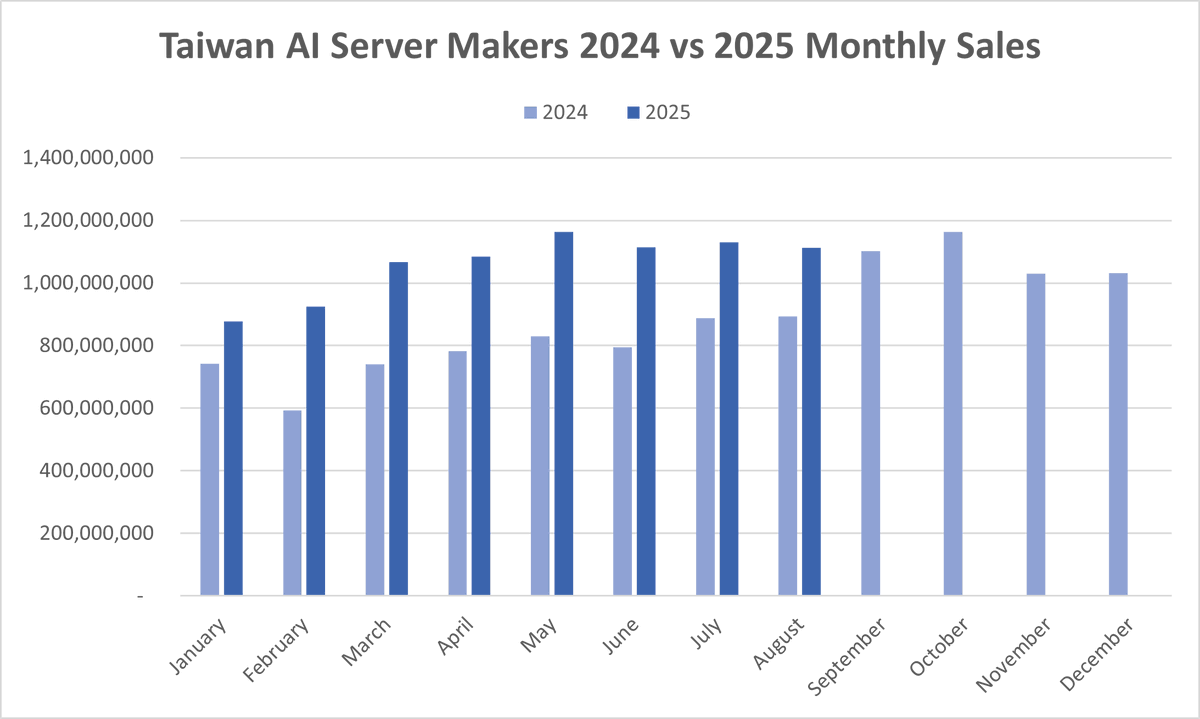

Strong demand for Nvidia Blackwell-based AI servers sent August revenue at Taiwan's ‘Big 6’ makers up a combined 24.8% year-on-year to NT$1.11 trillion (US$36.6 billion). 1/7 $NVIDIA(NVDA.US) $Taiwan ...............

AI server orders have not been affected by US tariffs, said Wistron CEO Jeff Lin, media report, adding demand remains so strong that AI servers continue to be in short supply. Wistron has not made any..................

Nvidia’s quantum computing team will include an alliance of US and Taiwan companies, media report, including Quanta Computer, Compal Electronics, and Supermicro, with Quanta doing hardware testing and.........

The committee is also considering alternative compensation if Musk’s $56 billion 2018 package isn’t restored in his ongoing court appeal. Tesla has not commented on the matter.

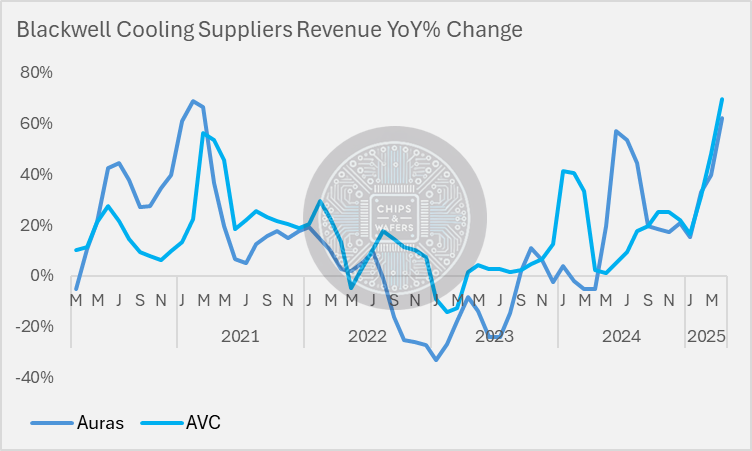

April was a massive month for Taiwanese server cooling component suppliers📈

Both Auras & AVC recorded record monthly revenue.$NVIDIA(NVDA.US) $Dell Tech(DELL.US) $Super Micro Computer(SMCI.US) $Corewe...