Company Encyclopedia

View More

Bio-Techne

TECH.US

Bio-Techne Corporation, together with its subsidiaries, develops, manufactures, and sells life science reagents, instruments, and services for the research, diagnostics, and bioprocessing markets worldwide. The company operates through two segments, Protein Sciences, and Diagnostics and Spatial Biology. The Protein Sciences segment develops and manufactures biological reagents used in various aspects of life science research, diagnostics, and cell and gene therapy, such as cytokines and growth factors, antibodies, small molecules, tissue culture sera, and cell selection technologies. This segment also offers proteomic analytical tools for automated western blot and multiplexed ELISA workflow consists of manual and automated protein analysis instruments and immunoassays for use in quantifying proteins in various biological fluids.

770.48 B

TECH.USMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

📈💡 Show your trades (P/L), share your insights, and earn cash rewards*! Congrats to the winners and here comes the 3rd round 🎉🎉

$AT & T(T.US)rump Media & Tech.US Haven't kept an eye on it for a while, and I was taken aback when I checked. Can't claim to understand it—just feel it's time to exit.

Welcome to the Community’s Spotlight Ep.1!

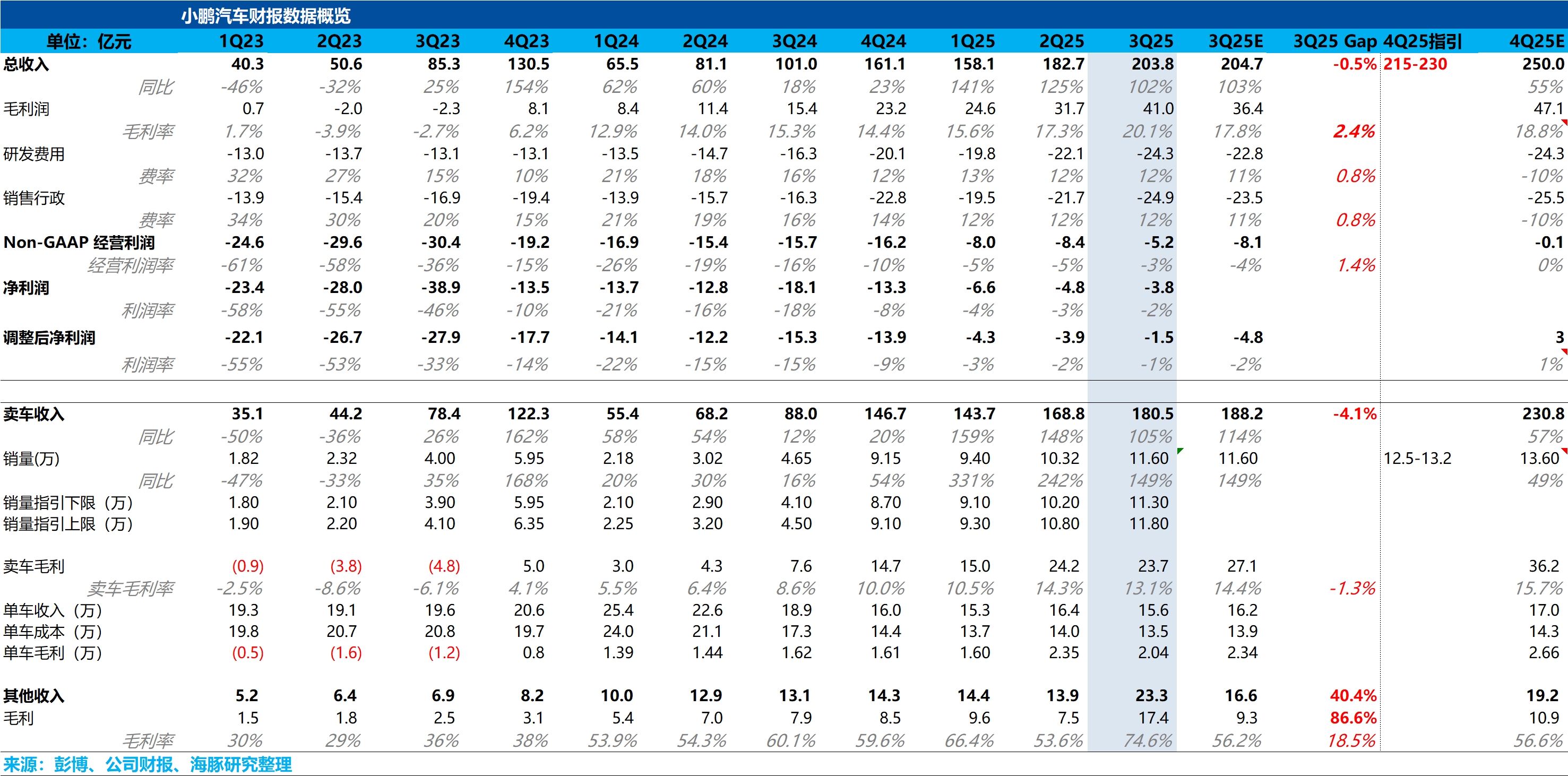

XPeng 3Q25 Quick Interpretation: The "slightly cold" car sales business meets the hot AI expectations.

Due to XPeng's recent updates on AI advancements during last week's Tech Day, the stock price has...

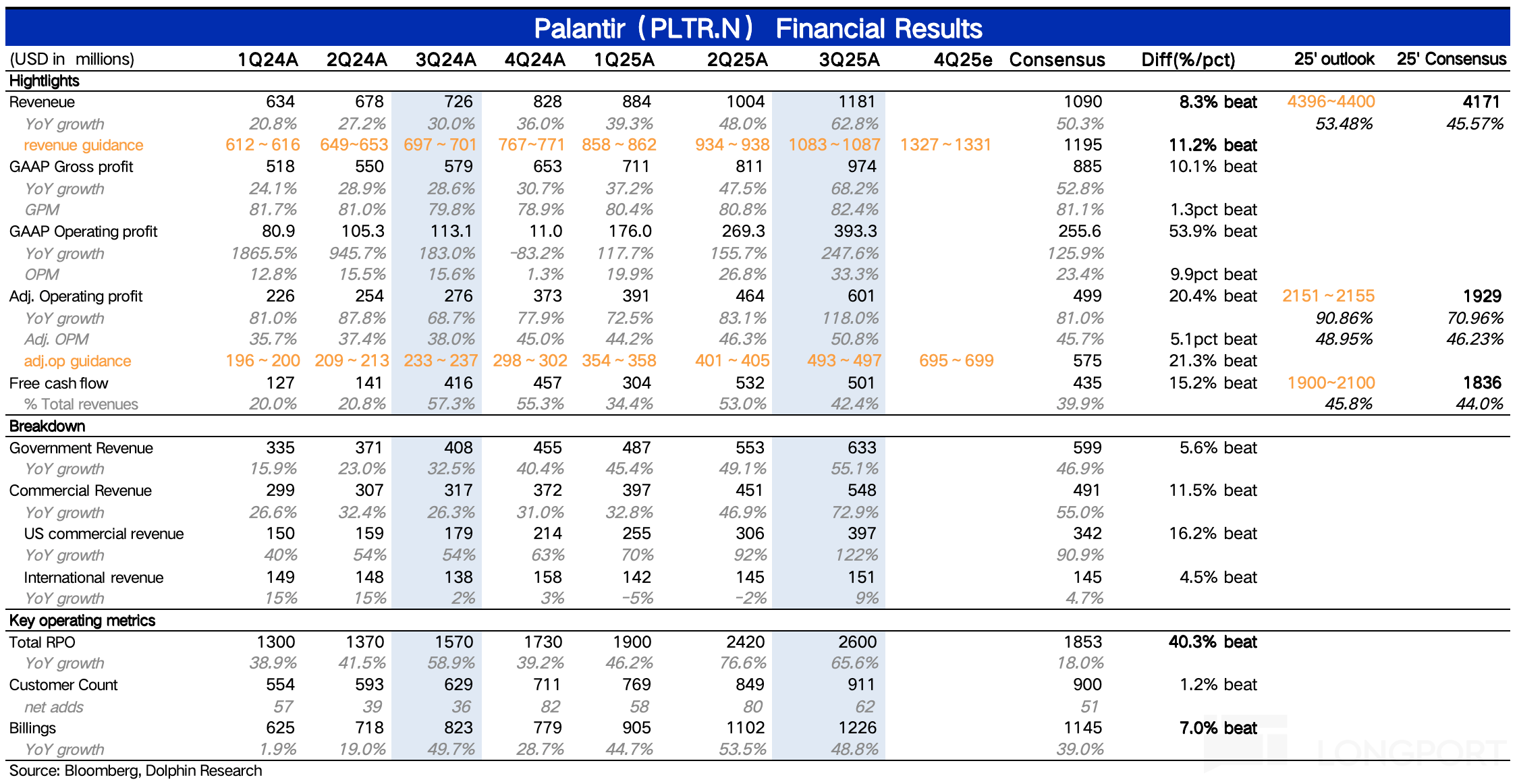

Palantir (Minutes): Customers are no longer satisfied with a single scenario but rather with a system restructuring.

The following are the minutes of the FY25Q3 earnings call for $Palantir Tech(PLTR.US) organized by Dolphin Research. For earnings interpretation, please refer to "Palantir: Valuation Too Advanced, Bac...