Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

Below is a summary of the FY25Q3 earnings call for $Unity Software(U.US), compiled by Dolphin. For a detailed analysis of the financial results, please refer to ‘Unity: Patience Pays Off as Transforma...

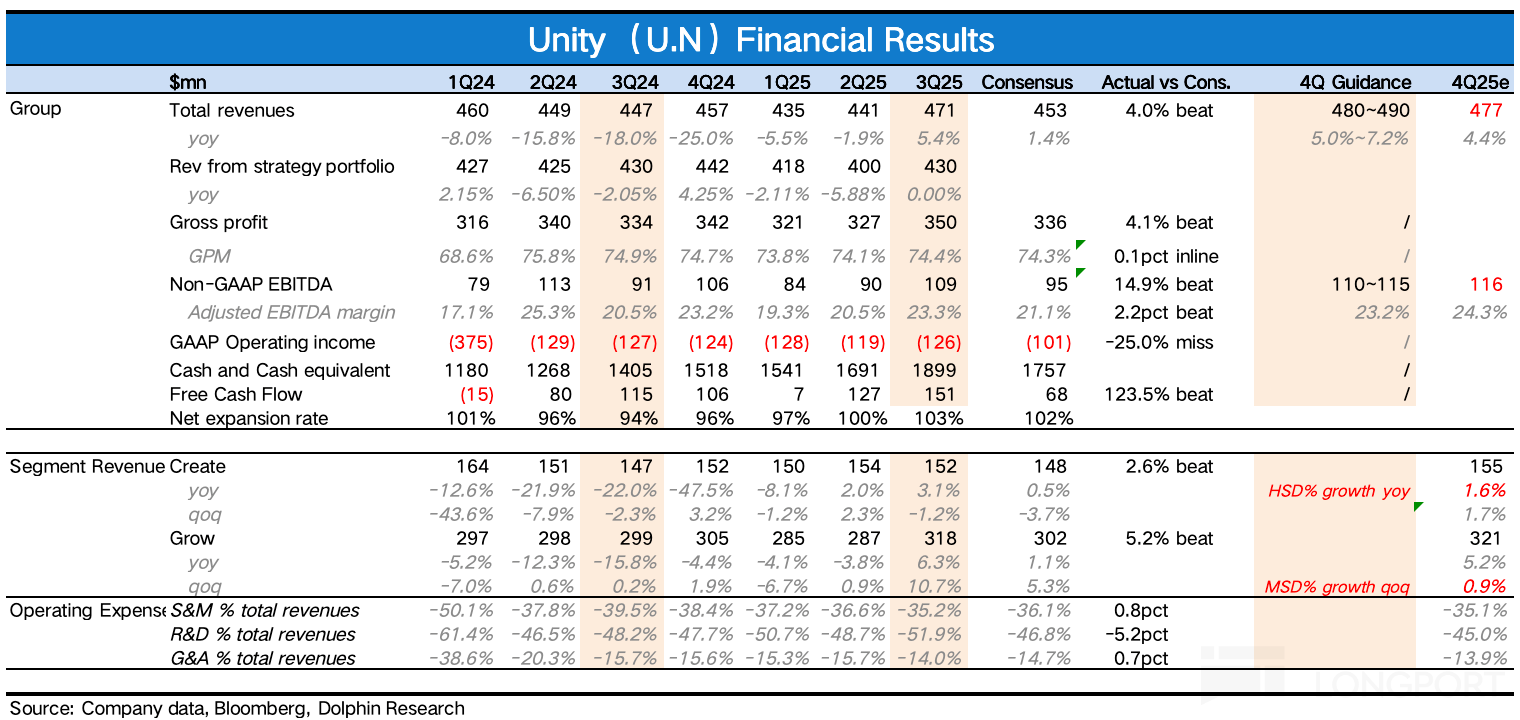

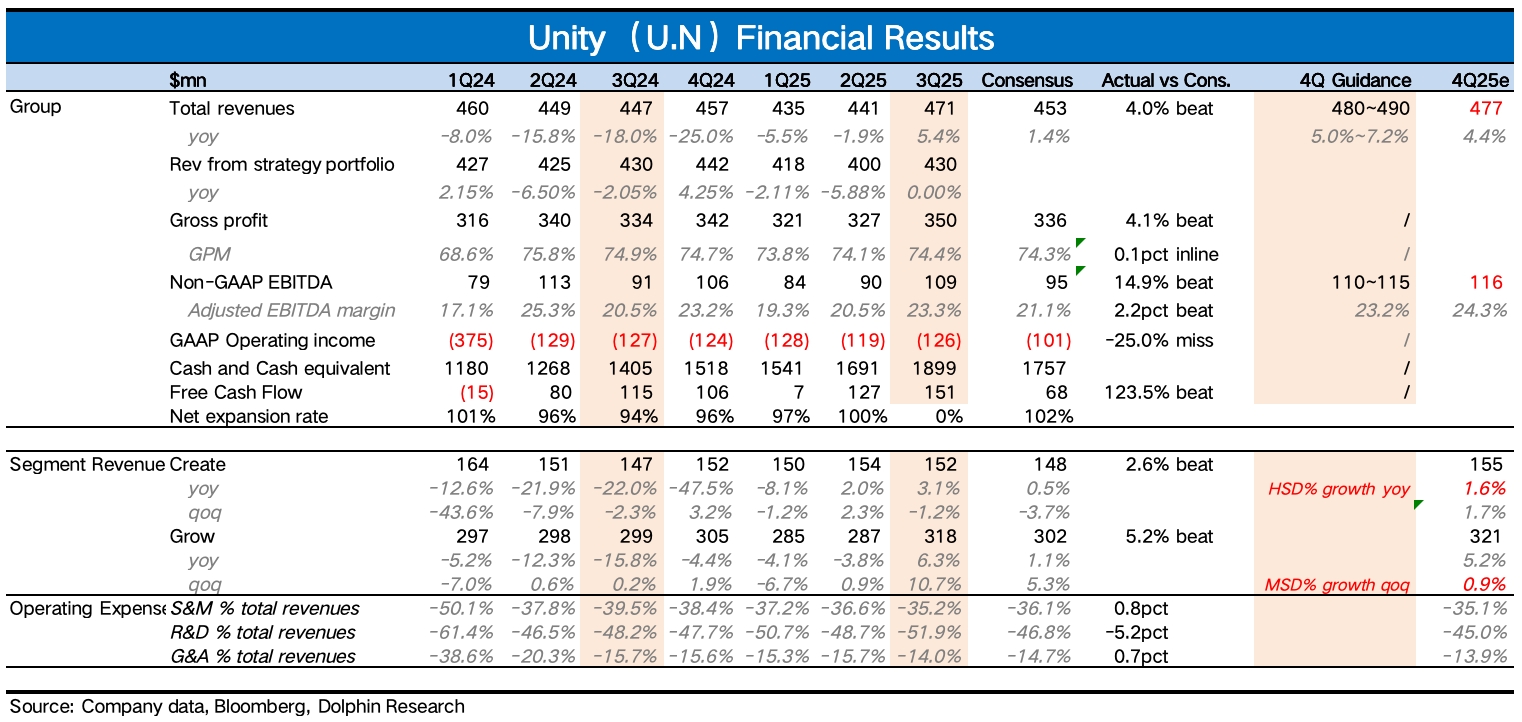

Hello everyone, I am Dolphin Research! On November 5th, Eastern Time, before the U.S. stock market opened, the leading game engine company $Unity Software(U.US) released its Q3 2025 financial report. ...

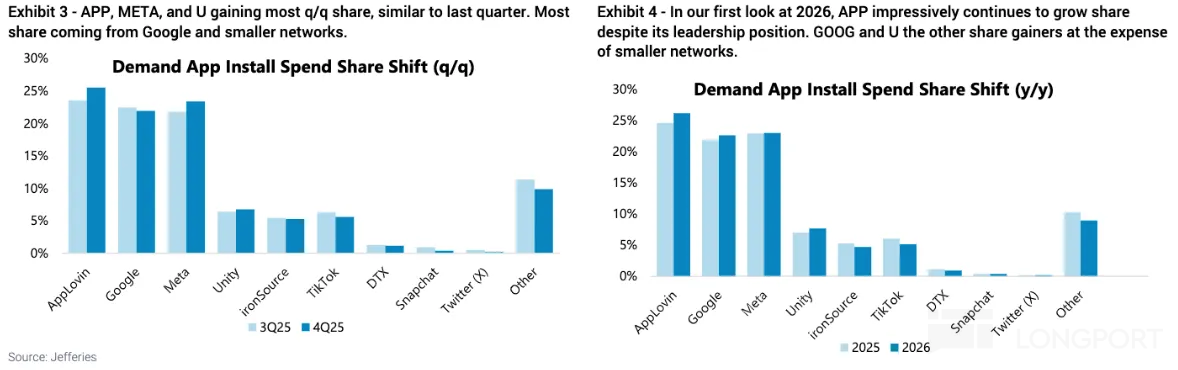

Unity 3Q25 Quick Interpretation: The Q3 performance overall slightly exceeded BBG consensus expectations. The market was particularly focused on advertising revenue, which grew by 11% quarter-on-quart...

Elon Musk reveals new information about Tesla AI5; CDF plans its first interim dividend | Today's Important News Recap

1105 |Dolphin Research Key Focus: 🐬 Macro/Industry 1. China has made adjustments to its tariff policy on the United States, announcing the suspension of the previously imposed 24% tariff rate on cert...

The following are the minutes of Unity FY25Q2 earnings call organized by Dolphin Research. For earnings interpretation, please refer to "Vector Finally Shows Progress, Can Unity Make It to the Table?"...