Company Encyclopedia

View More

TOP Fin

TOP.US

TOP Financial Group Limited, through its subsidiaries, operates as an online brokerage company in Hong Kong. The company is involved in the trading of equities, futures, and options products; and the provision of brokerage and value-added services, including trade order placement and execution, account management, and customer support services. It also provides a range of futures products, such as index, forex, agricultural product, energy, and precious metal futures; and operates as an escrow agent in transactions relating to securities sales and transfers. In addition, the company offers stock and options brokerage, structured note subscriber, consulting, currency exchange, margin financing, OTC derivative trading, and loan services.

1.174 T

TOP.USMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

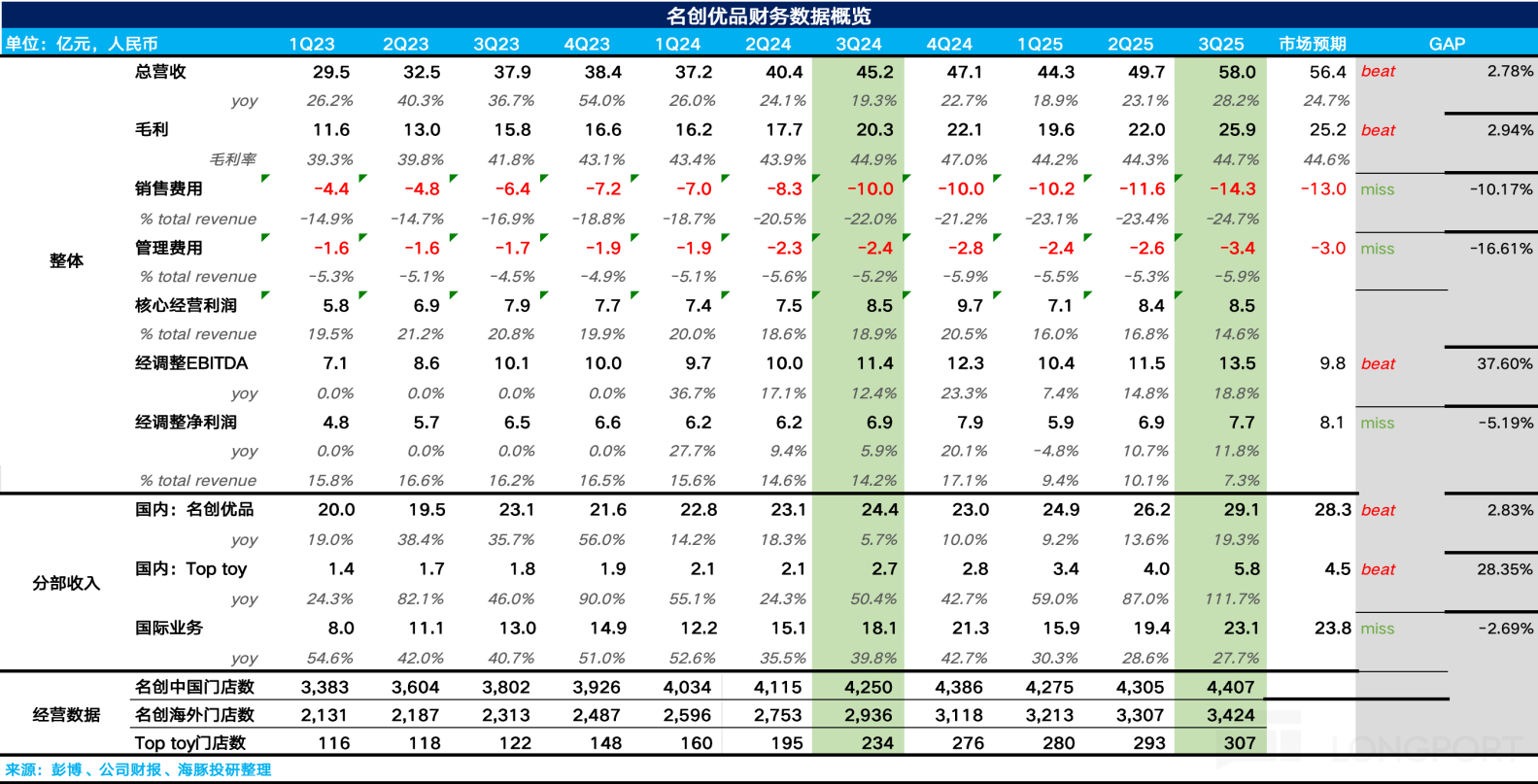

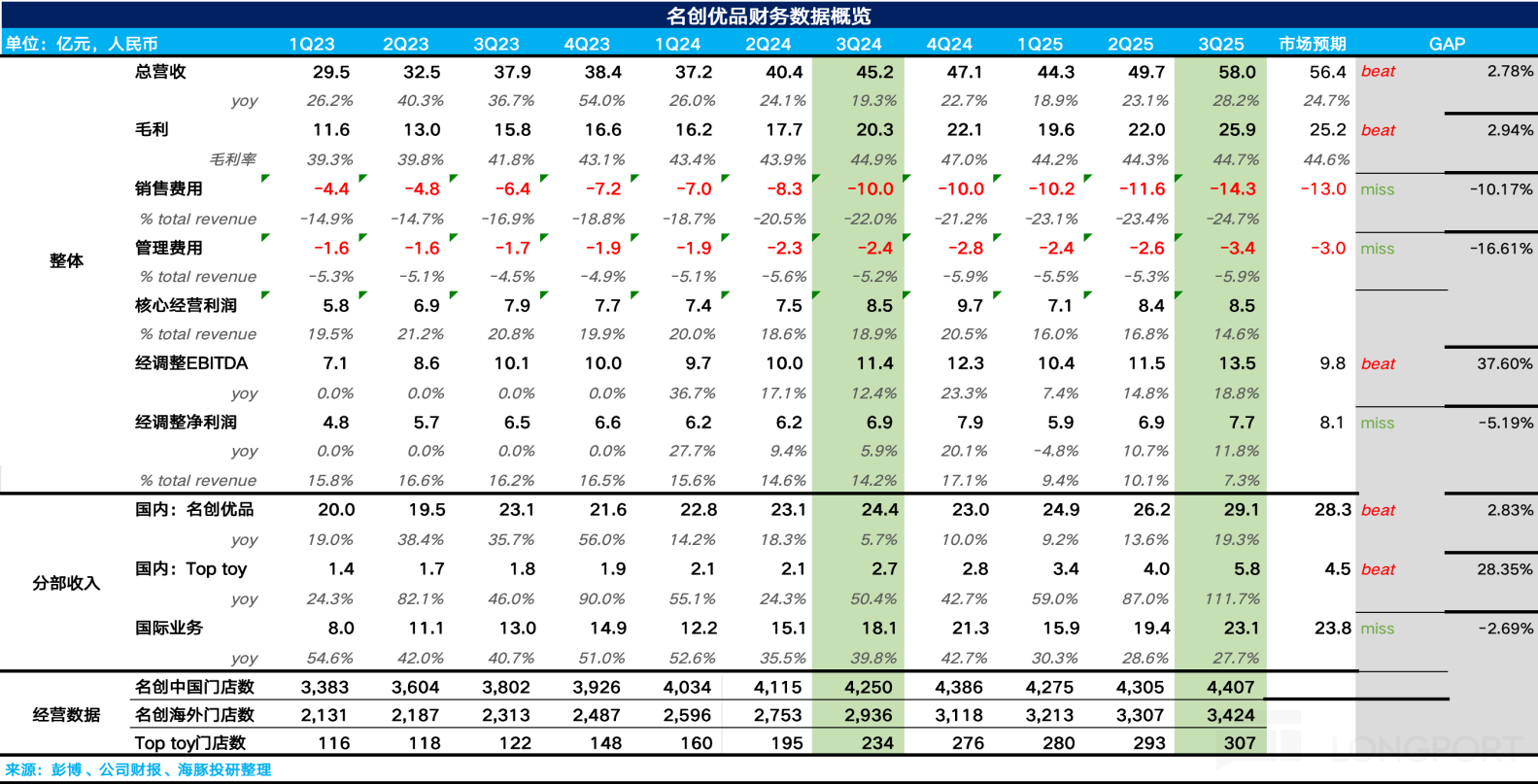

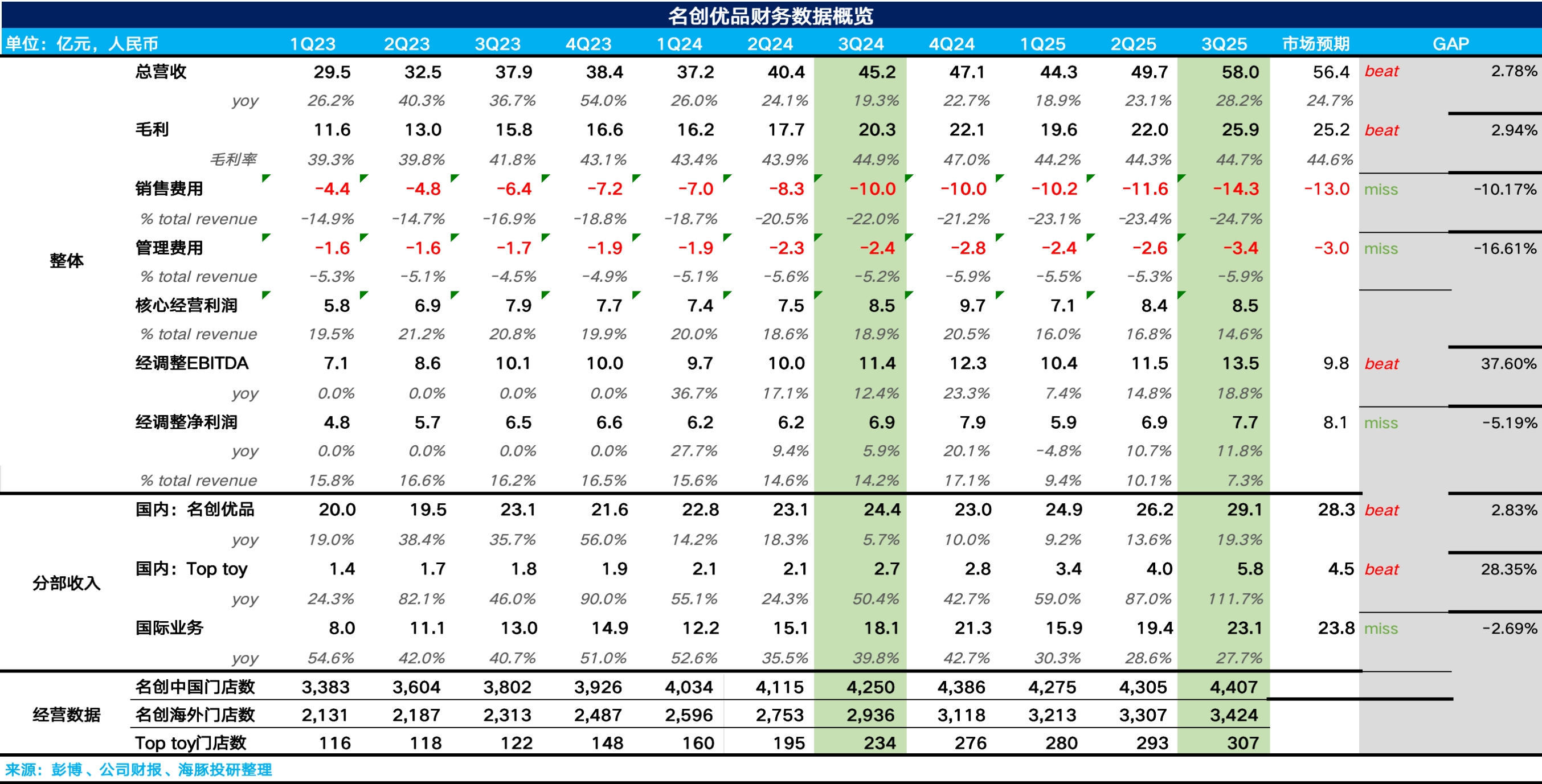

MINISO (Minutes): It is expected that same-store sales in both China and the US will achieve double-digit growth in the fourth quarter.

The following are the minutes of MINISO's Q3 FY25 earnings call organized by Dolphin Research. For an interpretation of the financial report, please refer to "MINISO: Revenue 'Money Printing Machine',...

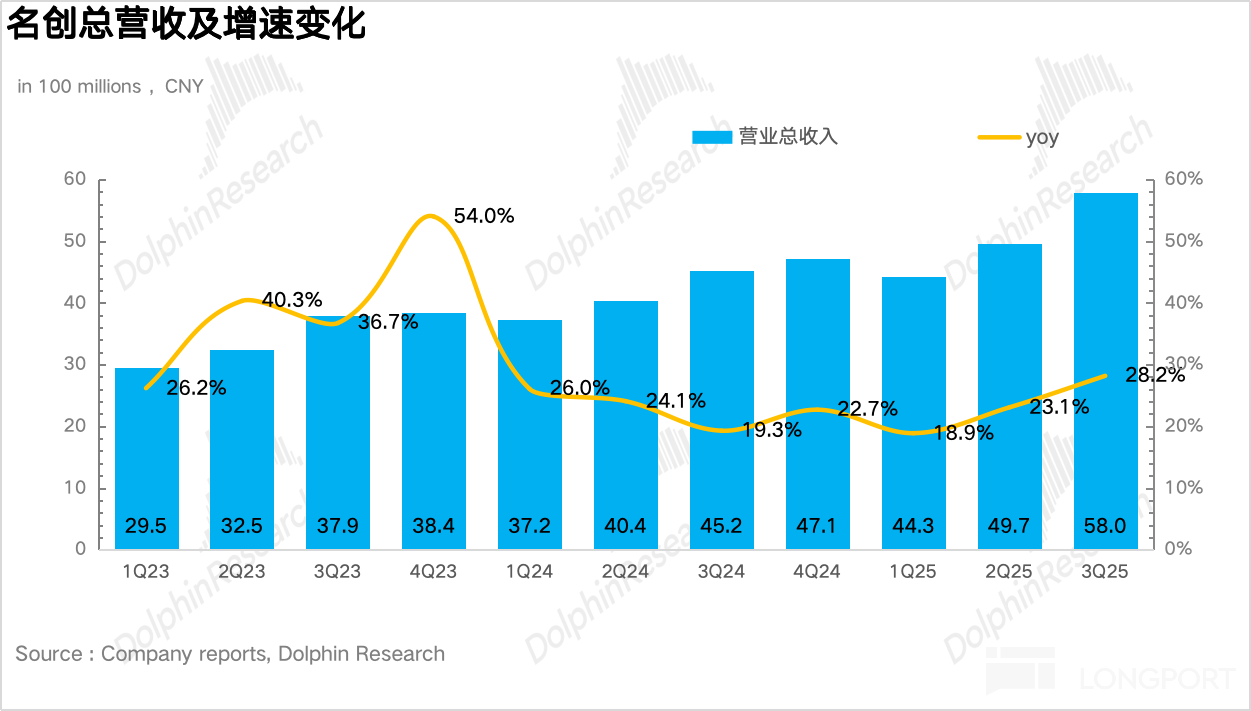

On the afternoon of November 21st, Beijing time, $Miniso(MNSO.US) $MNSO(09896.HK) Miniso (9896.HK) (MNSO.N) released its Q3 2025 earnings. By closing inefficient small stores and focusing on larger on...

MINISO 3Q25 Quick Interpretation: Overall, MINISO's third-quarter performance was mixed. On the positive side, by closing inefficient small stores and focusing on larger stores, same-store sales growt...