Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

Why does Li Auto want to divert its energy to making glasses? Glasses seem more like an AI label to make up for the sales decline, including the previously independent app of Li Auto's assistant, whic...

The original post is at: https://x.com/Maggie191919/status/1994246921372745773 I just copied the text. But I had Gemini redesign the featured image, and after seeing it, I think it's awesome! The futu......

$Tesla(TSLA.US) Tesla is back in the spotlight — up nearly 2%, and now planning to double the number of Robotaxis in Austin. Its AI chips and that billion-kilometer autonomous-driving dataset are unde...

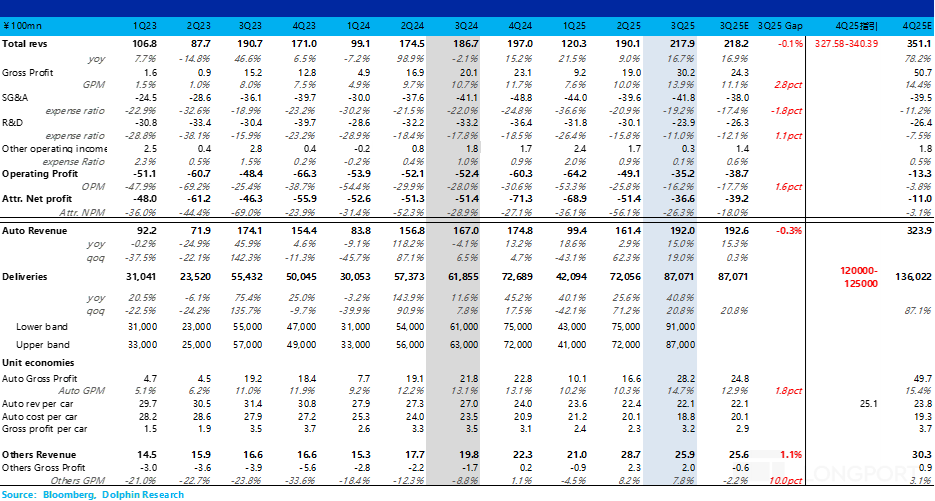

Nio (3Q25 Minutes): Expects 20% vehicle gross margin in 2026, achieving full-year Non-GAAP profitability

Confident in achieving quarterly breakeven in the fourth quarter

1121 | Dolphin Research Focus: 🐬 Macro/Industry 1. Last night's non-farm payroll data was released, presenting a 'split' scenario. On one hand, the number of jobs grew beyond expectations, while on t...